Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.US Dollar, FOMC, Financial Stress

The FOMC statement came & went without much of an impact. It reaffirmed the intent to begin contracting the balance sheet. As usual, the FinTV experts kept discussing words used in the statement including the new word “somewhat”. We prefer to look at what the various asset classes did from 10 minutes prior to the FOMC statement to the close on Friday – The Dollar fell by 90 bps; yields along the 10-2 yr Treasury curve fell by about 3 bps while the 30-yr yield fell by 1.8 bps, a bull-steepening. Gold & Oil rose by more than 1% & all major stock indices, except the Dow, fell a little.

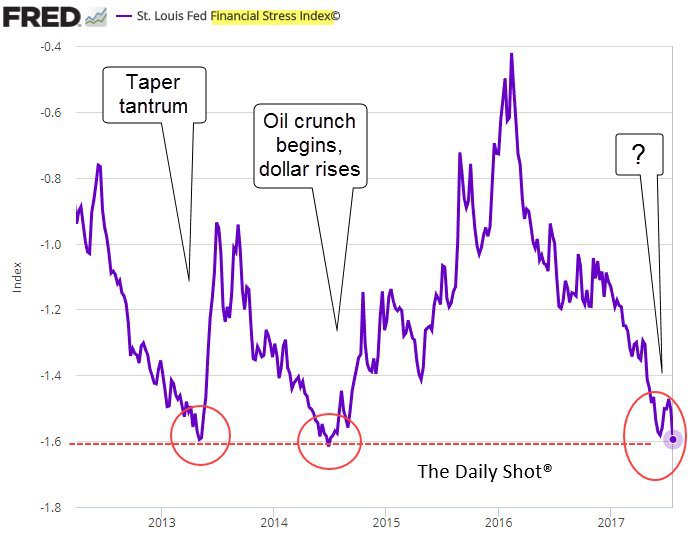

In reality, all the huffing & puffing of the Fed has had little impact on financial conditions:

- (((The Daily Shot))) @SoberLook 16 hours ago – Chart: The

@stlouisfed Financial Stress Index –

What gives? Jim Caron of Morgan Stanley Investment Management explained on BTV:

- ” … any time you get a 2% decline in the Dollar, that’s about equivalent of a 25 bps rate cut; the Dollar is down 7% on a trade weighted basis; that is equivalent of about 3 rate cuts just based on the Dollar; that basically eliminates the recent three rate hikes; so even if the Fed is trying to increase interest rates, they are not actually changing policy at all; the financial conditions remain really easy; you do then get an exuberation in other assets; equities for example”

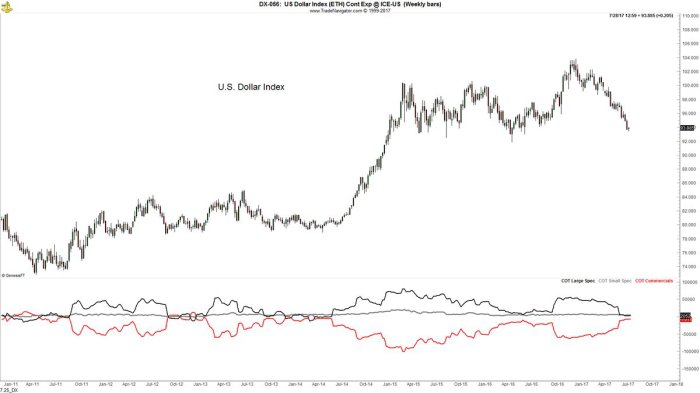

Does that mean the Dollar has to rise to remove liquidity from the system? If so, what is the current positioning in the Dollar?

- Peter Brandt @PeterLBrandt Commercials have smallest net short position since May 2014 low

$DX_F

But what trigger could cause this positioning come into play? Last week we wondered if the FOMC statement could serve as a trigger. It didn’t. But others came around to the case of a Dollar rally this week including one who has been right recently on Rates, Silver & recently Oil. .

Like us, Carter Worth has been wrong in this call at least so far.

2. Reflation?

The only up day in the S&P this week was Tuesday, a day which saw Freeport explode to the upside by 14% and US Steel explode in the after-market by 10% after rising 2.5% during the day. Copper broke out to match the move in FCX.

- Peter Brandt @PeterLBrandt Jul 26 – $HG_F $JJC #Copper completes possible massive H&S bottom target = 3.70

Copper & Freeport kept much of their rally into Friday’s close. But US Steel reversed very hard and closed down 15% from its Wednesday morning high and down 2.3% on the week.

Copper & Freeport kept much of their rally into Friday’s close. But US Steel reversed very hard and closed down 15% from its Wednesday morning high and down 2.3% on the week.

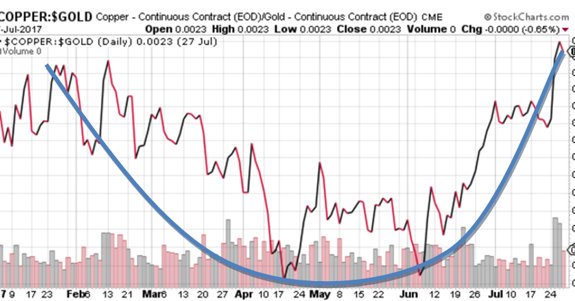

Gold rallied as well but the Copper-Gold ratio went somewhat vertical this week.

According to this favorite indicator of Jeffrey Gundlach, Treasury yields should be exploding upwards. And they kinda did on Tuesday with the 30-10 year part of the curve up 7.5 bps on the day. But yields began falling gently post Wednesday’s FOMC statement.

Despite that gentle fall, the 30-year yield rose by 8 bps on the week while the 10-year yield rose 4.5 bps. In contrast, the 2-year yield fell by 0.7 bps steepening the 30-5 curve by 6 bps & the 10-2 curve by 4 bps. On the other hand, Treasury yields fell on Friday despite the 2.6% print in Q2 GDP.

So what’s going on? Is the action in interest rates real or this market driven reflation trade for real? Is it money running out of FANG stocks into reflation stocks? Or is it as Larry McDonald asked in his Bear Traps Report – “did those ten “mad men” in a room in Beijing put too much pressure on the gas pedal this time?”

3. Stocks – CSCO as a T-Bill & S&P as a money market fund?

More & more smart, really smart, investors are coming forth to declare their caution & recommend it to others. The celebrated Howard Marks received the most attention & rightly so. But we were struck by what Roger McNamee said as he was rhapsodizing about the limitless opportunity for Facebook:

- “as an investor, I am very cautious …. I have an outsized weighting in T-bills right now because I look around & I see things going on in the global business & political environment that I have never seen in 35 years as an investor & which I am not sure anybody has seen in a 100 years which I think should be scaring investor more than we are seeing now”

We still recall a conversation in late 1999 with a technology executive who was bemoaning his decision to sell his company to another company for a higher valuation rather than to Cisco Systems for a lower one. He told us he wished he had sold to Cisco because “CSCO stock was safe as a T-bill“. We remembered this conversation when we read the tweet below on Friday afternoon:

- Charlie BilelloVerified account @charliebilello Had someone ask me today if it’s safe to “park their money” in the S&P for a few months as it never seems to go down. The new money market.

No wonder the VIX hit a new low this week. That was too enticing for Jeffrey Gundlach who bought five month S&P puts this week. That is thinking ahead.

On the other hand, Lawrence McMillan of Option Strategist wrote on Friday:

- “In summary, all of our indicators continue to be bullish. The overbought condition in volatility warns of a sharp, but likely short- lived correction, and that is probably imminent. But that won’t change the intermediate-term picture unless the major support levels of $SPX are taken out.”

But the Russell could be a different story:

- Peter Brandt @PeterLBrandt –

$RUT$RTY_F That#RUSSELL has turned down from upper boundary is actually quite negative. RABTs usually bearish

Last week we featured a tweet from Mark Newton about the breakdown in Transports. Well, DJT fell by 2.6% this week & by 3% just on Thursday. This looked oversold to some:

- J.C. Parets @allstarcharts – Transportation stocks finding support near their late 2014 highs, which is where they should if this is still a bull market

$DJT$TRAN$IYT

That is a big “if”, isn’t it? Remember the optimism in Transports when they hit a new all time high in the first week of July? Remember the Tall Tales and Transports article we featured on July 8, 2017 which warned – “the last 3 bear markets all saw Transports hitting new all-time highs just prior to the steepest losses”.

What about EM and the Dollar?

- Mark Arbeter, CMT @MarkArbeter – Neg. correlation between

$USD,$EEM. $ nearing chart support, 200W average. EEM near chart rez. COT data bullish for $, bearish for$EURO

4. Gold

Gold was up 1.1% this week but the real action was in miners, especially the big guys with NEM up 7.8% & ABX up 4.4%. The performance of Gold drew some admirers this week:

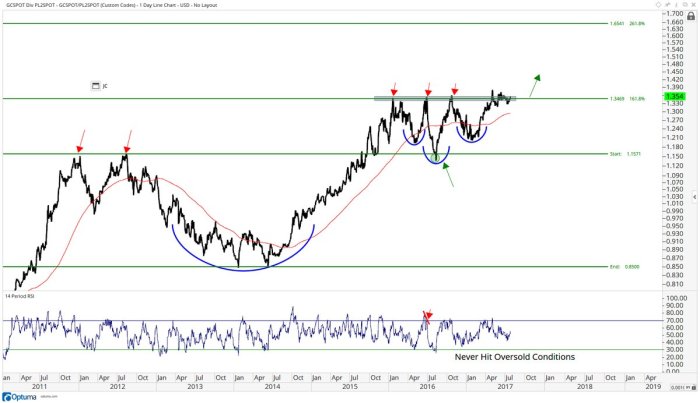

- Jeffrey GundlachVerified account @TruthGundlach Gold at key juncture. Pushed above 200 day moving average recently, and the 50 and 100 today. Coiling just below 5 year downtrend line, too.

But Gundlach has liked Gold for some time. How about someone new & about Gold’s partner metal?

- Peter Brandt @PeterLBrandt For first time in long time, I am quite impressed with metals

$SI_F$SLV$GC_F$GLD Was Jul low the blow off low?

How about a skeptic looking anew?

- J.C. Parets @allstarcharts what’s up with that Gold to Platinum Ratio? Anyone think we finally get that breakout from this 18-month range?

$GLD$PPLT$GC_F$PL_F

5. Oil – Unison or Divergence?

Oil was up huge this week, up over 8% in both USO & BNO. In fact, crude was up every single day this week and closed above its 200-day. What about resistance?

- Carolyn Boroden @Fibonacciqueen – Crude is testing second resistance…I don’t see any swing sell triggers yet…tis possible we just blow through here…watch the zone!!NTNT

On the other hand,

- Lawrence McDonald @Convertbond Bear Market Rallies – Crude 2017 Other Side of the Mountain? Jun 21-Jul 25: +15.7% May 5-May 25: +18.8% Mar 27-Apr 12: +14.3% Bloomberg

In contrast to Gold miners rallying much harder than Gold, Oil stocks badly underperformed crude this week. XLE was only up 2% & OIH was actually down 24 bps this week. And the biggest & baddest of them all was the worst performer:

- Charlie BilelloVerified account @charliebilello – Interesting to see the largest oil company, Exxon Mobil, hitting 2017 lows day as Crude rallies 17% in the past month.

$XOM

Perhaps that’s why:

- Kate’s Dad @KASDad 3 hours ago- Impatient, shorted

#Crude$CL_U at 49.70. Could work a bit higher.$SPX$NDX$IWM

6. Kelly, Priebus, Scaramucci …

To repeat something we wrote on several occasions last year, watching the Trump campaign & now the Trump presidency has been a lot of fun. Great theater, great performances & above all great results, at least from Mr. Trump’s point of view. Look back to the campaign and you will notice major media eruptions, calls questioning sanity of Mr. Trump & declarations of melt up in the campaign. In every case, the media eruption was followed by higher quality & more professional hires followed by greater success.

Isn’t that what happened again? After a hyper-hyper media ventilation, what do we have? A far better & more respected John Kelly as Chief of Staff. Even Mr. Trump’s most strident critics ended up praising the hire & concentrated their negativity on whether he will succeed or more accurately when he would fail.

People forget that the chief, actually the only, strategist in the Trump campaign was Donald Trump himself. In the same way, the real White House Chief of Staff is & has always been President Trump. All others are specific to a job, a project, an assignment given by the President. This is one reason those who know him call him “transactional”.

Reince Priebus was instrumental in getting the GOP establishment to support & back Candidate Trump. Priebus marshalled all the resources of the GOP to make the Trump campaign better funded and better supported. That is why he was made Chief of Staff. His next job was to manage the GOP leadership to get the Trump agenda passed. The failure of the Senate Health Care bill on Thursday night ended the need for Priebus; he was no longer a major asset to the Trump Administration. He might be next year into the November election but not now.

Enter John Kelly to virtually universal acclaim. But ask what is the main job for General Kelly as White House Chief of Staff? What does he need to manage to get a huge win for America & the Trump Presidency? North Korea. When was he hired? The day after the successful launch of an ICBM by North Korea. As we wrote in our recent Fourth of July article, the USA has pretty much decided to wage war on North Korea. That decision, we believe, got ratified this Friday with the ICBM launch by North Korea.

This is a huge risk & a huge reward opportunity for the Trump presidency. It needs to be managed delicately, firmly, & with precision. You don’t need the GOP leadership for this; you need close cooperation with Secretary Mattis & the Pentagon. Recall the recent stories about how there are differences between Secretary Mattis & NSA McMaster. The same stories hinted that General Kelly was more on the side of Secretary Mattis than NSA McMaster.

His appointment as White House Chief of Staff puts the power of the presidency behind General Kelly in his management of the North Korean conflict and the Pentagon. His job is to get a big win for America & solve to North Korean mess once & for all. Frankly, there is nothing more momentous over the next year not even tax reform. So let us all wish the best of luck to General Kelly. We all need it.

Back to the communication eruption. Notice something very different about this episode vs. all the previous locker-room type eruptions? In all previous cases, the eruption that was necessary was done by Mr. Trump. This is the first time, Mr. Trump assigned another voice to trigger a communications eruption for him. And the Mooch did a great job. Every one was riveted on the locker room language, the intensity of emotion and the no holds barred attack on Priebus. No one talked about anything else after the New Yorker story broke. CNN/MSNBC went nuts shouting about the dysfunction in the Trump White House.

What a perfect setup to announce the appointment of General Kelly as the new Chief of Staff? And that set up was manufactured by the Mooch either intentionally or naturally. Throughout the campaign we had argued for a media hit team to take the pressure off of Mr. Trump. He found one in the Mooch and it worked beautifully.

What about Sessions? He has promised to reveal his actions against leaks within the FBI next week. The House Judiciary committee has asked for a Special Counsel to investigate the Clinton mess, Lynch & Comey. Will the GOP leadership in the Senate & the House back this request? And will AG Sessions “reluctantly” agree to appoint such a Special Counsel in view of the evidence presented & in deference to the wishes of the Republican leadership who backed him? If he does, then it would be a yuuge win for President Trump.

Then would we wonder whether Mr. Trump’s public criticism of AG Sessions was really intended to scare the GOP leadership in to putting pressure on AG Sessions and providing him cover for what President Trump wants him to do?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter