Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Big Question

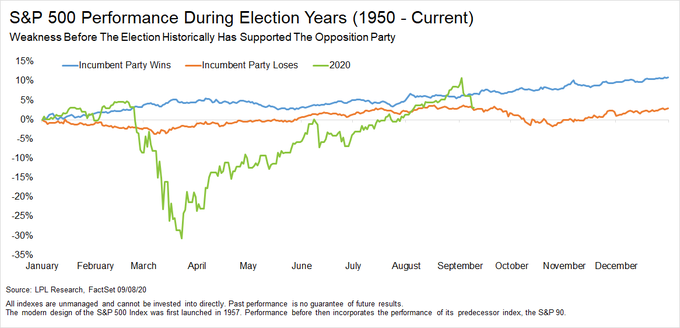

- Ryan Detrick, CMT@RyanDetrick – Historically, if the incumbent President is going to lose, stocks start to weaken right about now.

With this hanging in the balance, why on earth would Democrats agree to any economic stimulus at this point? After all the next 7 weeks are the end run of a four-year effort. Perhaps that is why Morgan Stanley’s Jim Caron said NO when BTV’s Jonathan Ferro asked him whether we will get a fiscal stimulus bill. But Caron remains bullish on Credit because of the Fed.

Mike Wilson, Caron’s colleague on the equity side, thinks stimulus will happen:

- “very near term, we have this risk of fiscal cliff & the negotiations are stalling out, that’s a big deal …. we don’t get Cares 2, we have a serious problem; but we think that will happen .. “

Even the ardent admirers of liquidity in the system & cash on the sidelines demand fiscal stimulus. Look what Rick Rieder said to BTV’s Jonathan Ferro:

- “you can’t underestimate the liquidity they are putting in the system; I have never seen in my career this sort of liquidity ; amount of cash that is on the sidelines is incredible …. the markets are generally in a pretty good spot …. should not be deluded into believing that economy has enough momentum on its own; it needs stimulus, it needs capital investment; it needs infrastructure ; state & local funding; health care funding… it has to happen ….”

2.”business cycle rules the roost”

No we are not quoting Lakshman Achuthan of ECRI, the outfit that almost displays the business cycle as their flag. The quote above is from Morgan Stanley’s Mike Wilson who told BTV’s Jonathan Ferro that his biggest investment decision was to flip to cyclicals over defensives in March. He says this is similar to 2000-2001 when the equal weighted S&P outperformed the market-weighted S&P.

- “surprised at the persistence & explosiveness of the economic surprises .. the earnings revisions that have come thru that is core to our thesis … this is a typical recession, recovery that is happening at light speed … the V shape is even sharper than we saw after the great financial crisis … very near term, we have this risk of fiscal cliff & the negotiations are stalling out, that’s a big deal …. we don’t get Cares 2, we have a serious problem .. but we think we power through that & next year the bull market will resume in earnest … index levels range bound is the call from MS now; why? differentiate between mkt cap weighted S&P and equal weight S&P; — multiple expansion has already happened; .. we see multiple contraction over next 3 months that will hit largest companies the hardest … the earnings story is very real … the average company has more operating leverage than the large cap behemoths who have already benefited … this is very similar to what happened in 2000-2001 when market weight S&P went down 30-40% and equal weighted S&P was up; this time we don’t expect market do go down 30-40%, we kinda expect it to trade sideways for a bit …but many stocks in the S&P 500 which can make new highs … that’s how we are positioning ourselves …. the story repeats, business cycle is the dominant factor … March we flipped & decided to get more cyclical …. cyclicals over defensives … business cycle rules the roost..”

Listen to the conversation between Mike Wilson & BTV’s Jonathan Ferro:

Rich Bernstein seems to agree:

- Richard Bernstein@RBAdvisors – #Russell #2000 up and #NASDAQdown today. Today’s implied economic forecast is #bullish. Remember broad markets signal better #economy.

3. Up & Down or Down & Up?

This week Jim Cramer featured the views of his colleague Carley Garner. She explained how the RSI, the Relative Strength indicator, failed to match the highs of the Nasdaq 100 and the S&P 500 recently. In fact, the RSI diverged from the NDX price action on the last two rallies. Unfortunately, CNBC keeps hiding the meat of such Cramer clips behind their pay-firewall. Of course, simple folks like us should be grateful that CNBC at least leaves a bit for the huge majority of their viewers:

- “e-mini S&P futures – as long as 3280 holds, 75% chance that S&P will make another run to new highs ; but that may be the last leg higher …. significant resistance at 3660; what if S&P makes a new high & then fails to jump the hurdle at 3660, then a fast & furious correction; then 3185 then 3050 & then 2750 … bottom line 3660 is less likely than 2750 …”

Tom McClellan used the Recent Non-divergence to argue for more downside now:

- “The history shows us that a meaningful drop out of such a divergence does not end after just a 3-day drop. Usually it lasts until this indicator gets down close to the 30 oversold level, or even below it. In either case, the implication for the moment right now is that there is still more work to do.”

In contrast, Katie Stockton of Fairlead Strategies is in the Down & Then Up camp, as she told CNBC’s Joe Kernen:

- “Assume this period is constructive … pullbacks are worse in first few days – 1st 3 days were hard … One more volatility spike that might do it …. Apple initial support at 100; that’s pretty dramatic downside; …. but it would maintain the uptrend”

What about the VIX? Lawrence McMillan wrote on Friday in his summary:

- “The trend of $VIX is in question. $VIX has closed above its 200-day moving average, which is negative, but the 20-day moving average of $VIX remains below the 200-day, which is positive. In practice, there won’t be a trend of $VIX until both $VIX and its 20- day MA are on the same side of the 200-day.”

- “In summary, we have both short-term buy and sell signals in place — more sell signals than buy signals. But until $SPX breaks support at 3280, the $SPX chart will not be bearish. If that happens, then a more severe downside move will be likely. In any case, we will trade the signals we have, both long and short.”

On the other hand, some have real conviction. Read what Thomas Thornton of Hedge Fund Telemetry wrote in a rare public release of his weekly commentary:

- “everything is a sell signal …. Sentiment in the US bounced and I expect a lower high bounce then lower. ALL OF THE US INDEX ETF’s NOW HAVE SELL SIGNALS WHEN YOU SEE IT LOWER INTO THE YELLOW ZONE”

And “ALL … ETFs” include TLT, the Treasury Bond ETF, as well as Gold.

One comment that might spell “Rolaid” after the above:

- Marco Kolanovic of JPM via Market Ear – “We retain a pro-risk allocation in our model portfolio, given the strong rebound in global growth, a tailwind from light investor positioning, the cheap relative valuation of equities, and policy support. The Tech- and Momentum-led correction over the past week removed some froth from overextended segments of equity markets, and reset already light macro and systematic positioning even lower” – Sep 11 2020 at 18:17

Send your feedback to [email protected] Or @Macroviewpoints on Twitter