Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Pictures over Words

We are simple folks who think simply. What follows below is neither erudite nor full of reasoned hypothesis. It is just what we noticed.

Guess when did the selling start this week? Just after J-Square (Jay & Janet) stopped speaking on Tuesday about 1:10 pm or so. Check out the one-day charts for Tuesday below:

DIA SPY

QQQ TLT

Tuesday’s charts for the Dollar and volatility are also consistent with the above. We cannot recall what J-Square said* that would cause this consistent cross-asset turn, but the turn is clear. It caused stocks to go down, TLT to go up (rates to go down) and Dollar to go up. Reflation trades & Commodities got shot on Tuesday. The biggest index hit was Russell 2000 which was down 3.58%. The next affected was KWEB, the Chinese tech ETF. But the NDX was only down 53 bps on Tuesday. VIX closed up 7.5% to 20.30. Wednesday was pure carnage perhaps due to overseas action with KWEB down 8.4%. But QQQ was only down 1.68%. The Russell continued its descent by falling 2.4%.

That downturn continued on Thursday morning until about 11:00ish. That is when the Dow, SPX & Russell 2000 made their week’s lows after TLT made its weekly high earlier Thursday morning.

DIA – 5 days SPY – 5 days

TLT – 5 days Russell 2000 – 5 days

Frankly, this week’s chart for the Russell 2000 is a beaut. And this week’s low for the Russell 2000 marks a 10% correction from the all-time high reached a couple of weeks ago. Remember what Mike Wilson of MS said when he downgraded small caps – that this cycle is marked by speed. So is it possible that the correction in Russell 2000 is nearly over?

Won’t it be interesting if Mike Wilson comes in next week to re-upgrade the small cap sector? For one, it would show that simpleton thinking may actually have a bit of value. On the other hand, Russell 2000 did closed down 3% on the week, the only broad index to do so.

This week’s chart of QQQ chart looks different from the above. And that needs to be viewed along side the KWEB chart.

Like the Dow, SPX & Russell 2000, the QQQ made its weekly low on Thursday morning. But it took another fall on Friday morning because of KWEB type stocks were sold off hard. And KWEB only stopped falling after the margin clerks closed their books around 2:30pm on Friday.

We don’t know if the selling of the positions (that are a part of KWEB) was completed on Friday or whether another forced selling bout will return on Monday. That makes us look at the charts of Volatility.

UVXY – 5-day VIX – 5-day

The tweet below suggests that even the big folks were too early on Friday morning:

- Joe Kunkle@OptionsHawk – Vol. is just going to die next week $UVXY to Zero? Sellers of next week $5.50 calls all morning

Boy, these short calls must have been painful from 1:00 pm to 3:00 pm. But what if they are right and volatility falls hard next week? As Lawrence McMillan of Option Strategist reminded his readers on Friday afternoon:

- “The volatility space has been a much friendlier area for the stock market bulls. The $VIX “spike peak” buy signal of March 4th remains in effect, and the trend of $VIX remains downward.”

VIX closed this week below 19. What if it gets closer to 15 next week? Wasn’t that Tom Lee’s hypothesis for the S&P to rally to a real new high, may be to 4400? The S&P did close above 3940, a key level for some gurus.

And what does next week bring?

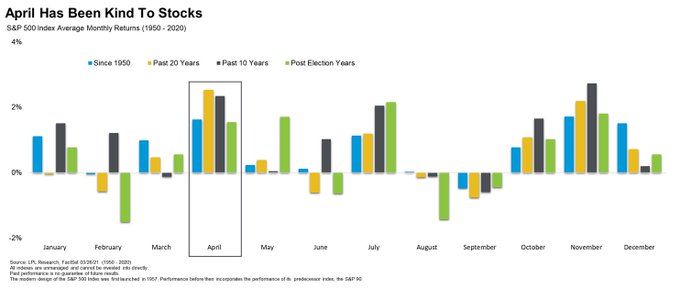

- Ryan Detrick, CMT@RyanDetrick – Remember we saw some late month selling in February and March. The good new is April is on the horizon, which has historically been a solid month for stocks.

It is important to end well, as the proverb tells us. So what ended the week very well? The Transports ETF, DJT, closed up 3%, almost double of S&P’s 1.5% rally. And its chart for the week looks well too.

It did have a double bottom on the week and it utterly ignored Friday’s liquidation of KWEB stocks.

What might be a good set of trades to put on just before the Easter break? Buying Costco, Walmart, Amazon & Shopify per the legendary Larry Williams via Jim Cramer:

What about the long term, you ask?

- Richard Bernstein@RBAdvisors – Mar 24 – Some say S&P 500 up 70+% in last 12 months indicates #risk. But no mention the index was up 70+% after the 2009 trough which signaled the beginning not the end of a #bullmarket.

*We tried the monetary “Silence is Golden” inducement to persuade Jay Powell from speaking aloud. May we now recommend “monastic silence” for both Jay & Janet for the next two weeks. It is a tried & true practice in many religions, as we are told.

2. Rise of the Rejected

In keeping with basic spiritual thinking, asset classes that have suffered rejection & contempt this year did better this past week. Yes, the heavily shorted Dollar bounced a bit for the second straight week. But the asset class totally rejected & virtually condemned by the rich & powerful actually showed some bounce. The Treasury ETFs, TLT & EDV, rallied for the first 3 days of the week. They gave up some of their gains on Thursday & Friday and closed up 1.2% & 2.1% resp.

The Treasury yield curve flattened some with 30-yr yield down 6.3 bps,20-yr yield down 7.1 bps, 10-yr down 5.6 bps and the 7-year down 3.4 bps. The 5-year barely budged though, only down 1.5 bps.

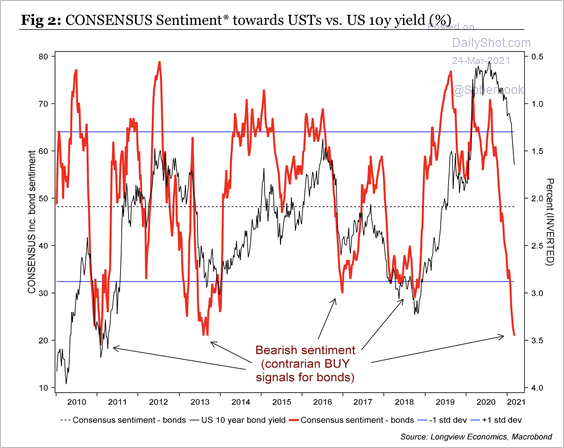

But Treasuries are still deemed outcast per

- Jesse Felder@jessefelder – Mar 24 – ‘Bearish sentiment on Treasury bonds is at an extreme.’ thedailyshot.com/2021/03/24/inv via @SoberLook

Whether Treasuries are brought back into society or they remain outcasts depends on next Friday’s Non-Farm Payroll number, a number that is expected to come in very strong.

3. The loved & embraced

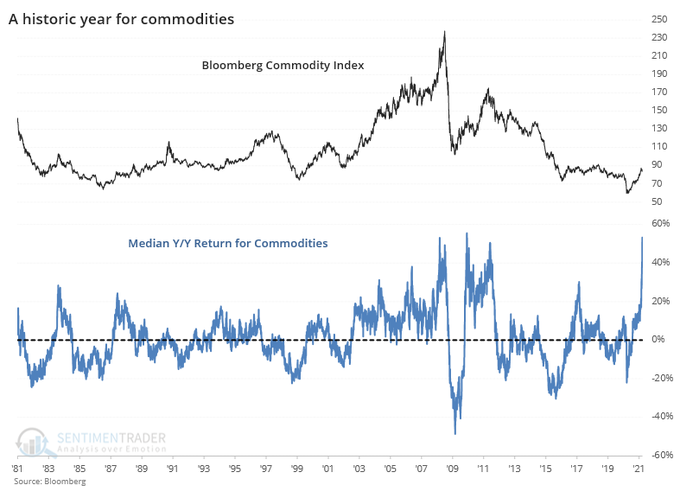

One view says “super-cycle”.

- SentimenTrader@sentimentrader – Mar 23 – A new super cycle? For only the 2nd time in 40 years, the median year-over-year return for a broad basket of commodities has surpassed 50%.

Some seem to want continuing evidence.

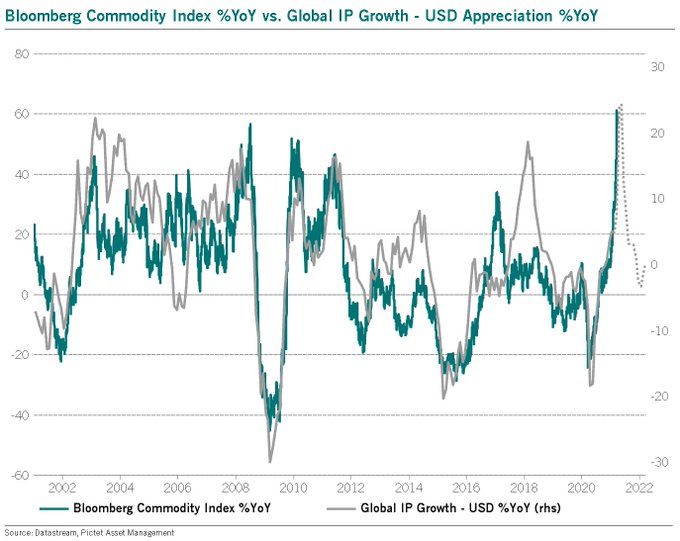

- Julien Bittel, CFA@BittelJulien – Here we go. Commodities have been all the craze recently, but… In order to be constructive from here, 2 things needs to happen: 1) Dollar needs to weaken further 2) Global growth momentum needs to surprise on the upside Weak USD + strong growth = rising commodity prices.

Very few can convey with as few words as Ian Bremmer:

- ian bremmer@ianbremmer – Mar 25 – This should work.

We do realize how big this event is & how widespread the consequences can be. But we have not found any one who can either quantify the impact or even offer a reasonable analysis. So we will let the markets tell us when they know in their enormous but finite wisdom.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter