Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Back to the past?

Remember how it was back in September? Stocks were rallying, interest rates were rising, growth was fine and the Fed was talking about raising rates. This week was kinda like that – stocks have been rallying; even consolidating weeks like this one have a bullish slant. Rates rallied hard this week with the 30-year yield leading the way up almost 12 bps. The 5-year yield was up 9 bps & even the 2-year yield was up 6.5 bps. And the curve is re-steepening. The economy is not falling and look what some one said:

- Igor Schatz @Copernicus2013 – DUDLEY: FED MIGHT START HIKING IN THE SECOND HALF OF THE YEAR the front end of the curve, still pricing in cuts has been put on notice

If this continues past next week’s payroll report into the March 20 FOMC meeting, will Chairman Powell get a bit more hawkish in his presser? If not, will the curve-steepening accelerate? After all, rates don’t need strong growth to keep going up. Just look at Germany. The 10-year German Bund doubled in yield this week from 9 bps to 19 bps without growth picking up. What was needed was the TLTRO talk by the ECB.

The growth flavor of markets comes from the new resurgence of Chinese stock market. Even the disappointment of the Trump-Kim summit did not diminish expectations of a US-China deal of some sort. Actually, the deal itself may not be important. As long as the talk is about a deal happening and as long as tariff escalation keeps getting postponed, the markets seem happy to go along.

Look at what Lawrence McMillan wrote in his Friday summary:

- “In summary, the market remains bullish in the near-term, since there are no sell signals. Yes, there are overbought conditions, and the market swiftly turned negative last year in late January and early October, without a lot of warning — but there were SOME warnings and divergences. None of that exists now. For now, though, remain long — while tightening stops and rolling calls up to higher strikes, but it appears to be too early to go short.”

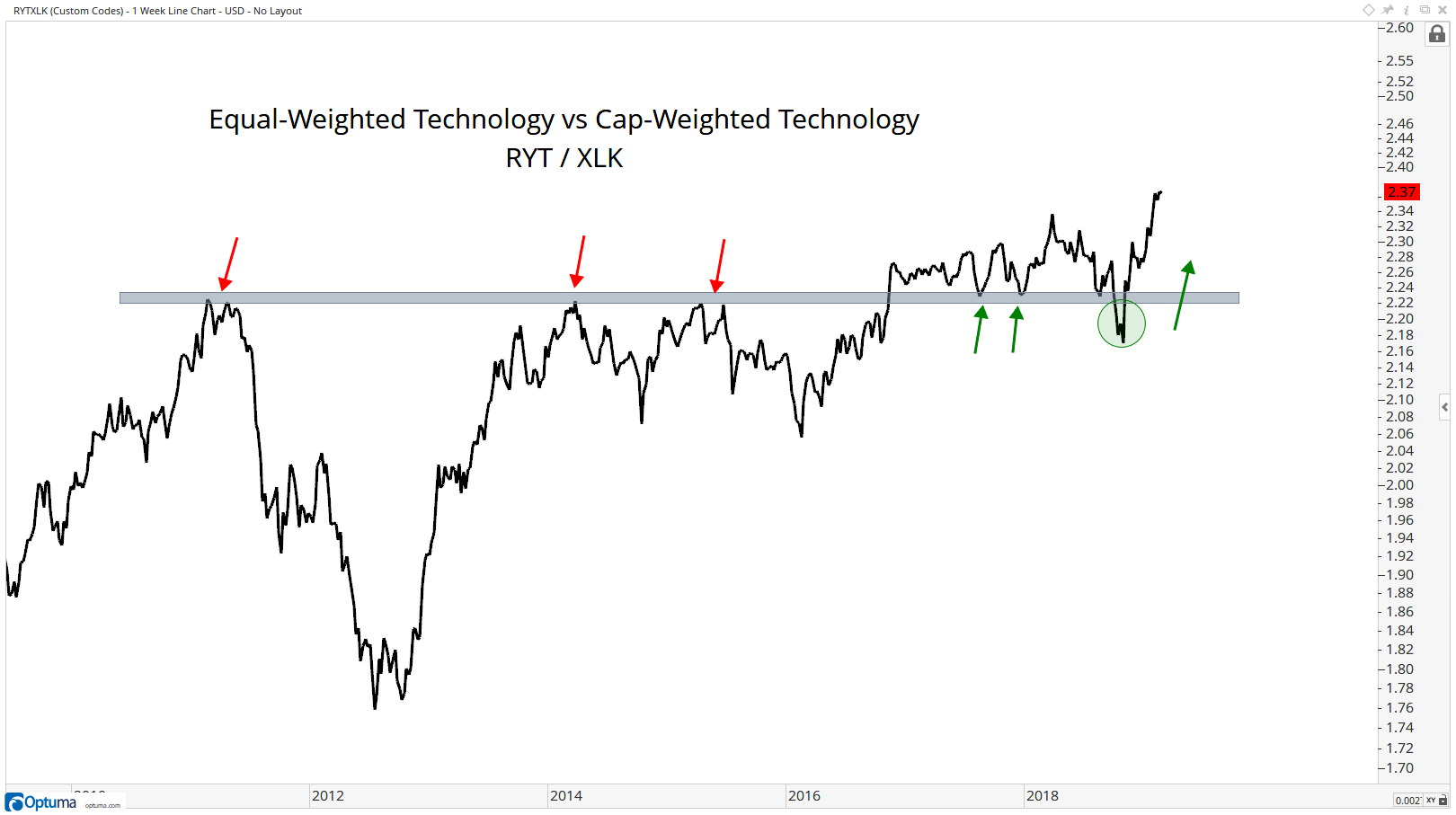

Even though, the indices are not moving up, the breadth rally is helping non-index stocks rally. That is true even in the technology space as J.C. Parets wrote in his post Broadening Upside Participation In Tech Stocks.

- To me, this suggests an expansion of upside participation, not a contraction.

I’m taking the Equally-weighted vs Cap-Weighted Technology ratio breaking out as evidence of expansion of breadth. In other words, more stocks are participating to the upside, not fewer ones.

2. Economy

The forward view is still not good.

- Yahoo FinanceVerified account @YahooFinance – Highlight: “It’s unequivocal that the direction of much of the [economic] data… it’s been slowing down,” says @businesscycle’s Lakshman Achuthan. “The market is eternally hopeful… but the actual data is still decelerating.” @BrianBrenberg also weighs in on China.

From a consumer standpoint:

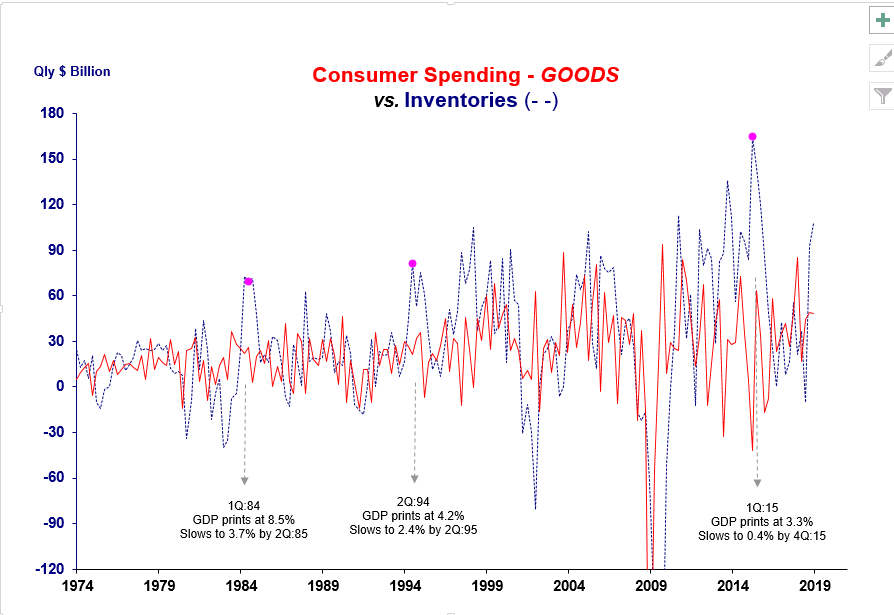

- steph pomboy @spomboy buried within this morning’s GDP report was another huge inventory build. when the overhang was last this large, it didnt’ end well for growth …or profits (which slowed from +7.6% to -10.7% in 12 months’ time)

Then the comps:

- David Rosenberg @EconguyRosie I can hear it — ‘where’s the recession?’ Yet we had identical GDP growth rates in both Q4 2000 and Q4 2006 and the downturns started the very next quarter!

Frankly, Q4 2006 won’t be that bad. We would still have 10 more months to go for stocks.

3. Interest Rates

The action was in Rates and Gold this week. Perhaps that correlation is to be expected:

- Lawrence McDonald @Convertbond – Once again, when you think you’re trading gold, you’re actually trading bond yields. Via @BearTrapsReport

The entire Treasury curve bear-steepened this week while Gold fell 3% with miners falling 5.5%. But some feel the recent curve steepening may be too much too soon:

- Igor Schatz @Copernicus2013 – 5s30s ripe for corrective flattening

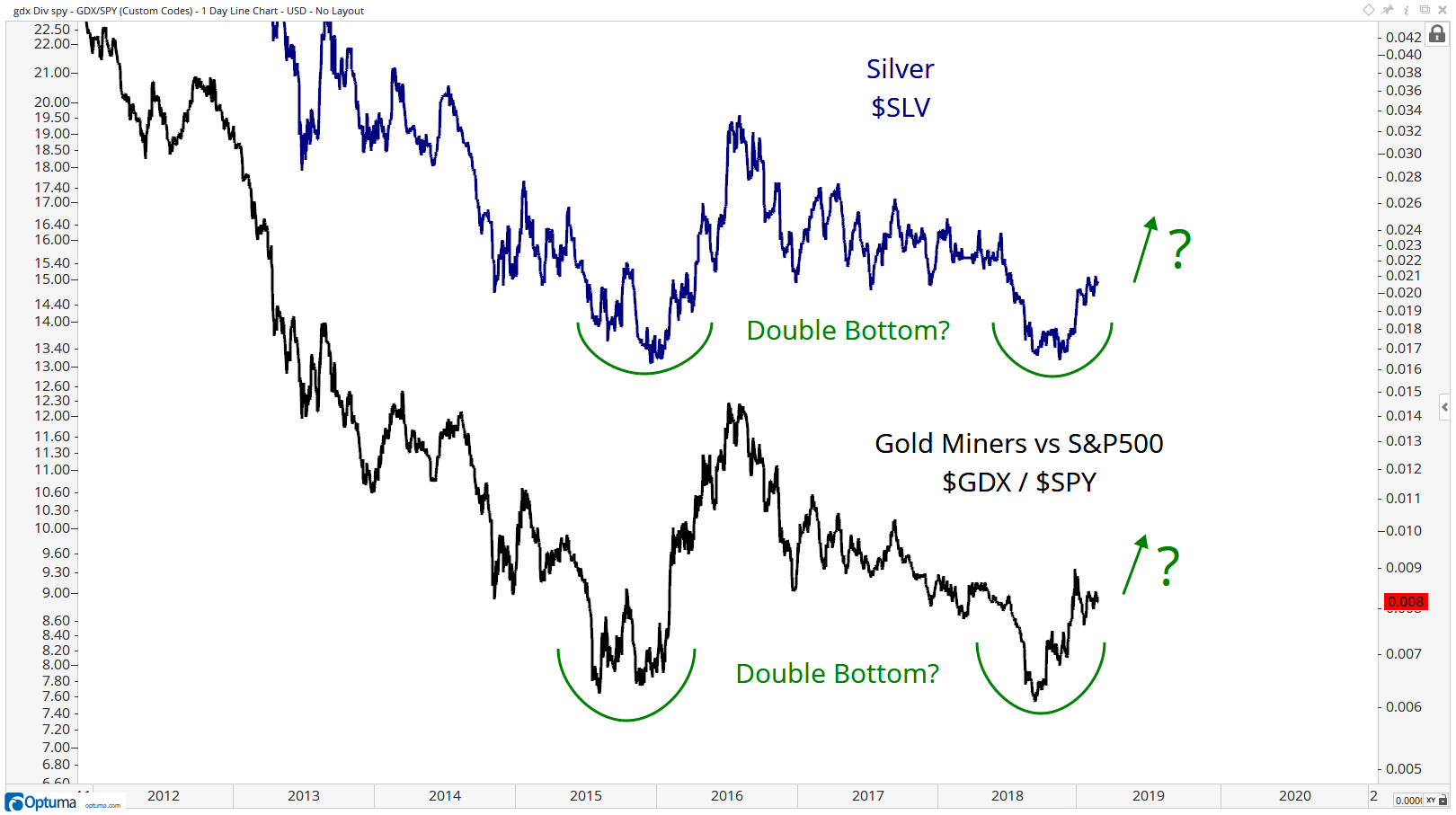

Getting back to Gold, J.C. Parets says “But from epic frustration comes secular periods for profit. I think this is what we have here”

- “In this chart we’re looking at a couple of potentially historic double bottoms. Up top we have the Silver ETF $SLV finding support near its late 2015 lows. Down below we see the Gold Mining ETF $GDX vs the S&P500. In other words, this is the relative strength chart for Gold Miners. Like Silver, the ratio is finding support near its 2015 bottom. … I do think it’s important to note that we’ve gone from just a trade, to potentially something more secular happening.“

But what if Larry McDonald is correct, then rates should drop as Gold has a secular rally, right?

4. US-India Defense Partnership

A big focus of this Blog is the close & mutually beneficial partnership that is evolving between US & India. Unfortunately, this week was not positive for this partnership. But the end of the week was positive, thanks to the man so many love to hate.

The biggest problem in the US-India relationship is the past that involves the terrorist-nurturing regime in the Indian Sub-continent. That problem stems from the history of the military relationship between the most powerful democracy in the world & the most rabid terror-producing regime in the world.

4.1 MIG-21 vs. F-16;

The MIG-21 is a legendary plane. Approximately 60 countries over four continents have used MIG-21s in their air force. India is the largest operator of MiG-21s today. But how old is it? Wikipedia answers:

- “In 1961, the Indian Air Force (IAF) opted to purchase the MiG-21 over several other Western competitors. As part of the deal, the Soviet Union offered India full transfer of technology and rights for local assembly. In 1964, the MiG-21 became the first supersonic fighter jet to enter service with the IAF.”

Today the Indian Air Force flies over 110 MIG-21s. Back in 2006, India announced a plan to replace its MIG-21 fleet with a modern fighter. But, as is typical of India, nothing happened. Now India is in the process of selecting a replacement again and the selection is likely to be announced after the elections in May 2019. Russia is offering MIG-35, France the 5th-generation Rafaele & Lockheed the F-16.

That brings us to the legendary F-16, a plane designed to be the MIG-21 killer. We hear that the F-16 design team kept a model of MIG-21 on their desks to remind them of their goal. The design proved to be revolutionary.

Harry Hillaker deserves much of the credit for this revolutionary fighter. Back in the mid-1960s, Hillaker spent his off hours designing the plane of his dreams – a lightweight, high-performance jet that could fly circles around all other fighters. The obsession became the F-16, the standard by which other fighters have been measured.

Unlike the MIG-21, the F-16 is not a vintage plane. According to an article in the National Interest titled Why Russia and China Still Fear the F-16 Fighting Falcon,

- “…the U.S. Air Force intends to continue flying its 1,200 F-16s well into the 2040s by extending the airframe’s service life from eight to twelve thousand hours.”

The F-16s were sold to NotPakistan when the regime was deemed to be a critical ally against terror even though the Taleban never had any planes at all.

4.2 Indian MIG-21 vs. NPak’s F-16 – Impact on Lockheed’s Plans in India

Unfortunately for Lockheed & its intense marketing effort to sell the F-16s (a newer version now renamed F-21), the Lockheed F-16s of NotPak met Indian MIG-21s over the line of control in Kashmir. In this dogfight, India’s Wing Commander Abhinandan got a radar lock on a NPak F-16, chased it into NPak-occupied Kashmir and shot it down with a short range Russian R-73 missile. The downed F-16 was a two-seater version and both NPak pilots ejected.

Abhinandan’s MIG-21 was shot down by another of the NPak F-16 with the AMRAAM missile. He ejected into NPak-occupied Kashmir and was caught by NPak army.

- ANIVerified account @ANI – Sources: Picture of portion of downed Pakistani Air Force jet F16 from yesterday’s failed PAF raid, wreckage was in Pakistan Occupied Kashmir. Also seen in pic, Commanding Officer of Pakistan’s 7 Northern Light Infantry.

This incident is doubly negative for Lockheed. First, Lockheed made F-16s were used to attack India and the Indian Air Force, a force to which Lockheed is trying to sell its F-16s in a massive $10 billion + deal. And India was defended against Lockheed’s F-16s by fighters from France & Russia, the two big competitors for the massive Indian Force deal.

If this is not enough, the “modern” F-16 that Lockheed was marketing as a MIG-21 replacement was shot down by a vintage MIG-21 of the Indian Air Force. The impact of this was summarized by the veteran defense reporter Manu Pubby:

- Manu PubbyVerified account @manupubby – Other things aside, shooting down of a Pakistani F 16 by the Indian MiG 21 Bison will have a disastrous impact on Lockheed Martin’s ongoing campaign to sell the fighter to IAF. Even though re-branded as the F 21, my guess is that its chances have been shot beyond visual range.

Among the “other things” is the big one:

- Manu PubbyVerified account @manupubby – India sharing F-16 evidence, will ask Washington to track down missile fired at Indian jets. US provided funds to fight terror (in 2008) being misused? http://www.ecoti.in/q6Zj2Z via @economictimes

The F-16s were supplied to NPak by previous administration. Nonetheless, the Trump Administration has a thorny problem on its hands – what to do with the clear & obvious misuse of US-supplied F-16s by NotPak? How does that fit with the new US Major Defense Partner role of India in the Indo-Pacific?

The shooting down of the F-16 by an Indian MIG-21 has implications far beyond India & NPak. The F-16 remains the backbone of many allies of America and they will reexamine the role of their F-16s in their defense analysis. That is so reminiscent of 1965.

4.3 US-India-NPak triangle – 1965 War

Sadly, nothing ever changes in the US-NPak-India triangle. Below is a clip of the largest tank battle since Kurst, the largest tank battle of WWII between Germany & Russia. Back in 1965, America was entirely on the side of NPak and had supplied NPak with the then state-of-the-art M48 Patton tanks. All India had at that time were vintage Centurion tanks which could not stand against Patton tanks. Given their big edge in quality & quantity, the NPak army came up with a bold plan to cut across North India.

The clip below is really worth watching. The NPak attacking force had NPak’s pride, the 1st Armored division with 260 Mark 48 Patton tanks, and a full infantry division. In their way, were two artillery regiments of the Indian Army with 135 inferior tanks (M4 Shermans & Centurions). This battle is still taught in military schools around the world.

The Indian regiments met the attacking force in an marshy area that was flooded overnight by destroying an agricultural canal. The weak Indian tanks were deployed in a horse shoe formation hidden in tall sugarcane fields. The NPak Patton tanks drove straight through, confident of their long range guns & heavy armor.

Unfortunately for them, the heavy Patton tanks got stuck in the flooded marshy land and became sitting ducks for the deadly crossfire of Indian tanks & artillery. The NPak divisions lost 155 Patton tanks & 14 tanks were captured by Indian forces who only lost 22 tanks. That battle proved decisive and turned the fortunes of that war.

As you will see below, a town was built to show case the destroyed Patton tanks and was called Patton Nagar (town). This debacle proved to be very negative for the global image of invincibility of U.S. Armor

Watch at the end of the clip to see how the western press described this as a “Pakistani Victory” and praised them for their fighting valor. The above clip shows the headline from an Australian paper but the coverage was the same in America & Britain. It was deemed inconceivable that the pride of the US army, the Patton tank, & the intensive training given to the NPak military could have been so decisively destroyed.

That part of history was repeated almost verbatim this week by BBC, Bloomberg & CNBC, all telling their readers & viewers that NPak had shot down two Indian fighters & captured 2 pilots, a story that was fed to them by NPak army. Later that afternoon, the number of pilots captured was reduced to one but still CNBC kept telling its viewers that 2 Indian fighters were shot down without mentioning the F-16 that was shot down by India. They continued broadcasting this false news despite being advised of their “fake news” with evidence.

CNBC has a very big presence in India with Bloomberg trying hard to increase their share. But that does not change the innate anti-Indian (or anti-Hindu as they prefer to say) nature of CNBC, Bloomberg et al. And it won’t change until the Indian people begin asking themselves why they need anti-Indian US networks to tell them about Indian markets in India.

4.4 President Trump

Is there any positive for US-India relations to report this week? Yes. Read the tweet below:

- S Gurumurthy @sgurumurthy * – Laughable that liberals (really apologists of Pak) want us to thank Imran Khan for Abhi’s release. If anyone is to be thanked for that it is Trump. If anything is responsible for that it is the rise of India as a major power which has dwarfed Pak into a small criminal enterprise.

India was enraged at the treatment meted out to the captured Indian Wing Commander Abhinandan. India demanded that he be returned immediately & without any preconditions. As the the description below shows, the Indian Navy was moving towards the NPak port of Karachi as a part of a planned escalation.

The timely & decisive pressure put by President Trump forced the hand of NPak & prevented the escalation of an already bad situation. Kudos & thanks to him.

Since correlation is a part of markets, think about the following correlation about US media – the sections of US media that are anti-Trump are also the sections that are anti-India and they tend to broadcast “fake news” about both President Trump & India. Remember how CNBC put pro-Trump comments by Carl Icahn behind its fire wall and allowed free, unrestricted access to anti-Trump comments by Meg Whitman during the 2016 campaign?

* Mr. Gurumurthy was the man appointed to the governing Board of the Reserve Bank of India last fall. His pressure finally led to the resignation of the then RCI Governor Patel. So when Mr. Gurumurthy gives credit to President Trump, take that seriously.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter