Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”today they bent the knee”

What a perfectly succinct phrase from Josh Brown, a CNBC Half Time trader! That is exactly what Fed Chairman Powell did before markets. It was evident that he was seriously shaken by the fury of the financial markets & the criticism that was directed against him after the December FOMC meeting.That is why he needed previous Fed Chairs, Yellen & Bernanke, with him on stage to give him support.

But that was not enough. He had been so rattled by the carnage created due to his “autopilot” remark during his FOMC presser that he did not want to make any mistake of communication on Friday. So he brought notes and basically read off his notes.

His reversal was captured well by CNBC’s Sara Eisen who tweeted to the moderator:

- Sara EisenVerified account@SaraEisen – @Neil_Irwin : please ask Powell and his predecessors whether it was a mistake to say that we’re a long way from neutral and the balance sheet policy is on autopilot

The tweet summarized the huge shift in policy Powell enunciated on Friday – muted inflation; not only were further rate hikes data-dependent but their precious balance sheet normalization could also be put on hold if needed.

The stock market, already up almost 400 points because of Chinese cutting their bank reserves rate by 1% & the visibly strong Non Farm Payroll report of 321K vs est of 176K, rallied to above 800 points as they listened to Powell concede all the above.

Caveat Listener! Bending a knee is not handing over your sword in surrender. And Chairman Powell did sneak in a remark about markets being ahead of hard data. Remember all Powell said is that they would be data-dependent. Meaning the monthly reduction of $50B from their balance sheet continues until data makes them stop. So Powell did not pause the ongoing removal of liquidity. Also Powell could possibly raise rates in March if the data doesn’t fall sharply. And he specifically referred to the strong 321,000 jobs number of Friday morning.

So it behooves all to ask how strong was the employment number? What jobs were created in December? Trust David Rosenberg to cork the champagne bottle:

- David Rosenberg @EconguyRosie – Multiple job holders jumped 117k in Dec., accounting for over 80% of the total job gains. Look at the number of unincorporated self-employed – +126k, or responsible for ~90% of the total gains in Dec. These are “counter cyclical” indicators. Markets haven’t scratched the surface.

And what would just one scratch reveal?

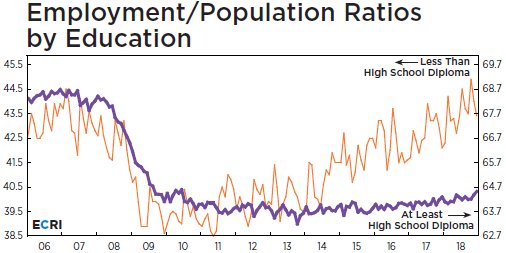

- David Rosenberg @EconguyRosie – The question is, when will the markets realize that the entire increase in employment and the participation rate came from 18-19 year olds? 2% of the pie carried the entire load!

For simple folks like us, ECRI’s Lakshman Achuthan posted a picture:

In addition, “ECRI’s U.S. Weekly Leading Index (WLI) decreased to 142.4 as WLI growth declined further to -5.3%, approaching a seven-year low.”

In addition, “ECRI’s U.S. Weekly Leading Index (WLI) decreased to 142.4 as WLI growth declined further to -5.3%, approaching a seven-year low.”

Look at the long term chart of WLI:

So what is ECRI’s central message?

- “Unfortunately, from our cyclical perspective, the end of the current deceleration is not yet in sight. For example, Weekly Leading Index growth, which leads peaks and troughs in overall economic growth by a couple of quarters, remains in a downtrend, pointing to further economic slowing ahead.”

We see a starker message by visually comparing today’s level of the above WLI to its level in Q3 2007, the quarter in which Jim Cramer ranted “they know nothing“. Bernanke did not pay heed to Cramer’s rant. And the Bernanke Fed kept lagging behind the deceleration in economic data thereby perpetuating the contagion and creating the turmoil of 2008.

That remains our real fear for 2019. Powell’s statement about markets being ahead of hard data leads us to conclude he has only acceded to the pause to placate financial markets. He still is not aware of the economy slipping under him. So by the time he gets it and stops the QT & cuts the Federal Funds rate, it might be too late once again.

If you don’t believe us, read the summation of David Rosenberg for this past week:

- “There is little doubt in my mind that the recession is coming and it makes no sense for economists to fight the tape”

Last week, we pointed out that the 5-year yield had broken below the 1-year yield and that the entire 1-5 year Treasury curve was inverted. With a up 371 Dow points week with two 90% up days, this Treasury inversion should have been reversed or at least corrected to a large extent, right?

Wrong. This week the curve inversion extended from the 1-5 year curve to the 1-7 year curve. Yes, despite a big rally in yields on Friday, the 7-year Treasury yield fell BELOW the 1-year yield this week. What about the 10-year you ask? Look:

- ((The Daily Shot))) @SoberLook – Jan 2 – Chart: The US swap curve has inverted

The Swap curve often leads the Treasury Curve. And the absolute levels of Treasury yields were down this week in a bull-flattening mode with 30-year & 10-year yields down 5 bps & the 2-year yield down only only by 2.5 bps.

The Swap curve often leads the Treasury Curve. And the absolute levels of Treasury yields were down this week in a bull-flattening mode with 30-year & 10-year yields down 5 bps & the 2-year yield down only only by 2.5 bps.

We hope the stock rally continues next week and interest rates rise at least a little & enough to reverse some of these inversion.

One positive development is that High Yield ETFs, HYG & JNK, outperformed TLT, the Treasury ETF.

2. Stocks

First, a cautionary signal:

- Bob Lang @aztecs99 – oscillators juiced up…way way overbought…

But is such a huge reversal in oscillators a good signal for the longer term?

- SentimenTraderVerified account @sentimentrader – The McClellan Oscillator has gone from -70 to +70 in less than 2 weeks. This happened 10 other times since 1962. All 10 saw the S&P 500 higher a year later. Its median return was +21.9%.

And what about two 95% up days?

- SentimenTraderVerified account @sentimentrader – Prior to today, there have only been 3 distinct times when NYSE Up Volume accounted for 95% or more of total volume twice in 2 weeks: Aug ’82: S&P 500 was up 31% six months later Jan ’87: Up 21% six months later Aug-Nov ’11: Up ~12% six months later

Very comforting but a sample size of 3 and all non-recession years? What did Lawrence McMillan of Option Strategist write in his Friday summary?

- “Volatility has been very tame this week. Even when $SPX was down 60 points on Thursday, January 3rd, $VIX was barely higher. The short-term $VIX “spike peak” buy signal is still in force, and $VIX has not returned to spiking mode since issuing that buy signal. On an intermediate-term time frame, the trend of $VIX is still higher, and that is bearish for stocks.””

- In summary, we are taking a somewhat positive view of the short-term, especially if other oversold indicators chime in with buy signals. But the intermediate-term outlook remains bearish as long as $SPX continues to make lower highs and lower lows.”

Basically wait & see . So it might be more useful to wonder what might do well if stocks do indeed rally this year. An old dictum from a legendary name:

- John Bollinger @bbands – Happy New Year! Please keep in mind that there is a long tradition of what did poorly last year doing well the next. Good trading!

But does that really apply to something thoroughly forsaken?

- J.C. Parets @allstarcharts – IF’ the selling in stocks is over (for now) then this $DB island reversal is most likely for real. It would certainly be one for the bulls $EUFN $SPX $DJIA one to watch….

How about an asset class or a region?

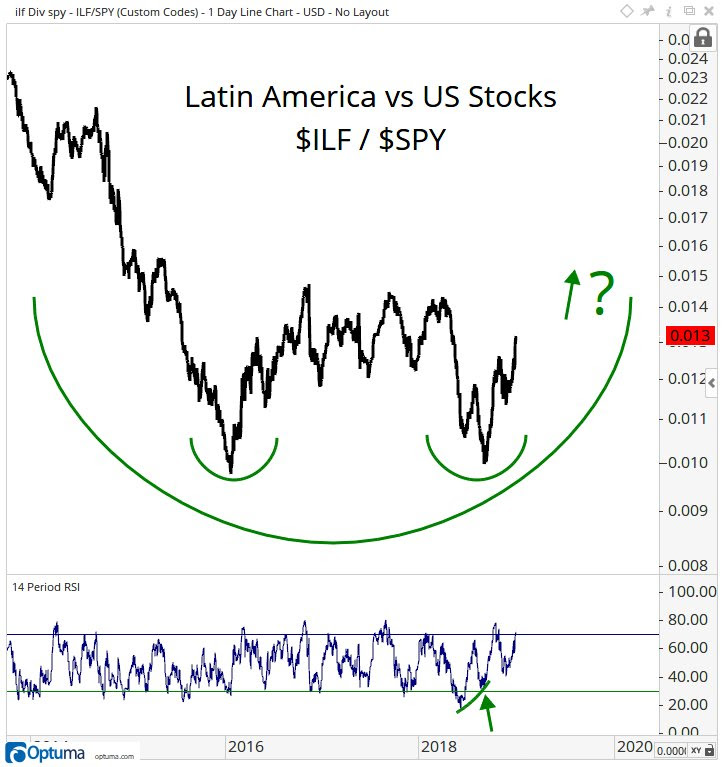

- J.C. Parets @allstarcharts – is this a multi-year bearish to bullish reversal in Latin America vs US Stocks? The relative strength lately certainly stands out $ILF $SPY $EWZ $SPX

Does that apply to a commodity too?

3. Oil

It certainly did to Oil this week. Brent was up 8% and WTI was up about 6.8%. Energy stocks did very well too with XLE up 4.9% and the higher beta OIH up 7.7%. This rally also did something interesting:

- Mark Newton @MarkNewtonCMT – #Crude‘s advance managed to exceed the entire Downtrend from October which is a near-term positive for WTI & plays into my thinking of some #Energy Mean reversion in the weeks ahead $CL_F $XLE $OIH

4. China, Apple & Four traps

We discuss this in some detail in our adjacent article titled China, Apple, Trump and 4 Traps of Magnus. It includes a partial review of the book by George Magnus of Oxford (sadly, not Dak Prescott’s Oxford) titled China, Apple, Trump & 4 Traps of Magnus.

Send your feedback to [email protected] Or @Macroviewpoints on Twitter