Editor’s Note: In this series of articles, we include important or interesting videoclips with our comments. This is an article that expresses our personal opinions about comments made on Television and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. How Do We Spell Relief?

The answer is “taper” not Rolaids. A steady taper of $10 billion or so at virtually every Fed meeting in 2014. Thank you, Drs. Bernanke & Yellen.

As we thought, the market celebrated this taper. And why shouldn’t it? It needed the relief for one. Secondly, this steady taper is so reminiscent of the 2004 guidance from Dr. Greenspan about 25 bps of tightening at every Fed meeting. The 2004 markets absorbed it, factored it in and rallied into year-end 2004. The 2013 stock market instantly grasped the message and rallied to its best week in 5 months. Now will this extend into a Santa Claus rally? As Jeff Saut of Raymond James wrote on Friday morning:

- “Unsurprisingly, given the attempted pullback since the November 29 high, the stock market’s internal energy, at least by my models, has a full charge of energy, implying there is the potential for another upside equity burst leading to the fabled Santa rally.”

5h

2. Tapering is indeed Tightening, but that’s OK

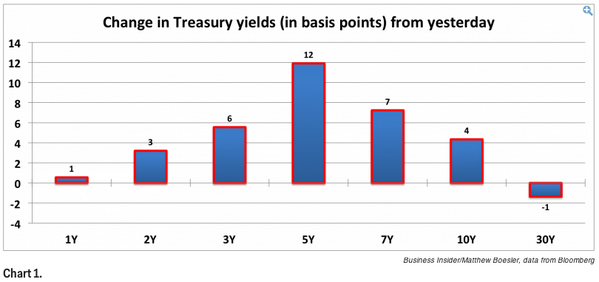

Chairman Bernanke talked and talked about his forward guidance, hoping to quell any fears about hike in short term rates. All his heralds on TV kept feeding the utter crap that tapering is not tightening, a claim we have laughed at and one that Rick Santelli shred on CNBC. This week, the interest rate market delivered its verdict.

The 5-year yield, the most sensitive and free indicator of short term rates, shot up by 18.7 bps on Thursday & Friday. And the yield curve flattened sharply with the 30-5 year yield spread falling by 24 bps in the two post-Fed days. This is the market’s verdict on tightening, at least to our way of thinking. The tweet below from Thursday morning tells the 5-year story better:

- Mathew B @boes_ – UST curve middle finger http://read.bi/J7MQwj pic.twitter.com/Hd5faAMc35

.

.

The end of QE was supported by our favorite indicator, the 100 bps level of 30-10 year yield spread. This spread fell below 100 on Thursday after a long time and fell to 93 bps on Friday. In the pre-QE days, this break of 100bps was rare (spread used to be almost always below 100bps) and signaled a buying opportunity in the 30-year. So if QE is indeed about to end in 1 year, then perhaps this spread may become useful again.

But what about a stronger economy? Q3 GDP came in at 4.1%. The 4-handle was higher than most expectations. So why should interest rates fall and TLT rise in the face of such strong data? Short-covering is clearly one answer. Sentiment on 30-year bond futures is all major lows.

Going back to 2004 (after all David Rosenberg thinks 2004 could provide parallels to 2014), we recall that final Q3 2003 GDP similarly surprised most with a 8.2% number in late November 2003. We recall every one on Kudlow’s show immediately called for a big rise in long duration treasuries. The reality turned out to be very different:

(TLT chart – December 1, 2003 – April 1, 2004)

So are we calling for a rally in TLT & Bond futures? We are not smart enough to do that. On the other hand,

- Ryan Detrick, CMT @RyanDetrick on Friday afternoon –

Consensus % bond bulls is bouncing off lowest levels since early ’11. This was a major low for $TLT. http://stks.co/f04TR

And Guy Adami of CNBC Fast Money, perhaps believing that being 50 yrs age is the new 20, spoke with the bravado of young man on Friday:

- TLT had a fascinating week, big reversal week, closed on highs today; I think TLT goes higher from here, pushes off towards $105.5

3. US Equities

Last week, Lawrence McMillan told us to not short the S&P. That was smart advice. This week, he says simply on Friday morning:

- “Even with the volatiilty following the FOMC meeting, SPX still has not broken out of the 1775-1812 range on a closing basis. If it DOES break out to the upside, the positive year-end seasonality should help”

The S&P closed at 1818 despite a small sell off near the close on Friday. So is that a breakout of his 1775-1812 range?

But what about 2014?

Leon Cooperman on CNBC FM 1/2 on Thursday

- “I’m positive but with a small p, emphasize the small p, and I watch your program, and in recent weeks, you had three prominent guests, very, very smart guests — Warren Buffett, and Carl Icahn, negative looking for decline, and David Tepper, full speed ahead, and I’m close to Warren Buffett. We’re in the zone of fair evaluation, with profits growing very slowly, in the end, it’s really about the multiple you assume for the earnings that we’re generating. we have $115 in estimated earnings in the coming year, and I’m thinking 16 times earnings, equals $1,840,”

- “Corporate profits this year up five. the cpi rising sub-2%. real gdp rising about two. short rates are zero. the average 10-year rate was probably 2.5% or a little less. S&P up 28%. It seems like a large number relative to the fundamental underpinnings of what’s going on in the economy, keeping in mind that was on top of the 13% rise last year, on a 6% profit increase. You know, the end of the day, what I like to say, is bull markets don’t end from old age. They end from excesses and the excesses that normally create bear markets are not present. We need a recession. We don’t see that in 2014. I would observe that investors are still underinvested.”

For the past couple of years, we have been running a Cooperman vs. Gundlach section. Whenever they were paired together on CNBC, they differed diametrically on the direction of 10-year yields. The first three went in favor of Jeff Gundlach. The 4th went decisively to Leon Cooperman and we called it so on July 20, 2013. The 5th began on July 17 when he made a bearish call on 10-yr Treasuries at CNBC’s Delivering Alpha conference. At least as of today, this 5th goes to him too. Kudos, Mr. Cooperman.

Bill Miller on CNBC Closing Bell on Thursday:

- “it’s a market that I think is roughly fairly valued in the sense that it’s around 15 times earnings. which is about the average in the post war period. the odds are that the multiple actually rises over the next several years. the market will be more dangerous at that level than it is right now. valuation is certainly not demanding on an absolute basis. and it’s extremely attractive compared to bonds”.

Jamie Dinan of York Capital Management on CNBC FM & 1/2 on Thursday

- “quite frankly, I think earnings are going to go up next year. I think companies will continue to buy back their shares, and we think there’s a better than 50/50 chance that you actually get multiple expansion next year as opposed to multiple contraction.”

Steve Schwarzman on CNBC Squawk Box on Thursday:

- “I think there’s a lot of bullishness, which feeds on itself. the real world is moving ahead. it’s not barrelling ahead. when you actually have an economy that grows at 2.5% ,2.75% and a stock market that goes up 27%, seems somewhat disconnected. it seems low probability that markets continue going up at 17%.”

Jim Chanos on CNBC Squawk Box on Thursday:

- “I think the risks have increased in the U.S. market rather dramatically in the last year. Are we at some sort of top? I have no idea. but I do know that people that were eschewing risk in 2009 when they should have taking it are embracing it in 2011. The same arguments can always be made at other times that the Fed has your back or my stocks are cheap relative to the market. All I know is the risks have increased dramatically in the u.s. market where that wasn’t the case in 2009-2010. we’re finding a meaningfully larger amount of opportunities on the short side at the end of 2013 than at any time since ’06-’07.”

Michael Hartnett in his Wednesday report:

- “A “Boom” is the big risk next year because bank austerity & policy uncertainly are ending. That’s what markets are now discounting. The pain trade for risk remains up because investor and corporate cash levels remain high. Without higher inflation or lower earnings, it’s stocks over bonds again in 2014. Buy the US dollar. It’s the last great “Great Rotation” trade. “

Tom McClellan discusses divergences in his A-D Line Divergence article:

- “If

the bearish divergence persists into 2014, then that could spell an even bigger problem for investors. Major market tops have typically followed divergent tops in the A-D Line by a period of 3-6 months. If the market does indeed make a price top in mid-January, as the 1929 analog suggests, and if the divergences are still in effect, then that will convey a more dangerous message about what lies ahead for 2014.”

4. Gold

Nothing got this Wednesday’s taper as wrong as the Gold market. Gold actually rallied into the Fed statement and then gave up. Its action on Thursday was plain viciously ugly. George Gero of RBC blamed it on year-end tax selling and new shorts coming into the market. He described the short gold trade as a momentum trader’s dream. But he thinks Gold will bounce back to $1,300 in Q1 2014. On the other hand, Frank McGhee revised his $1,000-$1,100 forecast down to $900 by the middle of summer.

5. Muni Closed End Funds

Usually leveraged closed end funds begin underperforming when a tightening cycle begins. But Muni closed end funds began rallying on Monday and actually rallied strongly post-taper. What’s up? Is that a sign that these funds are so oversold & so cheap that the reality of a steady taper over next year is better than the fear that was factored into these funds. Notice this week’s move in the December charts of three NY funds from BlackRock, Pimco & Nuveen. All three have approx. triple-tax-exempt 6.5% yields & trade at a discount to their NAVs.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter

.