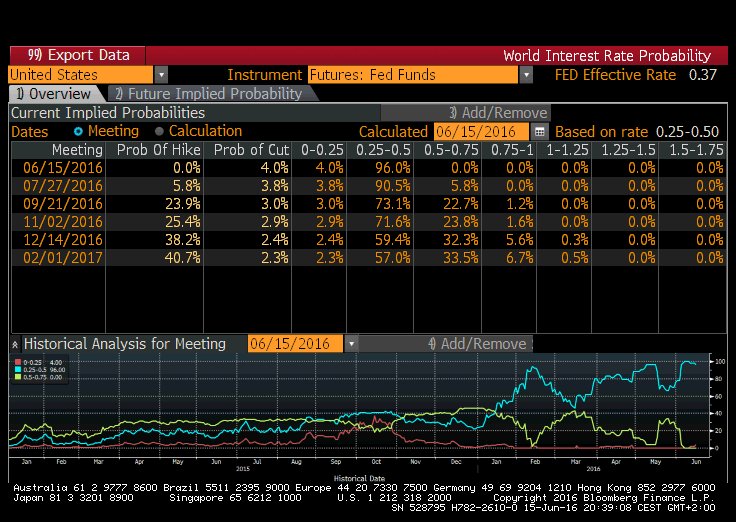

After promising to raise rates 3-4 times in 2016, after endless debates within & outside about when & by how much, the US Federal Reserve capitulated on this Wednesday, June 15, 2016. The Wall Street Journal used a stronger word in their title “The Fed Surrenders”. Much more importantly, the markets gave their verdict.

- Holger Zschaepitz

@Schuldensuehner –#Fed‘s Yellen: Mixed data justifies cautious approach. Mkts have repriced rate hike expectations. No hike in 2016.

That is not the worst of it. Prominent analysts like Jim Grant & Lakshman Achuthan are now saying the Fed will CUT interest rates as its next move. How sad is this?

Remember the Fed cut its overnight Fed Funds rate to ZERO% in 2008. It took them 7 years to finally raise that rate to a paltry 0.25% in December 2015. And now they might actually reduce that rate back to ZERO? Is ours a real economy or a moribund patient? The financially richest, militarily strongest, demographically positive, and technologically most innovative country in the world can’t manage to get to a paltry 0.50% interest rate?

What’s going on? The answer is simple – Contagion, financial contagion. It has been spreading through the body of the global economy.

1.Spread of the Contagion

Remember the contagion is not an attack that occurs suddenly & swiftly. An attack wakes every one up to combat it. A contagion is a slow spreading cancer or virus that is hardly visible when it enters. You see some signs as it begins spreading through the body. When you treat it, it responds for some time. Then it adjusts, mutates and continues its spread.

We first wrote about it on October 11, 2014 in our article A Contagion is Sweeping the World & It is neither Ebola nor ISIS. In that article, we pointed to a visible symptom:

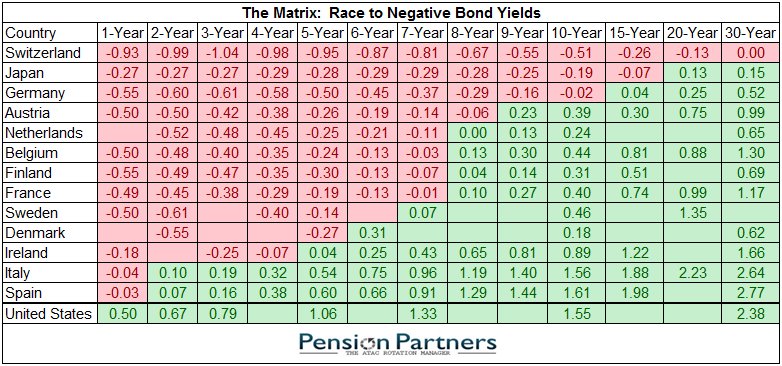

- “The best gauge of deflation fears are sovereign bond markets and they are literally screaming in fear right now. The annual yield on the German 5-year note has dropped to 0.155%, even lower than yield on the Japanese 5-year note of 0.158%”.

Since then we have written 6 articles tracking the spread of this global financial contagion. Look what has happened to the German 5-year yield in that period:

- from plus 0.155% in October 2014 to minus 0.005% in January 2015 to minus 0.13% in January 8, 2016 to minus 0.31% on January 30, 2016 and now to minus 0.49% on June 17, 2016.

Why focus on the German yields? Europe is the richest continent in the world and one that is mired in a deep economic malaise. Germany is the strongest & most dominant economy in Europe, the virtual linchpin of not just European but of global trade.

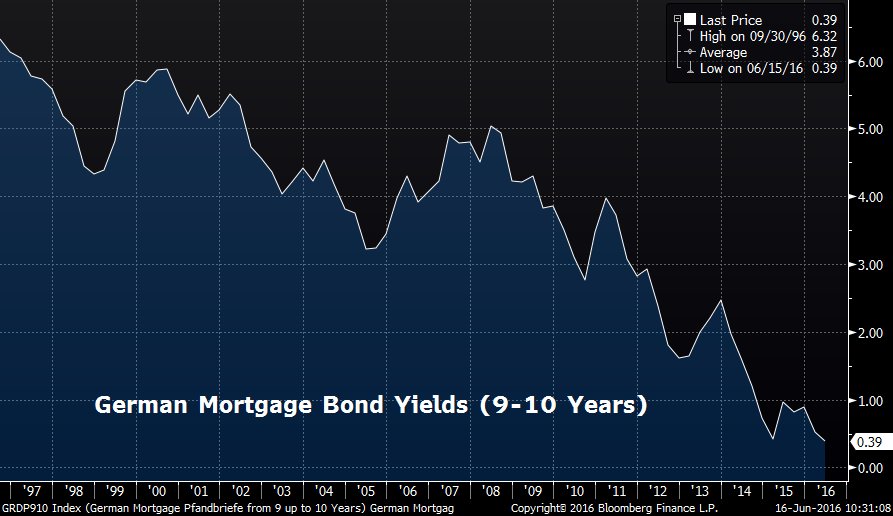

Things have become so bad that we don’t even focus on the 5-year. This week, something unimaginable happened. The German 10-year yield went negative on Thursday, June 16, 2016. The 10-year yield is linked to mortgage rates in most countries in the world. So where are mortgage rates in Germany?

- Charlie Bilello, CMT

@MktOutperform German mortgage bond yields down to 39 bps, an all-time low. On their way to negative yields I suppose…

So you can buy an apartment or house in Germany by getting a mortgage at the rate of 0.39%? This should trigger a new mortgage rush like the gold rush of old, right? Wrong because these low rates are a symptom of fear, of a lack of confidence and a lack of demand.

-

Charlie Bilello, CMT

@MktOutperform – Negative Yields through…

- Lawrence McDonald

@Convertbond Sheer Bond Madness https://www.thebeartrapsreport.com/blog/2016/06/16/bond-madness/ …

2. Are Central Bankers Insane or Is Insanity Forced upon Them?

Remember the European doctors of the middle ages? The only technique they knew was to bleed the patient to drive out the impurities or illnesses out of the patient. This cure was often worse than the illness & most of the patients died during the treatment. That didn’t deter the doctors. And they kept repeating draining blood from the next patient.

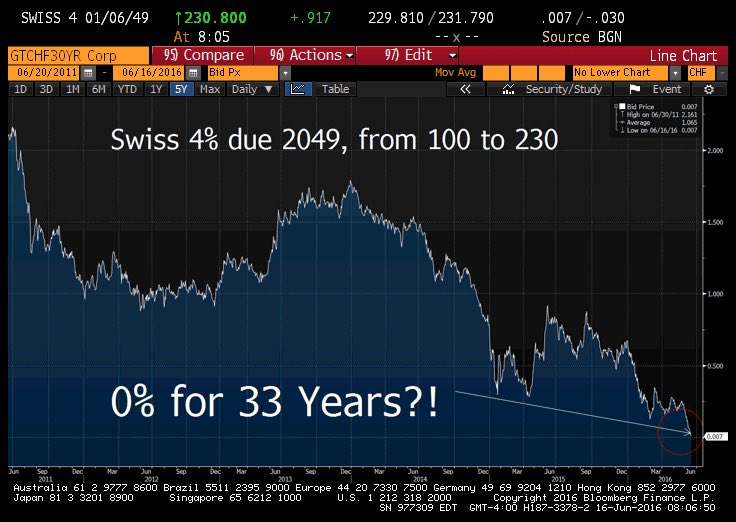

Today’s Central Bankers are like these medieval European doctors. Circulation of money is to an economy what circulation of blood is to the human body. All major financial institutions in an economy need positive yielding money to survive. How does a bank survive by paying its borrowers to borrow & charging its depositors to save? How does an insurance company pay out benefits if it pays out interest instead of receiving it on the premium it collects? How does a pension fund pay out benefits to retirees if it doesn’t receive any interest on the employee contributions it collects?

And think what happens to savers. How much more do they have to save for retirement if they don’t receive any interest on their savings and actually have to shell out interest to banks for keeping their money safe? We are back to an era when the only safe way to store your money was to buy Gold and keep it safe by burying it secretly in your farm or back yard. No wonder Gold is the best performing asset class in the world in 2016.

Remember what they said about insanity of central bankers back in February 2016:

- Marc Faber, Editor of Gloom, Boom & Doom Report on Fox Business on Thursday, February 11- “The central banks remind me of the movie ‘One Flew Over the Cuckoo’s Nest’ where the doctors are the insane, whereas the inmates are actually quite common people with common sense and normal, … This is exactly what I think is happening today“

- David Rosenberg of Gluskin Sheff on Bloomberg TV on Thursday, February 11 – “The latest experiment on negative rates is falling flat on its face, but in a classic case of following Albert Einstein’s definition of insanity, the academics who run the world’s central banks show no sign of backing away from a policy that is undermining the banking system“

Clearly the decision to impose negative rates has been insane, particularly so by Draghi of European Central Bank & by Kuroda of Bank of Japan. But is their insanity forced on them? By whom? By the Governments & elected Representatives who have surrendered all economic policy making to the Central Banks. Fiscal measures have become both intellectual anathema and political risk.

3. Global Elites & Revolt of the Middle Class

There is tremendous group-think in the world today. That group think comes from the elite intellectual class. They pervade all centers of policy making, implementation & dissemination in developed economies – University Academics, Think Tanks, Political Action Committees. The “best & brightest” people still run Japan; the “best & brightest” run Brussels-based EU & EMU. This “best & brightest” concept now runs deep even in America with the Academics-staffed Federal Reserve becoming the sole decider of economic policy. What happens when group-thinkers become all-powerful:

The global elite “intellectual class” is now a member of the Top 10%. It would be hard to find a financial academic, a think tanker, a middle level policy maker, a political action committee member that has less than $1.3 million in net worth. The only ones you can find are those who have been banished for betraying the new intellectual aristocracy. You see they don’t feel the effects of the contagion. Because they created it & they know how to profit from it.

It is the big broad electorate, the commoners who have been suffering. There are signs they are getting fed up. Next week’s Brexit vote is one sign of this nascent revolt. The Trump candidacy is another. Whether these revolts succeed or fail remain to be seen. Perhaps the pain is not yet acute enough for pitchforks & storming the Bastille.

Remember what we wrote in our first contagion article on October 11, 2014:

- “… remember that medical science knows how to cure contagions like Ebola. But economic science has never been able to cure a deflationary contagion.”

So don’t look to central bankers to cure the financial contagion spreading through the global economy.

Send your feedback to [email protected] Or @Macro Viewpoints on Twitter