Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Thanks Dr. Pangloss

Last week we summoned our inner Pangloss and wished for the aftermath of Irma to lead to “a joyous stock rally into next week’s option expiration with Dollar rising, rates rising and Gold giving up some of its gains ... “. Pangloss did come and how? Stocks enjoyed a joyous rally with Dow up 2.2%, S&P up 1.6%, Nasdaq up 1.4%, Russell 2000 up 2.4% and Dow Transports up 1.7%. Rates rose up sharply with 5-year yield up 16 bps, 10-year yield up 14 bps and even the 2-year yield up 11 bps on the week. And gold certainly gave up some of its gains by falling 2%. And yes, the Dollar rose by 60 bps.

Now what? The set up looked so perfect by Friday’s close that even Jim Cramer cautioned his viewers on Friday evening about being careful about a stock market which looks so good.

2. Gundlach vs. BAML Survey

Jeffrey Gundlach covered most major asset classes in his webcast on Tuesday, September 12 and, coincidentally, @ukarlewitz summarized the recent Fund Manager survey from BAML on the same day. The survey is based on positioning of large asset managers as reported by them to BAML and, as he has said, Gundlach considers positioning to be important for judging trade locations.

2.1 Dollar

- Gundlach said the Dollar was due for a rally after what has been the worst year for the Dollar since 1985. He said the Dollar should bottom now and DXY should go to 96-97 before the next leg down. But he cautioned that Dollar does not trade well.

- BAML – In September, 23% of fund managers view the dollar as undervalued, the most since December 2014.

2.2 Emerging Markets

- Gundlach – Dollar and EM are extremely correlated. Gundlach reminded listeners that he had recommended going long EM vs. SPY a few months ago and that trade has performed superbly. He added that ” he is not fond of EM in the short term“. He suggested booking EM profits for traders but staying long EM for investors because over the long term, EM was “way way” better.

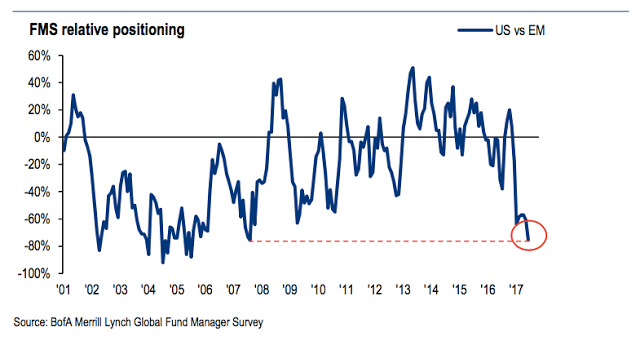

- BAML – This month, allocations [to EM equities] jumped to +47% overweight, a 7-year high (1.2 standard deviations above its long term mean). Emerging market equities are at risk of underperforming.

Gundlach did not comment on US equities.

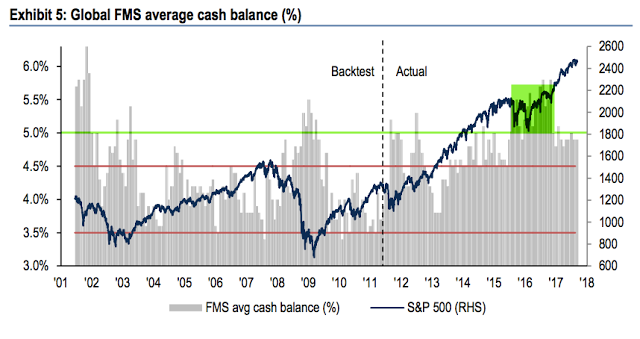

BAML – US equities are strongly out of favor and should outperform. Fund managers have now dramatically dropped their allocation to -28% underweight, the lowest since November 2007 (1.2 standard deviations below its long term mean). This is where US equities typically start to outperform again. … Cash remains high at 4.8% in September (BAML considers cash levels above 4.5% to be a contrarian long for equities). This is still supportive of further gains in equities.

What about hedging?

- BAML – only a net 27% of fund managers have not bought equities hedges (i.e., downside protection). Current levels are similar to those prevailing prior to the US election last autumn. This further indicates a lack of complacency.

2.4 Commodities

According to Gundlach, commodities seem to be “stirring off of a very low level“. He said commodities will go up after 10-year rates rise and that commodities tend to rally before a recession. But he added, commodities are not falling any more.

- BAML – Allocations to commodities dropped to a 1-year low in June (-15% underweight) before rebounding in September (-4% underweight). This is equal to its long term mean (neutral).

3. Economy, Interest Rates

The summary of @ukarlewitz on bonds was quite terse & short.

- BAML – Bonds are a modest contrarian long … In September, fund managers’ allocations to bonds rose -48% underweight bonds, the highest in 10 months. This is now just 0.3 standard deviations below its long term mean (i.e., close to neutral).

Gundlach , in contrast, was quite eloquent on bonds. As he has said before, he thinks the German 10-year Bund yield has no business being at 30 bps. He said retail sales, GDP, PMIs were as strong in Europe as in US if not stronger. He said Draghi will have to start talking about tapering and “one day“, the German 10-year yield won’t be pegged down. He said the German inflation is going higher and the German 10-year yield will rise to 1% and take the US 10-year yield with it. He said credit spreads should be widening about now and said this is a “very poor time for taking risk in bond funds“.

He thinks headline inflation should get to 2% by year-end but added that “core CPI is very disappointing for the Fed“. He pointed out that US loan growth is falling and that the flatness of the 2-3 year curve is suggesting the Fed will not raise rates much. He pointed out the 30-year yield has never broken its downtrend line and you cannot expect rates to go much higher unless that downtrend line is broken and the 30-year yield trades gets above 3% .

Gundlach said he is getting “a July 2016 type feeling in the bond market“. That is chilling when you recall that the 10-year exploded up from 1.36% on July 15, 2016 to 1.83% the day before the election and then to 2.6%+ in December 2016. Gundlach’s target for 10-year yield at year-end is 2.44%.

On the other hand, David Rosenberg reiterated his bullishness on Treasuries this week. His bullet point reasons:

- Aging demographics

- The Fourth Industrial Revolution

- Deeply embedded low inflation expectations

- Flatter Phillips Curve

- Negative unit labor costs

- Fierce competitive pressures in the retail sector

4. Equanimity of Pangloss

Nothing shook markets this week; neither the North Korean missile launch nor the downgrade of Q3, Q4 GDP by NY Fed, Atlanta Fed & the Cleveland Fed. Rates went up, Gold fell down & stocks rallied. We will see whether the FOMC can shake this Panglossian equanimity next Wednesday.

If not the FOMC then perhaps seasonality might:

- StockTrader’sAlmanac @AlmanacTrader – S&P 500 down 22 of last 27 week after September options expiration, average loss 1.00% – Next week is the…

What about the intermediate term? Lawrence McMillan of Option Strategist wrote on Friday:

- In summary, we have intermediate-term buy signals from all indicators. Thus our targets of 2540 to 2576, depending on which of our methods you are using, remain intact. A short-term overbought correction is possible, but even if it occurs, it should only be a minor deterrent.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter