Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Chairman Powell doing President Trump’s bidding?

A facetious statement on the surface, right? But look what Fed Chairman Powell did on Wednesday. He became President Trump’s champion against Mario Draghi and he collapsed short term rates. Remember Tuesday’s tweet?

- Donald J. TrumpVerified account @realDonaldTrump – Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others.

The President spoke & Fed Chairman Powell acted. How successfully you ask? Just look:

- Lawrence McDonaldVerified account @Convertbond – Good Night Irene, Colossal Implications here….

Mr. McDonald added on his Bear Traps Report blog:

- Goodnight Irene, the US Dollar has broken its uptrend which started in January of 2017. This is the beginning of a meaningful leg lower. The Fed has laid a beating on the global economy with eight rate hikes and $666B balance sheet reduction, all since 2016. That’s a colossal amount of tightening compared with the rest of the world. As they unwind this experiment, the greenback is in big trouble. We believe the Dollar is putting in its top, stuck in a dynamic where it’s a victim of its own success. If the Dollar breaks out to new highs, it will find itself in a tricky balance — more global economic destruction and an even greater need to cut rates.

Read what J.C. Parets wrote as a technician:

- “The US Dollar has been a big focus of ours all year …. The implications of the US Dollar’s next move will be felt worldwide. I’ve been in the camp that the US Dollar Index below 98 is positive for stocks and that a drop in the Dollar will most likely coincide with a rotation into emerging markets and european equities. While the Dollar has remained below 98, it’s been more of a sideways range that anything else. But we may have just seen the beginning of this collapse.”

How did the FXE, the Euro ETF, close for the week? Up 1.5%. How is that for fulfilling President Trump’s wishes?

2. Doing Trump’s Bidding II?

The best way to measure what Chairman Powell accomplished is to compare the Treasury rates from about 1:50 p.m. on Wednesday (10 minutes before the FOMC statement) to Friday’s close. Only two maturities went up in rates – 1-month rate rose up 4.2 bps & 30-year rate rose up 1.7 bps. The 1-month rate is obvious because the next FOMC meeting is 6 weeks away.

The biggest fall in rates was in the 6-month maturity (minus 13.5 bps). This fits in with the 100% probability of a 50 bps cut in the July 31 meeting. The next three declines were in the 1-year rate (minus 12.7 bps) and the 2-year rate (minus 11 bps).

In contrast, the 10-year rate only fell by 2.4 bps post FOMC & the 30-year rate actually rose by 1.7 bps by Friday’s close. And the 10-year rate closed above the big level of 2% to close at 2.08% despite falling below 2% on Thursday morning.

We don’t think the rate action would have been all that different had the Fed actually lowered rates by 50 bps on this past Wednesday.

3. Fed Schmed?

Most, including FOMC members, would agree now that the Fed made a big mistake by overly tightening in Q4 2018 and the American economy/people have paid for that mistake. That makes the Fed incompetent.

Yes, we do realize that Stanley Fisher, the previous Vice Chairman of the Fed, accused/praised Chairman Powell for raising rates in December 2018 just to demonstrate the Fed’s independence from the President. That statement almost accuses Chairman Powell of malpractice or almost treason. But we will not dwell on that here.

By refusing to accept their mistake in Q4 2018 and by taking so long to rectify it in 2019, Chairman Powell has demonstrated that they are ineffectual. How else could you describe a Fed that helplessly followed the stock & bond markets in late December 2018 & early January 2019 and has now helplessly followed the bond market this past week?

- Alex GurevichVerified account @agurevich23 – Fed: We’re hiking and reducing balance sheet on autopilot. Market: You’re easing in a year. Fed: We’re pausing, but still expecting 2 hikes this year. Market: You’re easing 2 times this year. Fed: We’re on hold, evaluating data. Market: Is it 25 or 50 bps cut at the next meeting?

Now what? We see the Fed as almost irrelevant going forward. They do not lead markets for fear of being proven wrong. They always make the other mistake & then they capitulate. Further what do they really accomplish? Look if the data continues to get weaker & weaker, if the business cycle now starts slowing down in addition to the inflation cycle, then the bond market will drive rates down to the level the bond market sees fit. If the data gets stronger, then the bond market will drive rates higher much faster than the Fed can say boo.

And who really gets impacted by the Federal Funds rate anyway? Most of the consumer loan rates are driven by the 10-year note & hardly anyone leaves cash in the big banks that don’t pay rates that Goldman’s Marcus, MUFG’s PurePoint pay. So the only ones who really care are the IEOR recipients.

So, frankly, who needs the Fed? It is almost as if Jim Grant has gotten his old wish of letting the bond market set rates. Fed Schmed, right?

But they still have the ability to do crazy stuff, the stuff that Draghi has been doing & now threatening to do more. That $12 trillion of bonds have negative yields is not scary enough for Draghi. In the same spirit, a Fed that is still reducing its balance sheet can also turn around & start another round of QE. Or they can start targeting bond levels.

Kinda like a military that screws up every conventional war is entrusted with deciding when & how to launch a nuclear war. Thank God that the US military is not deemed independent of the President.

4. Now What?

Rosie, the quintessential Unrosy, is clear:

- David Rosenberg @EconguyRosie – All that dovish central bank talk and the spike in oil prices and the most the TIPS break-even levels can do is nudge up a mere 5 basis points. Disinflation momentum obviously very intense

What did he say on CNBC on Friday morning? As we recall, his comments went something like this:

- “they are cutting 50 bps in July; they are not going to stop there; if you’re gonna go, you’re gonna go big; … they will get to zero-bound in 6-9 months; the 10-year Treasury will converge in yield to the 10-year gilt (85 bps) …. ”

Rick Rieder of BlackRock did not go that far; but he did venture in that direction on Thursday on CNBC:

- “front-end is now pricing in 80 bps of cuts this year; that is aggressive; for the first time we have taken off some of the short end & gone more on longer end, the 10-year; 10-yr could get to 1.80%”

What drives Treasury bulls even at these low rates, you ask?

- Jenna & John @StrategicBond – So what happened to the “transitory weakness” in inflation Mr Powell? Now there is a “prolonged shortfall” in inflation! Don’t confuse the cyclical with the structural. Inflation weakness is a global structural issue and has been for years! #slowdilocks? #disinflation

And the comparison:

- Jenna & John @StrategicBond – Central banks losing the growth and inflation battle — careful on US curve steepeners: IT’S DIFFERENT THIS TIME. From BAML — in 2007 when US market priced in 100bp cuts, 2s10s was +70bp steeper. And don’t even look at Europe!

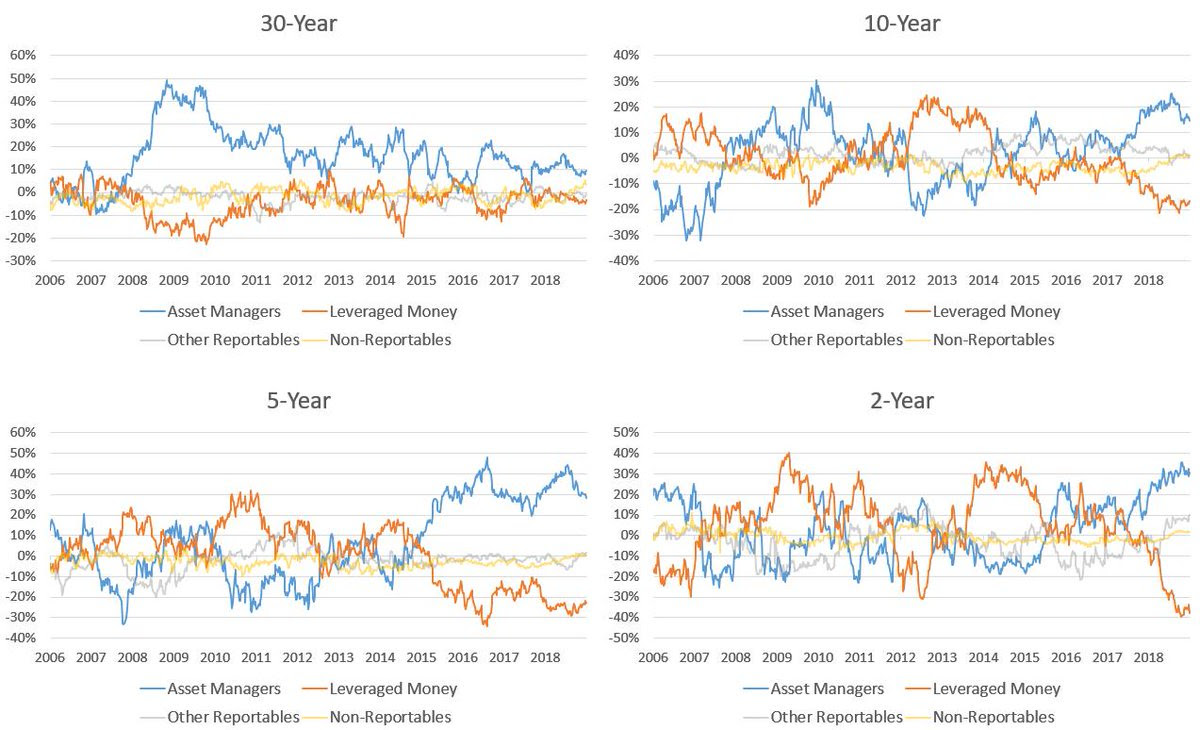

Then you have the positioning from Tuesday:

- Movement Capital @movement_cap – bond futures positioning. showing net position as % of open interest hedge funds are net short across all major contracts and have not covered during 2019’s rate collapse lower rates = more HF pain

On the other hand, the Daily Sentiment Index on Bonds is 91 and other measures also suggest a peak of sorts:

On the other hand, the Daily Sentiment Index on Bonds is 91 and other measures also suggest a peak of sorts:

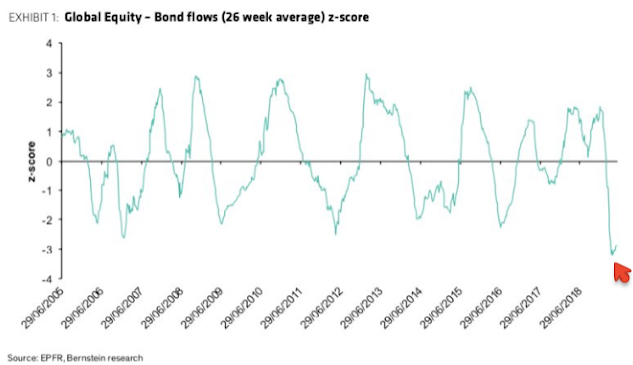

- Bluegrass Capital @BluegrassCap – “A study from Bernstein shows that flows out of equities and into bonds so far in 2019 is the most extreme in more than 15 years. This is an outlier event more than 3 standard deviations from the mean.” https://fat-pitch.blogspot.

com/2019/06/an-extreme-in- investor-fear-and.html …

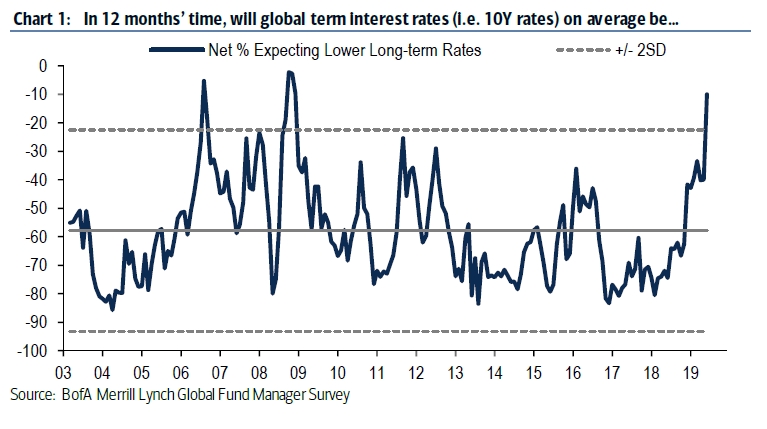

- Tracy Alloway @tracyalloway – The percentage of investors expecting lower long-term bond yields is the highest since late 2008, according to the latest BofAML fund managers’ survey.

What about trend exhaustion, you ask? Check the 4 charts that accompany the tweet below:

What about trend exhaustion, you ask? Check the 4 charts that accompany the tweet below:

- Thomas Thornton @TommyThornton – US bonds continue to get more DeMark daily and weekly Countdown 13’s while bullish sentiment remains extreme at 90%

Our own view is that a back up in 10-year yields to say 2.25% – 2.375% would be a gift. Because such a move would send the Fed back into its complacency & that would create another buying opportunity. We do remember the strong risk-rally in August-September 2007 and what a buying opportunity it created again for Treasury bonds.

5. Gold & Stocks

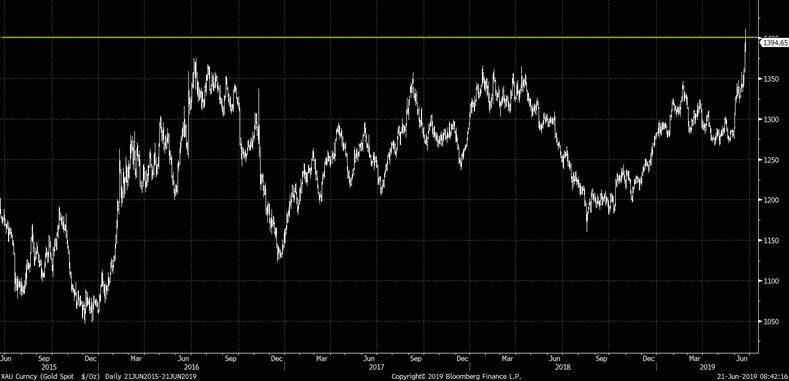

When rates go down & Dollar goes down, Gold jumps up. Actually it broke out this week.

- Jeff York, PPT @Pivotal_Pivots – Gold $GC_F is now up $100 since bottoming on the Yearly Pivot(P) Point. Tonight, Gold is finally breaking thru the Fibonacci Yearly R1 pivot @ $1350. Now $1350 becomes support and the Fibonacci Yr2 pivot point is the next target @PivotalPivots.

Gold closed up 4% this week with a weekly close above $1,400. Now to $1,700 in a straight line if Paul Tudor Jones proves correct.

Gold closed up 4% this week with a weekly close above $1,400. Now to $1,700 in a straight line if Paul Tudor Jones proves correct.

But what about stocks? Aren’t Gold Miners stocks too?

- Richard Bernstein @RBAdvisors – #Gold breaks $1400 but everything is supposedly OK because the #Fed is going to ease. Who cares about #profits decelerating and #geopolitics heating up? Party on, Garth.

By the way Gold Miner ETF, GDX, was up 8% & GDXJ, junior miner etf, was up 9% this week. As J.C.Parets reminded in his article Gold Is Cool Again:

- “When precious metals are doing well, the biggest pieces of crap mining stocks are the ones that do the best. All of those private investments in junior gold miners out of, say, Vancouver that have been worthless, will go up 10x 50x 100x. In the public markets, it’s the little public ones that will outperform on a metals rally. Just look back to early 2016. The worst ones did the best. That’s where the beta is.”

- “If the Dollar Index is below 98 we want to continue to aggressively own precious metals and especially some of the crappiest junior miners we can find.”

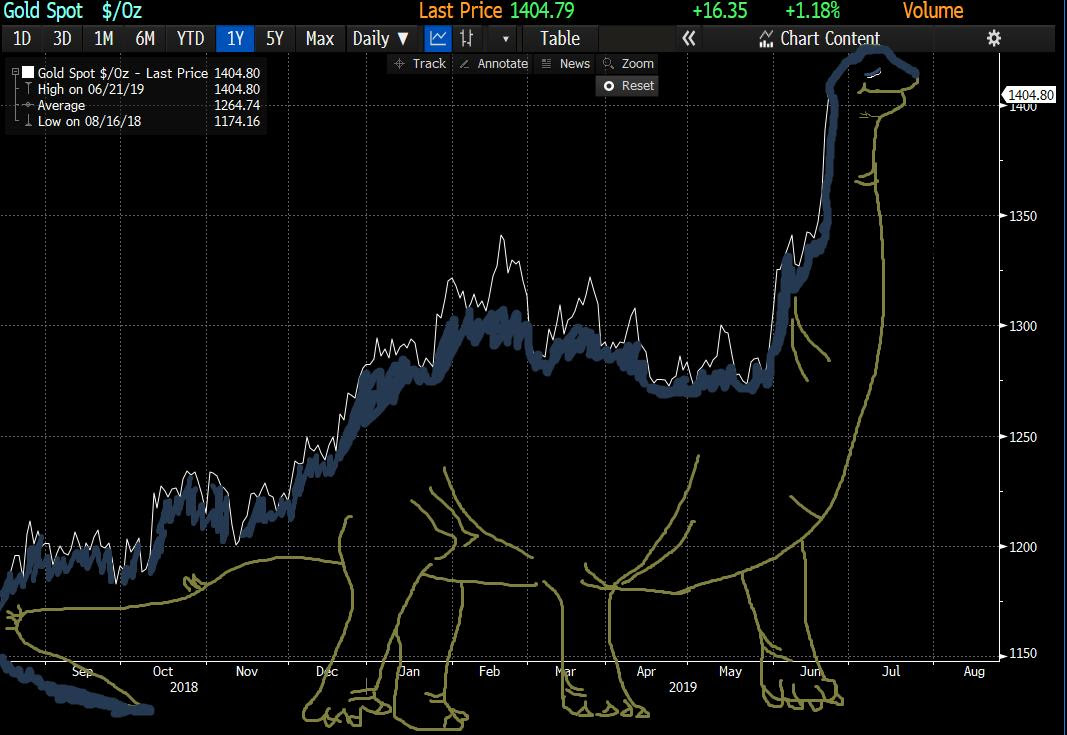

Remember the time when bitcoiners laughed at gold? A payback below?

- Livia Yap @liviayap11 – bitcoin traders: gold is for dinosaurs gold:

What about regular S&P stocks? We don’t have a good feel & we find Jim Cramer advising caution saying he is doing some selling with the S&P oscillator above 6. The data is not improving yet & the G20-trade stuff is ahead of us. We also don’t have a feel for how stocks would react to bonds selling off which would mean lower chances of a 50 bps Fed ease or how stocks would react to bonds rallying further on weaker data.

So we will wait & see what the market tells us next week.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter