Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Back to the Fed?

On Friday morning, Sara Eisen of CNBC said around 10:13 am – “seems the market needs something from the Fed “. Kudos to Ms. Eisen for finally seeing the light. At least she had the courage to say it out loud. Not many others have shown that courage. So they got scoffed at by the Bond King:

- Jeffrey GundlachVerified account @TruthGundlach Nothing like wiping out the entire strong YTD gain on SPX to make the “interest rates are rising for the right reasons” narrative to vanish.

Our “back to the Fed” title was drawn from the initial comments from the CNBC Fast Money gang on Friday 5:00 pm:

- Tim Seymour – “Fed is the reason we are here”,

- Brian Kelly – “Fed lit the match in a dynamite factory”,

- Steve Grasso – “It’s all rates”

But what exactly did the Fed do wrong? They have been raising rates & draining liquidity all year without too much impact. The bond market has been aware of the plan to steadily raise interest rates into 2019 or even 2020. Yet, the bond market kept in its long term channel. The only warning it kept giving was the flattening of the yield curve.

Then Fed Chair Powell said “we may go past neutral … we’re a long way from neutral at this point, probably” on October 3, the same day the Services ISM posted its best number in 20 years & ADP came in very strong. That broke the long term bond channel that had been acting as a dyke. By Friday, October 5, the day of the NFP report, the 30-year yield hit 3.40%, the 10-year yield hit 3.23% & the 5-year yield hit 3.07%.

Where did the stock indices close on October 3? Dow at 26828, S&P at 2925, NDX at 7637 & Russell 2000 at 1671. The fall in stock indices began the next day & has virtually continued non-stop until this Friday’s close at 24,688, 2659, 6852 & 1484 resp. How expensive were those loosely uttered words of Powell?

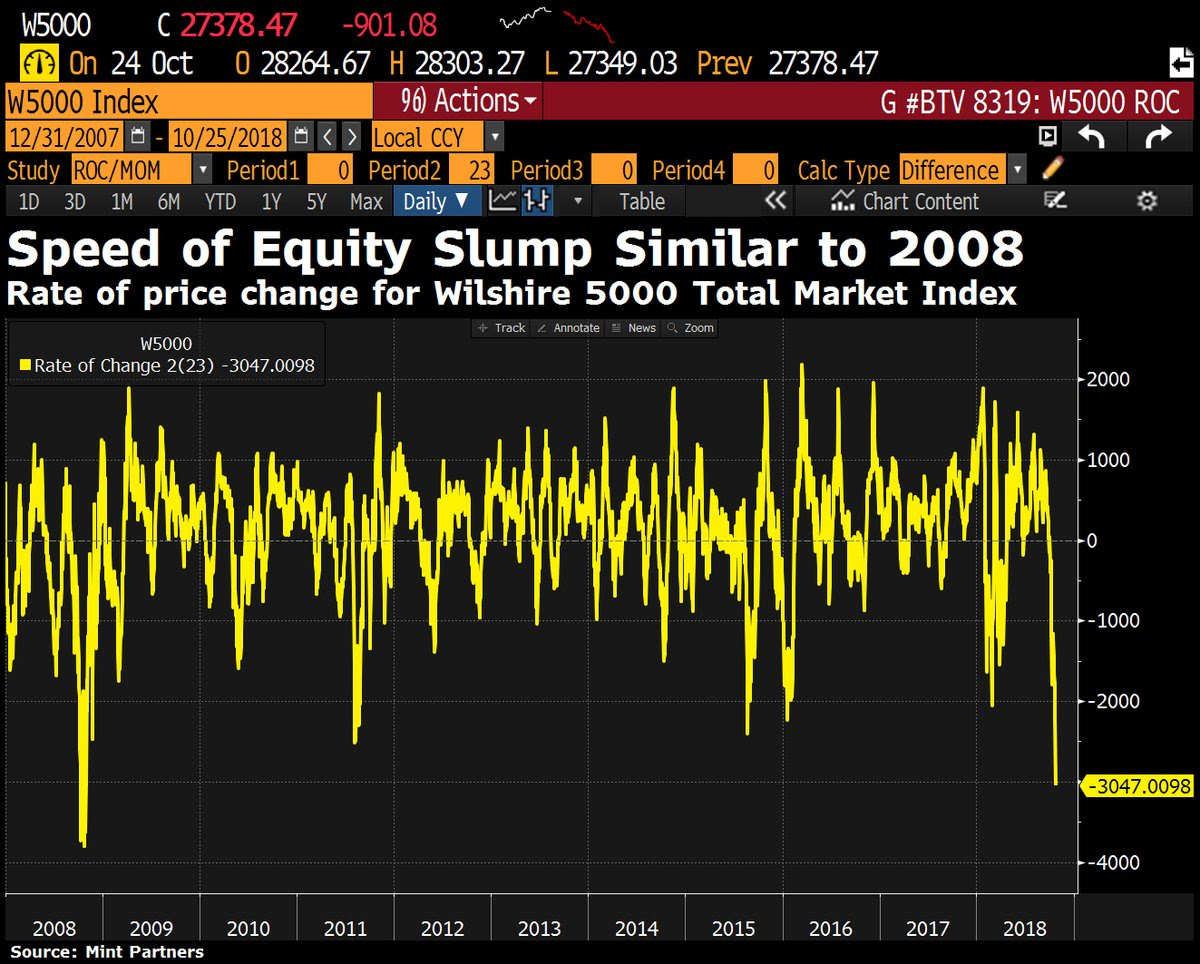

- matt miller@mattmiller1973“Over the past five weeks the U.S. equity market has collapsed by $3 trillion, the worst valuation crash since October 2008. The crash equates to 15% of GDP.” chart from Mint Partners via @queenofchartz

Remember Ruchir Sharma’s warning about a market decline hurting the economy because the global markets are 3.5 times the size of the global economy! Look what a historically small decline of 9% or so has done in terms of economic damage.

Remember Ruchir Sharma’s warning about a market decline hurting the economy because the global markets are 3.5 times the size of the global economy! Look what a historically small decline of 9% or so has done in terms of economic damage.

Clearly all of this didn’t start the day after the Powell’s “may go past neutral” comments on October 3. The fall in the Russell 2000 & other broad indices had begun early. But given the market caps of Dow, S&P, NDX stocks, the bulk of the market cap decline came post October 3.

This is why Sara Eisen’s comment about “the market needs something from the Fed” was so appropriate. Of course, had Sara Eisen been at her previous network, she would have heard “something” from Robert Kaplan of the Dallas Fed earlier on Friday morning:

- … I am very sensitive to not being rigid or pre-determined about the pace at which we get there (to neutral rate) and the reason is again, I expect GDP growth in 2018 to be strong but I expect it to to moderate in 19 & 20 as this fiscal stimulus starts to wane …. getting the balance right for me is going to require an open mind & to not be pre-determined or prejudge … “

This is a clear walk back, in our opinion, of the casual “may go past neutral …long way from neutral at this point ” comment of Chair Powell of October 3. Kudos to Bloomberg TV for isolating this 1:27 minute clip for simple folks like us. Actually, Vice Chair Clarida had also tried to inject some caution & date dependency into his own interview with Steve Liesman on Thursday. But that message was much more hidden than Kaplan’s clarity.

What about inflation though?

- (((The Daily Shot))) @SoberLook Chart (

@TheTerminal): US market-based inflation expectations are moving lower with crude oil –

Combine all this and what do you get – bull-steepening for the week with the 5-year yield falling by 14 bps on the week while the 10-year yield fell by 11 bps and the 30-year yield by a paltry 5 bps.

What about a fall from the lofty levels of NFP day, October 5? The 5-year yield has fallen by 16 bps from 3.07% to 2.91%, the 10-year yield by 15 bps from 3.23% to 3.08% and the 30-year yield by 8 bps from 3.40% to 3.32%. Both the 5-year & the 10-year yields broke to a weekly close below important levels of 3% and Santelli’s 3.10-3.11% resp.

Santelli thinks the 10-year yield goes to 3% after having broken the 3.10-3.11% support. Some say lower:

- Jeff York, PPT @Pivotal_Pivots –

$TNX 10yr. bond yields, ran into strong resistance at the Yr3 Pivot @ 3.24%. Look for a pullback to the Yr2 Pivot at 2.93%@PivotalPivots

Of course, the NFP report of next Friday, the midterms & the FOMC the week after that will have lot to say about where the 10-year yield goes.

Of course, the NFP report of next Friday, the midterms & the FOMC the week after that will have lot to say about where the 10-year yield goes.

2. Stocks Oversold?

Calling a bottom is a tough business. Witness:

- Scott MinerdVerified account @ScottMinerd – Stocks hold two-plus year uptrend. Deep oversold level suggests

#stocks have seen a near term bottom.

That was a trap door on October 11, not a bottom. So what about now?

- Scott MinerdVerified account @ScottMinerd – Stocks are cheap based on forward multiples and should rally by 15%-20% from here unless policy uncertainty around China and tariffs remains in place.

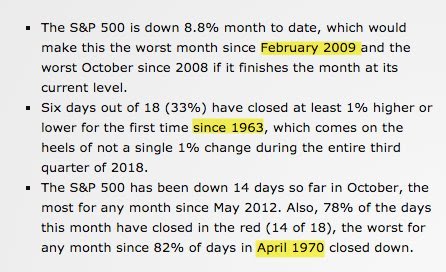

How rare is this decline?

- Urban Carmel @ukarlewitz – Persistent selling and volatility like this is ultra-rare (like once in 50 yrs rare) https://twitter.com/

RyanDetrick/status/ 1055463741222014976 …

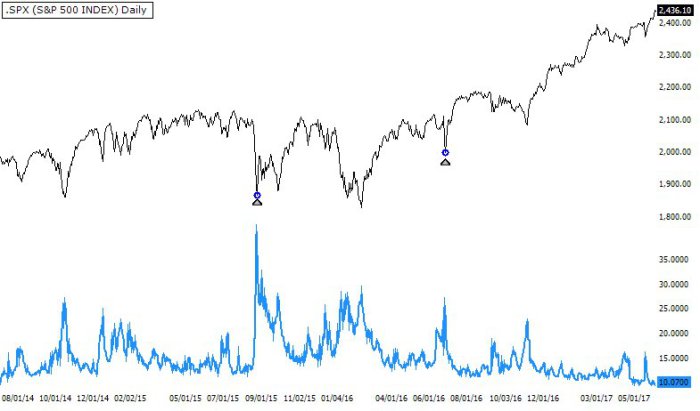

How oversold does it look technically?

How oversold does it look technically?

- Greg Harmon – views not blowing in the windVerified account @harmongreg – Momentum indicator MACD:

$SPY near Feb 2016 lows$IWM near Oct 2008 lows$QQQ near Mar 2001 lows

How about looking via SPX vs. VIX?

- SentimenTraderVerified account @sentimentrader There have been two other times in history (besides today) when the S&P 500 lost more than 1% on the day and the VIX so-called fear-gauge dropped. Aug 25, 2015 and Jun 27, 2016.

Both proved superb buying opportunities. How do you say this without a chart?

- Ryan Detrick, CMT @RyanDetrick –During a midterm year, what happens if you buy the low October close for the S&P 500 and hold till the end of the year? The S&P 500 has been higher the past 21 times – going back to 1934. In fact, 4 of the past 5 (back to 1998), saw double digit gains.

But some disagree, including the guru with the hot hand. Mike Wilson of Morgan Stanley said on Thursday that this rally can last 3-5 days but the decline is only 80% complete. He expects to see 2450-2500 in the next few weeks.

A more chilling possibility was voiced by Liz Ann Sonders of Schwab who said we might look back in a couple of years and see that the high on October 2 was the peak of this bull cycle. She also said the market often sniffs out a recession. Mark Yusco of Morgan Creek seemed fairly sure that this period is much like October 2000 and he expects a 40-50% correction in the next couple of years. In that vein:

- Conor Sen @conorsen – The S&P 500 is down 20 of the last 26 days. By my calcs, the only other times that’s happened since 1997 was 4 days in October, 2000.

If that is not gloomy enough, here is a la 2007:

- Jesse ColomboVerified account @TheBubbleBubble – Fund Mgr. Jeff Gundlach (@TruthGundlach): The corporate bond market is going to get much worse: https://citywireusa.com/

professional-buyer/news/ gundlach-the-corporate-bond- market-is-going-to-get-much- worse/a1168355 … $LQD $HYG $JNK

Finally, a warning about “funnymentals” from a proven guru:

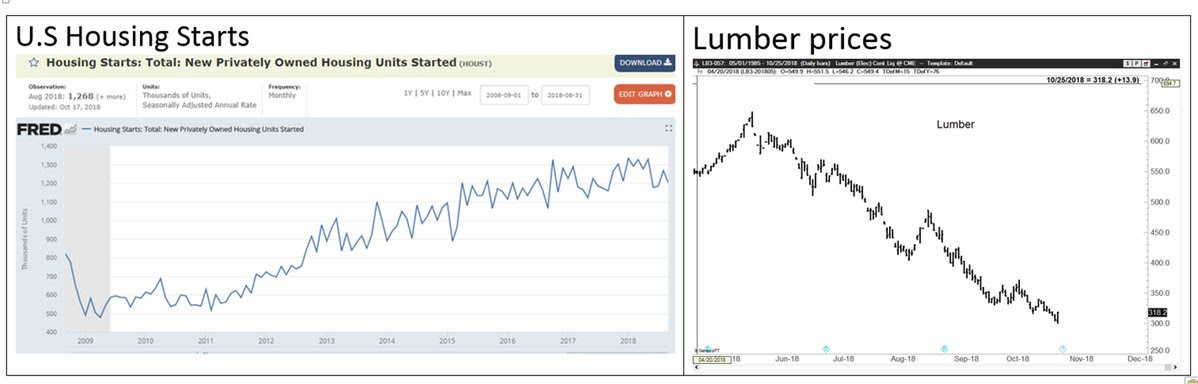

- Peter BrandtVerified account @PeterLBrandt – Lumber prices down more than 50% in construction boom. Put this one down in a long list of great examples of how deceptive it is to use fundamentals to predict prices. $LB_F

Send your feedback to [email protected] Or @MacroViewpoints on Twitter