Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”got us back on track again“

Last week, we postulated that the stock market is basically a confidence game, a game of confidence in President Trump’s agenda. We all saw that this week. After meandering for the first three days, in the words of Steve Grasso of CNBC FM, “President Trump got us back on track again” on Thursday.

President Trump said on Thursday morning that a “phenomenal tax cut package was coming in 2-3 weeks” and the stock market shot up to close at new all-time highs. On Friday, we found out that Gary Cohn, ex-COO of Goldman Sachs, was overseeing the tax cut plan and all 3 stock indices jumped up to close at new all-time highs.

But what about details, the what, the when etc.? It doesn’t matter much at this stage. Why? Because of what Rick Santelli said in his profoundly simple style – what’s in the box [President Trump’s agenda] is something better than we had before.

Lloyd Blankfein said essentially the same thing but in more words:

- “The change in the market today is from a cycle where we were of very low economic activity, consequently very low interest rates, and a very, very high level of—maybe call it pessimism about where we go. And it feels like we’re changing to one in which it’s going to get growthier. More growth out there, more opportunity and one in which we are getting a bit more optimistic”

And the economy might be seeing a Bona Fide Growth Rate Cycle Upturn ,according to Lakshman Achuthan of ECRI. Their “weekly leading index“ said Achuthan, “has very clearly given a “pronounced, pervasive, and persistent” signal that the upturn is real“.

Remember Larry Fink’s clear statement in 2012 that he would be 100% long stocks if he could. He proved to be correct. But today he is far from certain.

His words are almost a polar opposite of what he said back in 2012:

- “When consumer confidence was at the lowest, that was the low point of the equity market; you should be buying then. Now the consumer confidence is high and the stock market is very high; may be you should be selling now. The key is obviously for individual investors – they have to stay fully invested – the problem we have with retirement today”.

Fink does admit he is “pretty confused; ”. Why? Because, according to him, “We’re living in a bipolar world right now.” What bipolarity?

- “Fink said the 10-year benchmark Treasury could fall below 2 percent or rise above 4 percent, or the markets could see both outcomes. There will continue to be deflationary pressures in the economy due to advances in technology and possible disruptions in global trade. At the same time, if President Donald Trump’s goals to cut taxes and regulation take effect, and with the current low unemployment rate, it would only “take a little bit” to move wages higher”

- But Fink said “there’s greater probability that the 10-year Treasury is below 2 percent, and we’ll have a market set back of a considerable amount” because it will likely take until 2018 for Congress to get some of the policies of the new administration in place”.

2. All is well?

Contrary to Mr. Fink’s confusion, the financial markets are absolutely sanguine. Not only did major stock indices close the week at new all-time highs, but Treasuries & Gold Miners outperformed US stock Indices as well as Small Caps, Transports & even EEM, Brazil & India. TLT & EDV were up 1.5% & 2.5% resp; Gold was up 1.2%, Silver up 2.6% and GDX, GDXJ up 3% & 6.3% resp. And the 30-5 year curve bull-flattened by 6 bps despite a breakout in the Stock-Bond ratio:

- See It Market @seeitmarket – The stock to bond ratio remains above the rising 50 day moving average after a long term breakout $SPY $TLT

If hope is what pervades the stock market, what could cause a disruption? Perhaps seeing reality. Meaning the real danger could come when investors see the actual proposals of tax reform and then either ask “is that it?” or say “ok then!”. Or could it simply be a fear of heights?

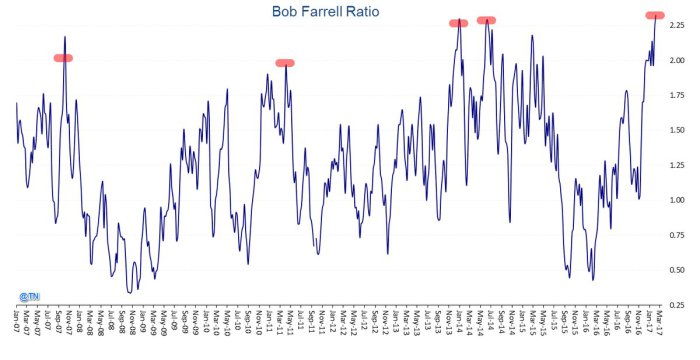

- Babak @TN – Feb 8 – Bob Farrell Ratio for Investors Intelligence also at extreme [bulls/(bears+half correction)] previous spikes up: Oct’07 Apr’11 Dec’13 Jun’14

On the other hand, how often have S&P puts been as cheap as they are now? Not very often. So even fully invested individual investors can protect themselves to some extent for the short term.

Send your feedback to [email protected] Or @Macroviewpoints on Twitter