Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”better not underestimate”

That was a clear warning from Larry Kudlow to China on Fox Business on Friday morning:

- ” … China better not underestimate the determination of President Trump to follow through & seek zero tariffs & non-zero tariffs & subsidies & a level playing field & major reforms in IP theft & forced transfer of technology – they better not underestimate the President … ”

He added:

- “ .. Chinese economy is slipping across the board; that’s one reason their currency is slipping; it’s not the only one … people are taking money out of China … they are not in good economic shape; so once again I will say they better not underestimate the determination of President Trump ”

The reality is China doesn’t know what to do. As Professor Mohan Malik, a China expert, tweeted:

- Mohan Malik 马立克 实事求是 @jmohanmalik – “Teng Jianqun, head of US research at the China Institute of International Studies – a think tank affiliated with the MoFA, said “China has never experienced such aggressive challenges” and needed a sustainable strategy for the long run.”

China first tried to fight US tariffs by letting the Yuan depreciate. But, as Larry Kudlow said, their twin problem is flight of capital by Chinese from China. So China tried to intervene in the currency market:

- Lisa AbramowiczVerified account @lisaabramowicz1 – China seems to be getting more concerned about the devaluation of the yuan & is being more aggressive with intervention. https://twitter.com/M_McDonoug

h/status/1025341813442469891 … The yuan strengthens a bit versus the dollar in response.

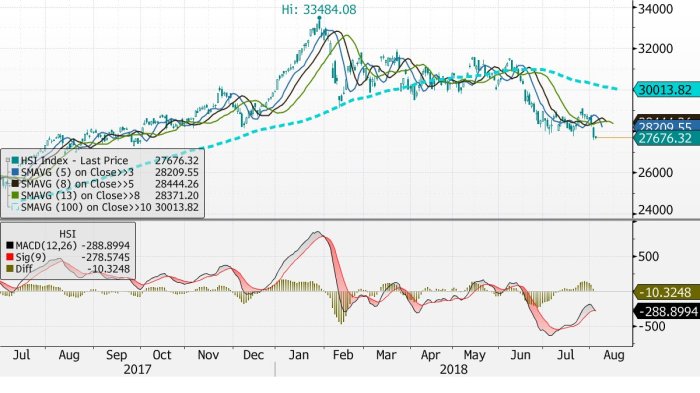

This was not positive for Chinese stocks:

This was not positive for Chinese stocks:

- Steen Jakobsen @Steen_Jakobsen – Hang Seng broke down today – interesting how PBOC FX margin impacts Monday open…

Some are looking to the next 2-4 weeks:

Some are looking to the next 2-4 weeks:

Larry McDonald from ACG Analytics & Bear Traps Report sees fast capitulation:

- “We’re setting up for a spectacular capitulation in the China shares, … We’re going to have a nice washout, I think, within two weeks.”

- “The Federal Reserve is going to $50 billion a month of balance sheet reduction in September. At the same time they’re hiking rates, the dollar made a 7 percent vicious move higher,” he said, also noting that China’s banking system, at $45 trillion, is highly leveraged to the U.S.

- “As the Fed’s trying to unwind, it’s creating this early stages of a recession in China and it’s going to come into a fantastic opportunity in the next 30 days or so,” said McDonald. He plans to buy the FXI ETF at the height of capitulation.

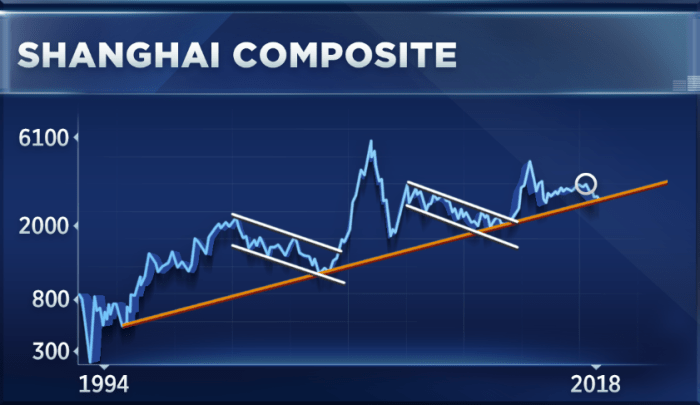

His clipmate, Piper Jaffray’s chief market technician Craig Johnson, said:

His clipmate, Piper Jaffray’s chief market technician Craig Johnson, said:

- “Right now we’re very close to violating the uptrend support line that’s been intact since 1996, … A break below this level is going to suggest that the next support could be 27 percent lower than where we are now.” A 27 percent drop from current levels puts the Shanghai at around 2,020, a level not seen in four years.

Craig Johnson also pointed out that the correlation between Shanghai Composite & the S&P 500 is positive 0.68. So a big decline in China should have a corresponding decline in the S&P 500.

But correlations shmorelations is what small business seems to be saying, according to a survey of 300 businesses from July 16-18 by UBS Wealth Management Americas;

- “Seventy-one percent of business owners surveyed by UBS Wealth Management Americas support additional tariffs on imports from China. Eighty-eight percent said that China engages in unfair trade practices, according to the UBS Investor Watch survey.”

- “Support for the tariffs is not confined to those aimed at China. Sixty-six support of business owners support additional tariffs on Mexico. Tariffs on European goods have support from 64 percent. Even tariffs on Canadian goods have the support of a healthy majority, garnering 60 percent approval, according to the latest survey by UBS Wealth Management.”

- “Far more business owners now think that tariffs will be good for their business. Back in April, just 23 percent said they expected new tariffs to help their business. In July, forty-four percent viewed the tariffs as a positive for their business. Just 32 percent saw the tariffs as negative for their business.”

The markets seem to concur with these businesses:

- Lawrence McDonald @Convertbond Who’s Winning the War on Trade? MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,781 constituents, the index covers approximately 85% of the global invest-able equity opportunity set.

#China

2. Non-Farm Payroll Report, US Economy & the FOMC meeting

The NFP print of 157,000 vs. expectations of 190,000 was almost perfectly weak.

- Bespoke @bespokeinvest – US Jul Nonfarm Payrolls +157k vs +190k exp/+202k prev U3 UER 3.9% vs 4.0% exp AHE +2.7% YoY vs +2.7% exp/+2.7% prev U6 7.5% vs 7.8% prev LFPR 62.9% vs 62.9% exp/prev

Treasury rates dipped a little with the 10-year yield moving resolutely away from the dreaded 3-handle & stocks closed up. Ninety minutes later came the Services ISM number:

- Viraj Patel @VPatelFX – *U.S. JULY ISM NON-MANUFACTURING INDEX AT 55.7; EST. 58.6 Big drop in ISM.. new orders falling to 57.0 (versus 63.2). First signs that Trump’s trade war is starting to bite for the US economy? Our view is

$USD macro cyclical dynamics has peaked. More misses will confirm this peak

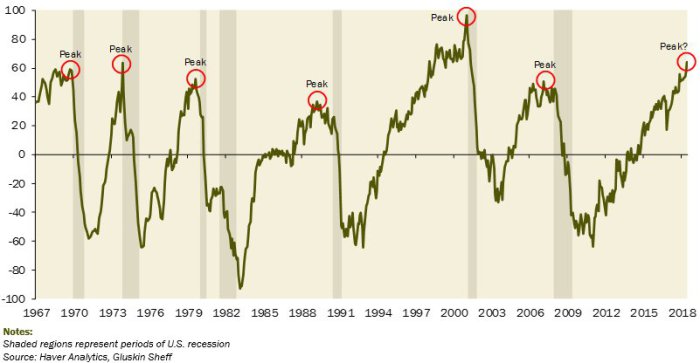

David Rosenberg was more direct:

- David Rosenberg @EconguyRosie Look out below! The non-mfg ISM business activity index just fell the most in any month since…November 2008! Eighty percent of the time when it declines this much we’re either in recession or crawling out of one.

Does that mean Chairman Powell & the FOMC are on the wrong path? And if so, what might happen?

Not only does Scott Minerd think the FOMC is wrong in thinking the economy is getting stronger not weaker, he thinks a financial accident is possible in the usually treacherous September-October time frame.

- “… there are any number of exogenous events out there that could cause a sudden decline in prices … it was very interesting to watch the Facebook experience recently .. boy, did that remind me of 1999-2000 when you would come in one day & one of the darling stocks in the internet bubble would collapse by 25% on what most people thought was a fairly innocuous statement … we are increasing the risk we can have a financial rout in Q3 or Q4“

3. Treasury Yields

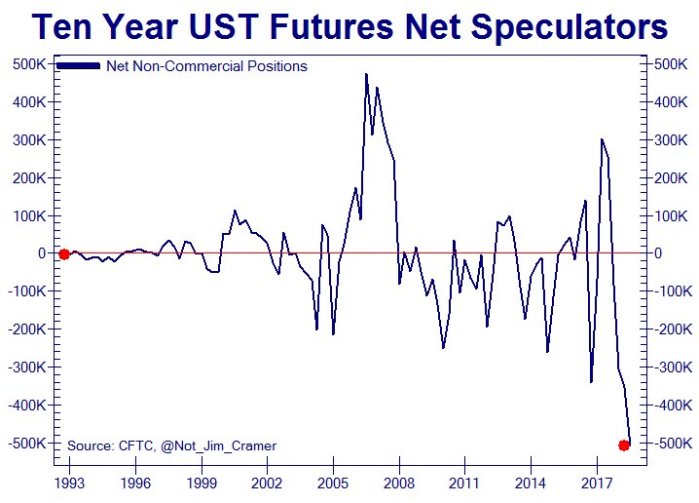

Despite the daily up & down moves in Treasury yields, the weekly move was really small. The 30-year yield rose by 0.2 bps, the 10-year yield fell by about 0.8 bps. But yields across the 5-2 year curve fell by about 3 basis points, thus steepening the curve a bit. The positioning remains very short:

- Not Jim Cramer @Not_Jim_Cramer – Speculators’ record net short position in Ten Year

That seems to have prompted a bear to wonder about a Treasury rally. Peter Brandt wrote in his article Clues from the Treasury Markets:

That seems to have prompted a bear to wonder about a Treasury rally. Peter Brandt wrote in his article Clues from the Treasury Markets:

- Treasury Markets – T-Notes – The COT profile is at all-time record extremes in terms of Commercial long and Spec short positions. The daily chart displays a 6-month bottom. While I am a long-term bear on Treasury prices (bull on yields), the COT profile and daily chart suggest a sharp rally could be in the works. I will monitor this market for a buying opportunity.

- Treasury Markets – T-Bonds – A rally on the monthly futures graph to 148^00 would be a retest of the overhead H&S pattern. The daily chart displays a possible inverted H&S bottom. This chart would suggest an advance to 152^00 – and that would go a long way to negate the H&S top on the weekly graph. The monthly T-Bond yield chart (next page) shows that the multi-decade channel remains intact.

His charts are best viewed in his article Clues from the Treasury Markets.

- Keith McCulloughVerified account @KeithMcCullough –Reiterating our call that the high for the US 10yr Treasury Yield in 2018 is in

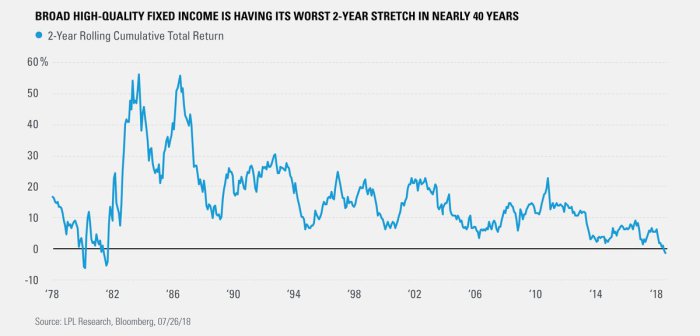

And don’t Bonds need some love after two down years?

- Ryan Detrick, CMT @RyanDetrick – Think you’ve had a tough two years? Bonds are down over the past 2 years for the first time since the early ’80s. https://lplresearch.com/2018/0

7/31/a-tough-stretch-for-high- quality-bonds/ …

This makes next week interesting. Because such sentiments expressed on a Friday, especially a NFP Friday, have led to rates rising hard the following week.

This makes next week interesting. Because such sentiments expressed on a Friday, especially a NFP Friday, have led to rates rising hard the following week.

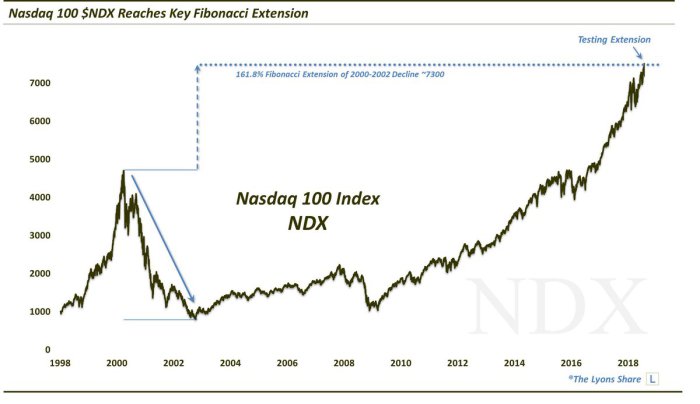

4. Nasdaq & Tech Stocks

You had to be on Mars or Venus to not know that Apple became the first stock in history to get to a Trillion Dollar market cap. This brought out numerous charts showing what happens to such stocks after achieving these lofty levels. One of them shows them all:

- David Rosenberg@EconguyRosieBig and bigger. As Apple becomes the first to join the trillion-dollar club, Nasdaq’s market cap-to-GDP ratio is now rapidly approaching the bubble peak during the dotcom era.

Also Nasdaq stocks are reaching an important line from beneath:

- Dana Lyons@JLyonsFundMgmtMore – ICYMI>ChOTD-8/1/18 Tech Rally Getting Extended

$NDX$QQQ Post: http://jlfmi.tumblr.com/post/176526558875/tech-rally-getting-extended…

That brings us to:

- Trading NationVerified account@TradingNation – Nasdaq could plunge 15 percent or more as ‘rolling bear market’ grips stocks: Morgan Stanley https://cnb.cx/2LWxGyE (via

@StephLandsman)

- “The market has just been getting narrower and narrower. So what we’ve seen is every sector within the S&P has gone through about a 20 percent correction on valuation except for two: technology and consumer discretionary — basically growth stocks, … Our view is that this rolling bear market has to complete itself by hitting those two sectors, and we think that’s actually begun.”

- “The Nasdaq could correct by 15 percent plus, the S&P 500 probably goes down about 10 [percent], … If the growth stocks get hit disproportionately hard, it’s going to be very difficult for that money to leak into other parts of the market without having some loss of value,”

That is consistent with:

- Thomas Thornton@TommyThornton –

$XLK doubled up short size to 5%

5. US Stocks

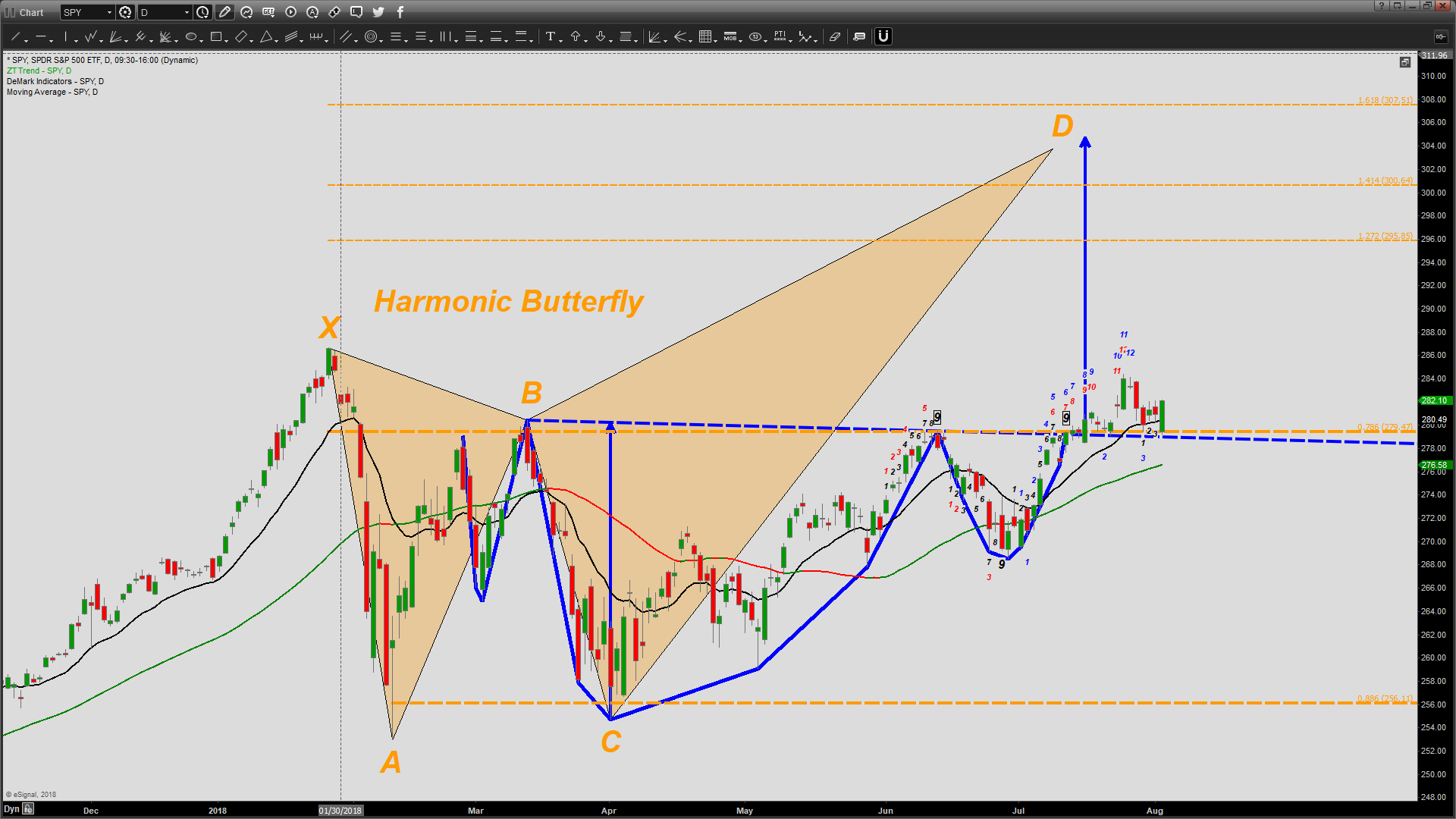

The S&P closed at 2840, just a big day or two from getting to a new closing high.

While the NDX was up 1.34%, S&P was up 74 bps, the Russell 2000 underperformed & actually closed down on Friday. But Greg Harmon of DragonFly Capital was Positive vibes in Russell 2000 on Thursday, August 2:

While the NDX was up 1.34%, S&P was up 74 bps, the Russell 2000 underperformed & actually closed down on Friday. But Greg Harmon of DragonFly Capital was Positive vibes in Russell 2000 on Thursday, August 2:

Harmon wrote:

- there are some positive vibes developing, should Monday’s low hold up. First, the low was a higher low. That alone would signal tightening consolidation. But then looking at momentum the story gets better. The RSI found support at a lower low, different from the price, and also turned up.

- This triggers a Positive RSI Reversal. And that pattern looks for a move higher in price at least as big as the prior leg up. That gives a price target to 171.60 on the IWM, or a new all-time high. Symmetry would suggest that happens somewhere in the middle of next week. Not a guarantee, but certainly positive vibes brewing.

What about the S&P? Lawrence McMillan of Option Strategist wrote in his Friday summary:

- Market breadth has been rather lackluster. So, both breadth oscillators remain on sell signals. Again, this has not produced a large market decline, but it is another sign of trouble. … Volatility is much more positive, as far as stocks go. $VIX has remained below 15, and thus it is a bullish mode. … In summary, a good number of the indicators remain bullish, and that keeps the intermediate-term outlook bullish. However, the mBB sell signal and the persistence of lackluster breadth are indications that not all is well.

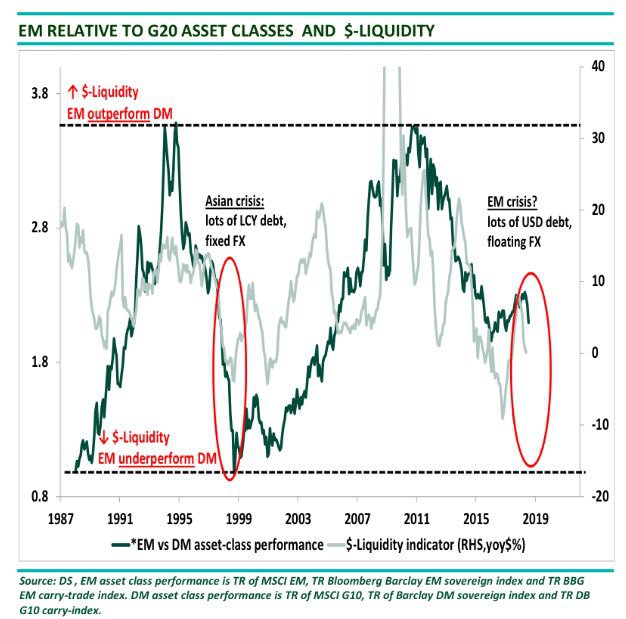

6. Dollar & EM Stocks

Marko Kolanovic, the Quant Strategist from JP Morgan, said this week that he is positive on EM & US while not so positive on EU & Japan. And he is a little more positive on EM than on US. That is mainly because EM positioning is very light & CTAs are short.

.

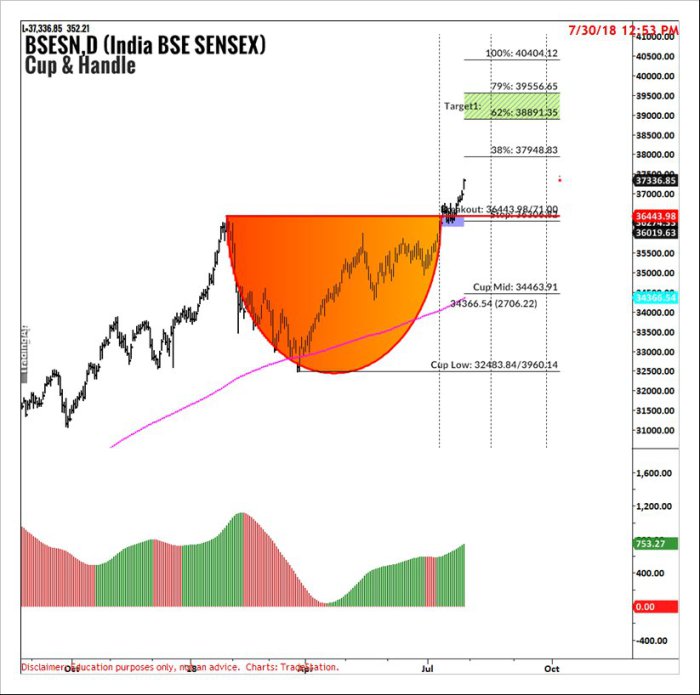

Actually, the country we termed as the “value” pick of EM has done great:

- Lawrence McDonald@Convertbond – Brazil equities up 15-30% from the lows, political risk easing

$PBR$EWZ

And so has the “growth” pick of EM. Actually it seems to be breaking out:

- suriNotes@surinotes Mon Jul 30 –

$SENSEX (India’s BSE Sensex) C&H Pattern

- हम भारत के लोग@India_Policy Indian consumer sentiment hits record high in July: Report https://economictimes.indiatim

es.com/news/economy/indicators /indian-consumer-sentiment-hit -record-high-in-july-report/ar ticleshow/65226777.cms… via @economictimes

Those who know anything about India know that success of India depends on very different things than the success of most other countries:

-

- Raoul PalVerified account@RaoulGMI – Ive always thought being a toilet manufacturer would eventually make someone very rich in India. Knowing India well, if anywhere needs toilets its the subcontinent. It is actually a huge step in the right direction, headlines humour aside.

None of this changes the impact of the U.S. Dollar on EM:

- Mehul Daya@MehulD1082 hours ago – More – Replying to @SantiagoAuFund

The starting of a long journey of em underperforming dm as dollar liquidity exposes those who benefited the most from easy money.

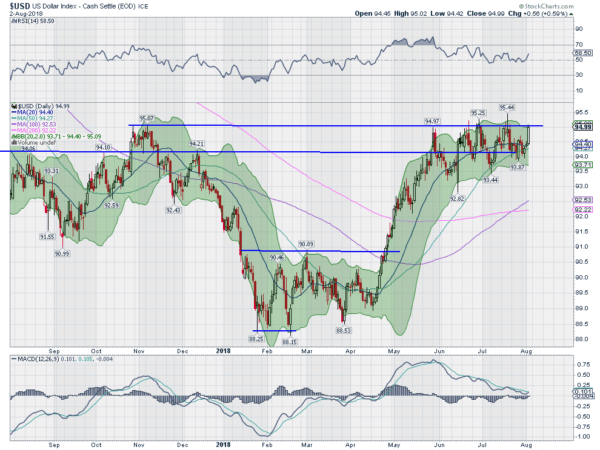

Where are we on the Dollar?

- Raoul PalVerified account@RaoulGMIMore – In macro world (while you are all messing around with

$TSLA for summer amusement !), we are near absolutely crucial levels in the Dollar (Euro 1.16 to 1.15 and CNY 7.00). If they go, things will get ugly, fast, for many assets classes…

But one guru is clear:

- Greg Harmon, CMTVerified account@harmongreg– Dragonfly Capital – Dollar Set to Break Out Higherhttp://dragonflycap.com/dollar-set-to-break-out-higher/…

$DXY$UUP$DX_F

-

- There are several thing to watch. First that consolidation has been tightening. Each low has been a little bit higher than the last one. This is a sign of buyers overwhelming sellers. It also creates an ascending triangle. A break to the upside carries a target to 97.

- Momentum has held bullish, but reset off of the extreme levels of May. The RSI held at the mid line on the pullback and is now curling up. The MACD has also reset lower, nearly to zero, but remains positive. Finally the Bollinger Bands were pushed open Thursday as the price drove up to resistance. The strong dayThursday sets it up and the Non-Farm Payrolls report Friday just might be the catalyst for a jailbreak.

7. Rape vs. Rape

Rape is a horrible act and one that really cannot be discussed without utmost seriousness. But the mess in Indian society tends to take the sting out of the worst of things and make you say what “Raymond” said about his family:

- “first you cry and when you cannot cry anymore, you laugh”

Hopefully, your order in this section turns out to be the opposite. First the laugh. The director of the following movie swears his film is based on an actual case of a young man who was imprisoned for raping a female buffalo; not just any buffalo but a prize-winning buffalo who won the title Ms. Tanakpur, after the small town of Tanakpur.

The young man had become platonically friendly with the young wife of a local bigshot who was 70 years old & unable to perform. The leader catches them talking, yes seriously only talking, in his bedroom and flips out. His goons beat up the young man. That was not enough. So he wants to charge the young man with rape. But his advisers tell him he would look bad if he charges the young man with raping his young wife.

So the advisers recommend charging the young man for raping the bigshot’s prize winning female buffalo – Ms. Tanakpur. The local Vet is coerced to provide a medical certificate of rape. The young man comes from a poor family and has no hope. But he get a smart lawyer who manages to get the case thrown out; not by invalidating the rape but by questioning whether the buffalo produced in court was actually the same buffalo who was “raped” by the young man.

That wasn’t enough. So to placate the big shot, the town council gives its own judgement – the young man was instructed to marry the female buffalo he had raped. The film is actually quite decent & totally realistic about what happens to a poor young man charged with rape of any female in today’s India.

Being India, you know that truth has to be stranger than fiction. That brings us to a real case filed this week against 8 men for gang rape of a pregnant female:

- Prasanna Viswanathan@prasannavishy – Haryana police arrest Jaffar Khan and Saahukar Khan who are among the 8 men accused of raping a pregnant goat in Nuh. They have been charged under Section 377 of the Indian Penal Code and Animal Cruelty Act

By the way, Mr. Vishwanathan (Vishwa-Naathan) is the well known editor of the reputed magazine Swarajya. The people of Haryana, a northwestern state, are considered to be among the most male-oriented people in India. So the state machinery is very vigilant & unforgiving of bad treatment of females. That is why you see the police officials standing proudly for their photo-op behind the photo of the two accused.

Another rape incident occurred two weeks ago in the neighboring & just as male-oriented state of Panjab. In this case, a 34 year female teacher was sexually abusing a 15-year old boy who was also her student. When the parents found out & filed a police complaint, the female teacher locked up the boy in her house. The boy was finally rescued by the parents with the help of her neighbors.

The police did charge her but what punishment did the female Judge give to the 34-year female guilty of statutory & forced rape?

- Deepika Bhardwaj @DeepikaBhardwaj – Jul 19 – 34 year old teacher in Chandigarh who was arrested for sexually abusing a 15 year old boy repeatedly and also holding him captive when his parents tried to rescue him, granted bail because “she is a lady”

Notice the Judge referred to the accused rapist woman as “lady” and not a woman. That is a unique aspect of today’s pro-women laws in India. A man can get charged & imprisoned under the Insult to Modesty of Women law because he called a woman “a woman”. No joke. A woman has to be called a “lady” and calling her a “woman” is deemed insulting to the woman and hence a crime under the law.

Notice the Judge referred to the accused rapist woman as “lady” and not a woman. That is a unique aspect of today’s pro-women laws in India. A man can get charged & imprisoned under the Insult to Modesty of Women law because he called a woman “a woman”. No joke. A woman has to be called a “lady” and calling her a “woman” is deemed insulting to the woman and hence a crime under the law.

Also understand that being granted bail in this case is tantamount to an acquittal for the accused rapist woman. Because the courts are so jammed with cases that it would take over 10 years for this case to come to trial. And after that long a period, very few are interested in spending months to fight the actual case.

So a woman guilty of sexually raping a 15-year old boy & holding him physically hostage is let go free on bail while young men accused of raping a female goat would be imprisoned for years. What a Judiciary? What a legal system? All this just so that India’s diplomats can hold their heads high in the world and proclaim India’s concern & action in protecting its females. And also because women outnumber men is India’s electocracy and Indian women are more dedicated in voting than Indian men.

Now you understand why we regularly advise families to leave their young sons at home while traveling to India. Your young son could accidentally bump into a woman in the crowded airports, train stations or on the street. Then the woman would have the right & the ability to charge your young son (as young as 2 years old, in one case) for molestation. And neither your son nor you would have any defense because the word of the victim woman is deemed sufficient to convict your son. Unless, of course, both she & you are smart enough to come to a financial payment for her emotional trauma.

Send your views to [email protected] Or @MacroViewpoints on Twitter