Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Launch

What we all saw on Thursday was utter fear in financial markets, fear of an unknown enemy that was threatening to engulf all of us coupled with the specter of a Government that seemed to have no clue. The only answers were of a kind that could only work in China, South Korea but never in America.

The fear did not peak on Thursday 4 pm with the worst down day (down 2352 points) in NYSE history but late into Thursday evening when the Dow futures fell another 500 points & the S&P futures touched near 2350. Friday morning was up a few hundred points mainly because of Chinese stimulus actions & stimulus talk from Germany. But that dissipated by late morning. Only the hopes of something meaningful from President Trump at 3 pm prevented another selloff.

The memories of the Wednesday speech were so fresh & raw that the S&P began selling off as President Trump began speaking. In fact, we saw a tweet saying “shut off his mike; S&P already down 2%” in the opening comments of President Trump’s speech.

But that was the initial jerky reaction. It was almost immediately clear that this was a totally different announcement. And stocks began moving up. They turned into a rally as Dr. Deborah Birx began speaking about “unleashing the power of the private sector“. The big surprise was that they had been working very hard behind the scenes for the past two weeks & were now ready to deliver. To us, she was the quietly competent & confident star of the initial part of the announcement.

The power & the reach of the private sector was on powerful display with CEOs of Walmart, Target, Walgreens, CVS, LabCorp & Qwest. The summary by Vice President Pence was just as competent & well prepared. He spoke of the plan as an “all of America” effort with close cooperation with the State & Local Governments. Then a confident & totally in charge President Trump made two big announcements. First waiving of interest payments on Student Loans and an instruction to his administration to fill the US strategic petroleum reserve to the top.

It was clear that Friday afternoon was just the beginning of a major drive, a comprehensive drive to contain, mitigate & then conquer CoronaVirus but also a major drive to boost the US economy with massive economic stimulus. No wonder the major indices rallied by almost 7% in the final 25 minutes on Friday afternoon.

Larry Kudlow went on Sean Hannity’s show on Friday evening to put a $400 billion tag on the stimulus from President Trump including purchase of 75 million barrels of oil from US Shale companies. And that does NOT include, per Dr. Kudlow, the waiving of the payroll tax deduction for this year something President Trump is committed to do.

Now it seems clear why President Trump waited till Friday afternoon to declare a National Emergency. They needed to announce FDA’s approval for the Roche CoronaVirus test. Secondly, he wanted to be totally ready to launch a complete plan backed by the largest private sector companies. He waited till Friday afternoon to get stock market’s powerful vote of support for the weekend to coerce Speaker Pelosi to get the House to pass the CoronaVirus Relief Bill. It seems he won on all three counts.

In addition, President Trump is readying more actions to help the middle & lower income Americans with a payroll tax suspension. That 12-18% increase in take home pay combined with a steep fall in gas prices and a potential suspension in rules that could allow mortgages to be priced at lower rates could together deliver a necessary boost in disposable income to middle & low income Americans.

We have been arguing since January 2016 that President Trump could easily pivot to pull a FDR. We might just see him do so in the next 2-4 months especially now that he may have to run against Biden. We understand the comparisons to 2000 & 2008. We can see that the potential for a recession is reasonably high thanks to the shutdown of a swath of US economy not to mention China & Europe.

But there is a huge difference between 2020 & 2000/2008. A sitting President was not running for re-election in 2000 or 2008. So the full power of the American Presidency was never brought to fight the onset of those recessions. Secondly, those two recessions were because of domestic excesses like telecom-tech bubble of 2000 & the credit bubble of 2008. The CoronaVirus is an enemy introduced into America first by China and now by the lethargic incompetence of Europe. How does one credibly oppose a valiant American President fighting to protect the American economy from the invasion by a foreign virus from China & Europe?

The above is neither a video review nor an election campaign analysis. It is very simply a description of how & why we think the US risk markets are more likely to rally from here into the October-November time frame rather than suffer a 20-40% fall from here, as some celebrated strategists & analysts predicted on Fin TV this week. And that is based on our assumption that

- the worst of CoronaVirus panic (panic not the spread) is behind us,

- the public-private partnership launched by Dr. Deborah Birx & her team will successfully mitigate the spread of that disease,

- and the joint financial stimulus from the Trump Administration & the Fed will be powerful & effective.

2. Europe as the “new China”

Guess who said that this week & where? Dr. Anthony Fauci to Joe Scarborough on MSNBC. Sorry, but that is both unfair & insulting to China in our opinion. Europe is far worse than China at least right now. China has bent the curve of CoronaVirus spread downwards while Europe has not even begun.

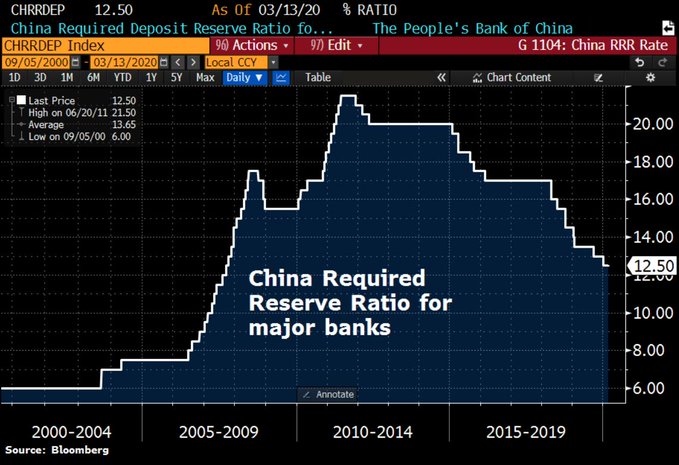

- Holger Zschaepitz@Schuldensuehner – Central Banks to the rescue: People’s Bank of #China has cut RRR by 0.5-1ppt for qualified banks, and another 1ppt for joint-stock banks. Cut will release RMB550bn ($79bn) of liquidity into the market, effective from 16 March.

In contrast, the European Central Bank was pathetic in its meeting on Thursday, March 13. Frankly, its utter incompetence & non-performance was a big reason for Thursday’s terrible decline in the US market. Not only is Europe sending CoronaVirus afflicted people into America but they are & have been exporting deflation to America as well. We could argue that President Xi has been much more of an economic friend to US than Chancellor Merkel.

Hoping against hope, we wonder whether Thursday’s drubbing & the apparition of CoronaVirus is scaring Merkel & Co. Because “the move higher in German 10 year yields” on Friday “was absolutely extreme” to quote Market Ear.

- Lisa Abramowicz@lisaabramowicz1 – Germany says it’ll spend billions to cushion the economy and will put no limit on its credit program to help companies. The market response is notable, with the fastest steepening of the German 2-10-year yield curve since 2008.

3. Da Fed

The Fed shot its second round just before the 30-year Treasury auction on Thursday at 1 pm. It wasn’t just a round. It was a huge artillery shell of 1 trillion dollars to destroy the bottlenecks in the Repo market. It worked for a couple of hours at best before failing. Read what Jim Bianco reported on Thursday:

- Jim Bianco@biancoresearch – Mar 13 – The first $500B 3-month Repo is done. Only $17B was taken. Nothing! Does this mean the street is not interested in liquidity to make markets? They only want to liquidate? Or, is the offering alone enough to give confidence? Two more operations coming in the next hour.

What’s going on? Fortunately for us, Bianco answered after talking to dealers.

- Jim Bianco@biancoresearch – – Dealers are telling me they badly want the $1T in repos, but can’t take it. Post-crisis rules, among so many different regulators (Basel 3, Fed, OCC, FDIC, etc) make it nearly impossible for them to take the money. They are telling the Fed their problems. The Fed had no clue.

These are sins of 2009, sins of the zeal to regulate in 2009, coming to haunt the bond markets in 2020. We don’t know if the Emergency Declaration would allow Secretary Mnuchin to unilaterally suspend these crippling regulations. If yes, then a big bottleneck might be cleared.

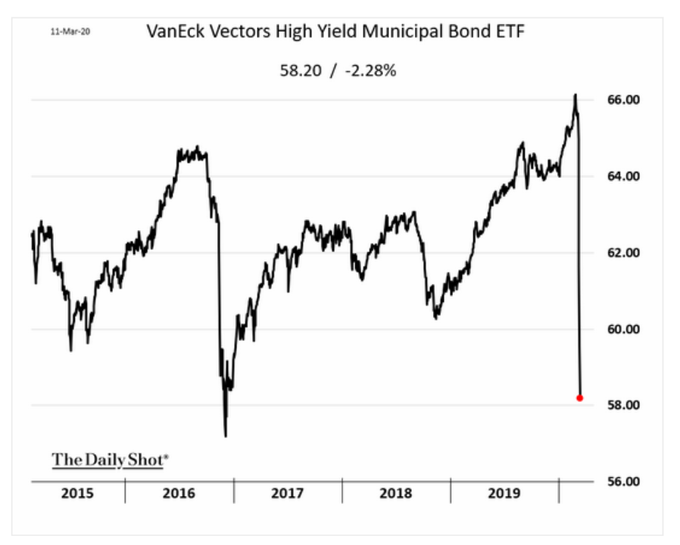

What happens when the Treasury markets get clogged? Big collateral damage. They sold everything & anything they could in fixed income markets. Corporate Bonds in the oil sector got liquidated all week thanks to MBS of Saudi & his war declaration against Putin. But why the carnage in Municipal bonds?

Forget Wednesday March 12 & forget “high yield” Muni debt. Look what they did on Thursday to Quality (technical title indicating OK to buy for bank portfolios) Muni debt funds, like NAN from Nuveen. This fund offers a 4.45% annual triple tax exempt yield payable monthly & now trades 13% below its Net Asset Value. Yes, it has a leverage of 38% but at near today’s interest rates the cost of leverage is trivial. Still they trashed it.

Does the Fed need to buy Municipal Bonds to enable States & Local governments (who will bear the brunt of CoronaVirus spending) to raise the money they need? NY Muni debt is still fine thanks to Gov. Cuomo but very few states/cities have the financial clout & governance of NYC. Another reason Friday’s highly competent & effective Emergency declaration was so critically important for the entire country.

As was the statement from Secretary Mnuchin that he & Fed Chairman Powell are talking every day. We have always believed & said that the economy works best when the Administration & the Fed march together hand in hand. Yes, sometimes it takes a crisis but so be it. So we do expect a clear statement from Fed Chairman Powell on Wednesday with another cut in the Federal Funds rate, if not sooner.

Another big positive is the plan to purchase of 75 million barrels of Oil from US Shale producers as stated by Dr. Larry Kudlow on the Hannity Show on Friday late evening.

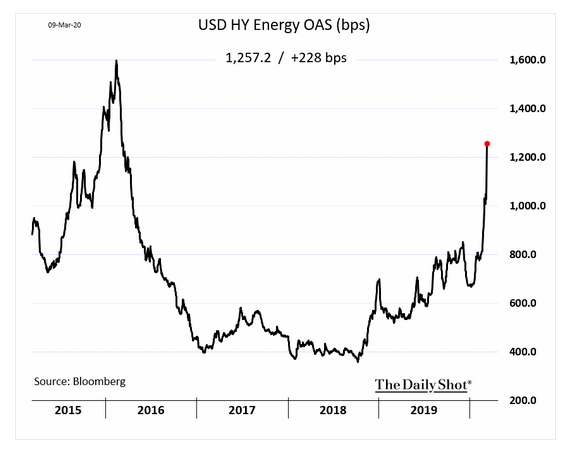

- Gregory Daco@GregDaco – – Stress in the HY energy sector via @SoberLook

We are not turning into socialists but we can’t expect a US corporate sector to fight alone in what is literally a “if I go, I will take you with me” type war between sovereign nations (Saudi & Russia). They need support from their own sovereign & we are delighted that President Trump & his team recognize that.

4. US stocks

The S&P has not delivered two successive up days since this carnage began. Will Monday prove to be an exception to this new “rule”? Jim Cramer voiced concern while discussing the views of his colleague Mark Sebastian. For some reason, this clip with charts is not to be found on CNBC.com or perhaps we are not smart enough to find it. So below is an excerpt from Cramer’s Street.com site:

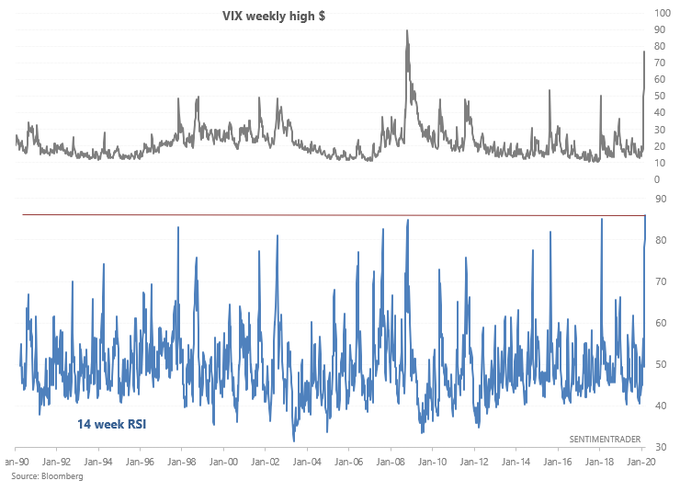

- “Sebastian studies the CBOE Volatility Index, also known as the VIX. He notes that this week, it had its fourth-highest close ever. The only closes higher than the current time period were during the Great Recession. ”

- “Peak volatility does not mean peak selloff, though. In other words, even if the VIX has hit its high, it does not mean we have seen the lows in the stock market. For instance, during the Great Recession, the VIX hit its two highest points in the fourth quarter of 2008, but was well below those highs when the market bottomed in March 2009”.

Everybody we know told us on Thursday evening that the S&P will fall another 15-20% before it finds a credible bottom. On the other hand,

- SentimenTrader@sentimentrader – Thu – VIX’s weekly RSI (using HIGH $) is now at it’s highest level ever – higher than during the 2008 crash Fear is at a MAXIMUM. Stay alert for a major upwards reversal in stocks

What did Friday bring?

- Market Ear – VIX – biggest candle up yesterday, biggest candle down today. TGIF for most.

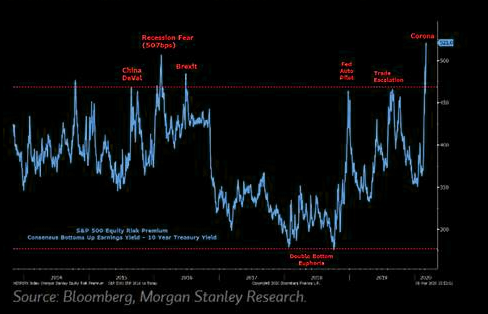

Also the cautious strategist Mike Wilson from Morgan Stanley suggested buying on Friday morning. And,

- Market Ear – Equity risk premium looks attractive

And what is next week? Option Expiration. How are they positioned? Did they sell their protection or close their hedges on Friday afternoon? In other words, what is the state of “Dealer Gamma”, the favorite term of Nomura’s McElligott?

- Igor Schatz@Copernicus2013 – 2680-2700 could still happen if we get short gamma books to chase the market at the close

And speaking of Mr. McElligott,

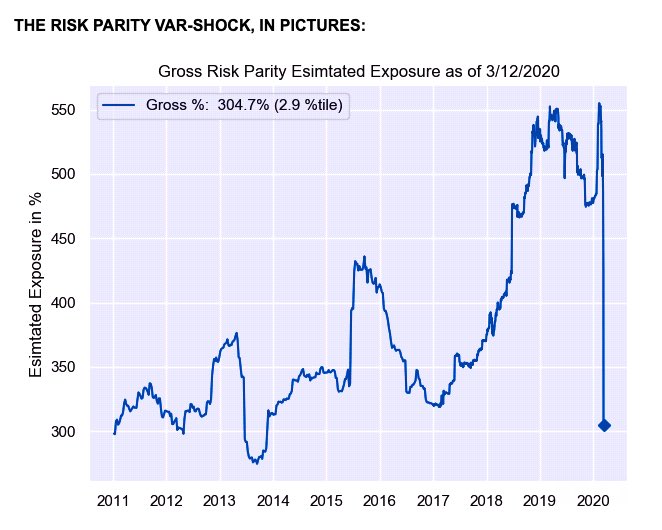

- JE$US@WallStJesus – MCELLIGOTT: #QE Has Returned. And The Risk Parity Kraken Has Been Unleashed. – https://go.shr.lc/2TNJO8c

What do these RP guys do? Sell when volatility spikes & buy when volatility falls. At least that is our understanding. If true & if the biggest down candle of VIX comment proves valid, then what?

Finally what is another opinion on the huge 7% rally in 25 minutes on Friday? And that too from someone who has had a hot hand recently:

- Keith McCullough@KeithMcCullough – I haven’t had such a great short selling opportunity day since October of 2008

Double finally, words from Rich Bernstein about how he is positioned going forward:

- “Everyone always looks for bubbles, and the bubble in this cycle wasn’t

in a specific asset class or sector. We think there was a bubble

in duration. Long-duration equities and long-duration bonds have been

tremendously overvalued and seem to be getting more so in reaction

to the black swan events. We remain hesitant to join in the fun. These sectors are performing very well, but it has rarely been a prudent strategy to buy historically overvalued assets.” - “Consumer Staples, Health Care, Utilities, REITs, Large Cap, and high quality

remain the dominant themes in our US equity portfolio. Our cyclicality

continues to be in China … Our fixed-income exposure remains in short-duration treasuries and TIPS. Our TIPS positions have obviously been derailed by the oil shock, but we continue to

believe that the risk/returns in TIPS are superior to those in nominal treasuries.

Gold remains in the portfolio as it’s been for the past 2+ years as a hedge

against uncertainty. One thing seems certain: coronavirus isn’t going to add

to certainty, so we feel gold should remain a core part of our portfolios.”

Speaking of Gold,

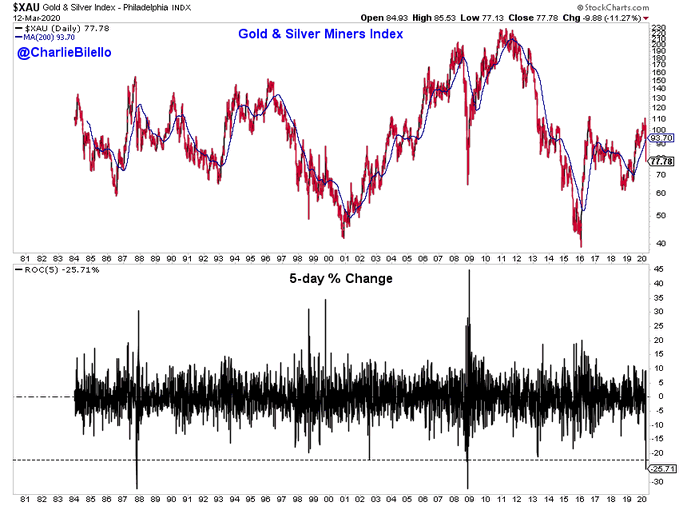

- Charlie Bilello@charliebilello – – Gold & Silver Miners Index down 26% over the last 5 days, the 3rd largest 5-day decline ever after 2008 & 1987. $XAU

5. Holi

This was one nasty bad week with major indices down 9-10%. But it ended with a bang, a 7% rally in the final 25 minutes of the week. What could be a better celebration of Holi, a festival of colors & song that celebrates victory of Good over Evil and the transition to Spring from Winter. Enjoy one of our most favorite Holi songs, a song that also shows what happens during a Bhaang-inspired Holi dance doesn’t matter:

President Trump wished Happy Holi to the Indian people just over two weeks ago on February 24. Now it is our turn to wish a very Happy Holi this weekend to President Trump & hope his declarations on Friday afternoon deliver brighter colors & festivity to all of America.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter