Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“Loco”, perhaps but at least not alone

Guess what we wrote last week, words that seemed “loco” to a few readers:

- “Chairman Powell did the right thing this past Wednesday. Now he needs to signal to markets that he will double down if needed and possibly even when if it is not needed. The only way to do so is to CUT interest rates by 25 bps in June and even possibly in April if the data keeps going bad with a subsequent rate cut in June.”

We didn’t make up that playbook. That was Greenspan’s playbook when faced with the crisis in late 1998. His two rate cuts seemed alarmist to many initially until a furious stock rally in November 1998 quelled all doubts. We remember that period & the panic in markets was such that they needed “whatever it takes” kind of assurance. Yes, those rate cuts should have been reversed in Q1 1999.

Hark back also to the wonderful situation created by Greenspan’s rate cut in 1995 after his brutal squeezing of inflation in 1994. That should be the better model for 2019 instead of 1998 but today’s leveraged economy with 10 trillion dollars of negative yielding global bonds make 2019 much more dangerous than 1995.

And how did this week begin?

- Rick RiederVerified account @RickRieder – Still, some U.S. and global #economic measures are decelerating at a concerning rate, so both close observation of the data and some cautionary portfolio #hedges are warranted.

Then on Tuesday,

- David Rosenberg @EconguyRosie – Curve inversion will be temporary only if one these happen: Fed eases or inflation expectations revive. When the inverted was a ‘head fake’, that 15% of the time, the Fed cut rates. As for inflation, the leading measures (NY Fed on prices, Atlanta on wages) have peaked.

That’s for a normal Fed Chair. What did swashbuckler Bernanke do in 2010?

- David Rosenberg @EconguyRosie – Definition of pushing on a string: When mortgage rates dive 70 basis points over a four month span and single-family housing starts are down, not up. Last time this happened in late-2010, Bernanke responded with QE2!

No one is asking for another QE4ever. Stephen Moore, the presumptive nominee for the Fed Board, told the New York Times that the Fed should immediately cut rates by 50 bps. He was accused of blowing hot. So on Friday stepped up his brother in thought, Larry Kudlow, to make the same demand in a decidedly blow cool manner.

Remember what Chairman Powell did in his last two pressers?

- “Then a panicky sell off in both Treasuries & stocks in October & the worst ever stock selloff in December and now a virtually panicky plunge in Treasury rates & a vicious sell off in stocks on Friday. We can’t recall two market convulsions like this from two consecutive pressers from a Fed Chairman in two consecutive FOMC meetings. We do feel for Jay, yes we do. He looks so sedate but he scares markets as no one we have seen.“

In contrast, watch Cool Tone Larry:

Just think! What if Jay Powell had been so smooth & cool in positively selling his freezing of rate hikes as a protective measure in his March 2019 FOMC presser? Would the Treasury market have reacted in the massive panic the way it did in response of Chairman Powell? Of course not.

But the CNBC Fast Money trader team reacted derisively to Kudlow’s “protective” comments. All of them questioned the need for “protective” measures because the economy is doing fine. Guess they don’t remember 2007 and how Fast Money traders spoke then. As we recall, as late as June 2007, the Fast Money team kept talking about inflation rising & increased growth in the economy. They haven’t changed a bit.

We wondered if they prevent their families from getting flu shots ahead of winter. Probably not. They understand that getting vaccines is a protective & cautionary act. Yet, they refuse to get what Kudlow was saying. Everybody knows & sees the contagion growing in Germany, Europe and now Asia. That deflationary slowing growth contagion could hit the American economy. And inflation is not only not growing, it is actually threatening to slip lower. So what’s wrong in asking the Fed to protectively cut rates by 50 bps, just as the Fed did in 1998?

Also these Fast Money guys, especially Guy Adami, don’t seem to realize that the markets and the US economy are no longer different & separate. Given the ownership & leverage in the system, created mainly by Ben Bernanke, there is a tight & resilient feedback loop between the economy & Markets. We have postulated that the destructive selloff in the US stock market courtesy of Jay Powell scared the US consumer. Now, some demonstrate that graphically:

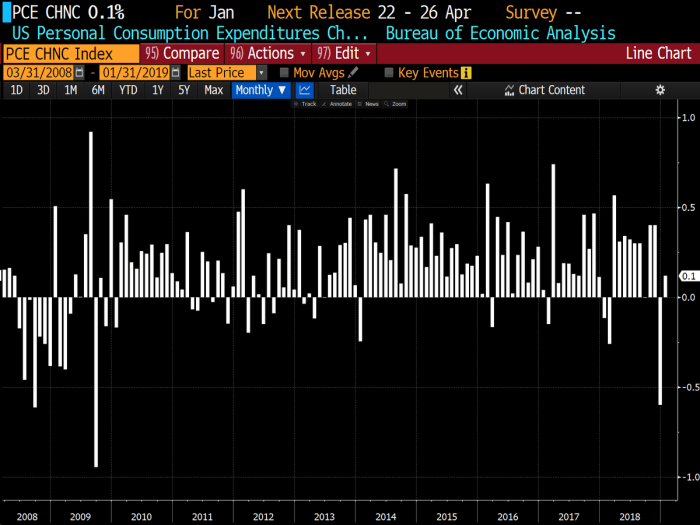

- jeroen bloklandVerified account @jsblokland – ‘Hmm’ chart! US personal spending recovers from its biggest collapse since the financial crisis in December, but less than expected.

What was the financial crisis in December? The worst S&P selloff in recent history. Chairman Powell gets it. That’s why he did what he did at the March 2019 FOMC meeting. The tragedy is that he totally blew the presentation & scared the listeners out of their wits. No wonder smart strategists are taking down their targets for the 10-year yield, like Steven Major of HSBC who has been more right than wrong.

- Lisa AbramowiczVerified account @lisaabramowicz1 – “Once again we take a hatchet to US Treasury yields; we cut our 10-year forecasts to 2.10% for end-2019 and end-2020. This represents a 40bp reduction from the forecasts we made six months ago:” HSBC debt strategists led by Steven Major in a report today.

Some question the timing but not the aggressiveness of the Fed in cutting rates:

- Bloomberg TVVerified account @BloombergTV – “The end of the cycle is nigh and we’re going to see rates move quite significantly lower,” Christian Lawrence of Rabobank tells Bloomberg’s @adsteel and @lisaabramowicz1 https://bloom.bg/2FKCwLv

Mr. Lawrence does not think the Fed will cut rates in 2019 but he sees the Fed cutting rates 5 times, yes 5 times, in 2020 and driving the 10-year yield to 1.25% by 2020-end. Why? He says the Fed is going to act aggressively to prevent a shallow recession turning into a very deep recession.

The 10-year yield at 1.25% by year-end 2020? Wow!

2. Could the Fed become another or the next China?

You have to admit that luck has favored President Trump since he announced his campaign. He has also been astute & smart to convert several seemingly bad happenings to good effect for him. One such is relevant to the Fed and that is the leadership of Ms. Maxine Waters & the inclusion of Ms. Ocasio-Cortez. The other is the release of the Mueller report within a few days of Chairman Powell’s presser & the waterfall decline in interest rates.

Last Sunday AG Barr gave a summary to the Congress & President Trump became joyously unbound. Even Robert Shiller, a Nobel prize winning economist, said on BTV that the Mueller report increased the Big Feeling of American Confidence President Trump has brought back.

And this week, a broadside was leveled at Fed Chairman Powell. Listen carefully to Larry Kudlow in the clip above. He describes his 50 bps rate cut ask as simply his view & uses the credibility of watching the yield curve by 30 years to support his view. Look how humbly & respectfully Kudlow said “Federal Reserve is an independent Central Bank; they are going to do what they are going to do“.

The Fed may be independent of the President’s authority. But they are answerable to the Congress, specifically first to Congresswoman Maxine Waters & her committee. Look what that opens us for President Trump, as we wrote back on November 10, 2018:

- “And whom does the Federal Reserve answer to? The Congress, not the President. That means Congresswomen Maxine Waters, the new Chair of the House Finance Committee. President Trump has already been clear about what he thinks about the Fed raising interest rates. Now he can publicly exhort Congresswoman Waters to exercise her oversight over the Federal Reserve.”

- “President Trump improved the incomes & prosperity of the American people in the last two years when he had leadership of the House. Now it is up to Congresswoman Waters & the Democrat controlled House to control the Fed, maintain the economy’s growth & raise incomes of ordinary Americans. If they don’t, they will face the fire of an unbound President Trump.”“

- This poses risk to the Federal Reserve. Congresswoman Waters has never been their friend. So she could ally herself with President Trump and act to lessen the Fed’s independence.”

Understand President Trump is already criticizing the Democrat House for not doing the people’s work and falsely going after the Russia-collusion. If the economy does indeed get worse and Chairman Powell remains adamant, he can direct his fire at both the Fed & Ms. Waters. How ironic would it be for Maxine Waters to defend the charges of being overly friendly towards the Fed and against the American workers & the increase in their wages?

Remember how the Congress was unhappy at President Trump’s attacks on China in 2017 and opposed to tariffs on China. But President Trump has so characterized China that now the Democrat House is more anti-China than President Trump is. Now you have Senate Minority Leader Schumer exhorting President Trump to be even more hawkish against China.

This scenario could repeat to an extent with the Fed. President Trump will NOT hesitate to put the blame on the Fed if layoffs increase, if wages slip & if the economy slows down. And Chairman Powell has set himself up as the target. Remember what he told 60 minutes – that (essentially) the President cannot fire him and he plans to serve his 4-year term.

So Powell himself has given the President an out and painted a bulls-eye on Maxine Waters, Nancy Pelosi & the Democrats for being responsible for oversight of Powell’s actions. So President Trump, under bad economic circumstances, could say that he would have fired Powell but he cannot and then ask why Pelosi/Waters have not fired Powell.

But the goal would not be to fire Jay Powell. In fact, Mr. Powell could prove very useful as a recalcitrant Fed chair who is anti-workers, anti-high-wages & who is backed & protected by the Democrat House. That would play very well in Big 10 country. By the time November 2020 comes around, the Fed & Fed Chairman Powell could end up being more unpopular with Democrats than President Trump.

That is what we mean by the Fed possibly becoming another China.

3. “Bond markets gone mad”

The most succinct tweet about the bond market turbulence?

- Jenna & John @StrategicBond – What happened in the bond markets last week is profoundly important… “THE POINT OF REALISATION” that: 1. US rates peaked at 2.4% this cycle vs 5.25% last cycle 2. QE can’t be reversed 3. If US can’t normalise, then no other central bank can

Go back to 2001 & notice that each peak in interest rates has been lower than the previous. This pattern of lower highs is ominous & suggests that the peak of the next cycle will be even lower than 2.4%, perhaps even a 1-handle peak rate. How depressing is that?

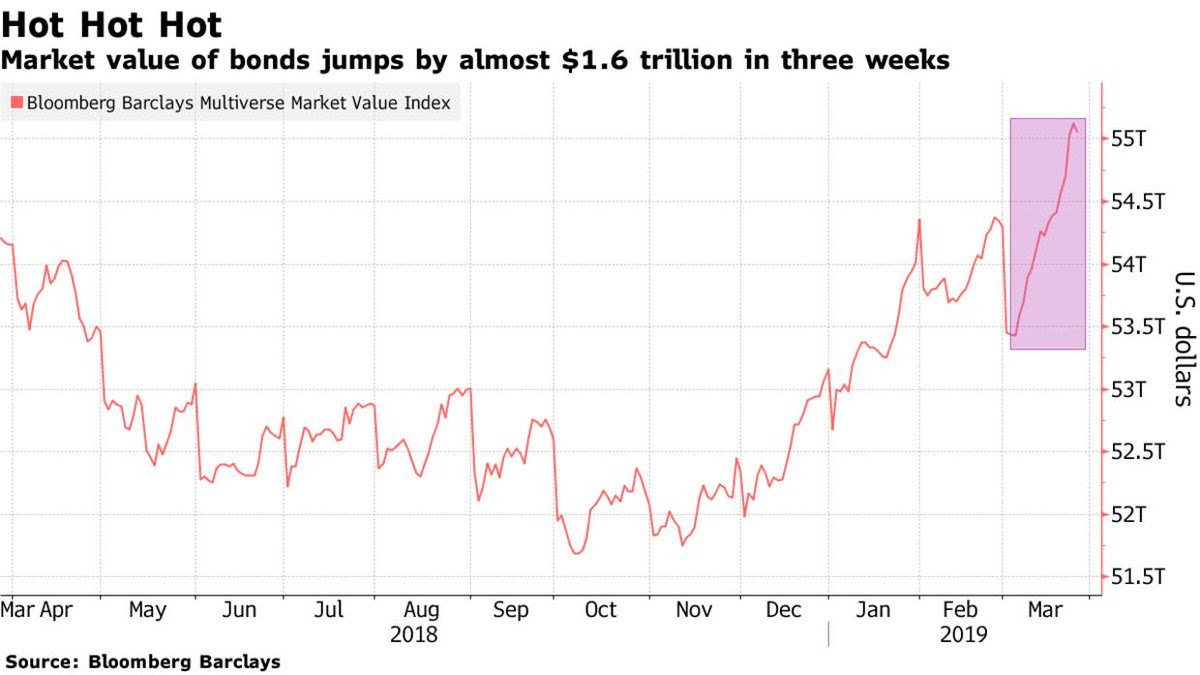

But how thrilling was this turbulence to long investors in bonds?

- Jesse Felder @jessefelder – Global Bond Markets Go ‘Mad’ as Everything Rallies at Once https://www.bloomberg.com/

news/articles/2019-03-27/bond- world-has-gone-mad-in-55- trillion-everything-rally? srnd=premium … ht @Peter_Atwater

What usually happens during such rallies?

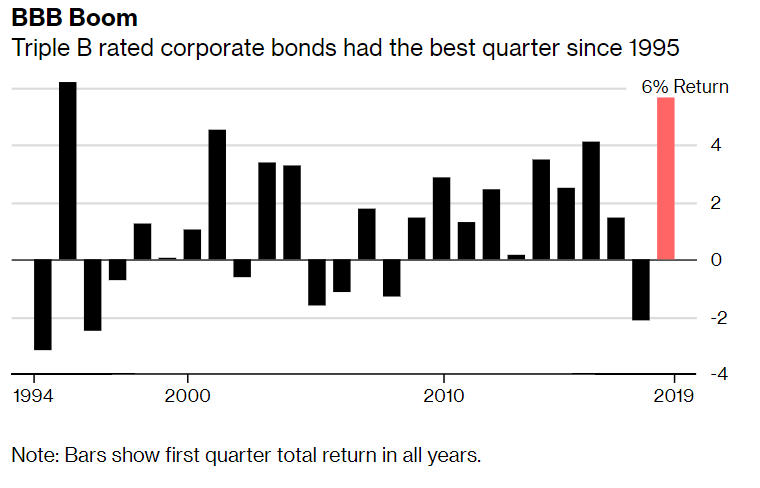

- Lisa AbramowiczVerified account @lisaabramowicz1 – The lowest-rated U.S. investment-grade bonds just had their best quarterly return since 1995. https://www.bloomberg.com/

news/articles/2019-03-29/bbb- rated-corporate-bonds-off-to- best-start-to-a-year-since- 1995 …

Aren’t flows linked to performance?

