Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Santa’s Stampede

Last week, we wondered whether Santa was coming. That was answered this week with a reindeer stampede. Having lived in Texas & being a fan of westerns, stampede is somewhat familiar to us but this week’s reindeer stampede was a sight to behold. And unlike a cattle stampede that leaves behind devastation, the reindeer stampede left happy hearts & singing portfolios at the end of the week.

David Tepper made a wow comment by saying this year is like the beginning of 2017. He further opined that unless & until bonds sell off, the stock rally will continue. There are two ways to see & say this. First the simple:

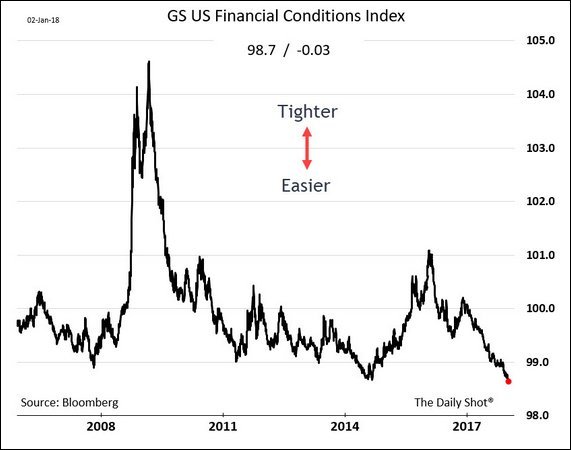

- Andrew Thrasher, CMT @AndrewThrasher – The Goldman Sachs Financial Conditions Index is at the lowest level (easiest conditions) since 2000. via @SoberLook

- Arun Chopra CFA CMT @FusionptCapital $DIA What you are witnessing in the convexity seen in bond prices applied to equities and earnings as the fed is now over 300 bips behind the curve. Fighting against it has proven to be equally, if not more so insane

#stocks

So how should we trade this? One highly simple answer is #GiddyUp:

- Tony Dwyer @dwyerstrategy

@petenajarian – can i get a#GiddyUp ??? With more Fed uncertainty, there will likely be more pullbacks along the way, but fundamentals, credit and history are pretty solid reasons to buy any temporary pullback

Is Mr. Dwyer hinting at a near term pullback? There are others who see too much of a good thing right now:

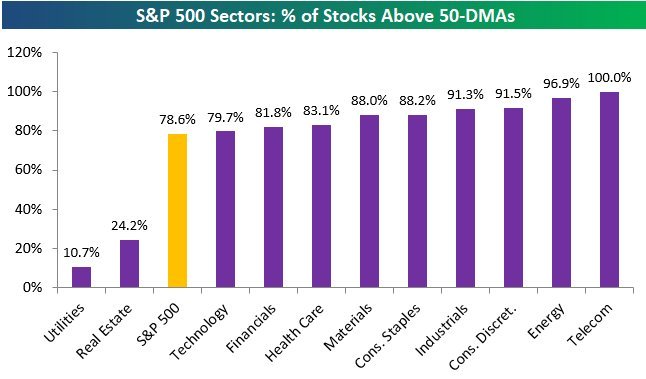

- Bespoke @bespokeinvest – These breadth levels are getting pretty crazy. Very strong across the board but can’t get much higher near term. Healthy market but very extended once again. $SPY $$ https://www.bespokepremium.com

/trend-analyzer/

- See It Market @seeitmarket chart via

@AndrewThrasher: “The S&P 500 is now more than 10% above its 50-week MA, something it hasn’t done since Dec. 2013. Over the last 15 years, short-term pullbacks have often followed…”$SPY$SPX

Wouldn’t it be ironic if the stock market rallies next week in the “face” of these pullback warnings?

2. Baskerville redux?

In the classic Sherlock Holmes look back, the really surprising action was the relatively blase action in the Treasury market. Long Treasury yields reacted with a “eh” and the Treasury curve either actually flattened a tiny bit. If there was a week that should have steepened the curve, this past week was the one. Yes, the 30-year yield did rise by 6.5 bps but that was a relatively benign decline in bond prices (TLT down 1.1%). Was this lack of action because of a mere 1-2 bps rise in German yields?

Notice we haven’t bothered to mention the 148K non-farm payroll number vs. 190K expectation & the big 239K November NFP number. Perhaps because the German yields rise was a mere 1-2 bps. Because it didn’t move markets beyond an initial ripple.

The one move to note was on Tuesday:

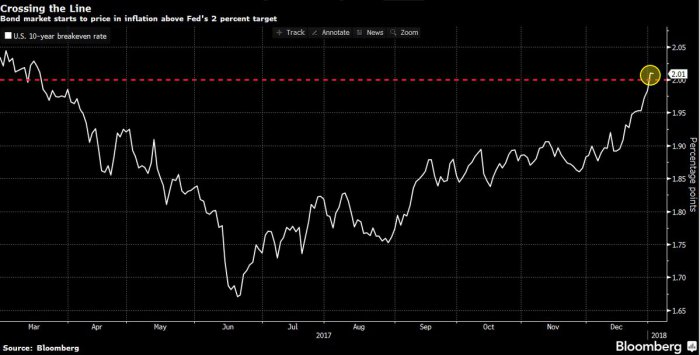

- Christophe Barraud

Verified account @C_Barraud – #Bonds | The yield spread between 10-year U.S. Treasuries and similar-maturity Treasury #Inflation Protected Securities climbed above 2 percentage points Tuesday, the first time since March – Bloomberg

So the reaction to next week’s inflation numbers should be interesting:

3. Commodities

Material stocks exploded this week with CLF up 12.8%, US Steel up almost 9% and even Ag stocks like Mosaic up almost 5%. Is this a sign for Commodities?

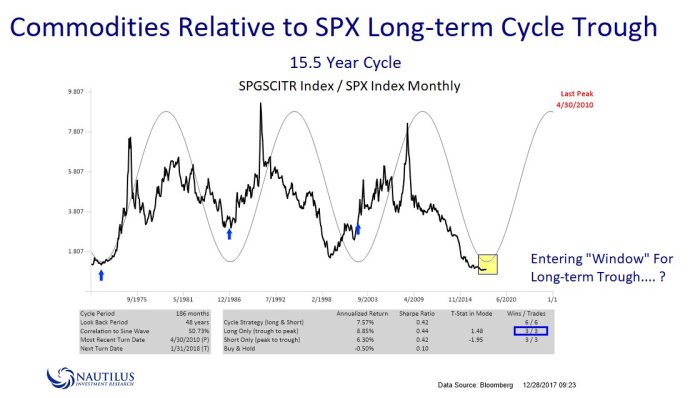

- Nautilus Research @NautilusCap – Commodities relative to Equities long-term cycle TROUGH 15.5 year cycle.

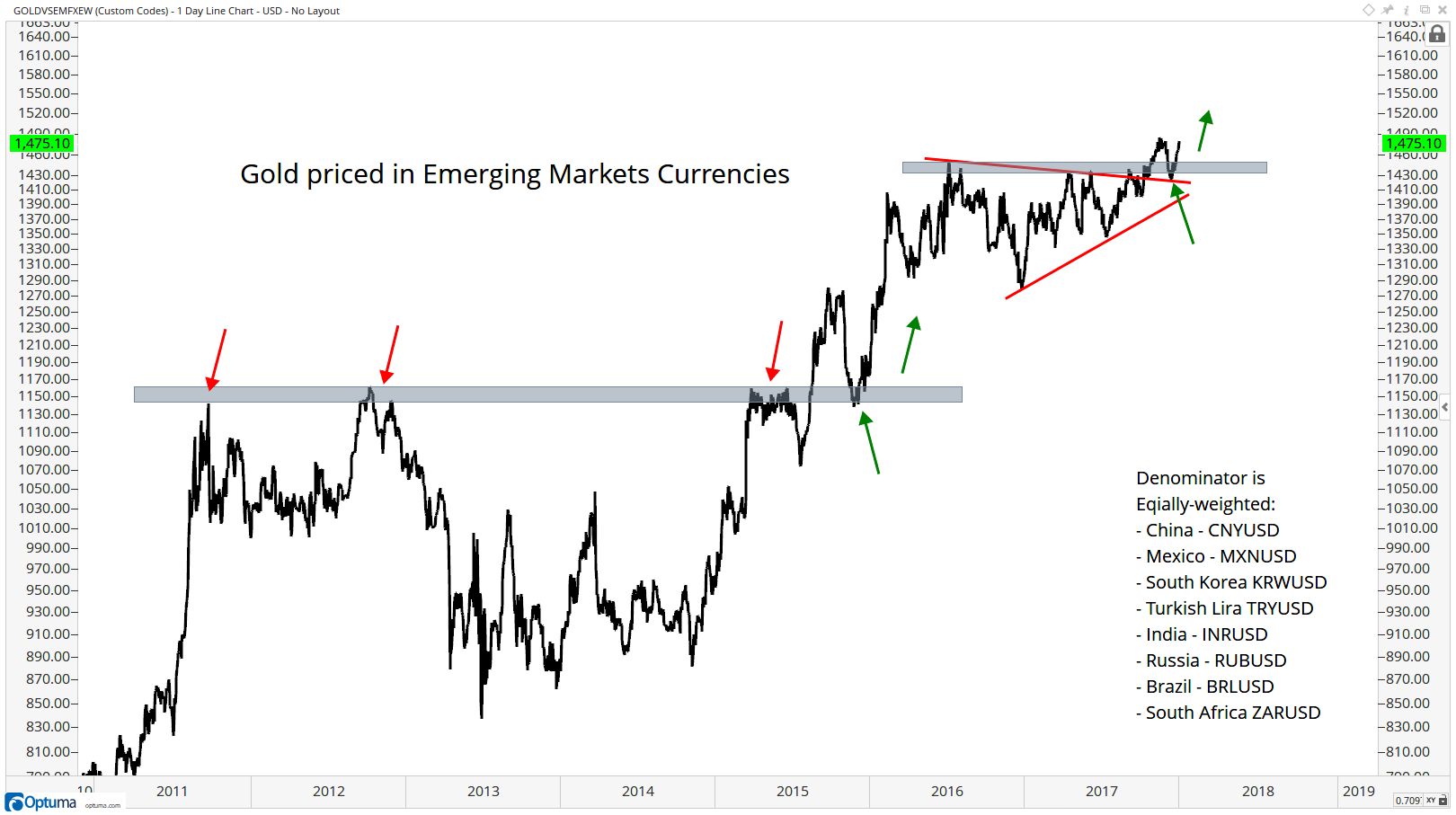

Not only did Gold continue its rally (1.2%) but one bear turned bullish on Gold this week. In his article, J.C.Parets looked at Gold priced in Emerging Market currencies:

- “Today I wanted to share with you what I thought is probably the most interesting, and bullish Gold chart I’ve seen. Here we’re looking at Gold priced in Emerging Markets Currencies.

- Well we’re breaking out of an 18-month base to new all-time highs. And we have successfully retested that breakout level.

- The overwhelming evidence is suggesting the risk here in metals and mining stocks is higher. The risk vs reward is skewed in favor of the bulls if we’re above those Summer 2016 highs.”

But is there any risk near-term after such a powerful advance?

- Peter Brandt @PeterLBrandt Nature of 2-yr sym tri in

#GOLD$GC_F$GLD raises red flags on current advance. 1.) Vol increased throughout. 2.) Shrinking vol from Dec low on rally. 3.) Lack of defined 5th pt. 4) COT profile

Then you have the most weird commodity of all – Both WTI & Brent rallied 2.4% this week. That was nothing compared to OIH rallying 7.4% on the week. Below is a 2-day old opinion:

Then you have the most weird commodity of all – Both WTI & Brent rallied 2.4% this week. That was nothing compared to OIH rallying 7.4% on the week. Below is a 2-day old opinion:

- Mark Newton @MarkNewtonCMT – Wed Jan 3 – $OIH Oil Service stocks just playing catchup to the movement seen in $XLE and $XOP & exceeding multiple prior highs puts this in a Bullish Technical position for further near-term follow-through

Send your feedback to [email protected] Or @MacroViewpoints on Twitter