Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“Turned into an algorithm & sent to Disney World“

Who should be turned into an algorithm? The “Fed” said Rick Santelli in another memorable quote. He was angry as we all were at the sheer stupidity or willful deception of the Fed heads over the past two weeks. No one should have any doubt that the Fed minutes released on Wednesday May 18 were at least colored if not made up. What models did they use to get the signals for a rate hike in June? And how unbelievably obsolete these models must be to send a tightening signal in this economy?

We blame Chair Yellen, We know she is surrounded by a bunch of incompetent, sorry obsolete, members who have been pushing her for a rate hike. In the past, she had stood firm. Why did she capitulate last Friday? Those who were knifed in their portfolio gut by the 38,000 NFP report must be asking Et Tu Janet?

Yellen and the Fed look absolutely awful. And what they have been trying to suggest has been shot:

- Charlie Bilello, CMT @MktOutperform – Fed Rate rate hike expectations moved from July to December after weaker-than-expected payroll report.

Steve Liesman was so shocked that he, perhaps inadvertently, blurted out the truth – “If July payroll report is weak, we may start talk about additional easing“. If Chair Yellen heard him, then she herself must have cried to “Et Tu Steve“?

Well, what is the trend of payroll numbers?

- Northy @NorthmanTrader – The trend is your friend

Friendship may be in the eyes of the beholder. But what about correlation?

- FxMacro @fxmacro – NFP just catching up to week ISM employment more to come… DB chart

Or

- Raoul Pal

@RaoulGMI – Well the divergence between ISM and payrolls finally closed…so now weak growth, weak jobs & no inflation. A hike = clear policy error.

The size of the error becomes evident when you look at the waterfall decline in Treasury yields & the explosion in gold & miners. But that didn’t impress CNBC’s Simon Hobbs who dismissed the NFP number and the market impact by saying the “employment number is just a random number generator.” Now you know it takes all sorts to become Financial TV anchors.

2. US & Global Economy

What did they say about wage growth in Friday’s NFP report?

- Lakshman Achuthan @businesscycle – Deceptive fact: 2.5% wage gr seems ok, but not if driven by falling gr in agg earnings/hours https://goo.gl/7mntMn

The labor participation rate ticked down again. Why is this important?

- Ben Casselman @bencasselman – Still, today’s report was BAD. More people gave up looking for work .http://53eig.ht/1XoJd9Q

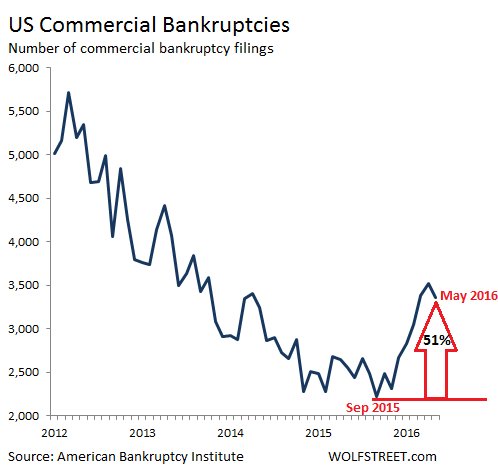

If employment numbers are bad, can corporate health be good?

- Jesse Colombo @TheBubbleBubble – US Commercial Bankruptcies Soar (despite Rosy Scenario):http://wolfstreet.com/2016/06/

03/commercial-bankruptcies- chapter-11-chapter-7-soar/ …

3. Treasuries

We can’t recall a day when the 2-year Treasury yield fell by 11.5 bps. This is insane. The steepest fall was in the 5-year yield – 13.3 bps. In contrast, the 30-year yield only fell by 7.7 bps. By flattening hard prior to Friday, the Treasury market had signaled that the Fed would be making a mistake by raising rates. For the week, the fall in yields was uniform across the entire 30-2 year curve – 14 bps on 30-yr; 15 bps on 10-yr; 16- bps on 5-yr; 15 bps on 3-year & 14 bps on 2-yr.

As an aside, we should all be grateful that America has a deep Treasury market. What happens in other countries without such a Treasury market? What protects those economies from a central bank mistake? Very little.

What does a parallel move mean?

- Tom Graff @tdgraff – Interesting that the drop in yields from 2-7 years is parallel. Market is saying that today’s job weakness will persist.

This fall in rates was global with the German 10-year closing at 7.4 bps after touching the all-time low of 6 bps intra-day. And the entire 1-9 year bund curve is now negative. So how far does the 10-year Treasury yield drop? Guy Adami of CNBC FM said 1.25%. Such a sissy target, right? Especially in contrast with 0.5% target of Raoul Pal.

BlackRock’s Rick Rieder said on Friday that they see tremendous international demand at the back end of the yield curve. Marc Faber said he owned Treasuries in lieu of cash because they are so much better to own than Bunds or JGBs. Well, with long rates falling and Fed on hold until data shows sustainable upward strength, shouldn’t leveraged municipal closed end funds do well? These have been doing great this year and may keep doing so, we think.

Not just municipals of course:

- Charlie Bilello, CMT @MktOutperform – USD Emerging Market Bond ETF at new all-time highs. Annualized Total Return since inception in Dec ’07: +6.4%. $EMB

4. US Equities.

The real surprise of Friday was the recovery in stocks after the initial decline at the open. But that has been the story for the past three days. Since a picture is worth more than words,

- Northy @NorthmanTrader – Market structure. $SPY

Frankly, the greater surprise was:

- Becky Hiu @beckyhiu – $VXX just made a new all-time low today. ¯\_(ツ)_/¯

Based on our own empirical observations, NFP Fridays often mark a local extremum in stocks. One reversal has already taken place. Uber-perma-bull Tom Lee came on CNBC FM to suggest a swoon in June in stocks and suggested buying only on that swoon, He added that clients who have made money till May 2016 are now booking profits.

Another way to say that:

- David Larew

@ThinkTankCharts – S&P 500 – RSI Negative Divergence – Breadth is crazy Bullish – starting to look like the head of a Black Swan

.

.

But what about falling rates helping out stocks? Or the infamous TINA? Of course, TIBA has been the real story of 2016 – TIBA being There is Bond Alternative – in recognition of TLT delivering 2X performance on S&P so far in 2016. But FinTV never gets ratings by recommending bonds. So there.

- Northy @NorthmanTrader – But you have a market that is highly expensive on any debt/EBITDA or GAAP P/E basis. Doesn’t mean we can’t squeeze higher, but it’s toxic.

5. Gold

Friday belonged to Gold & Gold Miners. Remember all the technical warnings & downtrend observations? Friday showed again that everything depends upon the Fed. According to Bespoke on Tuesday May 31, Gold had not seen an up day since the release of the Fed minutes on May 18. Then the 38,000 NFP number took the Fed out of the picture and vroom! Gold & Silver rallied by 2.5%+ and Gold miners exploded up 11%-12% on Friday. For the week, GDX, GDXJ, ABX, NEM were up 12.8%, 14.5%, 14.7% and 11% resp.

So is selling Gold & miners tantamount to believing in another Fed rate hike?

6. Emerging Markets

EEM outperformed US indices on Friday. Low Treasury rates & lower US Dollar are positives for EM stock markets. Goldman’s Timothy Moe made positive comments about India lauding the practical reforms that have taken place. His longer term drivers are 5-year very strong growth potential, that fact that we have a cyclical recovery in the economy & that there appears to be a beginning of a cyclical upturn in profits. Morgan Stanley’s Chetan Ahya said the Indian economy is at a “definite inflecion point” and expects a recovery. Growth has been powered by the two engines of FDI & public Capex. He says Consumption, the 3rd engine, is now taking off and a private capex revival is 12-18 months away. The trouble with India is that its PE premium to other emerging markets is high as it usually is when the fundamentals look up.

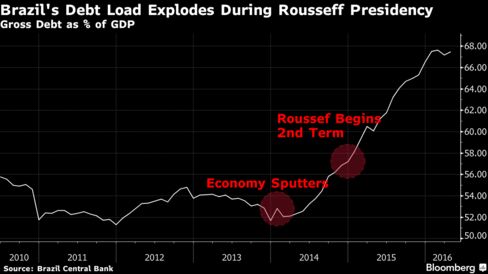

At the other end is Brazil, a turnaround story. It may be in a depressionary recession, it may have debt problems, but EWZ rallied 5.3% this week. That’s fine unless future becomes present earlier than expected.

- Bloomberg Markets @markets – Brazil’s Exploding Debt-to-GDP Is Going to Become a Problem Soonhttps://www.bloomberg.com/

news/articles/2016-06-03/ brazil-s-exploding-debt-to- gdp-is-going-to-become-a- problem-soon …

Hopefully this future doesn’t rear up until after the Olympics.

Send your feedback to [email protected] Or @Macro Viewpoints on Twitter