Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.GBP – Talleyrand

It used to be a often quoted dictum that a market accident invariably happens after a new Fed Chair takes over. After Greenspan took over from Volcker, we had the 1987 crash. After Bernanke took over from Greenspan, we had the 2007-2008 disaster. We got pampered & complacent with Yellen without realizing Yellen was a softer speaking Bernanke. Hardly any transition there.

But we all know Powell is different than Yellen. And he has a huge responsibility in navigating markets through the deleveraging. He forgot that his weapon was open market operations, not open mouth operations. He also forgot what the veteran French Diplomat for Napoleon days had said “Speech was given to man to conceal his thoughts”. He also forgot that Greenspan only became Greenspan after mastering the Talleyrand dictum.

Given all of this, why did Powell commit the unpardonable sin of flippantly saying something that shook the bond market out of its complacency? Frankly, the simplest & most “don’t overthink” comment was voiced by Becky Quick of CNBC when she said Powell “would not have said it in a Fed presser” or in a formal Fed communication. Peter Fisher paraphrased this on Friday morning on CNBC Squawk Box when he said Powell “let it slip“. But Fisher added the Fed has no idea where the rates will be one year or two years from now; that Powell could well raise the Federal Funds rate way above normal OR actually ease rates if the data turned weak.

There is no doubt that the loose lips of Powell sunk the barriers of the 30-yera bond channel & rates immediately swelled all over the barrier to cause havoc. The volume in the bond ETFs and the bond market was huge & the bond volatility spiked. Well, when bond volatility spikes & bonds crash, stocks do follow, especially Nasdaq 100 stocks. Look how the basic DDM models worked in practice over the last 2 months:

TLT fell hard in early August while QQQ & other stock indices kept rising. Then thanks to Powell, TLT collapsed & QQQ fell over a cliff. Now QQQ has actually fallen more than TLT over the past two months. IWM has done worse & SPY a bit better. The same happened in October 1987 but on a massively larger scale.

TLT fell hard in early August while QQQ & other stock indices kept rising. Then thanks to Powell, TLT collapsed & QQQ fell over a cliff. Now QQQ has actually fallen more than TLT over the past two months. IWM has done worse & SPY a bit better. The same happened in October 1987 but on a massively larger scale.

It was funny to see all the “rates are going up for the right reason, that’s good for stocks” FinTV anchors panic this week. They should listen to what Jim Bianco said about a “giant unwind at the asset allocation level” on Friday on CNBC Closing Bell:

(minutes 0:50 to 3:10).

Jeff Gundlach said on CNBC FM 1/2 that the velocity of the bond selloff suggests that the 30-year yield could shoot up to 4% & the 10-year to 3.5% before stopping. If that happens with velocity, stocks are not likely to smile.

Speaking of Gundlach, think back to what he said in his webcast on January 9, 2018. He spoke about how commodities rally sharply before a recession begins. In fact, he said a rally in commodities & an accompanying rise in interest rates is almost a precursor to a recession. Are these conditions in place now, with Oil’s rally till early this week & the rates explosion? We will see.

Some don’t need to see so much. Barry Sternlicht of Starwood was explicit in telling Cramer that the economy is not as strong as the Fed thinks; he said the Fed is looking at current numbers & not tomorrow’s numbers. We urge readers to look at the anger, almost contempt, in Cramer’s words & tone when talking about the asinine comments of Fed head Evans to Steve Liesman on Friday morning.

Then you had Jamie Dimon talk about geopolitical issues bursting all over the place on Friday. Forgive us for being simple-minded, but every one of these “geopolitical issues” should impact global growth negatively.

- EU threatening Italy to behave or they will let Italian banks implode – Isn’t that likely to lower German Bund rates & possibly Treasury rates too? When has a bank contagion been good for the global economy or rates going up?

- US-China trade skirmish-war – how on earth is that bullish for either economy or for rates? A WSJ piece argued that Trump Admin is increasing its aggressiveness towards China. Is that bullish for rates or bearish? Democrats are even more for bashing China for unfair trade. So this issue will remain no matter which party wins the House.

- The horrific allegation against Saudi Arabia of killing a journalist & now Pres Trump promising punishment if found true – does that make it more likely that Saudi Arabia tries to please Trump by raising production or lowering production?

Frankly, most of these seem to be triggers for global weakness & for rates to remain stable or going lower. That is why the Powell slip of the tongue was so terrible. Now it will be very hard for him to backtrack even if the data turns lower. So the next day to get real clarity will be November 8, the day after the midterm elections. We will gets lots of clarity that day on a lot of things. But what happens until then?

Below are some tweets & charts that show how tumultuous this past week was in equities. Did some fund blow up on Thursday to account for the huge sell program? Or was this unwind a taste of what may follow?

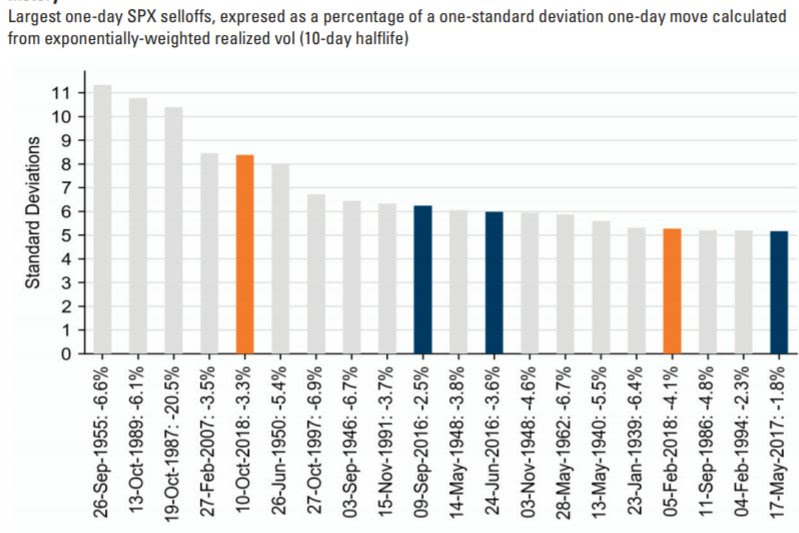

- Joe Kunkle @OptionsHawk – Wednesday was just the 6th 8-sigma event in $SPX history

Not just the size of the move but the velocity too:

Not just the size of the move but the velocity too:

- Tim SeymourVerified account @timseymour – STAT OF THE DAY: the 9D RSI closing level on the #SPX yesterday (9.7) was the lowest close I see going all the way back to 9/2001. Tells you the velocity of the down move. …maybe not much more but still lower than any time in the crisis!!!!

Now about Friday morning:

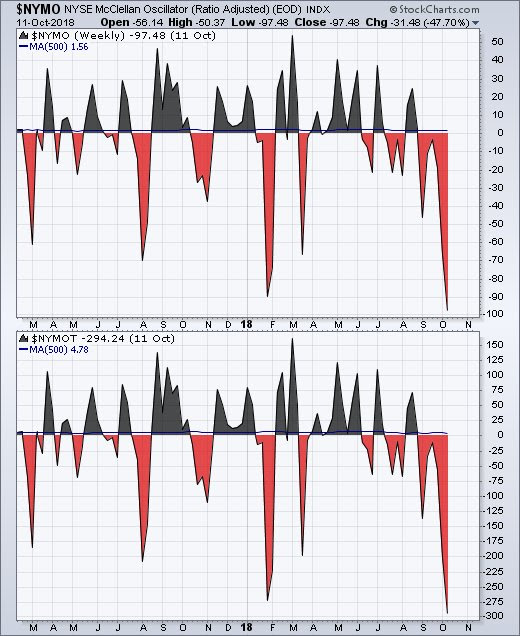

- Cousin_Vinny @Couzin_Vinny – $NYMO $NYMOT End of Day chart doesnt include todays extreme (-92) worse than FEB extremes which led to 14% gains over the following 8 months

OK, but what about the next 8 days?

OK, but what about the next 8 days?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter