Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Panic but whose?

Friday’s action in the markets was clearly driven by the specter of a much larger than expected Coronavirus epidemic in China & the possibility of virus migration to other regions. Every negative news triggered another down move in the S&P. We have no clue how far the virus might spread & what damage it might cause.

But we also detected a whiff of panic in Government authorities in US and of course in China. We saw news items about several cities in China being placed in near quarantine status point, about severe panic in Chinese authorities & a consequent drive to take all possible steps. Comments from US CDC & other officials also suggest a heightened level of monitoring & possible quarantine of people arriving from China or other affected regions.

And, as the old dictum goes, investors stop panicking when they see Governments panic. Yes, it has been usually applied to the Fed & global central banks but the parallel does apply to Government authorities in such apparitions of epidemics.

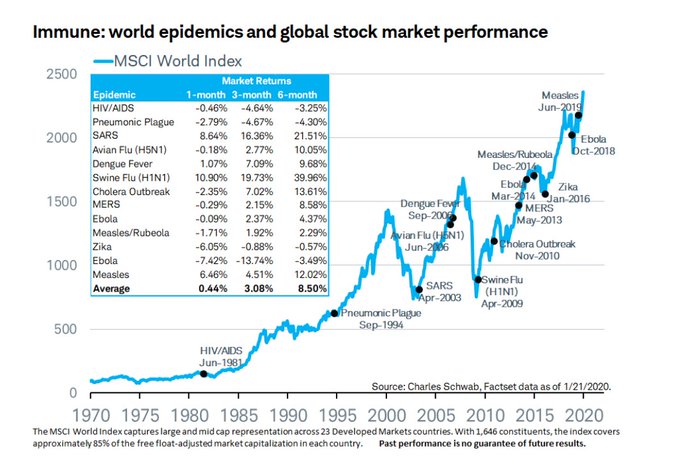

So speaking purely from a markets viewpoint, a crisis like this might well cure the US stock market from its complacency & the resulting decline could well create a buying opportunity as it did in previous epidemics.

- speculation@BarryAAnderson – Here’s how the stock market has performed during past viral outbreaks, as epidemic locks down 3 Chinese cities on.mktw.net/38AuYqm

The intermediate term question is about the impact of the virus & the virtual quarantine of tens of millions of Chinese people on the economy in China. And if China slows, don’t Asean countries slow as well?

What does that do to a Fed that might have had some desire to talk hawkish next week? How will Chairman Powell talk about the growth impact of this Coronavirus?

One clue came from U.S. interest rates.

2. Treasuries & the Fed

Interest rates fell every day of this week. The 30-year yield fell by 15 bps on the week while the 10-year yield fell by 14 bps; the 7-year & 5-year yields fell by 12 bps & the 2-year yield fell by 7 bps. The German 30-yr & 10-year yields also fell by 12 bps.

The U.S. 10-year yield closed the week at 1.69%, below 1.7% on a weekly close. How does it look graphically?

- via Market Ear – US 10 year yield – has not closed here since mid October; Now that’s a break down move.

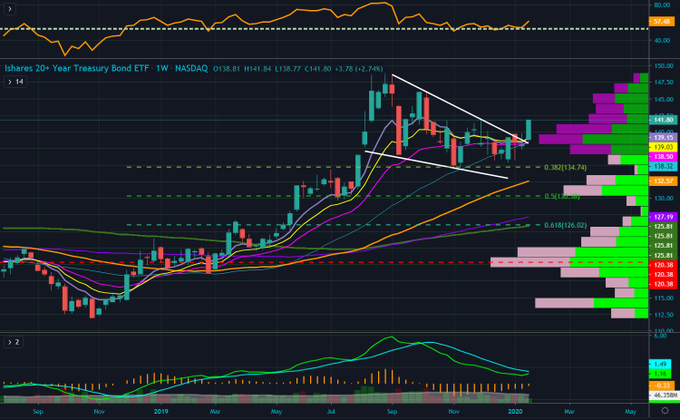

And TLT, the 20-year Treasury ETF, closed up 2.9% on the week beating every other asset class, including GDX, the Gold Miner ETF.

- Joe Kunkle@OptionsHawk – $TLT – Bond trade playing out nicely

But is this move in interest rates supported by a move in commodities? What about Gundlach’s favorite Copper/Gold ratio indicator?

- Lawrence McDonald@Convertbond – Copper Gold ratio vs. Rates is sending a message…

But the above is after the news of Coronovirus. That might prove a short term trigger. Is there any one who is arguing for a sustained move lower in interest rates? How about the RB pair? No, we don’t mean the running back pairs of either San Francisco 49ers or Kansas City Chiefs.

- David Rosenberg at Double Line Roundtable – “employment stats will decay & the consumer will follow the rest of the economy into a downturn; what this does is causes the Fed to cut the Federal Funds rate probably below 1%; whole yield curve is going to steepen but it will melt;”

He pointed out that the really big surprise of 2019 was not the equity market but the 20% return delivered by Treasury long bond and added

- “those returns in the Treasury curve are going to be achieved again in the next 12 months.”

Then you have,

- Jim Bianco at Double Line Roundtable – “I am a bond bull; I have been a bond bull for many years; I am going to stay a bond bull; I think the 10-year yield possibly goes to 1.5% if not make a new low; the 30-year did it last year; there is a possibility the 10-year could this year; I don’t need a recession for it; I have got no inflation; I believe in the Amazon effect; … slow growth out of the rest of the world & a weakening financial system around the world thanks to negative interest rates; “

Is there any indication that negative rates elsewhere might be driving money into US Treasuries?

- Lisa Abramowicz@lisaabramowicz1 – The gap between U.S. & German 2-year yields is now the smallest since September 2017. I wonder how much the rally in U.S. Treasuries is being driven by foreign buying.

David Rosenberg articulated this view explicitly in his interview with a Swiss entity:

- “Firstly, as a Swiss investor or a European investor, I truly would want to be invested in bonds that have a positive yield and liquidity. That means you want to be in other countries’ fixed income markets where Central Banks have the capacity to ease monetary policy. The United States fits that bill. That’s why I’m still a big fan of Treasuries. I think the U.S. Treasury market will be a very good refuge.”

But what about US institutional buyers?

- Jenna & John@StrategicBond – We have been touring the country with the JIF Forum — virtually nobody overweight bonds; most underweight, some overweight alternatives… Same feedback in Europe/US. Same results two years ago when bonds were materially cheaper! #pathofleastresistance

Hmmm! What if the big US buyers, especially the large speculative players & CTAs, start buying seriously?

- Raoul Pal@RaoulGMI – Buy bonds, wear diamonds…the replay of 2001 is in full swing.

Our friends at CNBC Squawk Box have no doubt forgotten but we do remember the terrific call made by Nomura’s Charlie McElligott on their show on Wednesday, December 18, 2019?

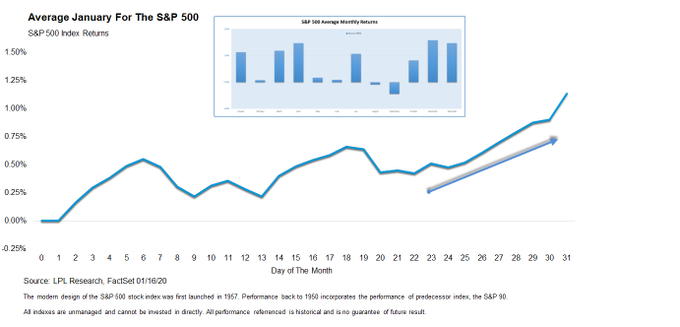

- “That dating back to 1983, we see January as a top 3 month of the year for Ten Year US Treasury future, higher with a 70% hit rate. This is then supportive of fixed-income out of the gates and likely speaks to fading the crowd who believes that in January you’ll see UST yields rocketing higher to start 2020, which in-turn many then expect to lead to further extension of this rebalancing trade INTO cyclicals out of duration sensitives (secular growth and defensives); conversely, I think Bond proxies hold just fine and can in-fact outperform said “cyclical renaissance” in January due to this likely “passive rebalancing” phenomenon.”

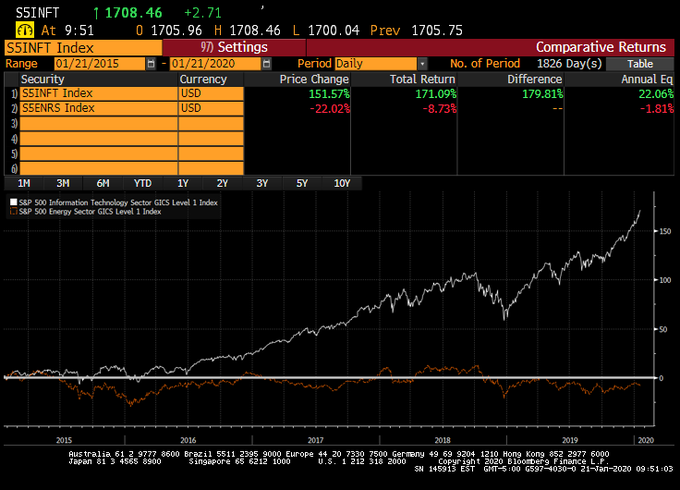

His trade for January was Long Bond proxies & Secular Growth-Defensive & Short Energy & Banks. Kudos to him.

But the picture looks different when you consider high yield bonds or leveraged loans:

- Lawrence McDonald@Convertbond – Leveraged Loan Mania Is Back With Federal Reserve on Hold: riskiest companies are now jumping at the opportunity to borrow. Junk-rated co’s, including one that exited bankruptcy not long ago, are managing to borrow at lower interest rates, the fastest pace since 2017. Bloomberg

And Jeff Gundlach said the BB bond market is as unattractive as he has seen in his career. In fact, he suggested selling BB Corporate Bonds & Buying S&P 500 – the risks are the same in the two but the rewards are very different.

3. Stocks

Frankly, what happens on Monday or Tuesday might be driven by news about Coronavirus than anything else. So what if the news remains bad on Monday-Tuesday and the fall in stocks on Friday is followed by declines on Monday & Tuesday? Wouldn’t that bring us to a much better buying level just ahead of the Fed meeting on Wednesday? What if Chairman Powell is forced to respond to the Coronavirus fears with soothing statements?

- Ryan Detrick, CMT@RyanDetrick – Stocks historically tend to do pretty well the last week of January. Could it happen again in 2020?

After all, by Wednesday we might see a peak, at least a local peak, in epidemic fears, a soothing Fed that reiterates their determination to not let the US fall into a slowdown and a far less overbought condition in the stock market. And we would have had a Boeing conference call , a Goldman Sachs analyst day & Facebook, Microsoft earnings on Wednesday after the close. With all this, could the Bulls actually drive the stock market higher on Thursday & Friday?

Of course, we might look back at the above next week and see how silly we were to even imagine a bullish scenario. On the other hand, look what Lawrence McMillan of Option Strategist wrote on Friday afternoon:

- “In summary, it seems as if the market is slowing down, but the indicators are still overwhelmingly bullish, as the only sell signals right now are the put-call ratios and breadth. Thus, it is important to wait for $SPX and $VIX to confirm before attempting to take a strong bearish position.”

Getting back to the first hand, Carter Worth of CNBC Options Action explicitly recommended selling or shorting QQQ.

.

Much will depend on both how stellar earnings are & what the guidance is. And, of course, on what the Fed says on Wednesday. We should not forget that Tech is divided into two big chunks – China-influenced & China-proof. We saw the nasty reversal in Semiconductors on Friday, possibly on China virus epidemic worries. But the China-proof Alphabet, Netflix were down far less.

But if not tech, then what?

- Richard Bernstein@RBAdvisors – #Replaying #2000 perhaps? #Tech and #Energy #performances show similar divergences.

On the other hand, as we recall, the 2000 top in major tech stocks happened in April after Q1 earnings. And back to the first hand, David Rosenberg agrees with Rich Bernstein based on his comments to the Swiss entity:

- “The energy sector’s market capitalization relative to the overall stock market valuation is the lowest it’s ever been. We’re down to almost a 4% energy share of the S&P 500. That’s lower than it was when the oil price was $11 a barrel back in 1998. We will not all be sitting in driverless electric cars three years from now. Fossil fuels are not going to go away that quickly. At this stage, there is a very firm floor. The energy sector is nowhere close to being priced for where oil prices are right now and there is justification for why the oil price will remain close to where it is for an extended period of time. So in a world where practically every asset class from real estate to corporate credit to equities is extremely expensive, energy offers very deep value. At peaks of the cycle this is where you want to be buying.”

But when might we see the peak of this cycle? Isn’t that the big question?

Finally, look at what Gold and Gold miners did this week. And that might be just the beginning if David Rosenberg proves correct:

- “Gold is inversely correlated with either near zero rates, zero rates, or negative rates which makes it an ideal investment. Mark Twain coined the phrase “Lies, damned lies, and statistics”. But the thing about charts is that they don’t lie. Gold went through a long-term, multi-year basing period. Now, it has broken out and the chart looks fantastic. Also, gold is no country’s liability. For example, in the United States M2 growth is running at double digits. So when you compare the new supply of gold against the supply of money coming into the system from Central Banks, to me it’s a very clear cut case that you want to have very high exposure to bullion.”

And why does he think Gold is going to $3,000 an ounce?

- “It’s just a matter of when, not if. Gold demand is predicated on the final act which is going to be right-out debt monetization. When we get to the lows of the next recession, we’re going to find that these Central Banks that already have been extremely aggressive are going to engage in what is otherwise known as the “debt jubilee” or a right-out debt monetization which was actually the final chapter of the Bernanke playbook. Remember, Ben Bernanke got his nickname “Helicopter Ben” because in a speech in 2002 he suggested that helicopter money could always be used to prevent deflation. So we’re going to have helicopter money.”

Send your feedback to [email protected] Or @MacroViewpoints on Twitter