Aren’t flows linked to performance?

- Jesse Felder @jessefelder 7 hours ago – “Bond-mad investors” are piling into corporates at a record pace. https://www.bloomberg.com/

news/articles/2019-03-28/bond- mad-investors-ignore-stock- market-s-best-quarter-since- 2012 …

Doesn’t every fall have its source in volatility & a bonfire of large positions? Just a couple of weeks ago, people noticed how complacently low bond market volatility was. Chairman Powell destroyed that calm & look what happened:

According to a Bloomberg article,

According to a Bloomberg article,

- “The stability in U.S. rates over the previous three months has gone the way of the dodo,’’ … “The deeper market pricing of inversion becomes, the stronger the rate-cut signal the market is projecting, and the higher the chances are this could turn into a contraction,” BMO Capital Markets strategists Jon Hill, Ian Lyngen and Ben Jeffery

But such peaks of volatility fade at some point & then the price move that accompanied the vol surge flattens out or reverses somewhat. Does that mean the precipitous fall in rates, that accompanied the volatility spike, is about to flatten or even reverse?

Well, the bottom in the 10-year yield was at 2.35% on Wednesday morning after the 10-year German Bund was sold at minus 4 bps yield. Since then the belly of the Treasury curve has risen in yield somewhat and the 30-year bond has outperformed the 10-year note in price. That is consistent with

- Jeff York, PPT @Pivotal_Pivots – Wed Mar 27 – 10 yr. bond yields $TNX is near my 1st. 2019 target at the Ys1 pivot @ 2.32%. YP to Yr1 is a computerized algorithmic move @PivotalPivots.

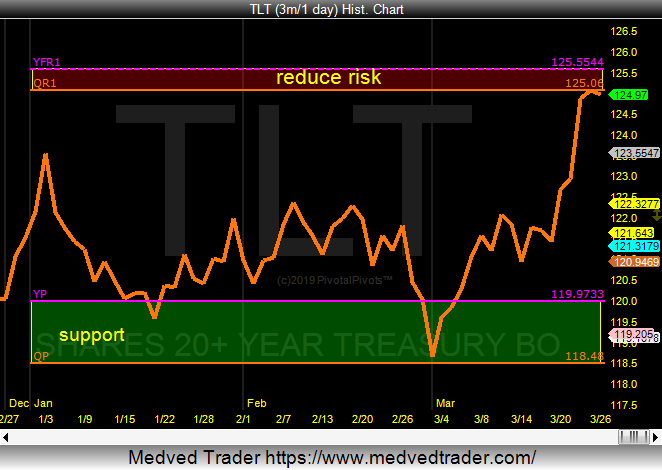

- Jeff York, PPT @Pivotal_Pivots – Tue Mar 26 – $TLT this past Qtr, went from a low on the QP to a high at the Qr1&YFr1 Pivots. This is a good spot to reduce or hedge risk @PivotalPivots.

But that has not worked out yet. TLT closed the week up 1.1% and the 30-year yield fell by 6.3 bps on the week. This fall was greater than that of the belly of the curve supporting the view below:

- J.C. Parets @allstarcharts – NEW POST: Long End Outperformance Continues https://allstarcharts.com/

long-end-outperformance- continues/ … $SHY $TLT

- “Below is the corrected chart, breaking down to nearly 15-month lows as momentum gets oversold. As long as prices are below this former support, the 200-day will begin to roll over and the bias will remain to the downside … We’ve preferred the long end of the curve since the failed breakout in this ratio last November, and current conditions suggest that trend remains intact over the intermediate-term. If it ain’t broke, don’t fix it.”

4. VIX, Volatility, Yield Curve, FX

Is there any relation between these different vols?

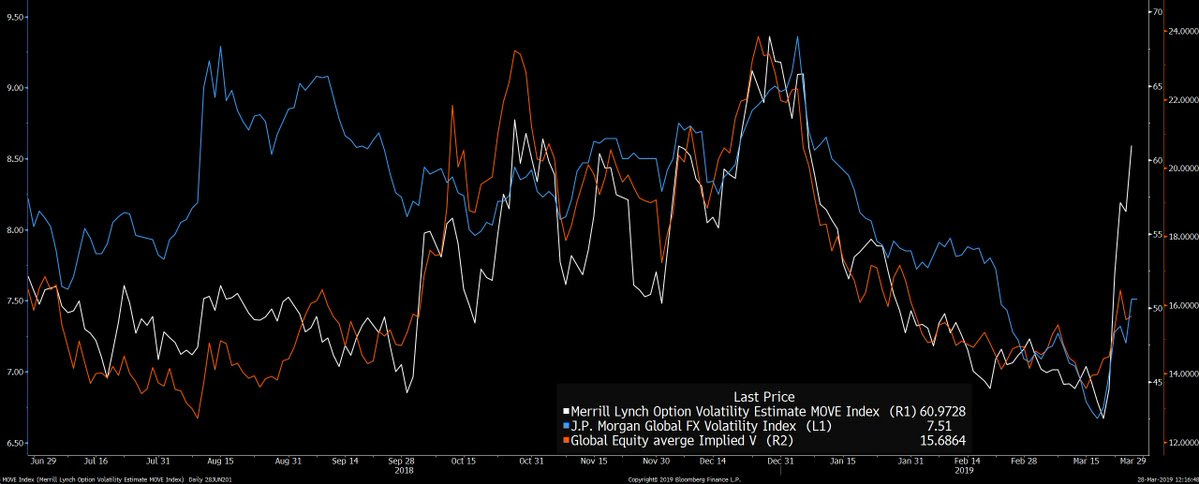

-

Real Vision Research @RVAnalysis – Where ever Bond (white) & Yield Curve volatility heads Equity (orange) & FX (Blue) are not far behind.

What is a more elaborate way of presenting this?

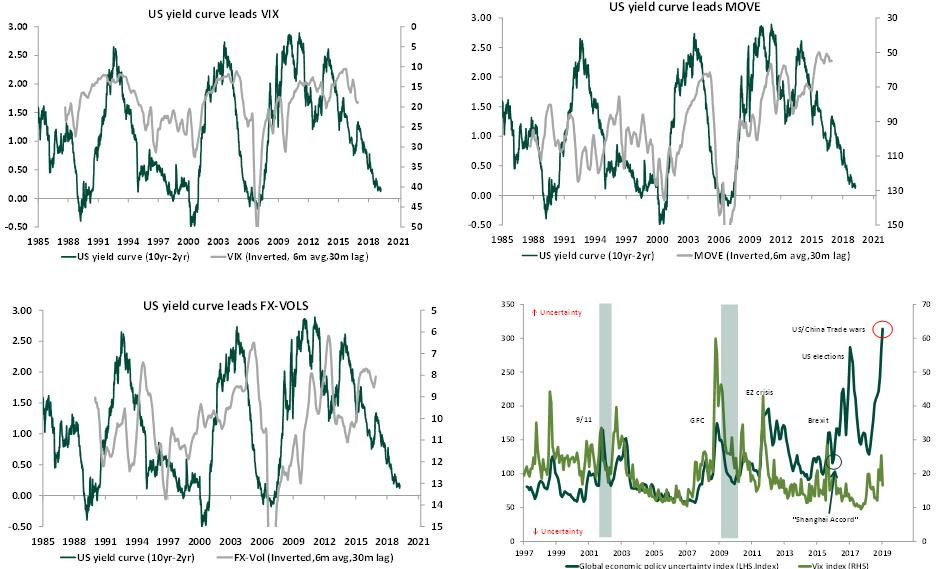

- Mehul Daya @MehulD108 – According to the US yield curve – it is time for volatility to move higher. Get ready. @neels_heyneke @RaoulGMI @ttmygh @andrewmanners5 @EVMacro

What does all this mean for simple stock investors?

- AndreasStenoLarsen @

AndreasSteno 16 hours ago – Here we go again! Short positioning in VIX is now more extreme than prior to Feb-18 and Oct-18 sell-offs in equities. Cross asset volatility: Time for a new explosion?  Read our take here -> https://ndea.mk/2uHkK5D

Read our take here -> https://ndea.mk/2uHkK5D

5. “Stock market is very healthy right now”

So said Jim Lebenthal of CNBC Half Time Report on Friday. That sounds crazy given the extreme short-volatility tweet above. But other factors tend to support Mr. Lebenthal’s claim, especially from a liquidity viewpoint.

First our simplistic indicator – relative performance of leveraged Closed-End Funds (CEF) to their unleveraged ETF counterpart. Below is a high yield comparison between leveraged DPG & unleveraged HYG:

The second is Tom McClellan’s data-backed article titled Bond CEF A-D Line Showing Big Strength.

McClellan wrote:

- It turns out that the Bond CEF A-D data are actually better than the A-D data for the “real” common stocks. Go figure.

- The Bond CEF A-D Line shown in this week’s chart is continuing to make new all-time highs, indicating that liquidity is strong enough that even these least-deserving issues can still get some of it. For as long as the Bond CEF A-D Line stays above its 5% Trend, we have some degree of assurance that that the uptrend for stock prices is going to continue. If these least-deserving issues can garner their share of the financial market liquidity, then that liquidity must be strong enough to lift up the rest of the “real stocks”.

- For right now, the Bond CEF A-D Line is making new all-time highs, saying that liquidity is plentiful.

No wonder this week was so good for stocks & it ended well too.

- Bob Lang @aztecs99 – spx setting up for the highest WEEKLY close since October 18.

Sentiment seems helpful too.

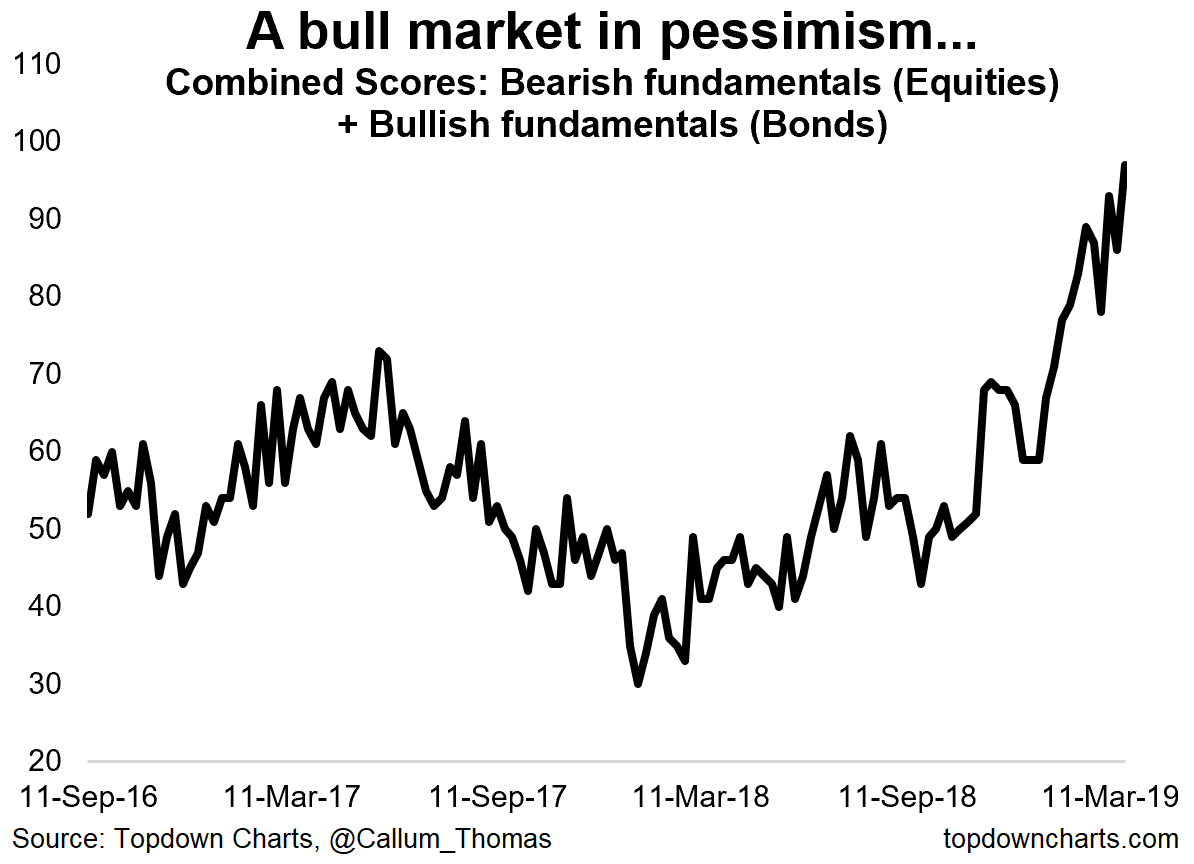

- Babak @TN – there’s a healthy dose of skepticism out there about the stock market, as shown by this chart from @Callum_Thomas data from weekly FinTwit online survey

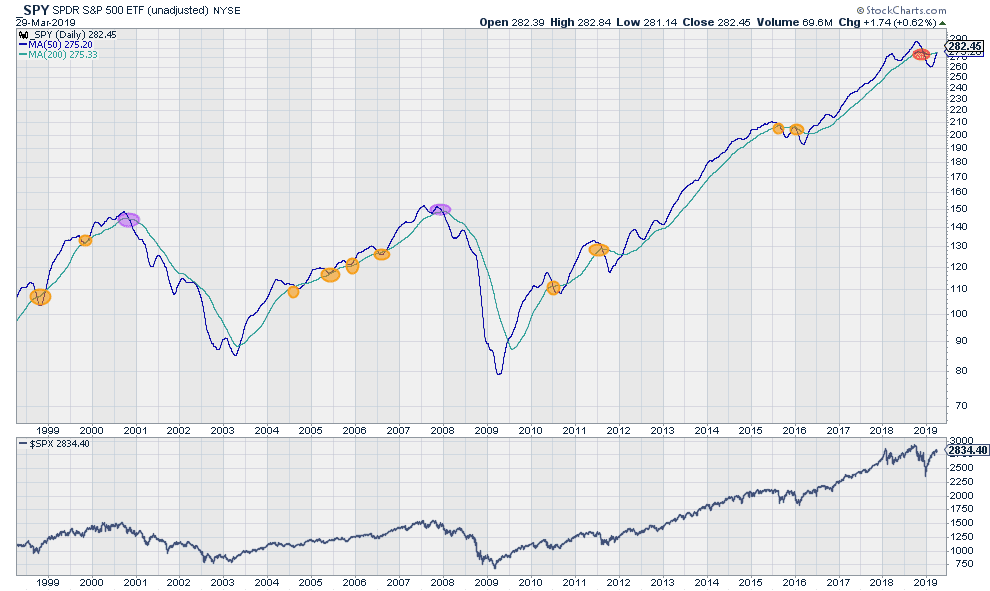

- Greg HarmonVerified account @harmongreg – $SPY Monday will print a Golden Cross

Wouldn’t it be ironic if after all these positive tweets, we actually get a downdraft next week, perhaps thanks to the high short VIX position. But we find it difficult to see a big VIX explosion if liquidity is indeed as plentiful as Tom McClellan says it is.

Unless next week’s economic data, especially the Non-Farm Payroll report, causes turbulence.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter