Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Stabilization?

Last week was pure chaos. Jim Bianco tweeted last week about the dysfunction in the Treasury market. If the market that defines risk-free rate levels becomes dysfunctional, how could other fixed income markets not get liquidated? Talk about dysfunctional – Treasury bonds got sold off big as stocks were collapsing in what became the worst week for the Dow Jones since 1933.

What led to that dysfunction? Treasury bonds were owned in leveraged size by the same entities who were liquidating stocks, “they” being the Risk Parity guys.

But as we pointed out last week, the Risk Parity ETF turned up on last Thursday (3/19) morning. How did it behave this week?

Yes. The turn on Thursday morning was real. Notice that while the S&P made a low on Monday morning, the Risk Parity ETF closed up. It rallied all week to close up 10% matching the S&P’s 10% weekly gain. And TLT also respected its turn of last week with a 5.5% rally this week with EDV, the Zero-coupon ETF up 10%.

Treasury yields along the entire curve fell this week as they should have given the economic picture ahead. The 30-7 year curve went down 20 bps in yield and the 5-2 yr curve went down 10 bps on average:

- J.C. Parets@allstarcharts – I know it’s all rainbows & butterflies in the minds of a lot of investors out there. But keep in mind that 30-yr Bond Futures $ZB_F, 10-yr Note Futures $ZN_F, 20+yr Bond ETF $TLT, and 7-10yr Note ETF $IEF all just went out at new all-time weekly closing highs…. $SPY $DJIA $QQQ

And yes, our own simple indicators of leveraged funds beating unleveraged funds also worked this week, thereby continuing their own turn of Thursday, March 19. It is almost as if they had discerned what the Fed might do.

The Fed’s announcements had a lot to do with this week’s rally in all markets (except oil, of course). But does that in itself suggest something about markets being near fair value on Monday, March 23? Read what Jim Bianco wrote in Monday:

- “Markets understand this and they are rapidly re-pricing to a post-virus world at historic speed. This is causing all kinds of problems as the markets move on from the old pre-virus reality.”

- “The Fed is attempting to stop this repricing from going any further. They essentially announced they are nationalizing the markets. They will set the price and provide the credit. They are hoping to stop the completion of the post-virus repricing.”

- “Will these new measures work? Can the Fed stop the entire financial world from repricing to what it perceives as fair value? It is difficult, if not impossible, to know where the market sees fair value at this point.”

- “We believe these new Fed facilities will only work if the market is close to a perceived fair-value level. If risk markets still see lower prices in a post-virus reality, then they will continue to head lower.”

Since the new facilities worked, it means, at least per Bianco’s logic, that the bond market levels were close to fair value as perceived by the bond markets. Look the high yield ETFs, HYG & JNK, rallied 10% this week despite the 8% fall in Oil.

Something else, something really important happened this week. The U.S. Dollar fell by 4.5% on this week recovering the 4.5% rise of the week before.

Unlike us, the Fed & so many, some were not happy with this week fall in the Dollar:

- Raoul Pal@RaoulGMI – Urgh, these dollar swap lines are causing a rapid unwind of the very recent dollar funding pressure. However, I only view this is temporary in nature, painful though it is…but as ever, lets see…

In contrast to Mr. Pal, Gold & Silver were thrilled. Gold rallied 11% on the week and Silver rallied 17% on the week.

Finally how do we describe what the Fed did this week? By quoting Jim Bianco:

- “It is difficult to find a superlative to describe what the Fed announced this morning.”

2. Stocks

Last week we closed with “Right now, everybody would settle for a near term rally that takes the panic down.” The panic didn’t really go down with $VIX closing this week almost at the same level it closed the week befoe. But what “a near term rally” did we get!

The Dow had an explosive 21% rally in 3 days from Monday’s close to Thursday’s close. It closed the week up 13%. The S&P rallied by 18% from Monday’s close to Thursday’s close and closed the week up 10%. And this week’s rally was consistent with the Treasury rally with XLU, the Utilities ETF, up 17% on the week, a 70% outperformance over the S&P.

Without question, the clip of the week was Bill Ackman on BTV on Monday in which he was clear & explicit. Key excerpts from his long clip are:

- “…. we are completely out of our hedge; we took that $2.5 Billion & invested it in equities; … country is getting to a right place in this issue; … we are making a huge recovery bet … we are all long; no shorts … still about 15-16% in cash“

Remember the MS QDS excerpt we had featured on Friday March 20, courtesy of The Market ear:

- “MS QDS argues for a 15% to 20% counter-trend rally over March month-end now that the system is completely reset (HF grosses and nets at virtual all-time lows, systematic strategies completely delevered (some even short) and >$1T sitting in money markets) with pension fund + asset allocator demand (~$160B) and today’s expiry helping to serve as a clearing event. …. “

What a superb call? They didn’t even have to wait till March month-end to get that rally. What are they saying now? Once again via courtesy of The Market Ear:

- Flow update: is there life after rebal? On pension rebalancing – QDS expects pensions to buy ~$100-110bn of global equities to rebalance 100% back to target weights around March month-end. The regional breakdown is $60bn /$35bn / $10-15bn to US / DM ex-US / EM Equities respectively. What stands out has been the lack of follow through from active accounts – making you wonder where the next source of significant demand comes from once Pensions have rebalanced.

All that is fine into Tuesday, March 31 but what is an intermediate term outlook? Mike Wilson of Morgan Stanley made an interesting case not just once but twice:

- Wilson on CNBC FM on Tuesday- bottom line is we have been in a bear market for several years; we think that this is the finishing move to a two-year bear market; … bear markets end with a recession; …. it doesn’t mean that the lows are really in … coronavirus combined with the oil price collapse which infected credit markets has made it a recession that is somewhat unprecedented in its speed & depth that we are seeing; … but that is now going to invoke policy response that is also unprecedented … we think the lows are pretty much in for 90% of stocks … there will be some testing, retesting … we think this is a perfect time for real money asset owner type clients to put some money to work ….

- Wilson on CNBC Squawk Box on Thursday – it’s consensus it is a recession; its probably going to be steeper than we have seen ever before; the question is whether it is short or whether it is going to be elongated … we are leaning more to the short & sharp; …. bear markets end with a recession; … this is probably the best risk-reward we have seen for investors in 2 years … we don’t know whether its going to be a V, a U … we don’t think it is going to be a L; … we see a recovery in the back half of this year …& we like these prices …. W is a typical bottoming process; as long as I am doing my buying towards the low end of 2400-2500 …. 3,000 is the bullish case… .

What about the near term?

- Lawrence McMillan of Option Strategist – There is a $VIX “spike peak” buy signal in effect (from March 17th), although it hasn’t performed well. In a more negative vein, $VIX has remained extremely high for a good reason. It is lower than realized volatility, but is obviously being “dragged” upward by the currently high levels of realized vol. Our conclusion is that a “core” bearish position should still be held, but that these short-term counter-trend buy signals can also be traded.

What about in 6-months or a year?

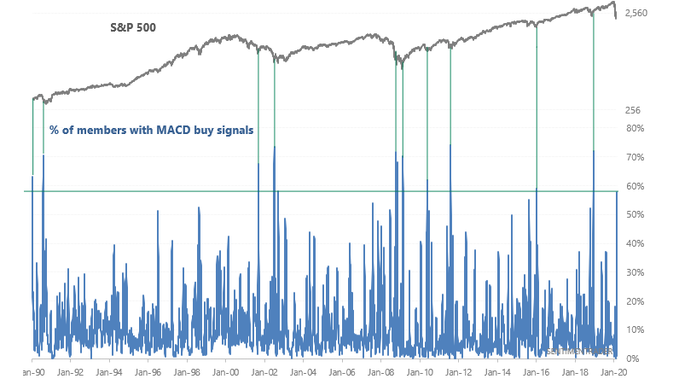

- SentimenTrader@sentimentrader – 57% of S&P 500 stocks have triggerd a MACD Buy Signal. Similar to many *HISTORIC* bottoms $SPX rallied 92% of the time 1 year later by median +18%, NASDQ Composite rallied 100% of the time 6 months later by median +18%

Assuming a new bull market could be beginning as this bear market ends, what could be its scale?

3. Second Prong of this Recession

While CoronaVirus is getting almost all the attention for this recession & market decline, we think the second reason is almost as important. The economies of several states, employment of nearly 1 million & the health of the US high yield market depends on this second factor – the Russo-Saudi Roulette.

The impact on a stock sector is clear:

- Lisa Abramowicz@lisaabramowicz1 – U.S. energy stocks are weaker than they have been since the Great Depression relative to the broader S&P 500: Michael Hartnett, BofA’s global chief investment strategist, via @TheOneDave

Like the stupid & nearly disastrous military intervention in Yemen, this oil price war is going to backfire on MBS & Saudi Arabia. As Geopolitical Futures wrote on March 27, 2000

- In reality, however, Riyadh may be forced to yield before Moscow. Saudi Arabia needs oil prices at $91 per barrel – more than three times the current price – to balance its 2020 budget. In contrast, Russia’s 2020 budget is based on oil priced at $42.40 per barrel, meaning that it can actually tolerate low prices for longer than the Saudis.

- As it stands, the road to recovery is long. Saudi Arabia, unable to set prices or increase demand, is running out of options and adopting a series of risky moves, hoping that it can either force Russia to capitulate or find new partners with which to navigate the oil market. OPEC+ as a price control regime is fragmenting, and Saudi Arabia is increasingly unable to sustain its pressure campaign on the Russian energy industry.

But that may be the lesser fight as far as the US economy & the High Yield market is concerned. It seems the bigger fight is being waged by the US Super Major companies against the mid & small companies. As Scott Sheffield of Pioneer Natural Resources said on CNBC of Exxon & other majors ” … they prefer independents to go bankrupt so that they can pick up the scraps .. we need Trump to do something …. “

Listen to Mr. Sheffield explain the stark reality:

- “About 74 public independents, there will be only 10 left by 2021 that have decent balance sheets; the rest will become ghost or zombies…; we are going to have about 65 independents that are going to have debt-cashflow or debt-ebitda of 5 to 1; … consolidation won’t happen because too many companies have too much debt ….”

Now you understand why Mike Wilson said the oil crisis was infecting the credit market. But can President Trump even spare any time to deal with this given the load he is carrying about the CoronaVirus?

4. Bigger Picture; A Big Cycle Change?

At the beginning of 2020, we felt almost certain that the Fed would cut interest rates; we felt quite certain that President Trump would announce a middle tax tax bill with tax cuts & possibly deferring payroll taxes into 2021; we felt there was a reasonable chance that President Trump would announce & run on a major infrastructure program in 2021 & ask voters to return the House to the GOP.

Well, the Fed did cut rates & how! President Trump has already made deferring payroll taxes a priority for 2020. That brings us to our third – a big infrastructure program.

But is there any room left? Listen to President Trump explain how the $2 trillion CoronaVirus Relief Bill could actually be a $6.2 trillion bill.

Of course, we all had heard this positively from Dr. Larry Kudlow & negatively from Mr. Gundlach:

Come on Mr. Gundlach. The “greatest generation” (as they tell us) dealt with 114% debt-gdp ratio in 1945. When US GDP was at 38% of Global GDP (as we recall) in 1950, the debt-gdp ratio was 89%.

The reality is that this multi-trillion dollar Bill is what it is called – ONLY a relief bill. Don’t take our simpleton view of it. Listen to Jim Millstein, Guggenheim Securities Co-Chair, explain it to Alix Steel & Sonali Basak of BTV. Ms. Steel asked Mr. Millstein the smart question about the CoronaVirus bill – “Is $2 trillion enough?“

Mr. Millstein’s response was music to our ears:

- ” … this [relief bill] is just going to tide them [individuals, small business …] through a really tough path; … in terms of actually stimulating the economy, … I think it is really time for Washington to address itself to our aging infrastructure …. that would be stimulative …. “

If we get one, clearly Gundlach’s 30% debt-to-gdp ratio would be left far behind. Because such a stimulative infrastructure program with similar copycat debt driven measures in Europe would raise rates in US & in Europe. Possibly that might lead to an inflationary cycle in America driven by rising blue collar wages & fiscal spending. If so, then possibly the back of the current disinflationary-often-deflationary cycle would be broken. We were not around then but, as we read, the 1945-1950s period was pretty good for wages, growth & stocks.

If so, Mike Wilson’s above call for the end of the bear market & SentimenTraders’s above tweet about a new bull market a la mid-1950s & post-2009 might prove true.

But first things first, this CoronaVirus has to be put away for good.

5. CoronaVirus Cycle from a Jyotish viewpoint

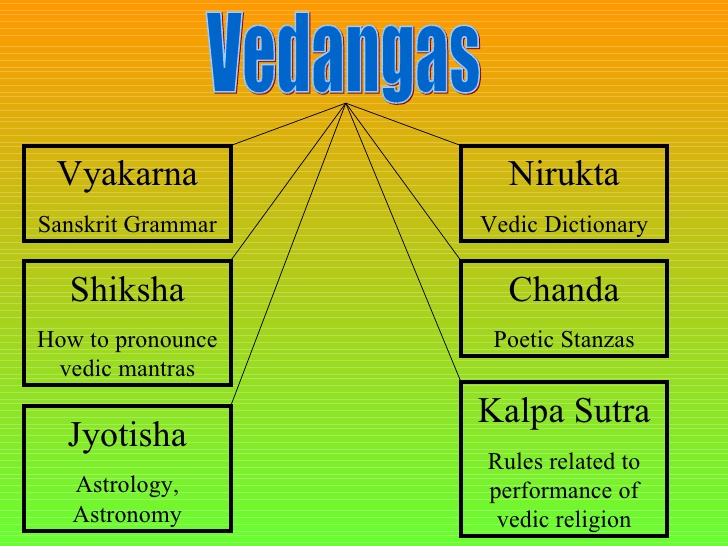

Hardly any one in America knows anything about the enormity of Sanskrut literature or its vast scope. Many might have heard that the four Ved (not Vedas as Brits & BrIndians call them) were the original texts. But associated with the Ved were the six Vedaang or auxiliary texts.

One of the six is Jyotish or Vedic Astrology as it is sometimes called. From what little we know & from what we have experienced, it is a deep system that, under a true expert, can deliver surprisingly true predictions. The trouble is most so-called Astrologers are non-experts or entirely oriented towards making money by predicting what their clients what to hear. But that doesn’t dilute the scope of the system.

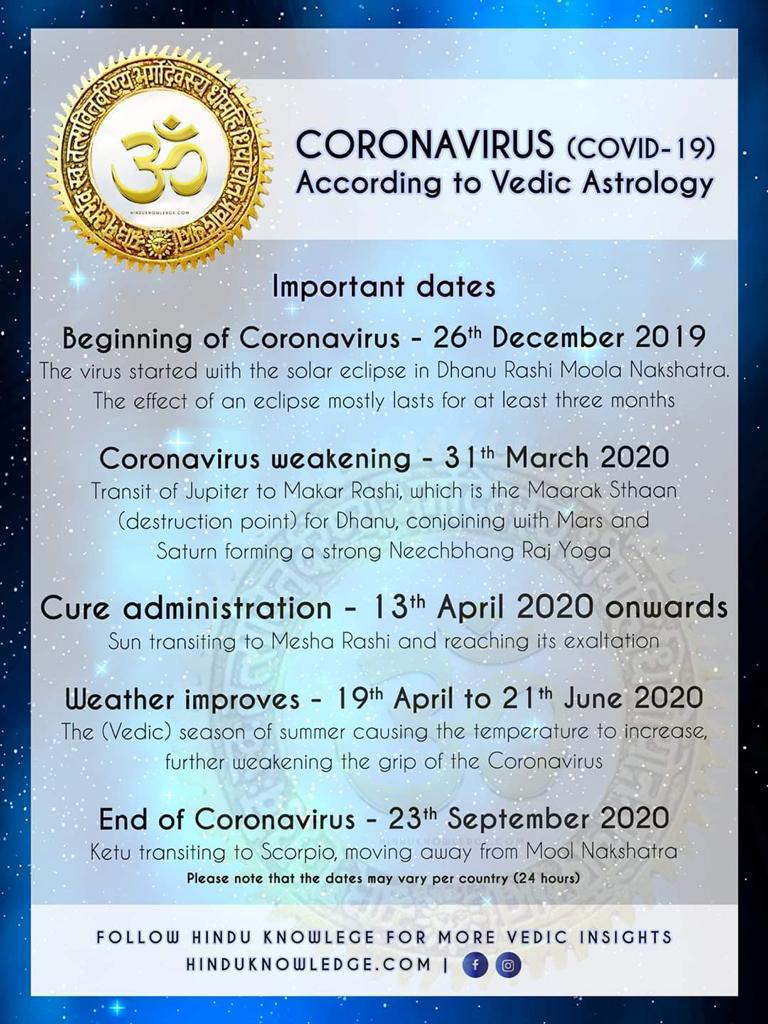

With that & without any comment or claim, below is a cycle prediction about the CoronaVirus that has been circulating on WhatsApp. We will all find out whether the predictions come true or not. In the meantime, it might serve to generate a chuckle.

Send your feedback to [email protected] Or @Macroviewpoints on Twitter