Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. “trying to hurry up & get out of Dodge”

What did the various asset classes do after Wednesday’s FOMC statement & Yellen’s presser into Friday’s close? The big moves were in the US Dollar – up 70 bps and in precious metals – Gold down 1.7% & Silver down 3%. The other big move was in belly of the Treasury curve – 5-year yield up 5.4 bps; 3-year yield up 4.3 bps & 2-year yield up 1.6 bps. The 10-year yield also rose by 4.2 bps. In stark contrast, the 30-year yield flat at 2.78%. In equities, SPY (down 25 bps) outperformed both EEM (down 1.4%) & Russell 2000 (down 70 bps).

This is clearly a hawkish market reaction despite the data & the steep fall in yields on Wednesday morning prior to the FOMC statement. Not only did Yellen/FOMC reiterate their plans for another rate hike in 2017 but they also reiterated their plans to begin contracting the balance sheet in 2017. The contraction would be slow at $10 billion per month but it would be a contraction nonetheless.

This was a very different Yellen. Why the change? CNBC’s Steve Liesman asked her about her plans for 2017. All she said was that she was determined to serve out the term that ends in February 2017. What do heads of major institutions do in the final few months of their tenure? Ensure their legacy!. We clearly feel that was what Chair Yellen was trying to do – raise rates to where she can leave saying she had normalized monetary policy. Clearly she doesn’t care about these efforts damaging the economy to the point of a very serious slowdown after her departure. As usual, Rick Santelli came up with the perfect line for this attempt – “trying to hurry up & get out of Dodge“.

Actually, Yellen may not be able to make it out of Dodge in time if the New York Fed staff prove correct in their revised outlook published on Friday – “The New York Fed Staff Nowcast stands at 1.9% for 2017:Q2 and 1.5% for 2017:Q3″. This reversed what hawkish Yellen/FOMC had caused on Wednesday afternoon & on Thursday. The US Dollar declined on Friday & the Treasury curve bull-steepened with the 2-year yield down 3.6 bps & the 10-year & 30-year yields down only 0.5 bps.

If the NY Fed proves right & the next two quarters show sub-2% GDP, can the Fed remain hawkish & raise Federal Funds rate to 1.25% – 1.5% by year end? If they do, then the 2-year yield would reach around 1.75% thereby almost flattening the 10-2 curve from its current 84 bps to say 10-20 bps. What legacy would Yellen leave then? Of deliberately creating a recession in 2017?

That may be why Jim Bianco said on CNBC Closing Bell that there is at most one rate hike left in this Fed campaign and the next step is a very slow contraction in the balance sheet. Then you have the emphatically articulative Doug Dachille of AIG explaining why demand for long bonds will remain high.

And then there is our favorite indicator. Two weeks ago we wondered whether that Friday’s breakout of TLT above its 200-day moving average & the breakdown of 10-year & 30-year yields below their 200-day moving averages would be sustained. Two weeks later we see that the price action has sustained & extended both breaks. That, if traditional patterns continue, should suggest high Treasury prices & lower yields at least in the short term.

2. Volatility

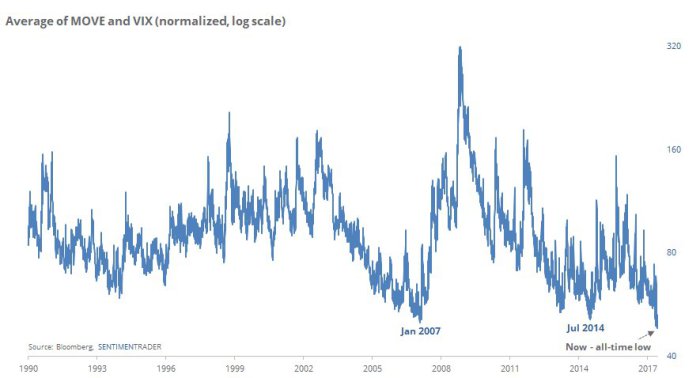

Neither the FOMC statement nor Yellen’s presser has had any measurable impact on either stock or bond volatility.

- SentimenTraderVerified account @sentimentrader – Wed Jun 14 – No worries – bond and stock volatility just hit an all-time low ahead of the Fed meeting.

As we recall, bond volatility tends to erupt before stock volatility. And the economic data seems to side with the 200-day break in Treasuries.

- Eric Pomboy @epomboy – Citi Economic Surprise Index tumbles -16.9pts to -78.6….lowest since August 2011. All is well

What happened after that August 2011 low in volatility?

(TLT) (SPY)

That would support the view of Chris Kimble that the Stock/Bond ratio could be creating an important pattern:

- The ratio put in a high back in 2014 and when it broke support at (1), bonds out performed stocks by a large percentage for the next year. Moving forward to the past few months, the ratio could be creating a topping pattern (head & shoulders top) at the same highs at it hit in 2014, at line (2).

But Tony Dwyer of Cannachord viewed the low in the Citi Economic Surprise Index differently. To him, the low in the index suggest rates are going to move sharply higher. So he recommended selling bonds & buying stocks with focus on financials, industrials, non-chemical materials & energy.

What does Lawrence McMillan of Option strategist say?

- In summary, the major trend of the market is bullish as long as $SPX remains above support. At the current time, we have sell signals from some indicators. Those are warnings that a sharp, but probably short-lived correction is possible at any time. If such a correction were large enough to violate the 2400 support level on $SPX, then bears could begin to think bigger thoughts.

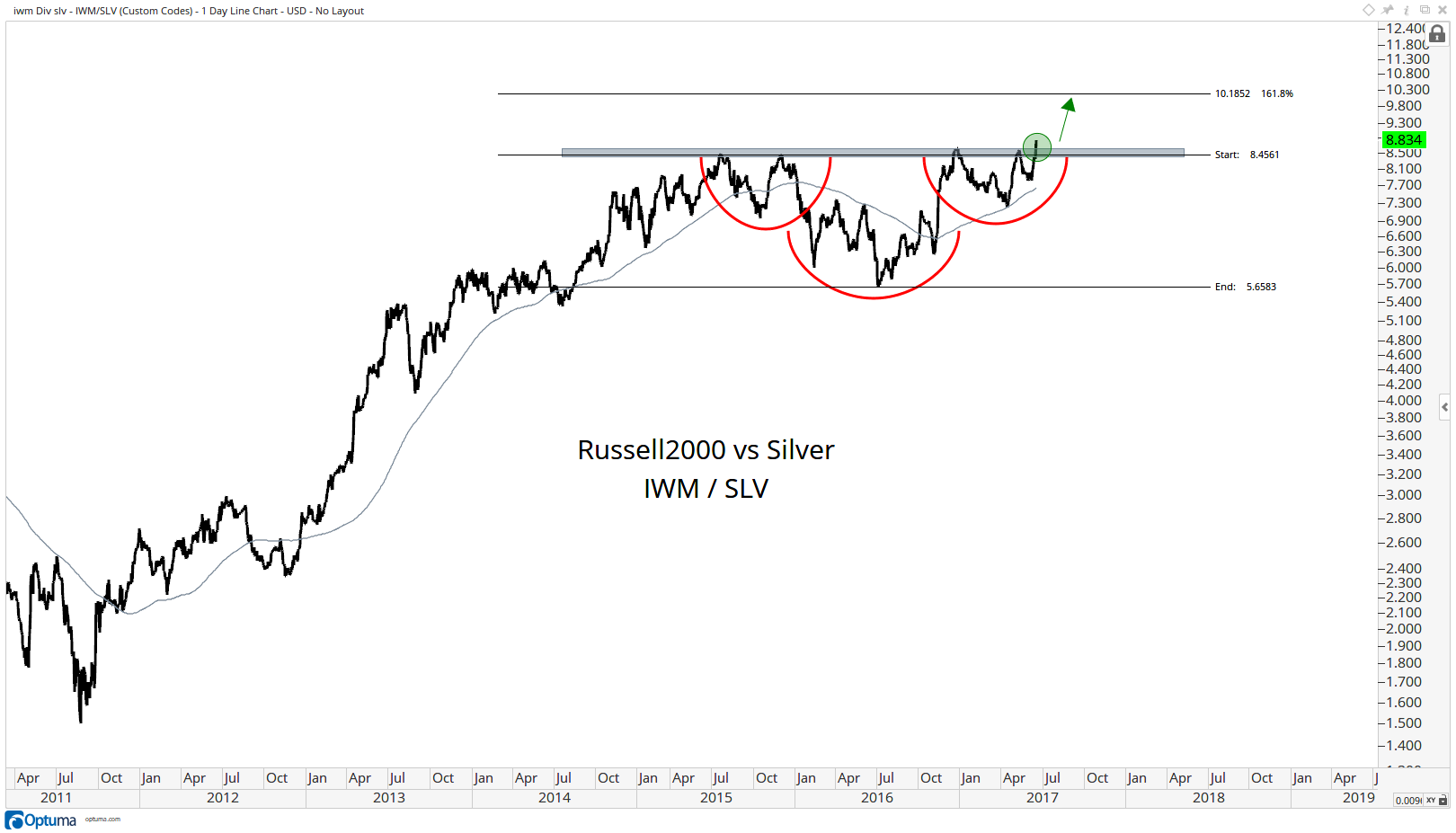

Stocks may not beat bonds but they should beat Gold according to J.C.Parets whose Chart of the Week is titled – Stocks Over Precious Metals For Another 20%.

3. Alexa

A cute tweet for a momentous event?

- JESAL @JesalTV – Jeff Bezos: “Alexa, buy me something from Whole Foods.” Alexa: “Sure, Jeff. Buying Whole Foods now.” Jeff Bezos: “WHA- ahh go ahead.”

This is a momentous event without question. Talk about buying low:

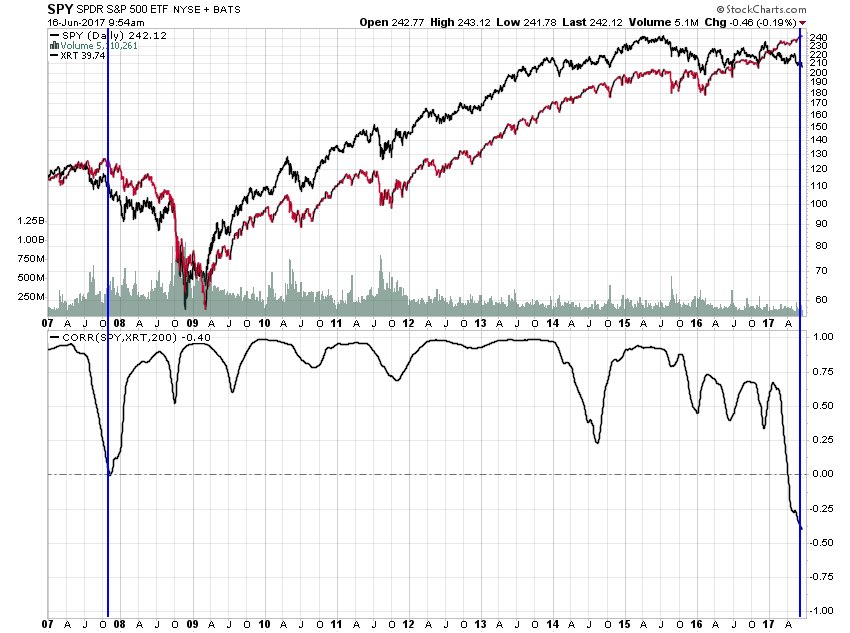

- Jesse Felder @jessefelder – Biggest divergence ever between the S&P 500 ETF and the retail sector ETF…

The leader of the top line reached down & bought a piece of the low of the lower line. Totally different from the 2000 acquisition of AOL at its high by a lowly Time Warner. That was an old line entity reaching for a new star while Amazon, a new wave giant, reached down to pick up what it thinks is a cast away pearl. How low has store-retail sunk before the predatory Amazon?

- Robin WigglesworthVerified account @RobinWigg – It’s Jeff’s world – we just get to live in it. Amazon value now almost as big as rest of S&P 500 food index, half of entire retail index.

This buy actually reminds us of another momentous buy that began a trend that lasted several years. Remember what happened 12-13 years ago. Private label was the absolute king & queen of retail. The adage was you have to be stupid to pay a premium for brands. So brand-based companies saw their stocks crater while private label companies got premium valuation. Remember when that changed? When P&G bought Gillette. Consumer branded stocks went on a multi-year multiple expansion from that deal onwards.

Whether store-based retail stocks rise from the rubble to which they have been consigned remains to be seen. But there is no question that Amazon bought Whole Foods because Amazon needed physical stores & their local distribution reach. This is a second clear sign that smart, very smart, buyers recognize the value in store-rich retail companies, the first sign being last week’s announcement by the Nordstrom family of their intention to take JWN private.

This is a smart acquisition by Amazon and they have the steely determination & execution capability to make it a big success. But which side gets a significant multiple expansion from this buy? Amazon or the store-based retail space. We suspect the former especially the ones that have the savvy & determination to execute their business.

4. Secular Rise

Guess where Amazon is investing very heavily? Guess which market Apple has to make work? India. And this week we saw another step in a secular rise of not just India but the rest of the Indian Subcontinent that takes its clue from India. Guess which four countries reached the Semi-final round of the ICC Championship tournament held in the UK over the last couple of weeks? India, BanglaDesh, NaPakistan & England. And England lost to NaPakistan in its semi final. Amazing that the country that invented Cricket couldn’t make it to the final despite being the host of the tournament & perennial Anglo powerhouse Australia couldn’t even make it to the semifinal.

So the final on this Sunday will be between India & NaPakistan. This guarantees great TV ratings and raises the market value of Indian Cricket stars which has been on a secular rise for years, This week India’s 28-year old captain became the fastest batsman in history to score 8,000 runs in one day cricket. He is negotiating an ad deal with Pepsi and could raise his demands even higher if he leads India to a win tomorrow in the ICC final.

Given the growth path of India, we think the highest paid athlete in the world could be an Indian in ten years or so.

All that is fine but what about India’s mind share in China?

5. Father’s Day & a Geopolitical Beginning

Something new & possibly important happened in the Shanghai Cooperation Organization summit held in Astana, Kazakhstan a week ago. Chinese President Xi Jin Ping told Indian Prime Minister Modi that he had watched “Dangal” & he had liked it.

What is Dangal? A huge blockbuster (#2 to only Baahubali 2) that was released in China recently and played on 7,000 screens. It became so popular that even the President of China watched it and liked it. When was the last time an American President, a German Chancellor, a French President watched an Indian film and liked it so much that they mentioned it in a global summit.

For a longer discussion why this may suggest an important geopolitical beginning, read our adjacent article A Father’s Day Movie & A Geopolitical Beginning!

By the way, do you remember the Chinese-origin Tiger Mother who proudly pushed her kids. Interestingly, some Chinese reacted negatively to this Indian father intensively training his daughters in the reaction clip below.

[embedyt] http://www.youtube.com/watch?v=65YJPTffyPY[/embedyt]

No wonder Amazon & Apple are trying so hard to seize market share in India because it is a secular growth story in rising incomes & rising power for at least another 15-25 years. So listen to Gundlach & buy quality consumer product companies during market corrections & hold on to them for the next 15 years.

By the way, it felt good to see that Gundlach also thinks INDA has made a double top and suggests adding only after a correction.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter