Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”I wish we have Brexit once a month“

We had a choice between Rick Santelli’s “Brexit never existed” comment on Tuesday June 28 and the comment “I wish we have Brexit once a month; it has been phenomenal” from CNBC FM’s Josh Brown on Thursday June 30. To be fair to Santelli, the rally was in full bloom by Thursday & so it was much easier for Brown to be bolder than Santelli. No question about the sentiment though. All investors would like a Brexit type decline every month if it always resolves the way this one has done, at least so far.

An old tenet says buy the equity market of a country who currency has been shot. Buy after the currency decline that is. That proved true this week.

- Jamie McGeever

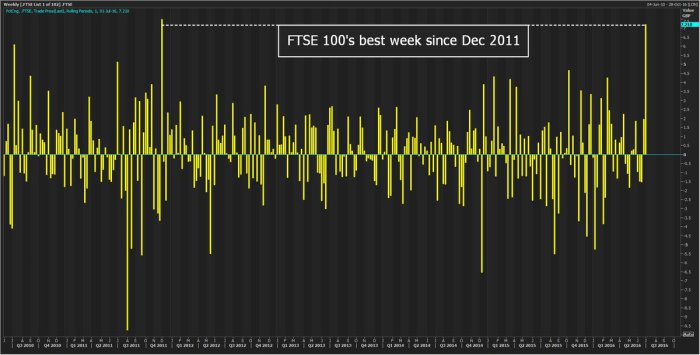

@ReutersJamie – FTSE 100 +7.2% this week, its best week since Dec 2011. Stocks of UK’s biggest firms clearly like the weak pound.

The FTSE did better than most but just about every asset class rallied hard this week, even the supposed safe havens like Bonds & Precious Metals. How complete & total was the mood swing from fear to relief?

- Charlie Bilello, CMT

@MktOutperform – Volatility Index ($VIX) Starts week at 25.76 Ends week at 14.77 Largest weekly % decline in history: -42.7%

Kudos to Ryan Detrick who advised correctly last week:

- Ryan Detrick, CMT @RyanDetrick – S&P 500 is down about 1.9% for the week. This is the 3rd straight weekly loss. Hasn’t been down 4 straight since Sept/Oct ’14 (Ebola lows).

So what does he say about next week?

- Ryan Detrick, CMT

@RyanDetrick – Fun stat for the day. S&P 500 up 3% this week with a day to go. The last 8 times it was up 3% for a week, it was higher the following wk.

Stock Indices, Treasuries, Credit & Precious Metals were all up this week with the S&P delivering the best weekly gain for the year. Wouldn’t all of us want a Brexit once a month, especially if we can avoid the Brexit decline & only participate in the rally afterwards?

We don’t intend to dismiss the seriousness of what Brexit would mean if, how, & when implemented. No one knows that because no one knows the who, meaning the new leader who would have to implement it. All that is unknown. So what is known now?

That the Bank of England will ease over the summer to try & defend the British economy from the ravages of uncertainty & from potential loss of confidence in investing by corporations & in spending by British subjects. BoE Governor Carney didn’t have to say this given what all western central banks have done since 2009.

But Carney did explicitly say this & caused a steep fall in interest rates and catapulted Gold & Silver to a semi blow-off phase. Who wouldn’t want this “phenomenal” action at once a month, right Mr. Brown?

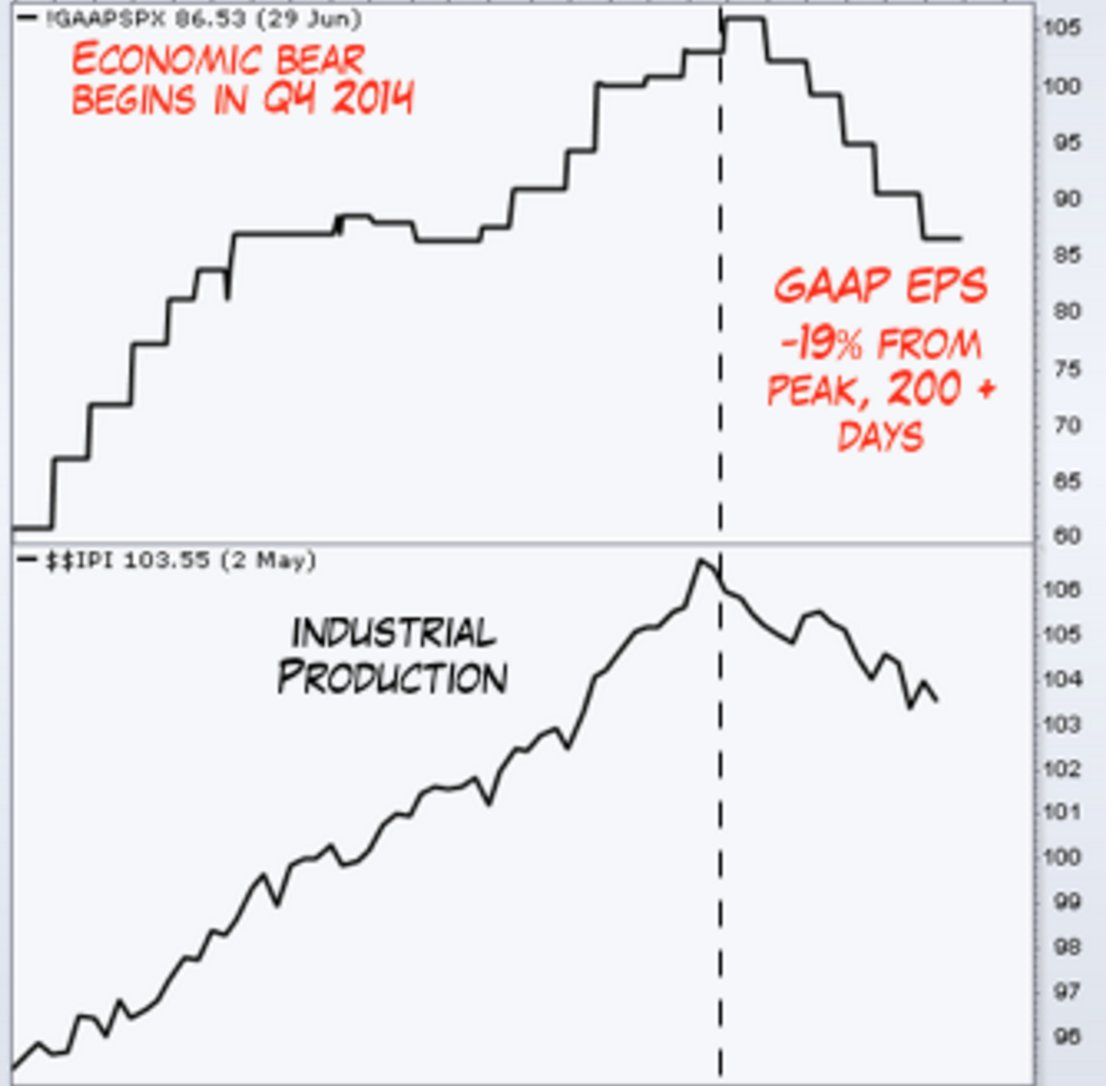

As we have been saying for the past two weeks, the real determinant of whether low rates become positive for stocks is the health of the credit cycle. Remember what Michael Contopoulos of BAML had postulated in February 2016 that high yield & stocks will rally together? Remember what Jeffrey Gundlach had suggested in February 2016 that closed end credit funds that trade at a discount to their NAV will outperform S&P 500? Gundlach had not given names of specific funds. But remember the names Bill Gross had suggested, DPG & UTG?

The reason we bring this up is that Contopoulos suggested buying high yield bonds on Monday evening after the 2-day Brexit selloff. So any one who remembered the Contopoulos/Gundlach/Gross chain of suggestions could have bought DPG & UTG (trading then at large discounts to their NAV) on Tuesday’s open. How did these two closed end funds perform from Tuesday to Friday? DPG is up 6.8% & UTG is up 3.4% from Tuesday’s open. Still outperforming the S&P 500.

So as long as high yield keeps performing & the credit cycle doesn’t trend downwards, we should welcome central banks pouring in more & more liquidity, right? We are so tempted to say yes unequivocally but we do remember how the credit cycle turned down quickly & without much fanfare in July 2007?

- David Larew

@ThinkTankCharts – Large Banks underperforming like in 2007. Junk Bonds to oil speculators 1.7 Tril – Subprime Mort. 2007 1.7 Trillion

3. Banks

This was a great week for Banks, wasn’t it? Almost all US banks passed the Fed’s stress test and raised both their dividends & buybacks. No wonder, Goldman Sachs, Morgan Stanley rallied by 5% this week. And so did Citibank. This prompted:

- Trading Stocks @AlertTrade – Technical Alert: Financial Sector ETF has a Bullish MACD crossover at…http://dlvr.it/LhqYHc → via #AlertTrade

There was good news for European banks as well. The European authorities permitted Italy to launch a 150 billion Euro program to provide liquidity guarantees to Italian Banks. It seems clear that BoE Governor Carney will support large UK banks. Then why on earth did European Banks perform so badly this week? And why were UK bank stocks were such disasters when the FTSE had its best week since December 2011? How big a disaster?

- RBS was down 23.5% on the week, Barclays down 14.3% & Deutsche Bank down 5.5%.

Is something going on?

- J.C. Parets

@allstarcharts – why do I get the feeling we’re going to hear some “news” regarding european banks in the coming days/weeks…..price suggests something’s up

But not all are so bearish:

- CNBC’s Fast MoneyVerified account

@CNBCFastMoney – European banks are tanking, but@Convertbond says they could be a buy. Here’s why

We hope Larry McDonald (@Convertbond) proves right and soon. European Banks are acting like Oil did in early January. We know what negative interest rates do to banks and to European banks in particular. But that is old news. So what’s the new trigger? Is it the lack of a functioning government the real problem for UK Banks?

May be it is what Barclays chief Jes Staley told BTV’s Erik Schatzker on Thursday, June 30:

- Barclays Doesn’t Need More Capital Even With Brexit … Barclays can’t let Brexit change its strategy, still plan to sell down non-core assets and Africa unit stake … The likelihood of an economic slowdown in the UK is much higher today than it was last week … Stock decline prompted by earnings concerns, not capital or liquidity questions

Does this glib & arrogant assurance in the face of a collapsing stock price prompt any one else to recall the L-word? We sincerely hope not. But if warranted, is there any one in UK Government with the clout to persuade the UK parliament to do/approve a RECAP of UK Banks? With the people of UK tolerate that discussion let alone approve of it? Come to think of it, can President Obama even bring up the idea of America helping to rescue UK banks?

The biggest problem this year could be that elections & political turmoil are a much bigger issue than health of European banks. So let us all pray that Larry McDonald proves right and European bank stocks stabilize soon.

The easiest route for financial contagion to enter America is via UK banks. So US bank credit cannot remain stable if European Bank credit begins to trend down along with European bank stock prices. And the US credit cycle cannot remain stable without US bank credit remaining stable.

4. Treasuries

Investors often adjust their long Treasury positions to match their duration targets during the afternoon of the last day of each month. This usually creates a visible move up in TLT just before 3 pm on month-end days which is often given back between 3-4 pm. We saw that this Thursday too. But the giveback after 3 pm was both immediate & hard. The close was also weak & the Carney announcement was hours old.

That is why we were stunned to see a 8-10 bps decline in the 30-year on Friday morning. The 30-year actually traded at 2.18%, the lowest yield in living memory and the 10-year traded just below the 2012 pre-open low of 1.38%. What happened overnight that precipitated this large move? We couldn’t find any trigger for such a big move especially after a big decline in yields during the first four days of the week.

The 30-year was the absolute star of the week down 18.5 bps. The 10-year yield only fell by 12 bps and the 5-year by a smaller 9 bps. The German 30-year only fell by 10 bps thus contracting the Treasury-Bund spread. Now what?

Komal Sri Kumar explained how the 10-year can keep falling to 1% & may be even down to 90-80 bps. In his view, the BoE will lower rates to 25 bps in July, then to 0 bps in August & go negative thereafter. That he says will drive the 30-yr yield below 2% & 30-yr mortgage below 3%. Sri Kumar has been right so far and we see no reason to doubt his suggested path of the BoE (Sri is in itself an honorific by the way, so Mr. Sri Kumar might be weirdly repetitive). On the other hand,

- Lawrence McDonald

@Convertbond – Year ago today, 90% of Wall St research was bond bearish (3% 10s target), today 90% are bullish with Treasuries at 1.40%

Our featured bear of this article seems to concur:

- David Larew

@ThinkTankCharts – Utilities – Hanging Man Top – look for a reversal in US Treasury Bonds on Tuesday

As we have seen again & again this year, a context between charts & Central bank pronouncements always ends the same way. So will any central bank promise or deliver any additional easings over this weekend?

In any case, the really big event could be next Friday’s payroll report. How the Treasury market responds to a stronger than expected or a much weaker than expected NFP number might prove both interesting & revealing. Of course that depends on how the Treasury market positions itself ahead of Friday’s number.

5. Equities

The S&P began the month of June at 2097 & closed it at 2099. Quite a bit of volatility in between but no progress month/month. What about July?

- Ryan Detrick, CMT @RyanDetrick Jun 30 – Going back to 1928, the S&P 500 in July is up +1.52% on avg – the best month of the year, topping December’s +1.40% gain.

- In summary, the last few days have reversed a number of indicators back into the bullish, or at least neutral, column. The bears have lost control, and it would take a close of the gap on the $SPX chart at 2036 in order for the bears to regain control. Meanwhile, we have a number of buy signals that have triggered, and these have worthy track records. So we are short-term bullish for now, and if the put-call ratios can roll over to buy signals, then a more intermediate-term bullish stance would be warranted

- We wrap up Trendline Week with perhaps the most significant trendline development of the week. It highlights an index that broke its major bull market trendline during the early-week Brexit hangover, only to recover it, demonstrably, by week’s end. It certainly was not the only index or security to accomplish this feat; however, considering the importance of the index – and the trendline – it was one of the most significant saves of the week. The index in question is the Value Line Arithmetic Index (VLA).

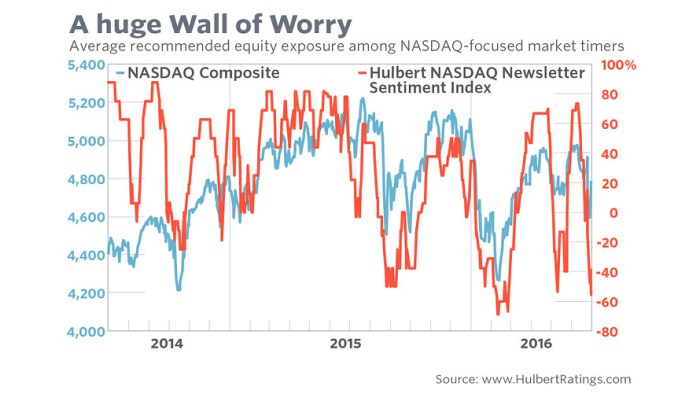

And sentiment seems to support the bullish call according to Mark Hulbert. Some excerpts from his MarketWatch article:

- The U.S. stock market kicks off the second half of 2016 facing a huge Wall of Worry. And that’s bullish. In fact, one stock market sentiment index is now in the vicinity of the extremely low levels that, in the past, preceded sizeable rallies … This average currently stands at minus 55.6%, which means the average Nasdaq-oriented stock market timer is allocating more than half of his short-term equity trading portfolio to going short. That is an aggressive bet that the market will keep declining.

As you can see from the chart above, the HNNSI just recently was quite a bit higher. On June 9 it stood at +73.5%. That means in just three weeks the average recommended equity exposure has fallen 129 percentage points. That’s an extraordinary drop in such a short period - Further evidence of how bearish the market-timing community is: Since Monday, the day of the post-Brexit correction low, the HNNSI has fallen an additional eight percentage points — even while the market staged a powerful rally. … That’s not the kind of sentiment behavior typically seen at major market tops

On the other hand,

- David Larew

@ThinkTankCharts – RSI negative divergence on the S&P 500 – likely consolidation to down next week

Others see much more than a consolidation.

- ValueWalk @valuewalk – Kolanovic Sees Risk Ahead, Brexit Crash Similar To August 2015 @MarkMelinhttp://www.valuewalk.com/2016/

07/brexit-crash-stocks/ … $$

And,

- StockTwits @StockTwits – Here’s why markets could still be in a stealth bear market. Interesting share via:http://stocktwits.com/

TopDownTechnicals/message/ 57705208?utm_medium=community- twitter&utm_source=t.co&utm_ campaign=outboundteam … $SPY…

What we do know is that EM markets continue to outperform the S&P. And they should do so as long as US Dollar doesn’t strengthen hard & interest rates remain benign.

6. Gold, Silver & Miners

The absolute stars of the week were Silver & Gold Miners. Silver was up over 11% while Gold only rallied 1.8%. Gold Miners rallied by 8%-9%. Yes, the second stage of this week’s performance was triggered by easing promises of Carney. So are we done or is there a third stage waiting to be propelled?

- J.C. Parets @allstarcharts – Metals and Mining also looks like it’s ready for another leg higher. $XME ready to break out of this 2 month range. Next target is 31.66

What about Silver? Carter Worth of CNBC Options Action sensibly said he didn’t know. He called Silver a “kind of a runaway train” and added “something like this can take a life of its own“. Some others are more convinced.

- Open Outcrier

@OpenOutcrier – Silver gonna run into $20 here in a dime.$SLV$USLV

And some ask can Silver remain behind Gold?

- Sheldon McIntyre

@hertcapital –$SILVER$SLV now running to test the 200-week sma, just as$GLD did recently. This is just the beginning.

Given all of the above what can we say? Simple: