Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Fed At War”

We have used the war analogy since the launch of the CoronaVirus task force by the President in the Rose Garden. We used it deliberately to describe how all the branches of the US Government were coming together to unleash the power of USA. This Thursday, we read another war analogy from an unlikely source. Krishna Guha, the erudite ex-Fed guy at Evercore ISI, described the Fed’s “stunning in its scope” action as below in his note:

- “The Fed is at war against the virus and this is a wartime degree of commitment to credit policy,”

But the Fed is only one branch & no country goes to war with only 1 branch. What we saw on Thursday was the new & current “Bank of Uncle Sam“, as Paul McCulley, the ex-Pimco guru, labelled it on Thursday on CNBC. He spoke of “beautiful cooperation” between the Fed, the Treasury & the Congress.

Read what Chair Powell said in his Q&A on Thursday, via Jim Bianco tweets:

- “These programs we are using, under the laws, we do these, as I mentioned in my remarks, with the consent of the Treasury Secretary and the fiscal backing from the Congress through the Treasury. And we are doing it to provide credit to households, businesses, state and local governments. As we are directed by the Congress. We are using that fiscal backstop to absorb any losses we have.”

- “Our ability is limited by the law. We have to find usually, and exigent circumstances and the Treasury Secretary has to agree, and we are using this fiscal backstop. There is really no limit of how much we can do other than meet the tests under the law as amended by Dodd-Frank.”

So what has the Fed achieved, really? The best answer came from CNBC’s Mike Santoli who said “Fed has taken away the scariest scenarios“.

- Tony Dwyer@dwyerstrategy – That Fed move is a game changer. They clearly saw what a bunch of us were worried about in credit. They obviously cannot change the economic decline as we are shut in, but they are doing EVERYTHING they can to prevent another credit crisis.

Dwyer is absolutely correct. Businesses, individuals are in an impossible situation because of enforced shut-down, lock-down conditions. There is nothing they can do until the economy reopens for business & until the damage done to finances of companies can be unwound. This is why it is absolutely mandatory to prevent a credit crisis taking hold before the economy has a chance to recover. That is what the Fed is determined to do at least via its unlimited market operations.

Last week, we pointed to the havoc in mortgages via a chart of Anally Mortgage stock, NLY. This week, NLY rallied by 52.5%, the bulk of the gains coming on Wednesday & Thursday. High Yield ETFs, HYG & JNK, rallied by 12% on the week.

If you doubt the Fed, look at the bounce in Long Duration Treasuries which were sold in bulk during the Risk Parity meltdown. Remember the liquidation in LQD, the investment grade bond ETF? It is practically back to old highs on high volume. But what about HYG, you ask? Look at the chart of HYG vs. SPY via The Market Ear:

The message is loud & clear, at least in credit, meaning the stuff Fed can buy. Don’t fight this Fed, not when it is at War. As Krishna Guha, warned in his note – “The Fed hasn’t yet exhausted its ammunition. There’s more it can do.”

Simply put, this is not merely a tale of “two sinks”, as Jeff Gundlach put it. There is no shortage of “sinks” at the Fed:

- Jim Bianco@biancoresearch – – The Fed just threw another “kitchen sink” at the markets. Another $2.3T in buying. * new SPV to buy $500B of munis * Will buy junk now (if downgraded after March 22) * will buy junk ETFs (now HYG) * will buy PPP and CARES loans * expanded existing SPVs

2. Fixed Income

A perfect week in Fixed Income, at least as the Fed would see it. Treasury rates went up at longer maturities – 30-yr & 10-yr yields rose by 11.5 bps; 7-yr rose by 8 bps & 5-yr yield rose by 2 bps. Correspondingly TLT fell by 2% while High Yield ETFs, HYG & JNK, rose by 12% each on the week. Munis rose in price as well.

Remember Thursday, March 19? That was the day we noticed a turn in what we call real reflection of Fed’s liquidity working. That Thursday morning DPG, a leveraged credit Closed End Fund (CEF), began outperforming HYG, the unleveraged credit ETF. Also the leveraged Muni funds like NAN began outperforming MUB, the unleveraged iShares Muni ETF. Looking back, what a turn it proved to be, both in absolute & relative performance:

- DPG is up 96% from the Thursday 3/19 turn; in contrast HYG is only up 16%; While MUB is up 13% from that Thursday’s turn, NAN is up 28%.

And even after this torrid rally, DPG yields 13.10% and HYG yields 5.31% while the NY Muni CEFs, like NAN & MHN yield 4.2-4.3%, triple tax exempt.

As a disclaimer, we don’t claim to have any special expertise in closed end funds & we certainly don’t have the infrastructure to research the large number of such funds. So we tend to use the funds recommended by Bond Kings & such. For example, we learned about Muni closed end funds by reading what Bill Gross used to say about them. We also remember that Jeff Gundlach recommended buying DPG & UTG near the bottom of the high yield sell off in February 2016.

Buying Muni CEFs as the Fed is about to begin a rate cutting cycle & selling them as the Fed is about to being a rate tightening cycle has proven to be a winning strategy. But these funds don’t do well during credit crisis, either the 2008-2009 kind or the March 2020 kind. On the other hand, buying them as the Fed starts pumping in liquidity to reduce/end credit crisis tends to work well. This is simply our experience, not a recommendation in any way.

3. US Economy

The Fed can do a lot as it has already demonstrated & the Fed can do a lot more as they have said. But the Fed cannot make the economy come out of the CoronaVirus. Consumers have to start spending; Businesses have to start hiring & increasing wages. And that looks kinda far away, right now.

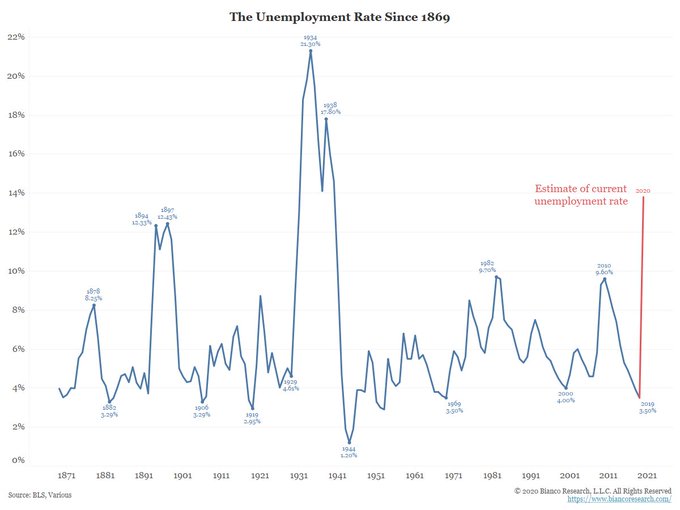

- Jim Bianco@biancoresearch – 10.27% lost their jobs, plus the 3.5% unemployment rate in Feb (before the virus). 13.8% unemployment rate right now. Highest since the Great Depression. (4/4)

Mike Wilson of Morgan Stanley said a couple of weeks ago that this recession will be steep but short. Now he has some company. Look what David Rosenberg said:

- “… The recession now seems to be short and severe, but there is no V-shaped recovery, either. …. I sense that we’re heading into a new chapter where we can start to pick a point of re-entry and get back to work. We have reached a point where the fear of economic disaster is starting to outweigh the fear of death by the coronavirus. It will start as a trickle and then become a trend … “

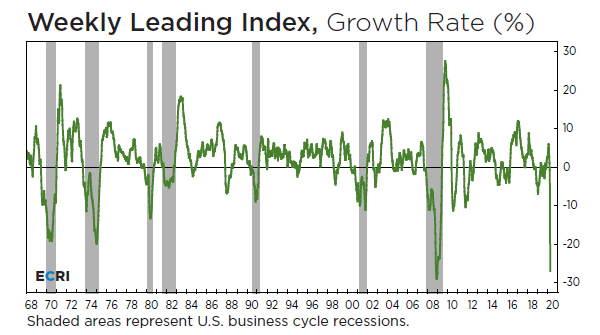

Hmmm! But what about the plunge in the Weekly Leading Index? Look what its creator/administrator tweeted this week!

- Lakshman Achuthan@businesscycle – This recession will be extremely deep, very broad, but relatively brief. Here’s why: bit.ly/348t7bf

Their conclusion:

- Regarding duration, though, this recession still could end up on the short side. In fact, there’s reason to believe it’ll be much shorter than the 2007-09 Great Recession, which dragged on for 18 months … it’s plausible that this recession could last about a half-year, rather than the one and a half years we endured during the Great Recession..

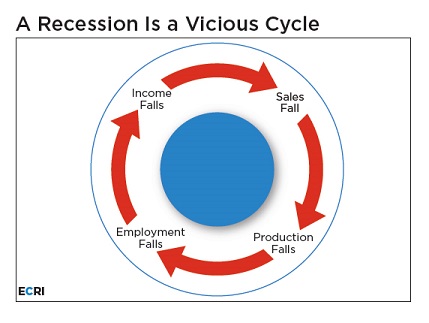

But what about the Vicious Cycle?

- “But if those shutdowns start ebbing by summertime, the economy will then begin reviving, albeit slowly and partially. As a result, the level of economic activity – in terms of output, employment, income and sales – will necessarily rise above the lows seen during the worst of the closures. … It’s when this vicious cycle ends, and switches to a virtuous cycle of self-feeding increases in output, employment, income and sales, that a recession is officially over. We believe that the end of the compulsory closures can jump-start this virtuous cycle in relatively short order.“

Is this what the S&P, especially the Russell 2000, were saying this past week?

4. Stocks

What a week! The Dow was up 12.7% & the S&P 500 was up 12.1% in its best week since 1974. But this pales before the 18.5% rally in the small cap Russell 2000, its best week ever. Is this the stock market sensing what Lakshman Achuthan wrote about a virtuous cycle beginning in Q4?

Or did the stock market show what Tom McClellan wrote last week about the message from the bearishness?

- “My data go back to 1990, and this is the largest 4-week change in the bearish percentage in all of that time. …. The message to take from seeing this sentiment extreme is that there is a lot of potential energy stored up which can help the market to rebound, as all of the investors and analysts who are on the sidelines or outright bearish can be harnessed and turned into buying pressure…. “

OK, but all that was last week. The S&P 500 closed at 2790, just below 2800. And 2800 was been an obstacle for awhile.

- Lawrence McDonald@Convertbond – – S&P 500 2019 Aug 5, 2800 May 23: 2800 May 13: 2800 Mar 28: 2800 Mar 15: 2800 Feb 24: 2800 2018 Dec 3: 2800 Nov 7: 2800 Oct 17: 2800 Oct 10: 2800 Aug 15: 2800 Aug 2: 2800 July 20: 2800 June 13: 2800 Mar 13: 2800 Jan 16: 2800 *A lot of “all-time highs” wrapped around 2800

Is that why a DeMarkian increased his shorts on Friday?

- Thomas Thornton@TommyThornton– Added back 5 ETF shorts late in the day. I’ll fight the Fed at $SPX 2800 with likely 20% unemployment

What about one who has been right on being long the rebound?

- Douglas Kass@DougKass – Big change in positioning today. From large long to market neutral on @realmoney for analysis.

Then you have the emphatic tweet from the Bond King:

- Jeffrey Gundlach@TruthGundlach – Sure glad I closed out all my equity shorts below 19,000 on the DJIA. Equally glad I put a few back on the last couple of days. If the Fed bails out everyone no one actually gets bailed out. Think about it.

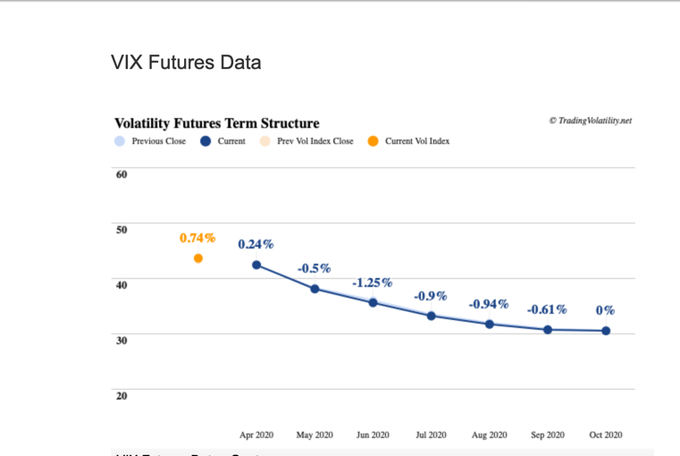

What about the VIX? One view:

- Bob Lang@aztecs99 – when they talk about bending the curve, the VIX is certainly looking that way, too.

Another view:

- Thomas Thornton@TommyThornton – – $VIX chart thoughts. Potential for upside reversal in the coming days

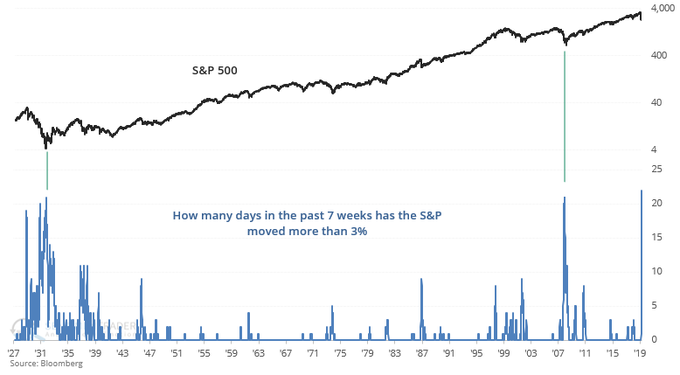

This near term stuff aside, is there a message in the volatility?

- SentimenTrader@sentimentrader – Volatility records being SHATTERED: 22 days in the past 7 weeks have seen the S&P move more than +/- 3% The previous records were in Oct 1932 and Nov 2008. In those 2 cases, the S&P staged *epic* rallies of +40% and +27% over the next year

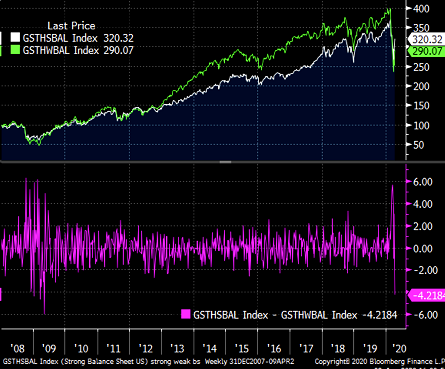

In a similar spirit, Market Ear sees a similarity to May 2009:

- Just like May 2009 – Strong balance sheets underperform weak balance sheets by the most since May 2009 this week. Is the narrative changing from “just like the crash of 2008 / just like bear market rally of 2008” to “just like the beginning of the mother of all recoveries and start of new bull market”?

5. Dollar, Gold, Commodities, Oil

After a 2.5% rally the week before, the Dollar fell 1% this week. Thanks to that & the new huge $2.3 Trillion stimulus from the Fed, Gold rallied 5% & Silver rallied 9%. Miners GDX & GDXJ rallied 15% & 20% this past week.

- David Rosenberg@EconguyRosie – The Fed is going to be buying HY bonds! In addition now to the muni market and investment grade. Equities come next, I am sure. The Fed has followed the ECB, which had already followed the BoJ. As Powell’s picture goes on the hundred dollar bill, gold is going a lot higher.

Gold mining stocks were not the only ones rallying hard. Mosaic was up 30% on the week, as were base metal stocks with FCX up 30% & CLF up 25% . And amazingly, Oil services ETF was up 20% on the week, while Oil fell 17%. Guess Fed support for High Yield bonds is far more important for the beleaguered oil services sector than the price oil or the disappointing 10 million barrel OPEC deal.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter