Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”He Giveth & Taketh Away”?

Remember what happened after the April 29 FOMC meeting & Powell’s presser? “A summary of performance from ten minutes prior to (April 29) FOMC to Friday’s (May 1) close is below:“

- “VIX up 18%; Dow down 3.8%; SPX down 3.8% (both vs. down 21 bps for entire week); Russell 2000 down 7.7% (vs. up 2.2% for week); EEM down 5.7% (vs. minus 1% for week); Citibank down 9.5% (vs. up 5.9% for week); HYG down 1.5% (vs. up 35 bps for week); JNK down 1.4% (vs. up 34 bps for week); OIH, the Oil Services ETF, down 7.6% (vs. up 16% on the week).”

The next week (May 2 – May 8) we described as perfect. Then came the May 9 – May 15 week which went as below:

- “VIX up 14%; Dow down 2.7%; SPX down 2.3% ; Russell 2000 down 5.5%; EEM down 2.5%; Citibank down 9.7%; HYG down 1.3%; JNK down 1.3% ; OIH down 8.5%.”

Our reasoning on May 16 was as below:

- “Why the eerie similarity? What was common to both these weeks 4/25-5/1 and 5/9-5/15? Fed Chairman Powell spoke during both these weeks. He put the kabash on stocks & risk markets. Why?”

- “Our guess is that he is still worried about the U.S. Economy but he is really upset about the huge stock rally. He would love a 10% correction in stocks so that he can add more liquidity without fear of being accused of creating another bubble. “

Apparently, Chairman Powell was disturbed by the sell-off in risk assets. So he went on 60 Minutes on Sunday, May 17 and basically said “don’t bet against us“. Look what that delivered from Friday May 15 to this past Monday, June 8:

- Dow up 16.4% from 23685.42 to 27572.44; SPX up 12.9% from 2863.7 to 3232.39; NDX up 8.2% from 9152.64 to 9901.52; Russell 2000 up 22.3% from 1256.99 to 1536.89; Dow Transports up 29.5% from 7761 to 10052.85.

Not only did Chairman Powell launch this massive rally with his 60 Minutes speech but he also let loose animal spirits embodied by Dave Portnoy who called Warren Buffet a has-been. Don’t you think Powell was stunned by what his 60 Minutes address had launched? Don’t you think he felt it was his responsibility to take this madness down? Don’t you think he felt this Portnoy-led madness would constrain him from delivering more stimulus when needed?

We think so. So in his statement & presser this Wednesday, he painted a dismal picture of the economy and almost painted himself as helpless. There was not even a trace of his 60 Minutes “don’t bet against us” bravado. And he did it to a market that was itself ready to be taken down after its euphoric 1,290 point rally on Friday & Monday, June 8.

We think the stock market’s reaction to Powell was sensible & rational. Some used to berate the stock market in undiluted terms:

- David Rosenberg@EconguyRosie – Jun 11 – So Powell fails to play the role of economic cheerleader and doesn’t signal moving beyond high-yield to start hoovering up S&P 500 contracts. Seriously, that’s all it takes for the bulls to say ‘adios’? The hallmark of a completely unhinged equity market.

Really, does this abuse fit the “Rosie” image? Especially since the stock market listened to Rosie’s wisdom & dutifully followed Powell’s pointed direction by falling 7% on the Dow on Thursday, the day after Powell’s presser. It might have helped that the market was very overbought & needed an excuse to correct that.

Frankly, we don’t put much credence in the idea that the increase in Covid cases had a lot to do with the decline. This increases still seem isolated. Of course, if New York & the Tri-State area get bad then it would be another story. Then you have,

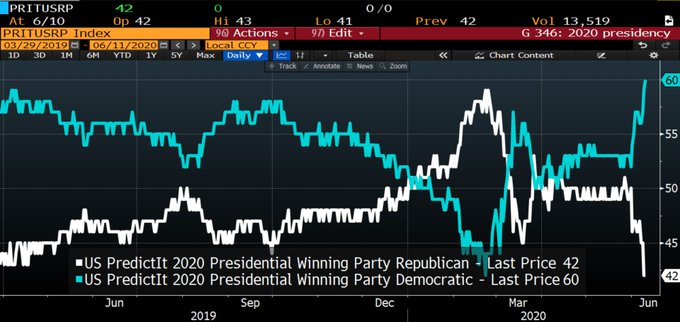

- Jeroen blokland@jsblokland – – Even wider: the gap between #Biden and #Trump election odds.

There is no question this will be a serious issue for the markets if it persists into the fall.

2. More Serious Risk – D word

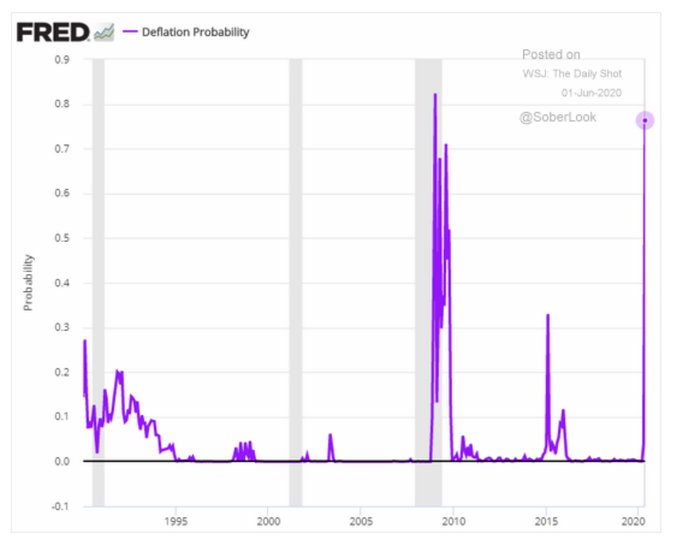

Last week we had featured a tweet & the chart below from the St. Louis Fed via @Soberlook showing that the deflation probability had spiked to dangerous levels (close to 80%).

This Thursday, the other D-symbol became a concern:

- Macro Charts@MacroCharts – Dollar Sentiment at 16, one of the fastest drops ever – near where some critical lows formed since 2011. Forecasters are predicting “dramatic falls” and a “crash coming”. A turn up in $DXY could shift global markets back to deflation at the margin, catching many unprepared.

This was no idle worry. By the close on Thursday, June 11, the yield on the 30-year Treasury bond had fallen by 26 basis points in 4 trading days. Remember the man who correctly advised in 2019 “Buy Bonds, Wear Diamonds“? On Tuesday, he came up with troubling charts:

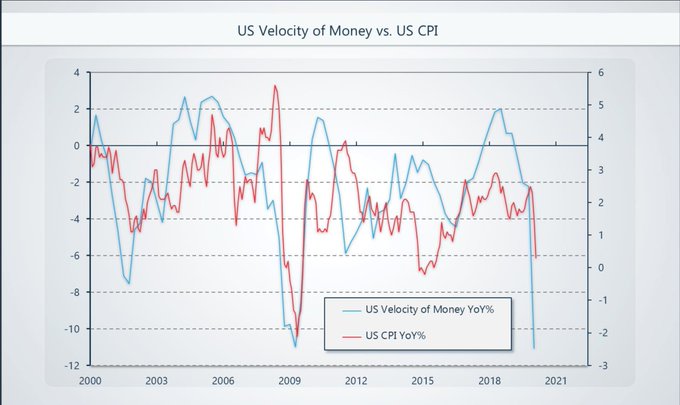

- Raoul Pal@RaoulGMI – And inflation is set to turn to deflation both in US and EU. Here is the US CPI vs. Velocity of Money…

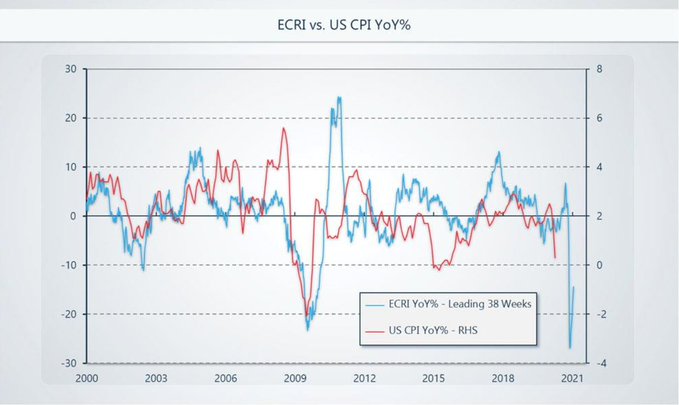

- Raoul Pal@RaoulGMI – And of you don’t like Velocity of Money then here is ECRI vs CPI…

Kudos to CNBC’s Sara Eisen for being that rare anchor who brings in smart guys to talk about interest rates going down from here. First she got Komal Sri-Kumar who said the 10-year yield will fall below 0.5%. Then she got David Rosenberg who said pooh & predicted the 30-year yield will fall to 50 bps and recommended buying the 30-year Treasury bond now.

3. On the other hand,

Albert Edwards of SocGen has been a prominent believer in the great deflation will be here thesis, otherwise termed as the ice age. That is why he has said that the 30-year yield will drop to Zero or below. He points out that, while consumer expectations of future inflation remain high, “delivered inflation” is plunging.

But he has changed his long term outlook coming closer to what we believe – that the stimulus from the Fed, the Administration & the rest of the developed world will keep getting larger & larger until, in his words, “the deflationary ice melts.”

That is why discussing how & when the Fed will reverse the stimulus & reduce the balance sheet is both pointless & stupid. Because the stated & deeply held commitment is to keep increasing the stimulus until the war ends. We know that was the case in World War II when the increase in production of military equipment kept on until that war was won. And that finally killed & cured the 1930s deflationary pandemic.

If the recent deflationary trend accelerates, we would expect the Fed to launch its next stimulus and Chairman Powell to go on 60 Minutes again, perhaps together with Secretary Mnuchin or Larry Kudlow. We expect that to happen even though the prior stimulus is yet to be used up as BlackRock’s Rick Rieder said to CNBC’s Becky Quick this week:

- “… amount of stimulus that has gotten into the system is so big & not only it is so big, but the multipliers on top of it are so significant … look at consumption data, credit card data, debit card data, trucking data … consumption is improving … housing numbers are pretty impressive, … people are starting to realize that this stimulus, monetary & fiscal, is very large & will get into the system going forward … “

But as Rick Rieder himself asked & answered

- “can it bring down unemployment back to 3.5%? … that’s going to be really hard … “

That is why we think we will see another stimulus before the previous one has had the time to get absorbed into the system.

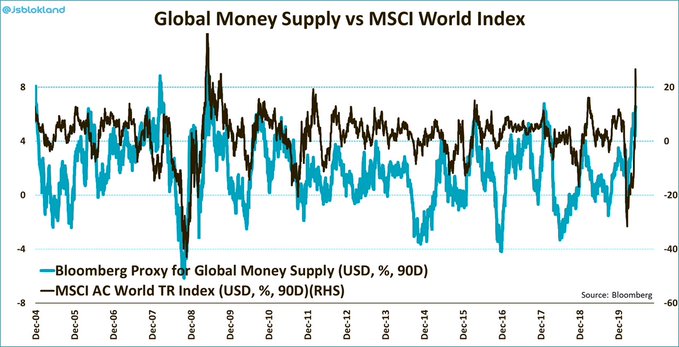

- Jeroen blokland@jsblokland – #Liquidity matters! An more is coming…

When will it get too much? When David Rosenberg comes on TV and says “Sell the 30-year Treasury Bond”!

A smart guy like Rosenberg will tell us to sell the 30-year T-Bond before the final stimulus is fully absorbed and that final unneeded stimulus will be the trigger to the rise of a new inflationary age. Because, as Albert Edwards put it, it will “ become increasingly clear that there is now no way left to reverse every government’s exploding fiscal liabilities“.

4. Wild Ride continues?

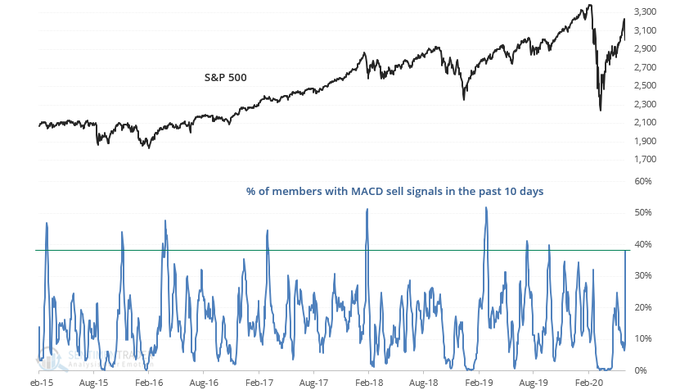

- Troy Bombardia@bullmarketsco – 38% of S&P 500 stocks have triggered a MACD sell signal. A significant number of stocks are rolling over. (This is happening in the NASDAQ 100 and Composite as well) Similar large spikes led to further S&P pullbacks and more volatility, particularly in recent years.

Stanley Druckenmiller mentioned the “breadth thrust” of Marty Zweig in his appearance on CNBC Squawk Box this week. That is a bullish indicator, as we recall. But look what Lawrence McMillan of Option Strategist wrote on Friday:

- “Market breadth expanded tremendously up through and including June 8th, culminating with “90% up days” on both June 5th and June 8th. In doing so, both breadth oscillators traded at the highest levels in their entire history. But, in a matter of just three trading days, breadth deteriorated so badly that both of the oscillators are now on sell signals.“

Isn’t that a textbook definition of a “wild ride”? But that itself could set up a buy signal according to Lawrence McMillan:

- ” … in the short-term, $VIX has spiked up, so a new “spike peak” buy signal is imminent.”

If U.S. Dollar is about to rally & if Deflation could be a near-term threat, what could be a trade that benefits?

.@CarterBWorth and @Michael_Khouw take a trip around the world of worry with a look at the emerging concerns for $EEM. pic.twitter.com/2RQEE4NJMZ

— Options Action (@OptionsAction) June 12, 2020

Speaking about EM, those interested can take a look at our detailed piece on how US is impacting the India-China competition and the long-term impact of Ladakh-Xinjiang on geopolitics. It is titled Ladakh-Xinjiang – Long term Game & A Window into China vs. India & USA.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter