Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Is this —- ?

What year is this? We have seen comments from several gurus about 2018 being another 2008, 2000 or 1998. But this week we heard a very different comment from a guru with a terrific track record, a guru that explicitly called the credit bubble in October 2007 after warning about it in July 2007, a guru who said Draghi’s commitment to whatever needed in 2012 was very bullish.

Larry Fink said this week to Erik Schatzker of BTV:

- “The question I am raising is is this 1994 when the markets were very concerned about growth; then the markets reasserted itself & then we got a 5-year bull market; we may be in that position; market may be wrong right now in that GDP will continue to grow, trade conversation is not that difficult for international commerce, & M&A and share repurchase will continue; if that is the case, we will wake up in a year from now and the market is going to be up 10-12%.”

What was the difference between 1994 and 2000/2007-2008? In the latter cases, the Fed raised interest rates until they busted the asset bubbles dominating markets & created recessions in the process. In contrast, the Fed began early in 1994 and stopped just in time. As a result, inflation was kept in check without killing growth. That created a disinflationary growth period for the next 3 years.

So the big difference is whether the Fed knows when to stop & whether the Fed decides it is safer to stop early rather than late. That brings us to:

2. “Debt coming due & we are raising rates – Really?“

Look what Henry McVey of KKR said to Erik Schatzker of BTV this week:

- ” … there is no other time in American history where you had the unemployment rate this low when you were stepping on the accelerator; there is some logic to that; if you have low rates & you can raise your nominal GDP faster, you can actually get pricing power, you can get some wage increases, you can actually reduce your deficits … “

Ex-Fed Governor Mark Olson said essentially the same thing to Rick Santelli this week:

- “Jay Powell is a financial guy; he understands that debt service capability is the driver here; & that’s why he is saying if the economy grows faster than debt then the ability of US economy to handle that debt is much more manageable”

Fed Chairman Powell said the same thing in this week’s Congressional Testimony that was perceived to be dovish.

So what is the problem? Richard Bernstein had said after the 2008 financial crisis that the Fed is essentially myopic in that they don’t see much beyond the US economy. They have been unable to identify the slowdown or contagion that seeps into America from overseas and therefore they keep focusing backwards on inflation and keep tightening until they blow up the economy.

Powell’s Fed may be repeating this mistake argued Viktor Shvets of MacQuarie this week in his discussion with Erik Schatzker of BTV. He argued that the Fed is looking at backwards inflation indicators and missing the biggest risk. What risk?

- “the US monetary base is actually contracting at the fastest pace any time since 1929“

Therefore Mr. Shvets urges the Fed to

- “do no further tightenings” and

- “stop reducing the size of their balance sheet in 3-6 months“.

David Rosenberg wrote on Friday – “The global economy, a decade past the financial crisis, has been fuelled by a record volume of debt“. Now ask yourselves – what economy on earth has managed to service its debts while its central bank is destroying liquidity at the rate of $50 billion per month, as this Fed is doing?

And what is the US economy after all? 70% of it is the US consumer. And how is the vaunted US consumer doing?

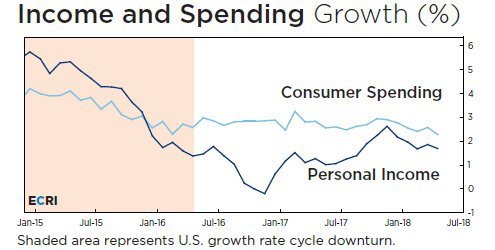

- Lakshman AchuthanVerified account@businesscycleThe U.S. consumer is under pressure, and now it’s getting worse. Full interview: https://goo.gl/Vy3A54

And is this affecting consumer spending?

And is this affecting consumer spending?

- Lakshman AchuthanVerified account@businesscycleContrary to the notion of a “strengthening” economy, consumer spending growth has fallen to a 4 ¼-year low. More info: http://goo.gl/Vy3A54

With all of this, wouldn’t you also say what President Trump said “… & we are raising rates – Really?“. He prefaced his question with only “Debt is coming due”. He could have added all the other factors we discussed above. Given his nature, how soft spoken & circumspect was President Trump while bringing up this issue with CNBC’s Joe Kernen?

With all of this, wouldn’t you also say what President Trump said “… & we are raising rates – Really?“. He prefaced his question with only “Debt is coming due”. He could have added all the other factors we discussed above. Given his nature, how soft spoken & circumspect was President Trump while bringing up this issue with CNBC’s Joe Kernen?

President Trump made it clear that he was speaking as a private citizen. Just to put his soft & circumspect comments in perspective, look at how another private citizen spoke about the Federal Reserve Chairman & Governors about 10-12 months prior to onset of that recession:

What a strange society we live in? The same Financial Network, CNBC, that did not utter a single word in 2007 to criticize Jim Cramer, the same CNBC that now displays this clip as a proud momento of their “journalism”, spent Thursday afternoon & all day Friday in sarcastically & angrily condemning President Trump for talking about the same risks Cramer ranted about in 2007.

Jim Cramer had no responsibility entrusted to him in 2007. He was simply speaking about the financial discomfort of his friends on Wall Street. And he was lauded for it. President Trump has been entrusted by the US electorate with the responsibility of economic welfare of the American people and he has NO RIGHT to publicly discuss his views about how decisions of the Fed might be affecting the economic welfare of the American people? What a weird society has America become?

Our hope and prayer is that Fed Chairman Powell understands the need for Economic growth to be faster than Debt growth, as ex-Fedhead Mark Olson said to Rick Santelli. If so, then Chairman Powell would very soon realize he should listen to President Trump as well as the various strategists who are telling him to stop raising rates right now.

Whether Chairman Powell does or not, the Treasury market realized it and acted on it on Friday. The 30-year Treasury yield shot up by 6.2 bps on Friday and the 10-year yield rose by 4.8 bps. In contrast, the 2-year yield only rose by 0.4 bps. It is as Jeffrey Gundlach has said on many occasions – the 30-year bond loves Fed tightening. The Treasury market has been ranting for weeks that the Fed raising rates is hurting inflation and slowing down the economy. By viciously flattening the yield curve, the Treasury market has been warning that the Fed might be making a mistake. So the possibility that Fed might listen to President Trump and stop raising rates was enough for a 180-degree turn in long duration Treasuries.

Remember we featured a warning by Greg Harman of Dragonfly Capital two weeks ago about TLT hitting at resistance from below. This week another technician went a bit further:

- J.C. Parets@allstarcharts Is this what’s happening here in US Treasury Bonds? Standard polarity behavior if you ask me

$TLT

Add to this what the Bank of Japan did overnight before Friday morning:

- Igor Schatz @Copernicus2013 – Huge move in 10yr JGB rate as they have erased 2 months worth of rally in last 3hrs.. this will likely put even more pressure on treasuries once Japan is back in the office Sunday night

$TLT$ZB_F

3. “their currency is dropping like a rock“

Once again, President Trump was being soft & circumspect in his interview with Joe Kernen when he said at minute 4:12 “China – their currency is dropping like a rock“. Wonder if that is due to Kernen’s soft & mellow personality!

Because President Trump should really have said “their currency is being pushed over the cliff“:

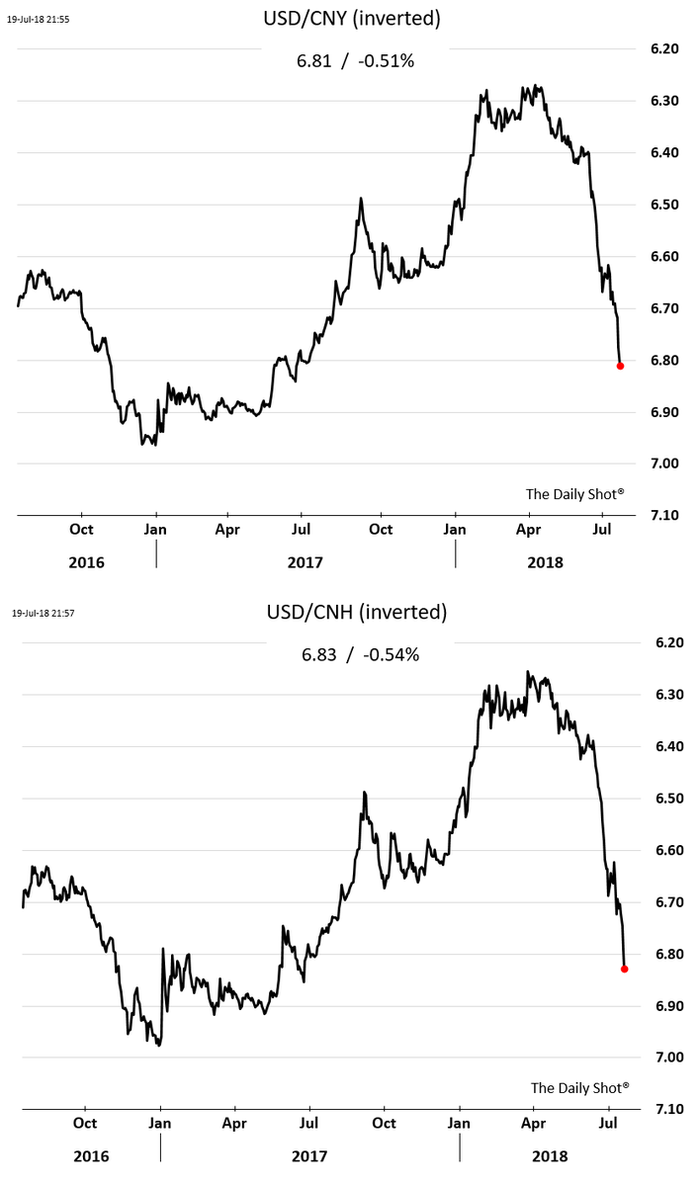

- (((The Daily Shot)))@SoberLook– Chart: This is starting to look like an intentional devaluation by Beijing to offset the impact of US tariffs; onshore & offshore yuan –

President Trump followed up the next morning with a tweet about the U.S. Dollar going up every day:

- Donald J. TrumpVerified account@realDonaldTrump– China, the European Union and others have been manipulating their currencies and interest rates lower, while the U.S. is raising rates while the dollars gets stronger and stronger with each passing day – taking away our big competitive edge. As usual, not a level playing field…

Like the Treasury market, the currency market listened:

The Dollar index that looked headed higher towards 96 turned on a dime and fell hard on Thursday and Friday. You have to wonder whether President Trump is a technician. Why? Look how perfectly placed his verbal intervention was!

The Dollar index that looked headed higher towards 96 turned on a dime and fell hard on Thursday and Friday. You have to wonder whether President Trump is a technician. Why? Look how perfectly placed his verbal intervention was!

- Jeff York, PPT @Pivotal_Pivots– The

$DXY$USD$DX_Ftoday, is testing the Yearly Pivot(YP) Point. This should be very strong resistance@PivotalPivots.

We wonder whether this salvo by President Trump is a shot across the Chinese bow and a warning that President Trump could declare China as a currency manipulator in October 2018. During his interview with Joe Kernen, President Trump displayed his willingness to put tariffs on $500 billion of Chinese exports if China doesn’t play ball. Being declared a currency manipulator is the next escalation with teeth.

But the immediate next step involves the announced tariffs on $200 billion of Chinese goods scheduled to go into effect on August 31, 2018. Read what Henry McVey of KKR said to Erik Schatzker of BTV this week:

- ” .. our base view at KKR is that they will implement the $200 billion come September and that is not where I think the market is; we think that has a longer tail than what the markets think; The US administration is very focused on China 2025 plan and they want a level playing field built around autos; globally that has impact on supply chains; … ”

This was also the main caveat to the bullish call of Larry Fink described in Section 1 above:

- “if we have true tariff wars, we will see the market down 10-15%“

That brings us to:

4. Equities

We will be brief in this section given the length of this article:

- Cam Hui, CFA@HumbleStudentUpside

$SPX breakout, FOMO rally next? https://buff.ly/2zTfrW0

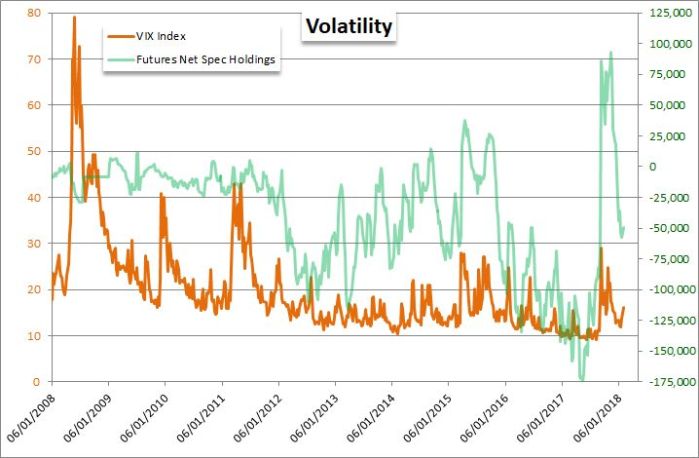

- John KicklighterVerified account@JohnKicklighter – …and net speculative futures positioning in

$VIX is heavier to the shorts. Because selling vol is the thing to do during trade wars?

If the Dollar stays weak,

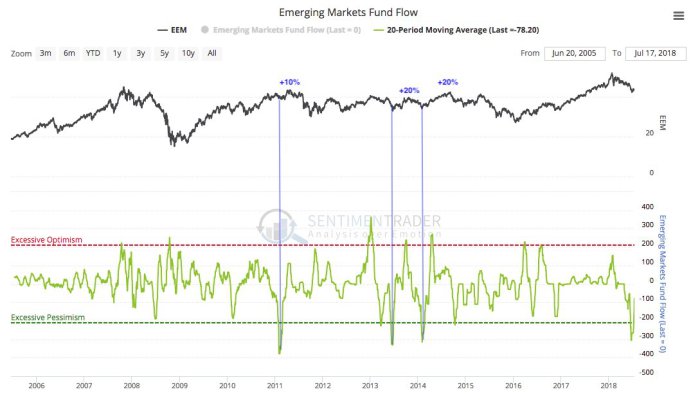

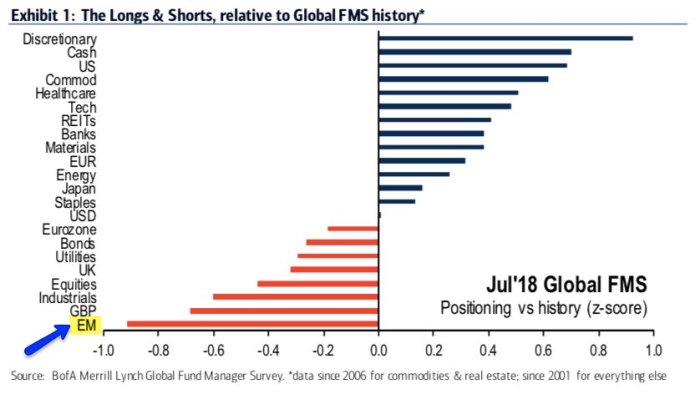

- Urban Carmel@ukarlewitz – Negative equity fund flows and underweighted. Their currencies and commodities not liked. But it might be time for Emerging Markets to outperform. New from The Fat Pitch https://fat-pitch.blogspot.com/2018/07/emerging-markets-might-be-ready-to.html…

- Cousin_Vinny@Couzin_Vinny

$EWZweekly chart bounce at 200ma – tends to run 6 – 10 weeks in each bullish cycle. Above 50d – target 40. Been in over two wks#diversify

5. Kudos

Below is President Trump’s interview with CNBC’s Joe Kernen. We think it is a must watch. If you do, you might see why Nobel Laureate Robert Shiller said on Friday on BTV – “President Trump brings to light things that need to be talked about“.

The CNBC transcript of the interview can be found here.

Not only must Joe Kernen be happy about delivering such an important interview but he must also have been thrilled to hear President Trump describe his Squawk Box as a “highly respected” show. He is the only one left on Squawk Box from the original trio of Mark Haines, David Faber and himself. So he probably feels a sense of ownership of the show.

Kudos to CNBC as well for three interviews in one week that, we think, will prove to be important & revealing – President Trump, Larry Kudlow & Steve Bannon. We may well be “Untouchable” in a caste-system sense to CNBC but that doesn’t affect us. Partly because we love markets & partly because we have been so robustly insulted so often & by so many that insults & bad treatment rolls off us like water from a Duck’s back.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter