Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Maginot vs. Blitzkrieg

Remember the notorious Maginot line defense of the French in 1939? The French were so confident that the line would protect them against the next German attack? That is what we remembered when CNBC’s Steve Liesman spoke this week about the determination of the Fed to maintain their process & discipline.

Guess Mr. Liesman has not heard of the John Madden dictum “speed kills”. Clearly the WWII French generals had not. Because the blitzkrieg of German armor left the French & their Maginot line standing shocked & bypassed. The extremely fast fall in Treasury rates has left the previously determined FOMC just as shocked & helplessly bypassed. Their Federal Funds Maginot level of 2.5% now stands so far behind & so completely worthless that Pimco warned the Fed is about to lose control of markets.

Yet Steve Liesman is undeterred at least on air and kept up the brave appearance of the Fed as laboriously & methodically steering an ocean liner. He was trying to deflect Rick Santelli’s sensible suggestion of cutting rates now & then taking that cut back if the need for it is reduced in the fall. In his proud role as the Fed’s voice on CNBC, Liesman dismissed such pragmatic practicality in his iron clad confidence about the Fed’s model-driven firm hand.

Remember what John Williams, the CEO & President of NY Fed, said last Friday, May 24? That he didn’t see “any strong argument today” for “an interest rate move”. He has changed his tune . Look what he said in his speech this past Friday, May 31:

- “… short-term rates should be cut aggressively when deflation or a severe downturn threatens. That is, do not ‘keep your powder dry. … ”

Remember what Goldman Sachs had written last week – ” … market pricing of Fed easing appears to be almost as stretched as it was in late March. Current rate cut pricing appears excessive ..” They seem to have changed their minds too by this Friday. They were not alone. As BTV’s Lisa Abramowicz & Jonathan Ferro wrote –

- “The question increasingly isn’t whether the Fed will cut rates this year, but by how much.”

And they answered it too:

- “Three quarter-point cuts, or a bigger cut once or twice“

What did Raoul Pal, the man who said “Buy Bonds, Wear Diamonds” weeks ago, write this week?

- Raoul PalVerified account@RaoulGMI – The entire yield curve in the US is now trading below Fed Funds, except the 30 years which is 10 bps away. The question for the Fed is how big and how fast to cut rates. My guess is 50bps by July/Aug and possibly another 50bps in 2019.

But does Raoul Pal know the Fed as well as Steve Liesman does or as Mohamed El-Erian suspects? Mr. El-Erian knows what the Fed must do:

- Mohamed A. El-ErianVerified account@elerianm – Consistent with #markets pricing another major #Fed dovish policy pivot,2-year US Treasuries are down 12 basis points more today.Officials have no choice but to explicitly signal onset of a rate cutting cycle if they wish to reduce risks of a costly policy mistake for the economy

The above he knows but what does he suspect?

- Mohamed A. El-ErianVerified account@elerianm – But such a pivot would be far from costless for the @FederalReserve. Yes it would reduce the risk of disruptive reactions by markets to what they deem to be a policy mistake. But it would also feed into the narrative of a flip-flopping #Fedthat lacks strategic anchoring/vision.

This is why Steve Liesman so quickly & contemptuously dismissed Santelli’s suggestion of a practical cut now that could be taken back if appropriate. That would be a flip-flopping Fed. That would be anathema to the Fed’s self-emphasized belief in the “infallibility” of their models.

Remember El-Erian is an erudite, soft-spoken professor. In contrast, Guggenheim’s Scott Minerd was a marine. He had no problem in speaking candidly about the Fed’s real sensitivity on CNBC’s Closing Bell:

- “They are very sensitive to [being criticized for] reacting to markets than reacting to fundamentals“

Steve Liesman knows this. He understands that the real mandate of the Fed is to maintain their institutional credibility and not the price stability or jobs/economy mandates given to them by the US Congress. Now if the US Military signaled that maintaining their own credibility was more important to them than winning the war they are fighting, they would be fired and/or court-martialed. But when the Fed does so, they are proudly maintaining their independence from the President.

And that means determination in not admitting their mistake & even greater determination in sticking to their model-driven path of dismissing the President’s comments even when he is right. Who essentially said this on Friday? A man who disagrees with President Trump on virtually everything – David Rosenberg

- “Fed overhiked at least 3 rate hikes in this cycle – it is the one thing I agree with the President“

Who else thinks so? And when should the rate cut cycle should have begun according to this proven analyst?

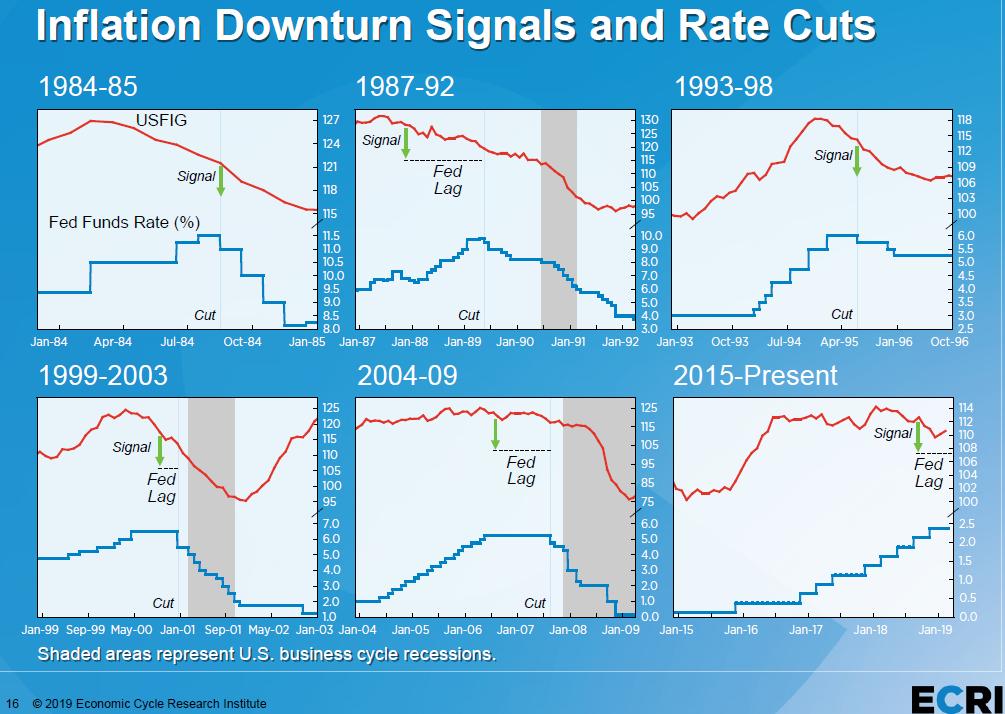

- Lakshman AchuthanVerified account@businesscycle – Plunging yields pressuring Fed to ease, going beyond consensus that Dec. hike was a mistake. But this ECRI finding, based on inflation cycles, says Fed rate cut cycle needed to start LAST Sep. See details on page 16 here: http://bit.ly/2GzHoDo

Understand this analysis has nothing to do with bond market action. It is entirely about fundamentals – the fundamentals of the current inflation cycle. What is the conclusion of this 19-page presentation?

- page 19 – “… the inability to execute preemptive rate-hike and rate-cut cycles is the real danger. This is because, as I’ve laid out, they simply don’t know how to foresee a cyclical downturn in inflation, which is important for engineering a soft landing.”

So now you have Santelli, a markets guy, and, Lakshman Achuthan, a fundamental analyst, both say the biggest danger of the Fed’s approach is the refusal/inability to execute preemptive cuts/hikes.

Achuthan describes two fundamental issues with the Fed’s analytical competence:

- First, the years-long inflation undershoot is basically a structural problem.

- Second, the Fed has lost its institutional memory about inflation cycles, which are distinct from the business cycle.

No wonder the Fed kept raising interest rates late last year when, as Achuthan says, they should have begun cutting rates in September 2018.

And what about the Fed’s deep belief in the Phillips Curve? Achuthan writes,

- page 10 – “In essence, the 1994-96 period was about preemptive rate-hike and rate-cycles – but not based on the Phillips curve“.

- page 11 – “25 years ago, it was already obvious to Greenspan that the Phillips curve was “quite ephemeral and misleading“. And his was not a solitary view – other FOMC members agreed.”

So did Fed Chairman Powell even understand what made Greenspan successful in mid-1990s when he praised him? We don’t know enough about Chairman Powell to answer that question?

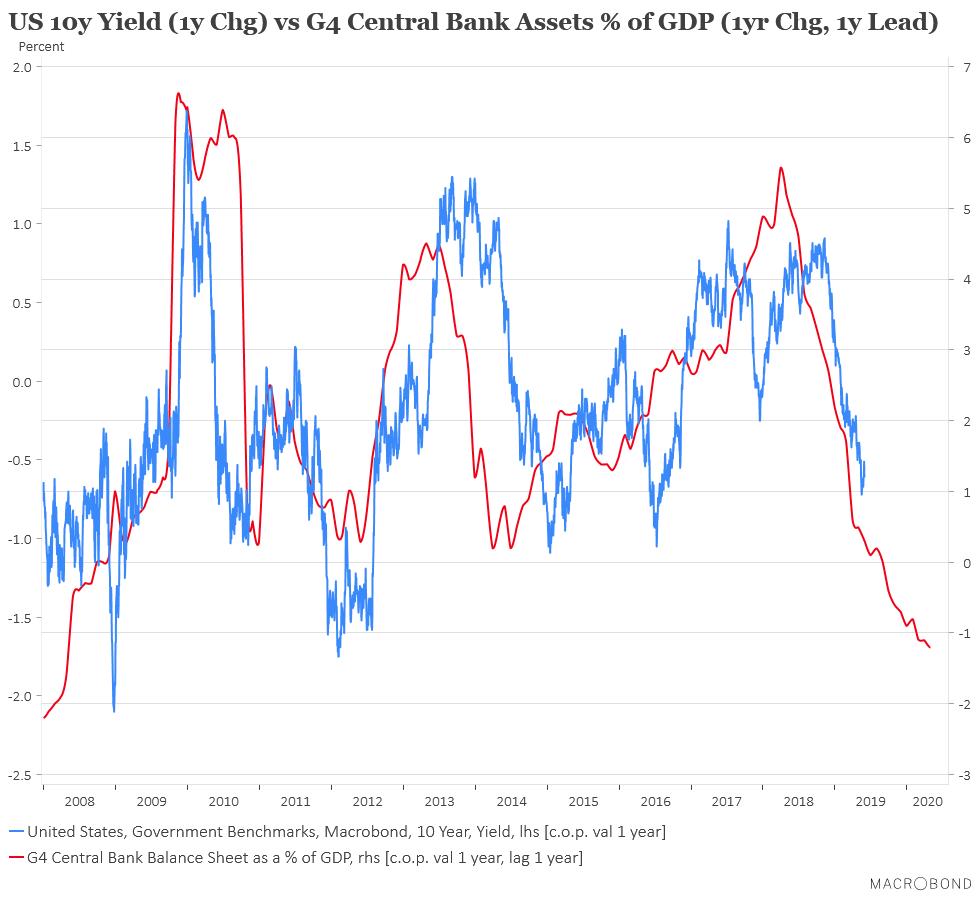

But, as Mike Wilson of Morgan Stanley, explained this week on BTV – this Fed doesn’t understand how QE & QT changed the yield curve and how this yield curve has been INVERTED since November-December 2018.

Watch this 2:30 minute clip. It will help explain why Mike Wilson has been more accurate than most about markets. Then ask yourselves why the Fed didn’t understand this or why it still doesn’t get it. Guess they are simply fulfilling their own mandate of remaining “infallible”.

2. Treasury rates

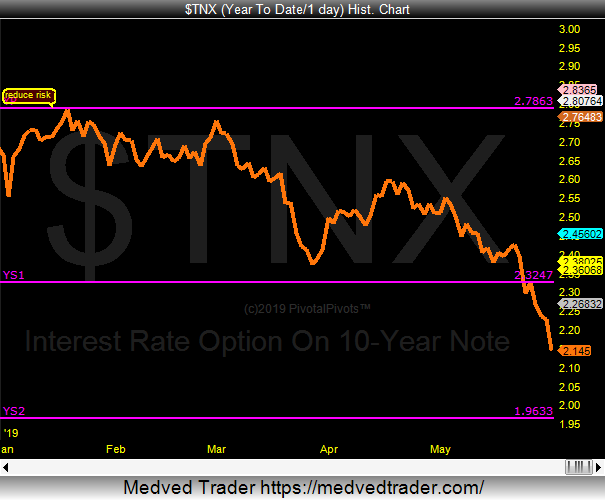

Last week we pointed out that the DSI (Daily sentiment index) on bonds was 86%. Well, this week it touched 91%. On the same day, we saw

- Jeffrey GundlachVerified account@TruthGundlach – Long maturity US Treasury price action today was consistent with a blowoff momentum top. I suspect buyer’s remorse will set in fairly soon.

Then two days later, we saw the waterfall decline in Treasury yields on Friday. The 2-year yield fell by 23 bps this week; the 3-year yield fell by 22 bps & the 5-year yield fell by 20 bps. The 7-30 year curve fell by 18-19 bps. Not just US rates. But, as BTV’s Lisa Abramowicz tweeted the Japanification of Germany is now complete. The 10-year Bund closed at minus 20 bps. That is doubly negative the minus 10 bps rate on the 10-year Japanese bond.

Given that this fall in rates is a global phenomenon, is there a global measure we can apply to understand where rates could go?

- Mark Louis@NoBServations – May have a ways to go…

What about technicians? Paul Ciana of BAML gave a target of 2.05% for the 10-year yield and 1.78% for the 2-year yield on Monday. That day, the target seemed aggressive. Now we could see it next week.

What about technicians? Paul Ciana of BAML gave a target of 2.05% for the 10-year yield and 1.78% for the 2-year yield on Monday. That day, the target seemed aggressive. Now we could see it next week.

What do this week’s fundamentals say about direction of yields?

- David Rosenberg@EconguyRosie – The most important takeaways from the GDP revision are (i) the capex recession has begun, (ii) the profits recession has arrived, and (iii) inflation is melting away.

This week, a target was updated,

- Jeff York, PPT @Pivotal_Pivots – Looking for 10 year bond yields $TNX to go down to the Yearly S2 pivot point(YS2) @ 1.96% @PivotalPivots.

There is no doubt about the momentum of the fall in yields. But is that momentum about to be reversed? Not yet, according to

- Thomas Thornton @TommyThornton – US 10 Year Yield – no change to our bias despite the large move and extreme bullish sentiment currently. On day 7 of 13 with DeMark Sequential Countdown

On the other hand, next week features lots of data beginning with PMI on Monday and ending with the Non Farm Payroll report on Friday. That data could reverse the momentum of this week’s fall in rates or amplify it.

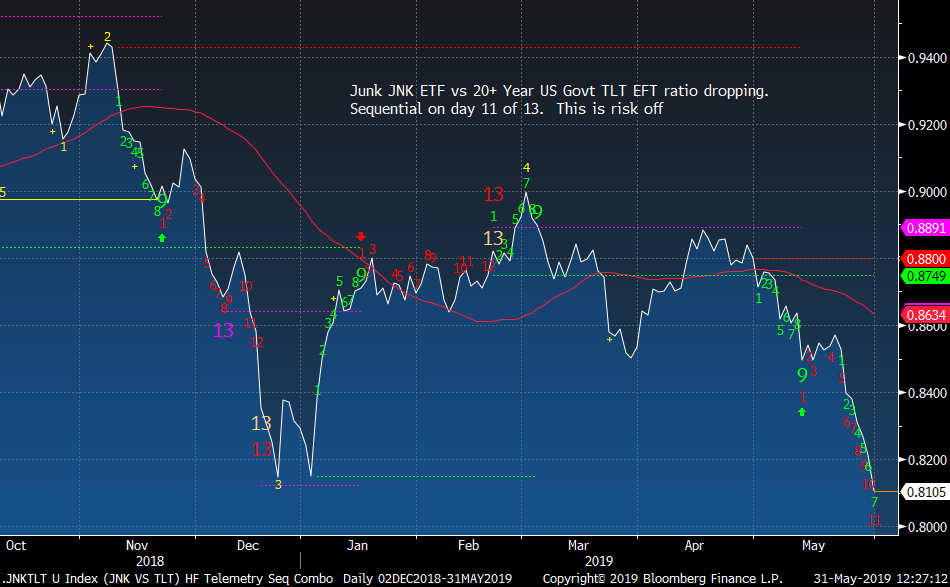

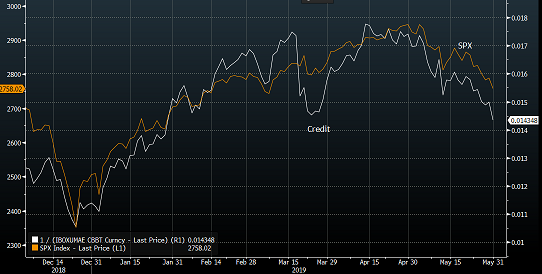

3. Credit

Credit finally got affected this week adding to the conviction about the Treasury rally.

- Thomas Thornton @TommyThornton – Junk Bond ETF vs 20+Yr US Govt ETF was a factor in cautious bias

Market Ear concurs:

- “Talking of credit, it has been one of the leading indicators to the downside and continues to “lead”.”

And on Friday?

- “US credit, CD IG, day highs, +4.6% at 69.8. Highest levels since late Jan.”

So now credit is sending the same message to the Fed, isn’t it?

4. U.S. Stocks

Any exhaustion in the downtrend yet?

- Thomas Thornton@TommyThornton – $SPX futures at first DeMark Trend Factor downside target 2760. I’ve expected this level and believe it can work lower with downside DeMark Sequential Countdown on day 6 of 13. A close under 2752 will change wave structure (3/8 close)

Not only did the S&P close below 2800 but it was both a weekly & monthly close under 2800. So, according to Lawrence McMillan of Option Strategist,

- “In summary, the $SPX chart is bearish and that’s all you really need to know. Maintain a “core” bearish position. There are plenty of oversold conditions setting up, but don’t buy because of those oversold conditions; wait for confirmed buy signals because an oversold market can decline a lot farther than one might expect (see what happened last December for an example).”

How far is a confirmed down level?

- Real Vision Research @RVAnalysis – #ES futures breaking the neckline, though unconfirmed until the cash #SPX follows suit. A confirmed break targets 2600

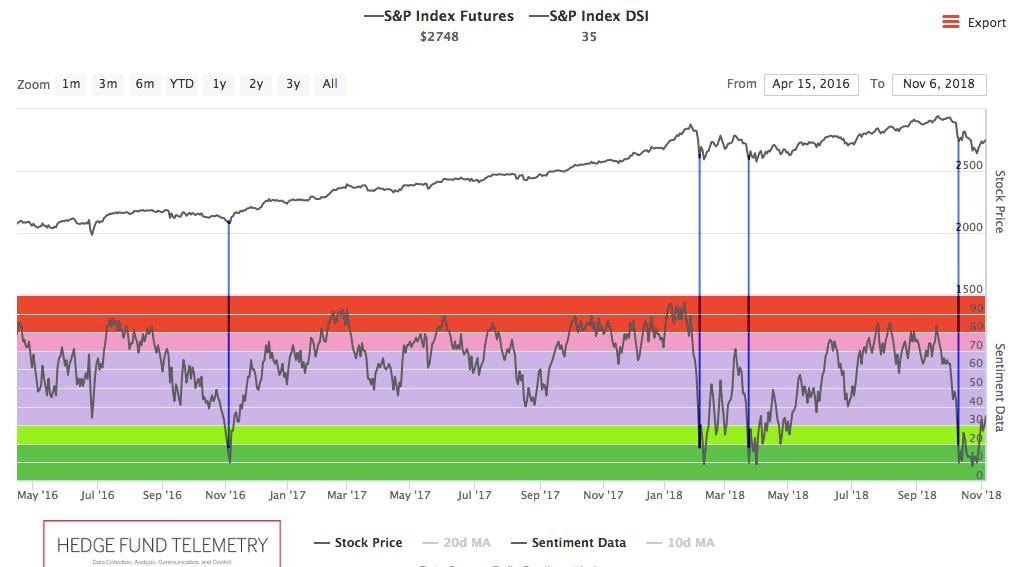

- Urban Carmel @ukarlewitz – $SPX DSI now at 12. Similar since 2016 shown below (source on chart)

- Babak@TN – NDR Daily Trading #Sentiment fell to 20% even yesterday – historically majorintermediate lows in bull markets have corresponded to 15%-20% levels

On the other hand,

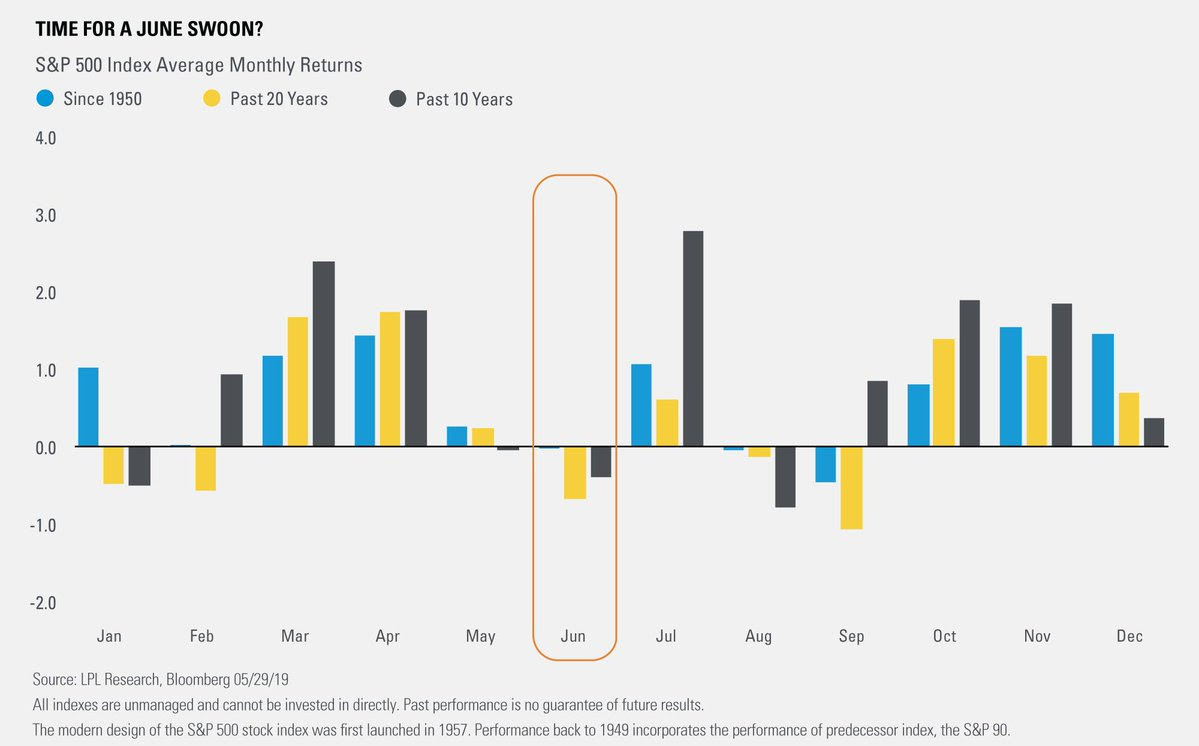

- Ryan Detrick, CMT@RyanDetrick – Here comes June, historically one of the weakest months of the year for stocks. https://lplresearch.com/2019/

05/30/time-for-a-june-swoon-2/ …

5. A bottom & bounce?

Is it a sign of bounce in the abused or was it the weakness in the Dollar? As Market Ear reported,

- “Emerging market vol, VXEEM, vs VIX spread continues coming down….”

And,

- “Several “things” are not behaving like they should in a “real” bearish sell off. JPM EM FX index is actually up today, EEM US trades unchanged….”

And in a week that saw Dow down 3%, S&P down 2.6%, Russell down 3.2%, EEM closed UP 1.9% with Brazil up 6.3%, Korea up 16 bps and India up 1.4%.

And in a week that saw Dow down 3%, S&P down 2.6%, Russell down 3.2%, EEM closed UP 1.9% with Brazil up 6.3%, Korea up 16 bps and India up 1.4%.

And in keeping with the Dollar weakness and, more importantly, with real rates falling plus possibility of a rate cut,

- Lawrence McDonaldVerified account@Convertbond – Gold’s “Cup and Handle” – Finally pricing in rate cuts…

6. US tariffs on Mexico

President Trump’s decision to impose tariffs on Mexico did change the psychology of some investors. For a detailed discussion of this decision, see our adjacent article – US-Mexico & Israel-Egypt vs. India-NaPak; A Shift in US Global Strategy?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter