Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.With Prayers & Best wishes

We hope that all readers offer their fervent prayers for a speedy recovery of President Trump & extend their best wishes to him and the Trump family. In fact, we hope those who don’t like him & don’t plan to vote for him do so with greater intensity.

We hope & wish the same to Ms. Hope Hicks & Senator Mike Lee and their families. Days like Friday tell us why human beings have fervently believed in prayer since our species was created.

2. Thanks to Cramer

We were watching CNBC after the close and we couldn’t help hearing an undertone (& perhaps more) in conversations between CNBC Anchors & Dr. Gottlieb about the President’s illness and the choice of the Regeneron Antibody Cocktail. That undertone was disturbing to us & we also felt that Dr. Gottlieb, as a CNBC Contributor, was trying to earn his pay by going along with the undertone of criticism from CNBC Anchors.

Then they got Jim Cramer into the conversation and it felt like a bright light was switched on in a dark room. Cramer was emphatic about the Regeneron treatment and explained what Dr. George Yancopoulos of Regeneron had explained to him on Mad Money just two days ago. Once Cramer began speaking, Dr. Gottlieb also changed his tone and became positive. That perhaps was not what CNBC Closing Bell anchors wanted but they wisely let Cramer to speak. Good for them and good for us.

Everyone should listen to Wednesday’s 3-minute clip of the conversation between Dr. Yancopoulos and Jim Cramer. And that is so whether you are anti-Trump or pro-Trump. The 1/2-liner take away is that their antibody cocktail gives patients their own immune response in a vial.

3. Numero Uno

The Dow was down 300 odd points in the pre-market and opened down as well. Then at a point, there was a swift rally.

- Jim Bianco@biancoresearch – S&P rallied 30 handles in less than five minutes on this headline *PELOSI URGES AIRLINES TO DELAY JOB CUTS AS DEAL ADVANCED Airline stocks are popping higher.

Not only did airlines closed up but the day fit the contrarian bullish Q4 trade of Hartnett of BAML:

- Market Ear – Hartnett’s contrarian bullish Q4 trade – Long global banks, energy, oil vs short US and EM tech. Bearish trade is long USD, defensives, util, long long bonds and short industrials….

Friday’s action showed that what matters most to markets is the stimulus they expect and not the economy. That is because a large stimulus bill serves as a bridge for consumer income & for struggling companies until the expected strong recovery in 2021. Look, even interest rates closed up on Friday despite a weak Non Farm Payroll Report.

4. U.S. Economy

First the Non Farm Payroll numbers:

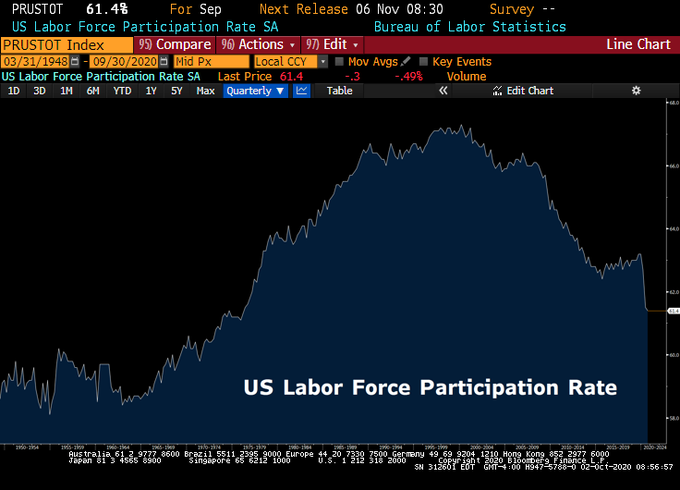

- Bespoke@bespokeinvest – US Sept Nonfarm Payrolls +661k vs +859k exp/+1.371mm prev U3 UER 7.9% vs 8.2% exp/8.4% prev U6 UER 12.8% vs 14.2% prev LFPR 61.4% vs 61.9% exp/61.7% prev

- Bespoke@bespokeinvest – A ~200k miss on the headline NFP number but a beat on private payrolls (877k vs. est. 850k). Manufacturing added 66k vs. est. of 35k. Last month’s NFP revised higher to 1.489 million from 1.371 million.

What did the gurus have to say? Depends on whether R is in the first name or last?

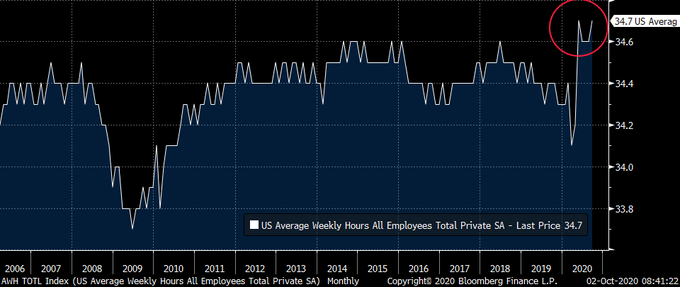

- Richard Bernstein@RBAdvisors – #Jobsreport disappointing for sure but sole LEADING indicator in report was actually strong. Weekly hours worked tied for highest in 15 years.

Then,

- David Rosenberg@EconguyRosie – The internals of the jobs report were horrible. The best of the employment story is behind us. And the permanent nature of the carnage is what we all have to deal with. Confidence is high only because ppl know the gvt will continue to put stimulus checks in their bank accounts.

See even the great Rosenberg concurs with our Numero Uno factor. What about the guru who predicted a short recession months ago:

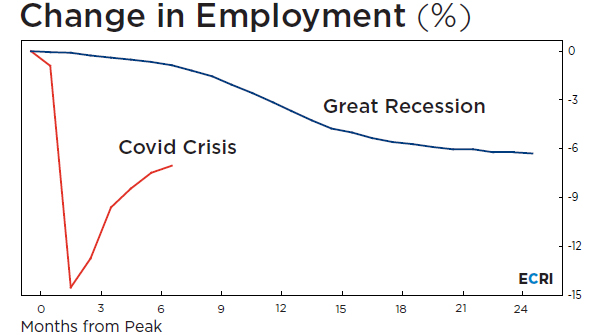

- Lakshman Achuthan@businesscycle – Still short of Great-Recession lows, the Covid recession jobs recovery is now slowing.

- Lawrence McDonald@Convertbond – BIG Problem Looking forward: At 61.4%, the lowest labor force participation, going back to 1976.

Larry McDonald also listed the layoff announcements overnight:

- Continental AG: 30k Disney: 28k Royal Dutch Shell: 9k: ALLSTATE CORP. TO CUT ABOUT 3,800 JOBS: UNITED DEEPENS AIRLINE INDUSTRY JOB CUTS WITH 13,000 LAYOFFS

But that didn’t matter to interest rates which closed up on the week:

- 30-yr yld up 8 bps; 20-yr yld up 7 bps; 10-yr yld up 4 bps; 7-yr yld up 2.5 bps; 5-yr up 2 bps; 3-yr up 1.5 bps; TLT down 1.8% and EDV down 2.6%.

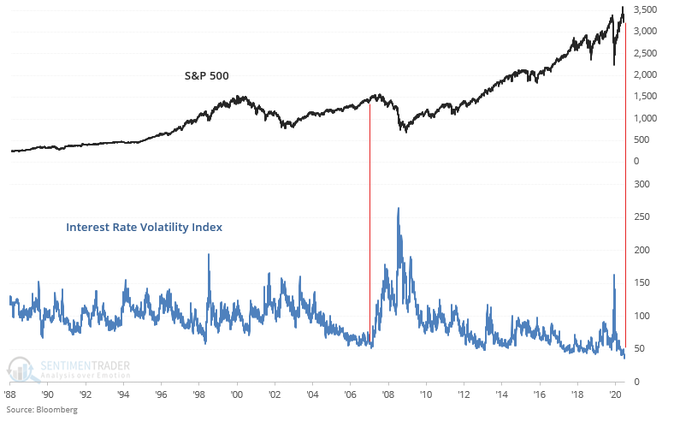

Not just did the interest rates go up but something else did, something the Fed doesn’t like to see. That, according to Market Ear, is “Treasury bond ETF volatility, VXTLT, continues exploding to the upside“

- “On Sep 23 we wrote – “Fed has definitely managed killing bond vol, but given the recent moves across assets and bond vol still in “coma” maybe it offers rather cheap optionality if things go very “fluid”?”

- “Since then VXTLT has managed putting in the biggest up move since the corona crisis panic, and things have not even started to get “fluid”. Irrespective of what assets you trade, watch bond vols and related instruments closely. One thing is sure, Fed might dislike rising VIX, but it hates bond related vols moving higher….“

Does this mean the Fed will come in? Or is the liquidity realized in credit already increasing? Remember what we wrote last week about our favorite realized liquidity indicator, the performance spread between leveraged DPG & unleveraged HYG?

- September 26, 2020 – “Not only is the absolute spread [between DPG & HYG performance] at about 35% is close to the March low spread of about 40%, but the RSI of DPG is almost touching the March low. And Friday was the first day in awhile to see outperformance of DPG over HYG. So are we close? We will see next week.”

Guess what? DPG was up 4.4% this week while HYG was up only 93 bps. And the turn in DPG-HYG did begin on Friday September 26 afternoon:

5. Stocks

Remember this tweet from last Friday?

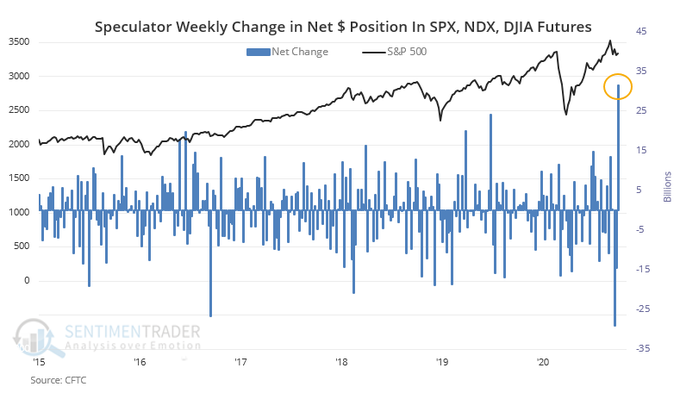

- SentimenTrader@sentimentrader – Sep 25 – Large speculators* haven’t had this much short exposure to major equity index futures in over a decade. They’re short about $47 billion worth. * Hedge funds, trend-following CTAs, etc.

Kudos, we say. U.S. Stock indices had an excellent week:

- Dow up 1.9% or up 509 points; S&P up 1.5%; Comp up 1.5%; NDX up 94 bps; RUT up 4.3%; Transports up 24 bps and EEM up 2.6%.

Mr. Sentiment Trader gave us terrific tweets for two consecutive weeks. What is he saying now?

- SentimenTrader@sentimentrader – What a difference a week makes. Speculators bought back about $32 billion worth of this net short position through Tuesday.

That is not so bad. Wait, he sees something that has led to the feared October apparition in the past, something that was discussed in the previous section:

- SentimenTrader@sentimentrader – Interest rate volatility is at an all-time low: In the past, such low volatility was followed by a sharp ramp higher and a stock market crash. 2007 all over again?

We ask again – will the fear of rising interest rate volatility make the Fed come in again? Or are they already coming in surreptitiously? Banks were up this week. Yes even Citi was up over 3% for the week. That doesn’t mean the Fed should not come in explicitly. Or are they still trying to pressure on Pelosi?

Speaking of banks, remember the two banks we highlighted last week? Yes, both HDB & IBN, private (non-government) banks in India, were up 6.5% each on the week, double the performance of both U.S. money-center banks but also of India ETFs.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter