What a morning was this Wednesday? It was a perfect celebration of Diwali, the festival of lights, which spreads joy into every household. The midterm elections spread joy into virtually every market – Dow exploded up by over 560 points; Interest Rates fell hard on Wednesday morning and by Friday’s close. Every sector of the S&P 500 was up and Emerging markets rallied hard. The U.S. Dollar declined and Gold, Silver, Copper went up almost as if they were all celebrating Diwali.

How appropriate to have all this happen on the day of Lakshmi Pujan, the day households celebrate the arrival of Goddess of Moral, Spiritual & Physical Wealth into their house.

Why the happiness? President Trump not just kept the Senate but strengthened his hold on it both by increasing number of seats held by Republicans and by electing his supporters over his opponents. Simultaneously the election gods removed the pressures he was under – the fate of the US economy and the well being of the US blue collar workers. Not even his enemies question the higher incomes & increased prosperity his first two years have delivered to the middle class & lower middle class.

1.Fed Independence, Maxine Waters & Democrats

And now, just as the US economy looks as if it is about to slow down, the mantle of responsibility has passed to Congresswoman Maxine Waters, the new Chair of the House Finance Committee, and to Congresswoman Nancy Pelosi, the old & new speaker. If the economy slows down and, if as a result, incomes & job security of African Americans go down next year, then President Trump will put the entire responsibility on Congresswomen Waters & Pelosi.

Remember, President Trump has already blamed Fed Chairman Powell for raising interest rates & thereby hurting the economic growth he has achieved. How right is he? Just look at how the darkness of the Fed’s obstinacy dimmed the lights of Wednesday. The Dow fell 200 points on Friday and the growth-areas of the stock market, housing stocks, semiconductors, were clobbered. So were emerging markets. The 2-5 year interest rates went up because the Fed said they would keep raising interest rates but the 10-30 year rates went down hard.

Look how Rick Rieder, the smart & honest Fixed Income specialist of the world’s largest asset manager BlackRock, described today’s conditions:

- “look what has happened to affordability, look what is happening to existing home sales, new home sales, building permits; its a big deal, its starting to break a bit“

Understand it is good for Rick Rieder’s fixed income investments if the economy breaks because interest rates will come down hard & his bond investments will rise in value. Remember, how long Treasury bonds went up by more than 25% in 2008 when the values of homes & stocks of middle income Americans got decimated. But no one in America wants the economy to go down including Mr. Rieder. That is why he seems to be sounding an alarm about the Fed raising rates too much.

But the Fed is supposed to be independent, right? That is the gospel today. And that was cast in stone during the days of Fed Chairman Paul Volcker who destroyed the rampant inflation of the 1970s during the Reagan Administration. But what has been the track record of the Federal Reserve in this century?

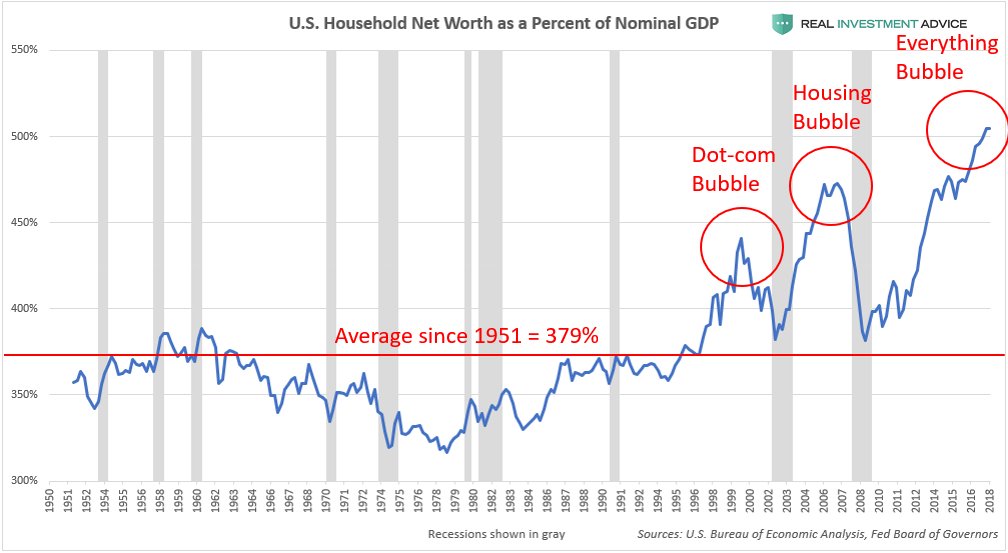

In 1999, loose money policy of Fed Chairman Greenspan created the Tech-Telecom bubble. To control that bubble, Greenspan kept raising interest rates in 2000 until he completely burst that bubble & sent the US economy into a severe recession. Then, for the next three years, Greenspan kept lowering the interest rates he had himself raised in 2000 to lift the US economy out of recession. But he kept that low 1% rate for so long and raised it so slowly that Greenspan created the housing & credit bubble of 2005-2006. His successor, Bernanke, did not act quickly and the result was the huge bubble of 2006-2007. In trying to deflate that bubble, Bernanke created another recession in 2008. Then, like Greenspan, Bernanke lowered interest rates to zero, introduced massive amounts of money into the US economy. This was continued by his successor, Janet Yellen. The result is another bubble, an everything bubble as it is now called.

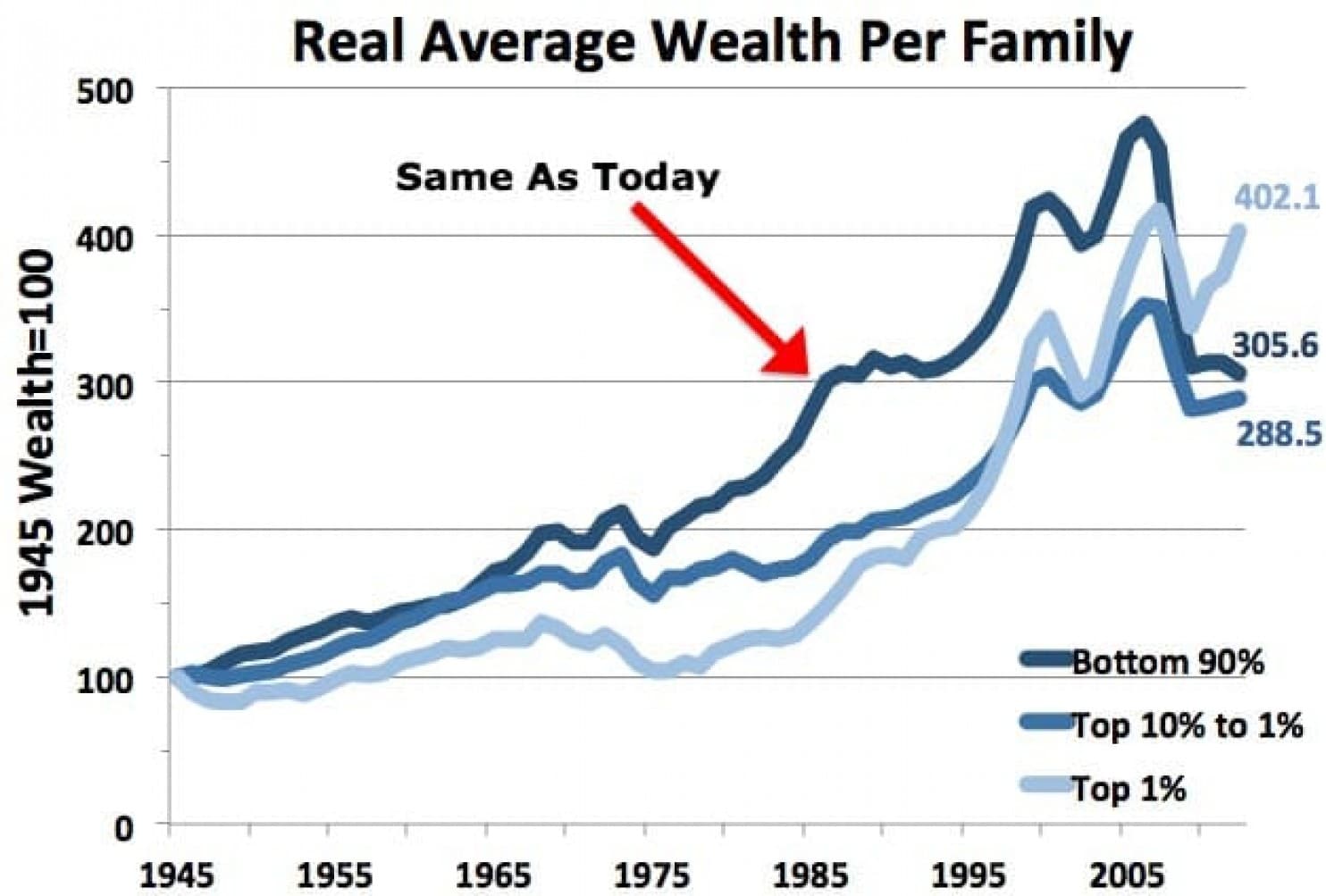

This Fed behavior is the principal reason for the wealth & income inequality in America. Look what the Wonkblog Staff of the Washington Post wrote on October 31, 2014 under the title The middle class is poorer today than it was in 1987:

- “Everybody but the richest 10 percent of Americans are worse off today than they were almost 30 years ago. That includes the poor, the entire middle class, and even what we would consider much of the upper class. The reason: The middle class missed out on the big bull market in stocks, but not on the even bigger bear one in housing.”

That was October 31, 2014, a period in which everybody was talking about jobless & incomeless growth.

That was October 31, 2014, a period in which everybody was talking about jobless & incomeless growth.

Nine months later, the candidacy of President Trump was born. Candidate Trump committed himself to improving prosperity of all ordinary Americans. And he has done that. Today, the jobless rates in all communities are near all-time lows and wages have increased over last year at the fastest rates in this century.

Naturally, the Federal Reserve is now gung ho about raising rates, removing financial liquidity & tightening financial conditions. And what is their track record? Look what Ellen Zentner of Morgan Stanley said on Bloomberg Television on Friday:

- “the Fed always hikes until they go too far & because a lot of the data is lagged; … so you don’t know you have gone past neutral until you have gone past neutral and its too late to take those hikes back“

Who suffers when the Fed goes too far as they have always done in this century? Ordinary Americans – the poor, the lower middle class, the suburban families. Look again at the bubble chart above or simply think back to 2000-2002 & 2007-2008.

And whom does the Federal Reserve answer to? The Congress, not the President. That means Congresswomen Maxine Waters, the new Chair of the House Finance Committee. President Trump has already been clear about what he thinks about the Fed raising interest rates. Now he can publicly exhort Congresswoman Waters to exercise her oversight over the Federal Reserve.

President Trump improved the incomes & prosperity of the American people in the last two years when he had leadership of the House. Now it is up to Congresswoman Waters & the Democrat controlled House to control the Fed, maintain the economy’s growth & raise incomes of ordinary Americans. If they don’t, they will face the fire of an unbound President Trump.

This poses risk to the Federal Reserve. Congresswoman Waters has never been their friend. So she could ally herself with President Trump and act to lessen the Fed’s independence.

2. Obama DOJ Redux

Watching Chris Mathews of MSNBC Hardball is often fun, especially when he reveals his inner intense admiration of President Trump. Look back to Thursday, August 18, 2016 when he interviewed newly chosen Kelleyanne Conway:

- “I don’t buy that there has been a problem of Trump being Trump; I think the problem has been that he has not always been Trump …”

This past week was much funnier. He literally went semi-nuts in extolling the courage & audacity of President Trump on his MSNBC Hardball show. He said the forced resignation of AG Sessions was like “General MacArthur’s Inchon Landing” in Korea; he referred to the “stones of this President” and added another comment about “steel xxx” of President Trump. He said “I am watching Trump with strength and the other side with weakness“.

Chris Mathews was ecstatic or apoplectic about the tactical audacity of President Trump in freeing himself of recused AG Sessions and appointing his chief of staff Whittaker as acting AG instead of Deputy AG Rosenstein.

This action by President Trump was overdue. As we had written in our article American Civil Wars & Insurrections in May 2017,

- “President Trump forgot the lessons of President Lincoln & the resistance of the South. He didn’t understand that he had merely won the first important battle of America’s new civil war and that the real nasty dirty war of attrition lay ahead of him.He forgot to build a bodyguard team around him to protect him from political assassination.”

What did we mean by a bodyguard team?

- “Look back at the behavior & steadfast attitude of both AG Eric Holder & Loretta Lynch. They were totally & unrelentingly loyal to President Obama above all other considerations. Look back to the last eight years and you will see that both AG Holder & AG Lynch placed protecting & defending President Obama above protecting their own personal reputations. “

That period was like the early part of the American Civil War. Now after the mid-term elections, it is like the last phase of the Civil War. Not that it is any less dangerous but today offense may be more relevant than just defense. And as President Lincoln chose General Ulysses Grant as his commander, President Trump should choose a proven offense oriented Attorney General.

After all, there is no shortage of investigations that could be launched in the national interest – Russian interference in the Democratic National Committee, Hillary Clinton emails, Clinton Foundation, FISA warrant abuse by rogue elements in the FBI & DOJ etc. Perhaps a new special counsel could be appointed to investigate all of this. If so, then Special Counsel Mueller might have to report to this new Special Counsel with larger & more inclusive powers to investigate Russian interference in the entire 2016 election process.

If & when this is done with the right AG and a capable Special Counsel, President Trump can devote himself to fighting Chinese trade related aggression against America and other matters of national & global urgency.

Then we and the world might see a truly unbound Trump.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter