Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Good” won!

Remember the tumult of last Friday with the Michael Flynn guilty plea and the 350 point decline in the Dow? By Monday morning, they were saying forget about it. Because the “Good” won and the “Bad” went away. We are speaking, of course, of the Jonathan Turley article The Good, the bad and the ugly of Michael’s Flynn’s guilty plea. The agent of the Bad, Brian Ross of ABC, was shunted away for a 4-week suspension and the Dow opened up 200+ points higher on Monday morning.

Four days later came the Tax Cut bill passage by the Senate. And talk began again about a major Infrastructure program early next year. That took care of the weakness in Transports and DJT closed up 2.1% on the week. The Dow and the S&P rallied a bit this week as well.

The action suggests that the upside exhaustion signaled by @TommyThornton last week is still a factor despite the good news. Lawrence McMillan of Option Strategist also saw some sell signals this week – “Market breadth has not been strong and both breadth oscillators remain on sell signals at this time“.

But “this is only a short-term condition” he wrote and added:

- “In summary, when the market sold on “the news” early this week, it looked like a correction might be able to take hold — perhaps driving $SPX down towards support at 2600. That was not the case. But even if a short-term correction were to take place, the intermediate-term indicators ($SPX and $VIX charts) are still bullish“.

2. Payroll Report

The payroll report came in at 228,000 and as “Rosie” Rosenberg said rosily – “There is no sense debating the contours of today’s employment report – it was buoyant“.

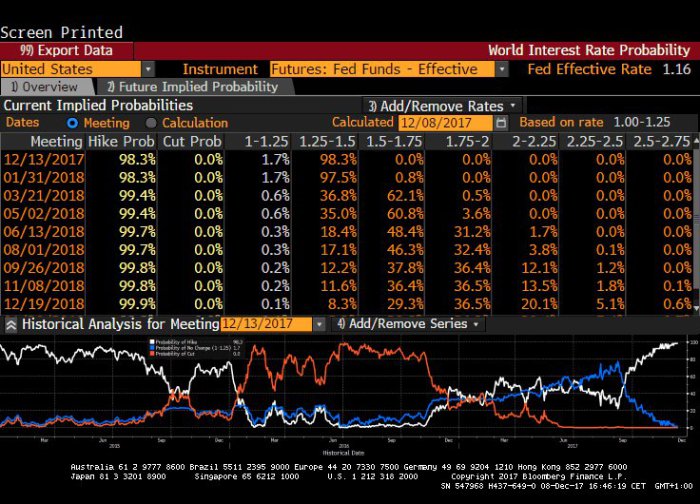

But look what happened. The inexorable force of the rising 2-year yield stopped as soon as the report hit the tape. Actually, the 2-year yield fell more on the day than the 5-year yield. What’s even more amazing? The 6-month yield dropped by 2 bps on Friday, more than twice the fall of 0.9 bps in the 30-year yield. That can only mean one thing – the certainty of the Fed raising rates in the next 6 months fell a bit. You can see that in:

- Holger Zschaepitz? @Schuldensuehner – Fed rate hike expectations drop a tiny bit after US jobs data as payroll rose 228k above consensus of 195k but average hourly earnings increased only 2.5% YoY, less than exp. Looks as if pay gains are slower than what’s expected at this stage.

This came at the end of a week in which fears of relentless flattening of the Yield Curve forced Jim Cramer to discuss the flattening with Gary Cohn after the payroll number. If Cramer-Cohn together could not dispel the flattening fears, then perhaps the fears are not misplaced. The 10-7 year spread that Rick Santelli talks about fell to single digits this week.

This came at the end of a week in which fears of relentless flattening of the Yield Curve forced Jim Cramer to discuss the flattening with Gary Cohn after the payroll number. If Cramer-Cohn together could not dispel the flattening fears, then perhaps the fears are not misplaced. The 10-7 year spread that Rick Santelli talks about fell to single digits this week.

- Lisa Abramowicz?Verified account @lisaabramowicz1 – The U.S. yield curve will probably invert within the next 2 years, says more than half of analysts surveyed by Bloomberg .https://www.bloomberg.com/news

/articles/2017-12-07/inverted- yield-curve-in-2018-is-taking- over-wall-street-outlooks

But it is always darkest before the dawn, right! And how do you measure the darkness of the hour? By looking at the size of the crowd, known as positioning.

- Lawrence McDonald? @Convertbond – Tue Dec 5 – Further flattening bets, the Street is piling in – one very crowded trade

But even a boat that has everybody on one side needs a jolt to topple over, right? Could Janet Yellen deliver one in her last FOMC meeting next Wednesday? She has already sent a gentle signal in last week’s updated Fed minutes. Perhaps the action in the short end of the Treasury curve post NFP report on Friday morning is another a signal from the Treasury market. Let’s watch the action in the short end & the belly of the curve next Thursday, the day after next week’s FOMC meeting.

What’s the old recipe for making money when the yield curve unflattens? Buy the long end of the flat curve! Is there any Institutional strategist who has the courage to say that? Guess what, we found one this week on Bloomberg TV. Matthew Hornbach of Morgan Stanley said on BTV that the 10-year Treasury yield will remain below 2.50% and then fall below 2.00% by the end of 2018. So he recommends getting overweight 10-year Treasuries.

Wait! Aren’t German Bund ylds going to explode higher and take the US Treasury yields with them? Wasn’t Jeffrey Gundlach worried about the 10-year Bund yield breaking above 50 bps a couple of months ago? Apparently the King proposes but the Market God disposes! This week, the 10-year Bund yield traded below 30 bps and closed the week just barely above 30 bps. And the German 2-year yield went below negative 75 bps this week but closed barely above that.

With the same Gundlachian logic. albeit in the opposite direction, Morgan Stanley’s Hornbach suggests going long 30-year US Treasury & short the 30-year German Bund.

3. Stocks

What is the intermediate term except a series of short terms? That makes us ask what about next week?

- Urban Carmel? @ukarlewitz – Wed Dec 6 –

$SPX: down 4 days in a row. Last 5 yrs, 17 of 18 (94%) closed higher by avg 1.4% w/in 5 days

Next week is Options Expiration. What usually happens in OpEx week in December?

- StockTrader’sAlmanac? @AlmanacTrader – December options expiration belongs to the bulls – December’s option expiration has a firmly bullish histo…jeffhirsch.tumblr.com/post/168324575642/december-options-expiration-belongs-to-the-bulls

- “December’s option expiration has a firmly bullish history. In fact, the week of options expiration and the week after have the most bullish record of all Triple Witching expirations (page 78, Stock Trader’s Almanac 2018). Since 1982, DJIA has advanced 27 times during December’s options expiration week with an average gain of 0.74%. S&P 500 has a similar, although slightly softer record. However, the record is not pristine. In 2011, Europe’s debt crisis derailed the market. In 2012, the threat of going over the fiscal cliff triggered a nearly 2% loss the week after.”

What about the Semis? Isn’t the selling & relative underperformance overdone? Carter Worth of CNBC Options Action suggested buying Semis on last Monday evening. The next day Andrew Thrasher joined:

- See It Market? @seeitmarket – Tue Dec 5 – chart via @AndrewThrasher: “For the first time since early 2016, the ratio between semiconductors and the S&P 500 is now seeing ‘oversold’ momentum as the ratio tests the June high.” $SOX $SPX

A day later on Wednesday, Mark Newton said not so fast & punted the ball to early next week:

A day later on Wednesday, Mark Newton said not so fast & punted the ball to early next week:

- Mark Newton? @MarkNewtonCMT – $SOX $SMH Semis led to the upside, and now have led to the downside, yet, the broader uptrends remain very much intact, and arguably getting close to an area to buy dips which could be in place by early next week

Early next week means buy before the FOMC? Mark Newton didn’t say.

Early next week means buy before the FOMC? Mark Newton didn’t say.

What about the emerging markets? They have recovered some but does the bounce have legs?

- J.C. Parets? @allstarcharts – Here are the

#BRICKS Equally-weighted, about half way to their upside objective imo$BVSP$RTS$NIFTY$SSEC$EZA$EWY$KOSPI

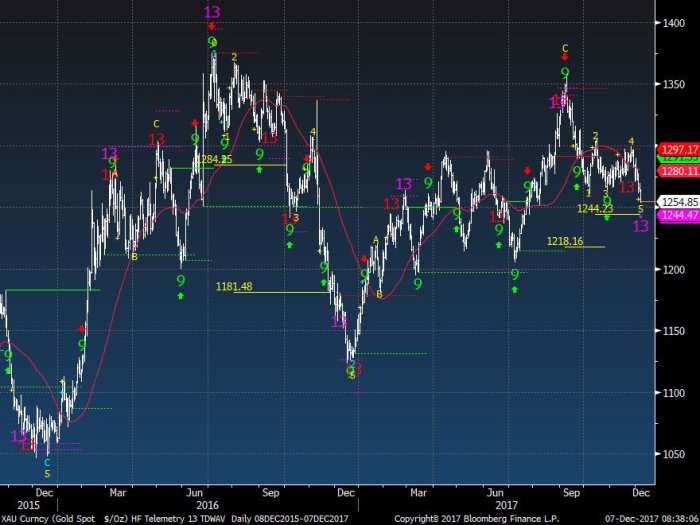

Gold, down 2.6%, had a terrible week. Silver was worse, down 3.6%. That seems par for this year’s ups & downs:

- Charlie Bilello?Verified account @charliebilello- Gold this year: +10%, -5%, +8%, -6%, +7%, -7%, +12%, -7%. 4-month low today. $GLD

But is the downside force close to exhaustion?

But is the downside force close to exhaustion?

- Thomas Thornton? @TommyThornton – Thu Dec 7 – Gold futures contract has a downside DeMark exhaustion signal today. As posted on Hedge Fund Telemetry daily note today

If Gold is close to a downside exhaustion, then Gold Miners should be ready for a bounce, right?

If Gold is close to a downside exhaustion, then Gold Miners should be ready for a bounce, right?

- Hedgehog Trader? @HedgehogTrader – Wed Dec 6 – $GDX RSI approaching 30 area where major bottoms have been made the last 4 times before, including last December.

There is something different going on, it seems.

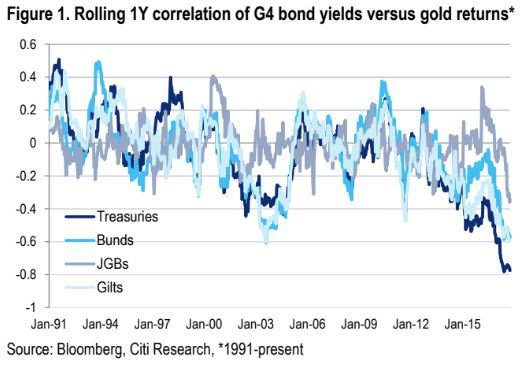

- Lawrence McDonald? @Convertbond- Big Shake-Up in “Gold vs. Bonds” Correlation, 3 Things You Need to Know https://www.thebeartrapsreport.com/blog/2017/12/07/bitcoin-eating-gold-alive-for-now/ …

#Macro#Bitcoin

Bitcoin has been around for a few years now and its popularity is only growing. Regular users of the currency can use sites like https://bitcoin-revolution.app/login/ to manage their wallets and keep on top of how much their bitcoin is worth. Even when there is a dip in the market, investors still choose to use invest in bitcoin because they know it will provide a return on investment at some point in the future. Simply put, people are selling gold to buy Bitcoin per this video. Loads of people from the States are beginning to buy bitcoin with paypal. In case you were not already aware, Bitcoin, often described as a cryptocurrency, a virtual currency, or a digital currency, is a type of money that is completely virtual. Bitcoin can be used to buy products and services, and it can also be traded. It’s also possible to reconvert Bitcoin to paypal, allowing investors the possibility to cash in their cryptocurrency when it suits them. This can also apply to other types of currencies, such as Etherium. Most cryptocurrency traders use cryptocurrency apps like the bitcointrader.ai app to monitor real-time market shifts and trends. With this in mind, it will be interesting to see how the relationship between gold and Bitcoin continues to develop. Larry McDonald also said their proprietary capitulation model is very close to calling a buying opportunity in GDX, the Gold Miner ETF. And that might come in the next couple of days. That puts it right smack on the FOMC meeting, right? Coincidence or Causation? We asked Brian Sullivan, anchor of the clip below. But we are just simple folks. Maybe that’s why Mr. Sullivan didn’t answer:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter