Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Look back to

the tweet & chart we featured 5 weeks ago:

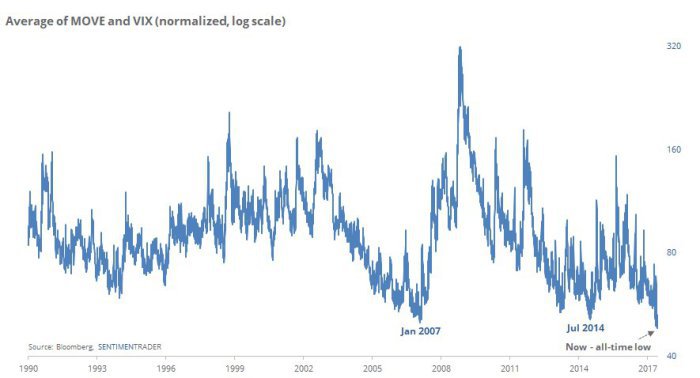

- SentimenTrader?Verified account @sentimentrader – No worries – bond and stock volatility just hit an all-time low ahead of the Fed meeting.

Soon thereafter began a bout of FX volatility. Then, on Tuesday, June 27, NY Fed president Dudley spoke about additional Fed hikes. That triggered a 2 week long rapid rise in Treasury yields. That must have been too much for the Fed.

So on July 11 & July 12, Dr. Lael Brainard & Chair Yellen sent dovish signals. That led to a fall in Treasury yields & the U.S. Dollar. Naturally Nasdaq stocks & FANGs/Semis exploded.

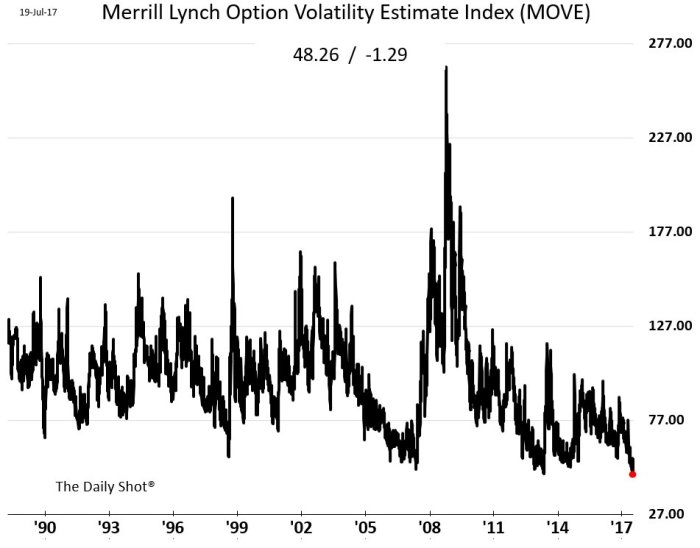

This week Draghi added fuel to what Brainard/Yellen had begun last week. So the market movements continued at a faster pace this week with US Dollar down 2%, TLT up 2% and NDX up 1.4%. The VIX kept falling as well and so did the BAC-Merrill Treasury volatility index MOVE.

- ((The Daily Shot)))? @SoberLook – Chart: Treasury implied volatility index (MOVE) hits record low –

With MOVE at a record low, VIX near its all-time low and currency volatility rising this week with a massive 2% decline in the Dollar, we seem to have returned back to the conditions on June 23, the day after Draghi spoke & 3 days before Dudley spoke to trigger fast rise in Treasury yields.

With MOVE at a record low, VIX near its all-time low and currency volatility rising this week with a massive 2% decline in the Dollar, we seem to have returned back to the conditions on June 23, the day after Draghi spoke & 3 days before Dudley spoke to trigger fast rise in Treasury yields.

What happens 3 days from now?

2. FOMC on Wednesday, July 26.

Literally no one on Fin TV discussed next week’s FOMC meeting with any seriousness or worry let alone foreboding. That certainly fits in with the lows in VIX & MOVE. What if Yellen surprises the markets & takes back some of the dovishness she showed in her testimony to the Congress? What might happen based on positioning in the markets?

- Peter Brandt? @PeterLBrandt Record commercial short position. Will commercials defeat breakout or will they be forced to capitulate? $EURUSD

Usually, the commercials tend to be correct because they are the real smart money, right? That could support a bounce:

Usually, the commercials tend to be correct because they are the real smart money, right? That could support a bounce:

- Blake Morrow?Verified account @PipCzar The DXY channel support and 78% retracement doesn’t get much more important, take a look at the RSI as well #forex $EURUSD $DXY #USD —->

Would Treasury yields bounce if the Dollar bounces? The trade below argues so:

Would Treasury yields bounce if the Dollar bounces? The trade below argues so:

- Joe Kunkle? @OptionsHawk – July 20- Treasury $TLT buyer of 10,000 August $125 puts $1.14 at CBOE this morning, big fade here causing sector rotations intraday

Post Dudley on Tuesday, June 27, both bond & stock volatility went up with Treasury yields shooting up & stocks consolidating. In that case, bond volatility shot up first, yields spiked up and then stock volatility went up.

That sequence may not be repeated and, as Ryan Detrick explained in his article MOVE Index and Treasury Yields, a sharp rise in MOVE can accompany a steep fall in Treasury yields as well as steep rise. That could happen if stocks fell first driving VIX higher driving down Treasury yields sharply.

All this could happen next week if Chair Yellen restores some fear to markets by taking away her dovishness of last week. But no one cared to wonder about this “if”. Is this complacency the cause or result of the lows in VIX & MOVE?

3. Stocks

Not only do we face FOMC next week, we also face seasonality:

- “The first half of July has been strong. Check that off for working in 2017, but be aware that the S&P 500 has tended to peak around now and the next few months can be tricky.” In other words, the next couple months could look more like the average of the past 20 years, but that potentially sets up a better buying opportunity“.

What does the channel look like?

- Kate’s Dad? @KASDad – #SPY flirting with what appears to be upper boundary of a wedge (in technical terms, this is known as the support and resistance indicator). Perhaps it will resolve by the end of the day. $SPX $NDX $IWM

- Joe Kunkle? @OptionsHawk – Russell 2000 $IWM trading over 47,000 Sep. 1 (W) $140/$130 put spreads to open

What do the transports say?

- Mark Newton? @MarkNewtonCMT #Transportation BREAKING down today under a 2-month trend- Something to pay attention to- Daily & weekly Demark Exhaustion– #Rails $IYT

With all the negative charts & Fed fear discussed above, wouldn’t it be ironic if Yellen comes across way dovish & markets rally next week with terrific earnings?

What better sight to put us all in a better mood than something bright & lustrous?

(Padma-Nabha-Svami Temple – richest place of worship in the world)

(Padma-Nabha-Svami Temple – richest place of worship in the world)

Who calls it so? The team of investigators who opened couple of hidden vaults in 2011 and discovered gold jewellery, objects and 100,000 historic gold coins. The total worth of all the centuries-old treasure is valued to be around $15 billion.

We visited this temple last year & were stunned to see the utter lack of security around this famous temple. Hope the hidden vaults are somewhere else.

Where is this located? In the southeastern state of Keral in the city named Thiruananthapuram. It is easy for us to say but it proved a real mouthful for CNN’s Jake Tapper. That is until he learned (via our tweet) that the only way to pronounce the name is by splitting the compound word into its 3 constituents as Thiru-Anantha-Puram or the holy (thiru) city (puram like pore in Singapore) of Anantha, a synonym for God.

Coming down from the heavenly to the earth:

4. Gold

With rates falling & Dollar cratering, Gold can move only one way, right? Gold rallied 3.6% this week, Silver rallied hard by 6% & GDX, GDXJ jumped by 6%.

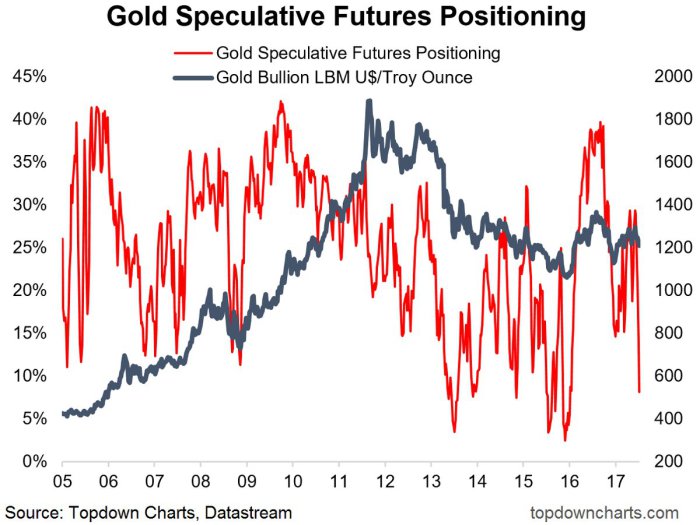

- Topdown Charts? @topdowncharts Big swing in #Gold futures positioning – becoming stretched to the downside… https://www.topdowncharts.com/

single-post/2017/07/16/ChartBr ief-109—The-big-swings-in-co mmodity-futures-positioning … $GLD $GC_F

Base metals & Ag stocks also flew this week with FCX up 9.6%, CLF up 8.6% & MOS up 7.8%. This is on top of the rally of last week in FCX (up 5.9%), CLF (up 9.7%), MOS (up 5%).

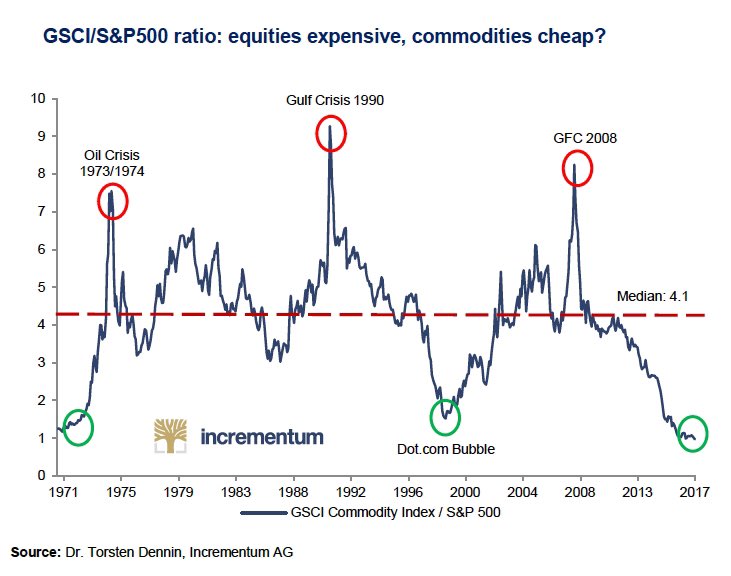

Kudos to Jesse Felder for his chart about extreme cheapness of Commodities vs. S&P that we featured two weeks ago:

- Jesse Felder? @jessefelder – July 7 – Over the past 45 years commodities have not been cheaper relative to equities than they are today http://www.visualcapitalist.com/commodities-h1-2017-cheap/ …

It has been a great rally for two weeks. Will it continue or will the FOMC put a brake on it next week? One way or another, it should be an interesting week.

It has been a great rally for two weeks. Will it continue or will the FOMC put a brake on it next week? One way or another, it should be an interesting week.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter