Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Peak or Downturn?

- Pantheon MacroVerified account@PantheonMacro – “The industrial cycle has peaked, but it’s not yet slowing.”@IanShepherdsonon U.S. Philadelphia Fed Survey, October/Weekly#JoblessClaims#PantheonMacro

The above is a big statement because Ian Shepherdson has been a bullish voice on the economy. What is a bigger statement:

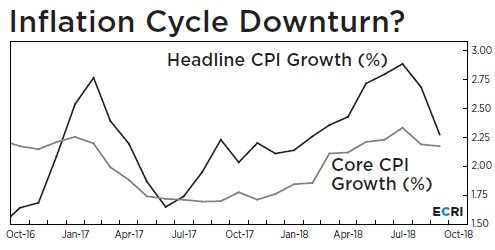

- Lakshman AchuthanVerified account@businesscycle– Taking a break, or rolling over?#ECRI goes public with @GrantsPub podcast on our inflation downturn call. Listen here: https://goo.gl/epe2Jf

The podcast discusses ECRI’s call for a downturn in inflation & home price growth. If proven right, this call would undercut the premise on which rest fears of Chairman Powell exceeding the hitherto accepted neutral Federal Funds rate. If the Treasury market comes around to ECRI’s view of an inflation downturn, the steepening of the yield curve that was launched by Powell comments would stop.

The podcast discusses ECRI’s call for a downturn in inflation & home price growth. If proven right, this call would undercut the premise on which rest fears of Chairman Powell exceeding the hitherto accepted neutral Federal Funds rate. If the Treasury market comes around to ECRI’s view of an inflation downturn, the steepening of the yield curve that was launched by Powell comments would stop.

James Bullard, St. Louis Fed president actually voiced what we think the FOMC should say.

- “The current level of the policy rate is about right, … Maintaining the current level of the policy rate would be an appropriate policy,” for the foreseeable future.”

Add to this the call from a J P Morgan model:

- “The probability of a U.S. recession within one year is almost 28 percent, and rises to more than 60 percent over the next two years, researchers wrote in a note this week. Over the next three years, the odds are higher than 80 percent … ”

Further add the fall in 3-4 bps in the German 30-2 yield curve, a fall that has until now influenced a fall in Treasury yields.

But, this week, the Treasury market was in no mood to listen to any of the above. It seems to accept only one message – the one voiced by Chairman Powell about hiking past the neutral rate. Look at what it did this week – the entire 30-2 curve rose 3.5 – 4.5 bis in yield despite a flat to down week in the US stock market. It seems to echo the new normal of bonds falling (rates rising) & stocks falling simultaneously.

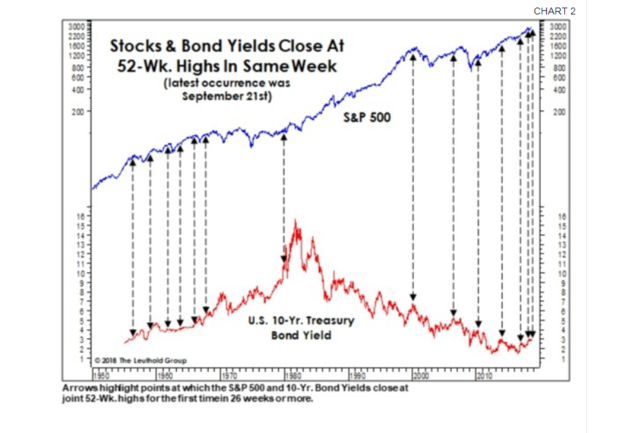

On the other hand, Doug Ramsay of the Leuthold Group, pointed out what usually happens when the 10-yr yield climbs to a 52-week high at the same time the S&P reaches a record:

- “Moves like that are unusual and have marked turning points for investors in the past … “Those joint highs worked as bond buy signals because the backup in yields was enough to slow the economy, … The fact that the stock market was at new highs suggests that the growth slowdown was unanticipated by equity investors.”

The Bloomberg article added:

- “On average, when rates and equities touch 52-week highs, yields fall 40 basis points in the next half a year, while stocks are more or less flat.”

2. 1994 or 2007 or Trump?

The last scenario is simple. The clear contrast of “Democrats produce Mobs, Republicans produce Jobs” with an assist from the Kavanaugh outrage leads to a Trump victory with GOP keeping both House & Senate. That can lead to a strong rally in November-December like the graphic below:

- Ryan Detrick, CMT @RyanDetrick Midterm years tend to see most of the gains late in the year. Could ‘18 follow suit? https://lplresearch.com/2018/10/18/the-calendar-is-a-bulls-best-friend/amp/?__twitter_impression=true …

The 1994 scenario, proposed by Larry Fink sometime ago, requires Treasury rates to fall and a massive rally in BOTH Treasury Bonds & stocks next year. This assumes the economy is strong but disinflationary. Just as Greenspan rate rises killed inflation in 1994 without damaging the economy, Powell rate hikes in 2018 will end up killing inflation threat without damaging the economy.

The 1994 scenario, proposed by Larry Fink sometime ago, requires Treasury rates to fall and a massive rally in BOTH Treasury Bonds & stocks next year. This assumes the economy is strong but disinflationary. Just as Greenspan rate rises killed inflation in 1994 without damaging the economy, Powell rate hikes in 2018 will end up killing inflation threat without damaging the economy.

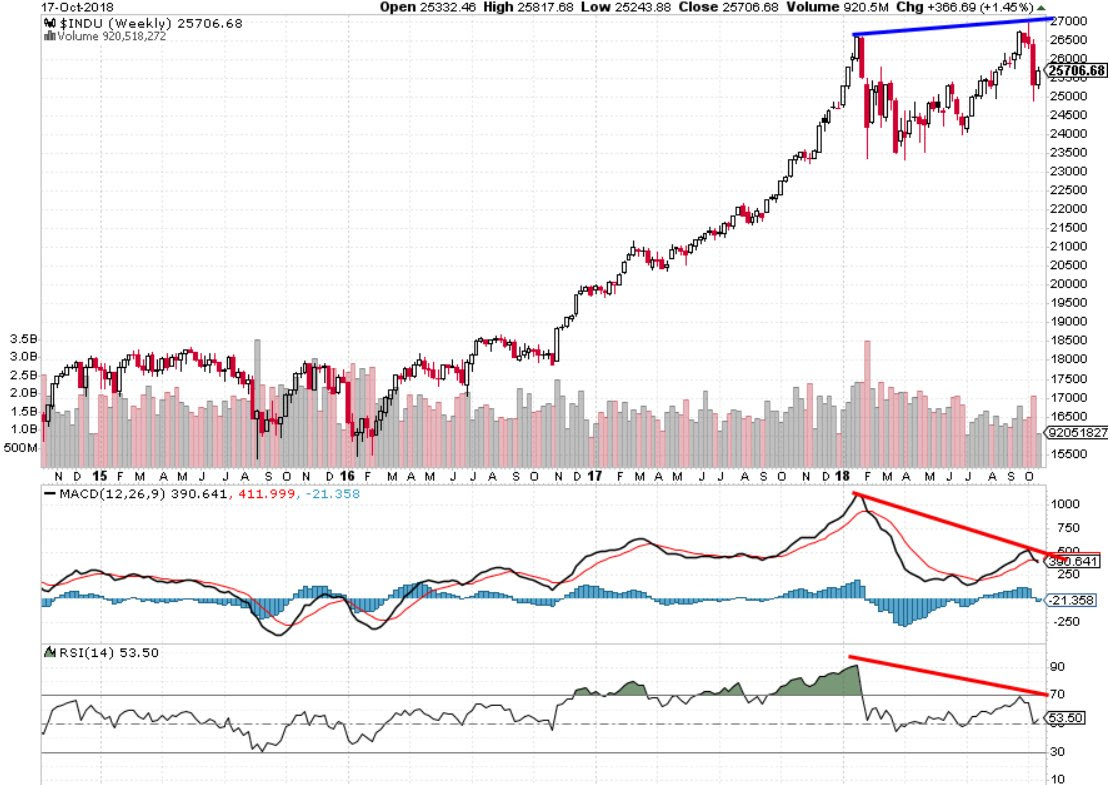

Then, of course, you have the dreaded 2007 double top:

- StockTwitsVerified account@StockTwits – This is the S&P 500 $SPX double top everyone is watching. https://stocktwits.com/Puart/

message/141801004…

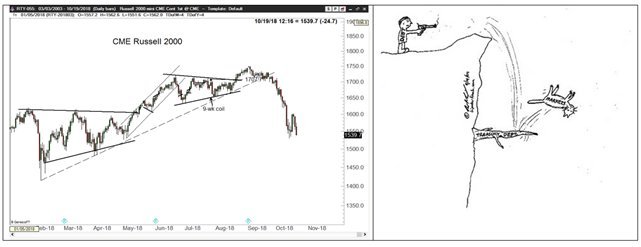

Another way to see this for small caps:

Those missing a 2000 comparison can view:

- J.C. Parets@allstarcharts – So are we just near the lower end of a massive range in Semi’s and we resolve higher, or is this massive distribution right at the March 2000 Highs?$SOX$SMH$XLK$QQQ

3. Gold

- David Rosenberg@EconguyRosie – You always want to buy the page B12 story on its way to A1. All the more so when sentiment is completely washed out and market positioning is more bearish than at any other time in the past 17 years.

A trader’s view is more nuanced:

A trader’s view is more nuanced:

- Greg Harmon, CMTVerified account@harmongreg – Dragonfly Capital – A Midterm Exam for Goldhttp://dragonflycap.com/a-

midterm-exam-for-gold/…$GC_F$GLD

“After two months marking time Gold moved higher last week. After a one day rise it has held up and consolidated again. This is happening at the July short term consolidation. It is also shy of retracing even 38.2% of the down move. Not a trend reversal at this point.”

“But getting close. The current test of resistance could put the brakes on the move higher in Gold. Momentum is starting to get into bullish ranges through. The RSI is peeking over 60 and the MACD has turned positive as it moves up. Continuation in price, through resistance, could lead to a move over that 38.2% retracement. I would get a lot more excited about a continued move higher and reversal at that point. That would pass the midterm exam.”

Send your feedback to [email protected] Or @MacroViewpoints on Twitter