Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.T-word

Hardly any one doubts now that President Trump is serious about getting what he wants on trade. Late this week, he allowed his aides to circulate the possibility of the W-bomb – dropping out of the WTO. All week, stock markets jerked up & down on the possibility of intensifying trade conflict between Trump’s America and Xi’s China. This was signaled by a hitherto sanguine bull on Monday:

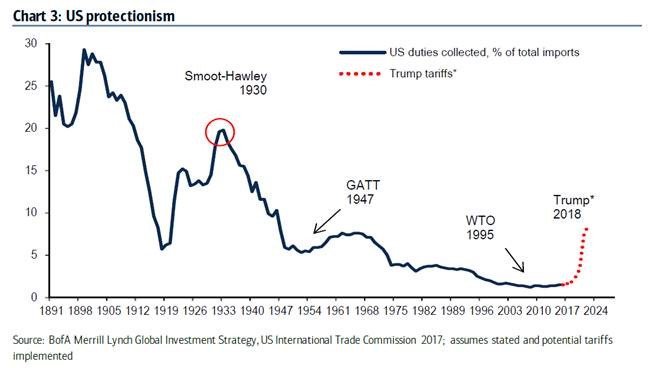

- Richard Bernstein@RBAdvisorsMon – Why is the market getting indigestion? BAML points out US

#tariffs could potentially be the highest in 70 years!! That’s a lot to swallow in one bite.

But tariffs are only a tool for President Trump whose real objective is a world without any tariffs at all. He has been vocally clear about this but many have chosen to not understand. Fortunately, two smart people do and they also understand why President Trump has almost all the cards in this debate:

Jim Bianco above:

- “Trump says “I prefer no trade barriers”; he is using tariffs as a tool to get there; what are we finding? the rest of the world is slowing down; the Chinese stock market is under tremendous pressure; they are under the gun to cave;he is not under the gun to cave; they are and I think he knows it; & they know it too; the markets … know in the end we might wind up with a better deal than we have right now; …”

- “Look at Europe; look at the rest of the World; it is slowing down a lot; real story is slowdown in the rest of the world ;”

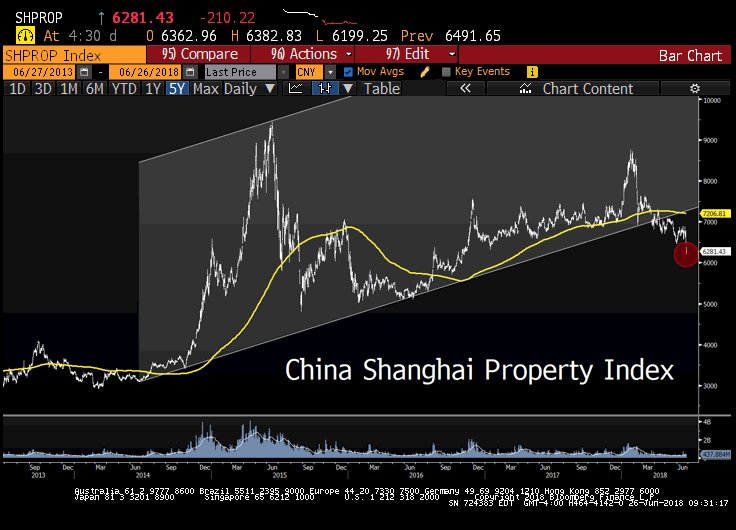

Another picture that suggests “caving in” might be better than valor:

- Lawrence McDonald @Convertbond China Shanghai Property 30% Off Sale “Global Synchronized Growth” was Wall St’s January theme for 2018

Business Cycle guys are also beginning to notice:

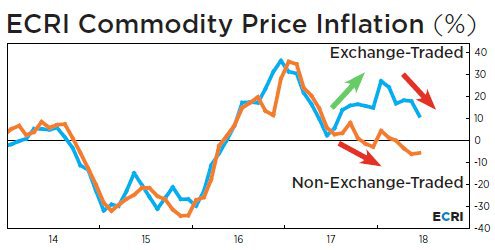

- Lakshman AchuthanVerified account @businesscycle The market may soon start asking if global industrial demand is all it’s cracked up to be. Read ECRI write-up: https://goo.gl/d4SVgf

- “The latest oil price spike may turn out to be a head-fake, because the economy is already slowing. While the oil cartel can try to fix the supply of oil, it can’t really control the demand side, which is dominated by the economic cycle.”

- “This is clear to us at ECRI because of our enduring focus on cyclical relationships and, in this case, sensitive industrial material prices, including oil. We’ve long maintained a daily price index of these commodities that moves in concert with cycles in industrial growth. About half of the price inputs we monitor are traded on various commodity exchanges, while the rest are priced from commodity producers.”

- “For the past few quarters a very unusual gap has opened up between the two groups, with the prices of non-exchange-traded industrial commodities, which most observers don’t watch, falling, and in some cases plunging. This behavior is in sharp contrast to the bullish sentiment shown, until more recently, by the strength in the prices of commonly-watched exchange-traded commodities.”

Is this plunge real or could it be smelling a “D” word in & by China?

- Lawrence McDonald @Convertbond US High Yield Wedge, Memories of the 2015 China Currency Devaluation

#EmergingMarkets

The economist with the most inappropriate nickname actually used the other D-word on Thursday:

- David Rosenberg @EconguyRosie Is the bond market catching a whiff of deflation? CRB metals and grains sliding, stronger USD, and rents now coming under downward pressure. See A2 of the WSJ (“Flood of Supply Is Damping Rent Rises”) and “Manhattan Apartment Inventory Rises, as Sales Dip Persists” on page A10A.

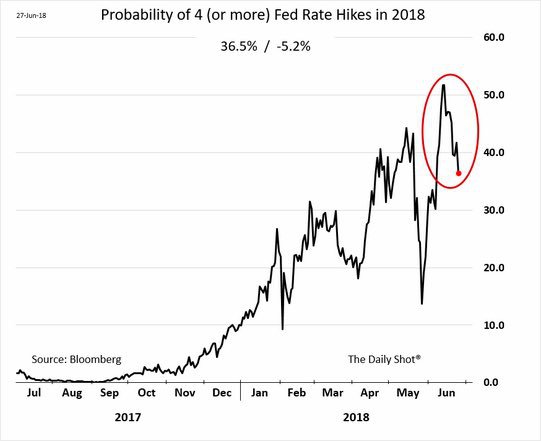

But is Chairman Powell listening? More importantly, are markets beginning to believe he might be listening?

- Rob Hager @Rob_Hager Probability of 4 (or more) Fed Rate Hikes in 2018 –

@Bloomberg @SoberLook

Now take a look at our favorite indicator – leveraged closed-end Muni fund vs. unleveraged Muni ETF:

Now take a look at our favorite indicator – leveraged closed-end Muni fund vs. unleveraged Muni ETF:

Not only is the ytd relative decline triggered by rising rate rise expectations getting back to even but PNF has also crossed over the 50-day, 100-day and, this week, the 200-day moving average.

Not only is the ytd relative decline triggered by rising rate rise expectations getting back to even but PNF has also crossed over the 50-day, 100-day and, this week, the 200-day moving average.

2. Treasuries

The big event in European markets was on Friday morning:

- Holger Zschaepitz@Schuldensuehner – Looks as if Merkel has saved her chancellorship in 11th hour deal. EU deal on refugees has thrown lifeline to German Chancellor, whose govt has been teetering on brink of collapse. Bavaria’s CSU meets on Sun to give agreement thumbs-up or down. Markets very upbeat. (via RTRS)

Perhaps because of this or in spite of this, German 10 & 30 yr rates are perched on key levels – 10-year Bund at 30.6 bps and 30-yr Bund at 1.028%. What if German 10-yr breaks 30 bps & stays below and/or German 30-yr breaks below 1% & stays below? Important question for next week, even though somewhat rhetorical.

Perhaps because of this or in spite of this, German 10 & 30 yr rates are perched on key levels – 10-year Bund at 30.6 bps and 30-yr Bund at 1.028%. What if German 10-yr breaks 30 bps & stays below and/or German 30-yr breaks below 1% & stays below? Important question for next week, even though somewhat rhetorical.

The Treasury curve bull flattened this week with 30-year yield falling by 4.8 bps, the 10-yr falling by 3.7 bps, the 5-yr by 3.4 bps & the 2-yr by 1.8 bps. The 30-yr yield broke below 3% on Friday’s close but remains above its 200-day at 2.968% . The 10-year yield closed at 2.86%, way above its 200-day at 2.66%. But TLT, up 90 bps on the week, closed at 121.72, above its 200-day at 121.09.

The week opened with Morgan Stanley’s Matthew Hornbach writing “We suggest investors buy 10-year Treasury notes outright,” (with the 2.9 percent level used in his trade recommendation).

Then on Wednesday, Cramer Fav Bob Lang asked whether “Bonds continue to be a safe haven in a storm”?

Then on Wednesday, Cramer Fav Bob Lang asked whether “Bonds continue to be a safe haven in a storm”?

- “The chart shows a modest uptrend but stopped firmly at the 200 ma, and notice the heavy money flow into bonds. Momentum indicators are in good shape here, and while we may see a bit of coverage here, a move above that 200 ma and confirmation would put more pressure on yields.”

It might be easier to follow his argument via his YouTube video below:

We have heard of left-handed compliments but not left-handed recommendation-like comments & that too on 10-year Treasury from an equity strategist who used to be a raging bull. Look what Barry Bannister of Stifel said on Friday:

- “how long can the 10-year yield stay up with the rest of the world’s central banks having no appetite in tightening? staples-healthcare-utilies trade is back to levels you saw in tech bubble in 2000 & in early 80s when we maxed out the 10-year yield“;

Any contribution from Credit to Treasury rally?

- Lawrence McDonald @Convertbond – US Investment Grade Corporate Bonds interest-coverage ratio, or ebitda to interest expense, is now below 10x, the lowest level since the crisis. (Just a small earnings cushion in place to meet obligations) Via

@BearTrapsReport

3. US Stocks

Despite the rally on Thursday & Friday and despite the huge boost to the Dow from Nike, the Dow closed below its 200-day on Friday. On the other hand, the S&P closed above its 50-day. So you can interpret the action both ways and many did.

The most bullish comment we saw was from Jeff Hirsch of StockTrader’s Almanac who told CNBC’s Brian Sullivan – “the first trading day of July is the best trading of the year (81% probability)”. The next is:

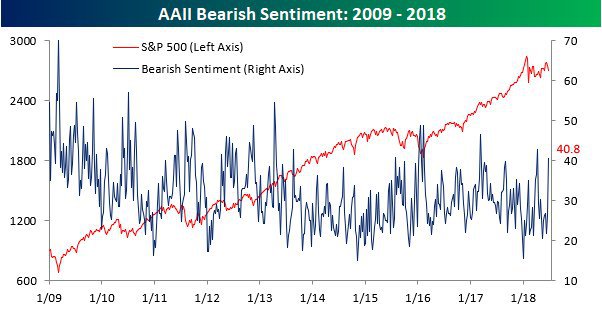

- Bespoke @bespokeinvest – Thu Jun 28 – This week saw the largest one-week increase in negative sentiment since January 2016. https://www.bespokepremium.com

/think-big-blog/bearish-sentim ent-surges/ …

The next was a confirmatory one:

The next was a confirmatory one:

- J.C. Parets @allstarcharts – Notice how the S&P500 never reached oversold conditions this month (14 day RSI 30). That is characteristic of uptrends, not downtrends

$SPX$SPY

How can one be bullish without breaking of a downtrend, however minor it might be?

- Mark Newton @MarkNewtonCMT – S&P made encouraging move to exceed minor downtrend at a time when signs of fear had been rising while June cyclicality largely mimicked what had been seen in May, April and March, with mid-month peaks and pullbacks into end of month

@Newtonadvisors

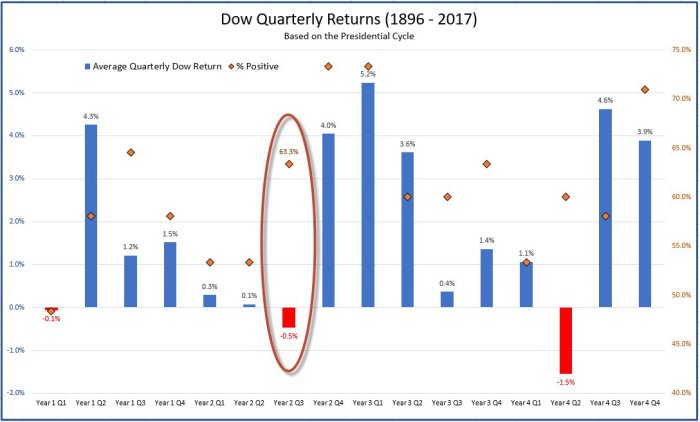

- Ryan Detrick, CMT @RyanDetrick – One for the bears. The next quarter is one of the weakest over the entire 4-year Presidential Cycle. Down 0.5% on average, with only Q2 of an election year worse … https://lplresearch.com/2018/06/29/third-quarter-blues/?adbsc=social_lpl_brand_awareness_20180629_76331107&adbid=1012728704919670785&adbpl=tw&adbpr=313335112#more-10122 …

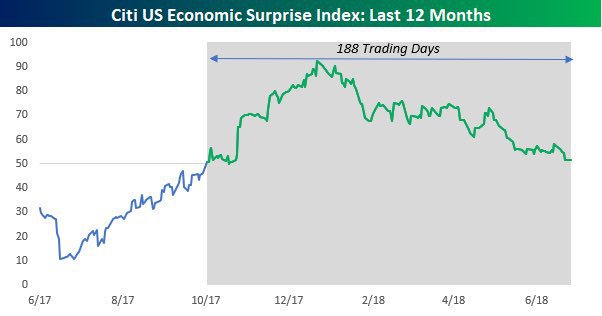

- Liz Ann SondersVerified account @LizAnnSonders – Citi Economic Surprise Index heading toward negative territory…in past, once expectations caught up to & exceed reality, S&P often stuttered…in both 1m & 3m periods following similar streaks, S&P avg’d slightly negative returns but tended to improve 6m later

@bespokeinvest

Next is for those who follow “smart money”.

Next is for those who follow “smart money”.

- Eric Pomboy @epomboy – Smart Money Flow Index drops to lowest since Aug. 2011

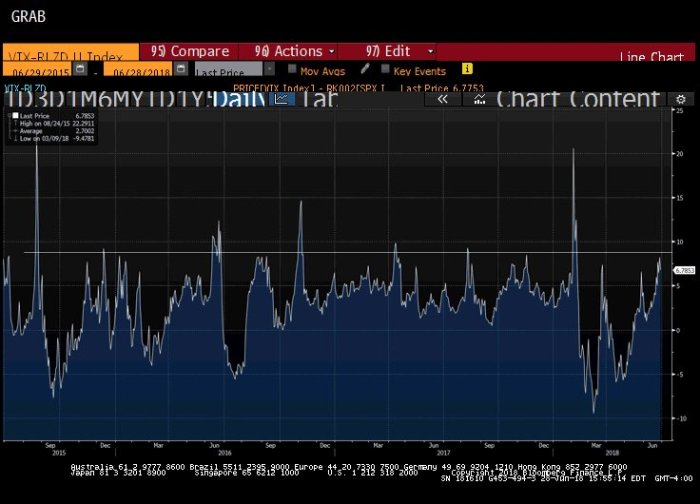

- Igor Schatz @Copernicus2013 – Spread between implied and realized vol only been wider around major events: XIVplosion, Brexit, us election and China deval

- David Rosenberg @EconguyRosie – What it’s like travelling to the USA: Homeland Security official needed to know where I worked and the address; when I was last in the States, and what it was I told our clients. On the last one, I merely said “that the bull market ended five months ago. Anything else?”.

4. Year-end

Statistics are signaling a positive end to the year:

- Ryan Detrick, CMT @RyanDetrick – One for the bulls. What happens when the S&P 500 is higher in both May and June (like 2018 will likely be)? The final six months of the year have been higher the past 11 times in a row. Going back to 1950? The final 6 months are higher 19 out of 22 times.

Remember what Paul Tudor Jones said on June 12, 2018?

- “I can see things getting crazy, particularly at year-end after mid-term elections; getting crazy to the upside“

We do see markets getting weaker & even lower in Q3 on EM problems or even with indigestion. And we well remember the third quarter of 1998. Greenspan totally changed that dynamic in November 1998 and triggered a massive rally into year-end 1998 and all through 1999. We certainly don’t expect Chairman Powell to repeat that. But a different dynamic could well trigger a rally from November to year-end. Look what David Rosenberg wrote this Thursday:

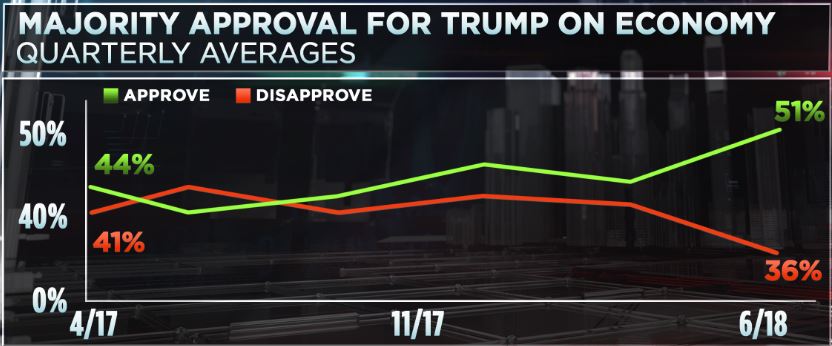

- “Shame – We have an Administration gaining political ground with the general electorate, and that indeed is a scary thing;”

Some might call the same thing “joyful”; perhaps those surveyed by CNBC:

But that is history. What about the future?

But that is history. What about the future?

President Trump has already begun talking about Tax Cut II to lower the corporate tax rate further. Then you have the Infrastructure Bill that El-Erian said would raise the growth rate to 3% +.

The point is that a victory for President Trump in November could catapult the stock market on hopes of Tax Cut II and a potential Infrastructure Bill in 2019. That might be enough to make the words of Paul Tudor Jones come through. And it could also postpone the 2020 recession many expect into 2021.

If the expected growth does not materialize and rates spike up, that’s a 2021 problem.

5. The Big Relationship

Look at this morning’s tweet and marvel:

- Donald J. TrumpVerified account @realDonaldTrump Just spoke to King Salman of Saudi Arabia and explained to him that, because of the turmoil & disfunction in Iran and Venezuela, I am asking that Saudi Arabia increase oil production, maybe up to 2,000,000 barrels, to make up the difference…Prices to high! He has agreed!

When did you last see such a tweet from a U.S. President? This is the result of what was done almost immediately after inauguration – the deal with MBS of Saudi Arabia. A perfect deal by President Trump granted their most fervent wishes – control of Saudi Arabia for MBS and a resolute war to curb Iran. In exchange, MBS & Saudi Arabia will do what President Trump wants about oil prices. FDR would be proud of this deal, we think.

As Jim Bianco said in the clip above, the markets get that the result of Trump actions is likely to be a better deal for America and what’s not to like about that?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter