Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.S&P Rally

Last week, we featured a Tom DeMark (via Cramer) call for a trend exhaustion signal at 4139 on the S&P and 33959 on the Dow. Both were left behind this week with S&P closing at 4185 & Dow closing at 34201. So was DeMark wrong or is a correction ahead at higher levels?

That reminds us of what a fervent bull had said a couple of weeks ago. When speaking of a “face-ripper” rally, Tom Lee had said that the S&P could to to 4,200 in April and then stall there for some time. Well, 4,200 is only 15 handles away or just a day’s work.

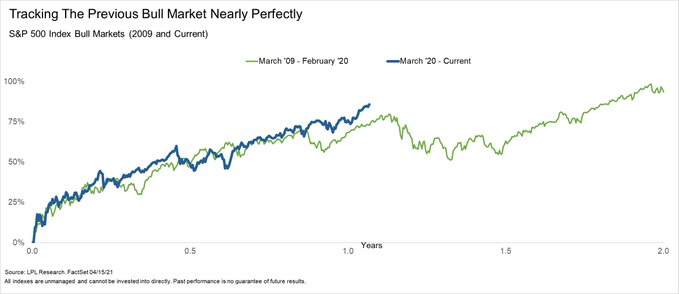

Then we saw one of the more bullish commentators warn of a parallel move & a reminder of what we might see shortly ahead if his parallel holds true:

- Ryan Detrick, CMT@RyanDetrick – Apr 15 – Amazing how this new bull market has tracked the ’09/’10 bull market. Be aware right about now is when that one finally rested and had a 16% correction into the summer months, before moving back to new highs before the end of the year in ’10.

This week another well-known strategist, Tony Dwyer of Canaccord, went neutral to a bit bearish on the stock market & said it is “time to take some profits“.

Describing his view as “a perma-bull pulls in the horns a little bit“, Dwyer gave 4 reasons for his step-back:

- “60-Minutes Powell was pretty hawkish – it was a change in tone”

- “Duke University CFO survey of 100s of CFOs is at the 3rd highest level in history – so no one on this planet can be surprised about good earnings & good economy in the next 6 months,”

- “Relative underperformance of cyclical stocks”

- “Tactical indicators are approaching stall speed ”

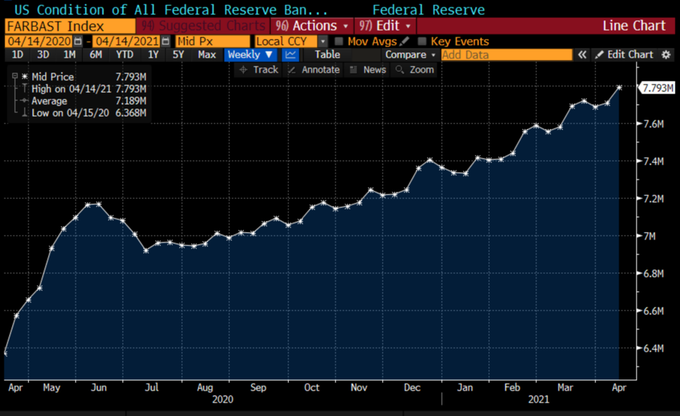

Speaking of the Fed talking hawkish, we must point out that

- Lisa Abramowicz@lisaabramowicz1 – The Fed’s balance sheet grew by $84 billion in the past week, the most in a month, to a new high of $7.79 trillion.

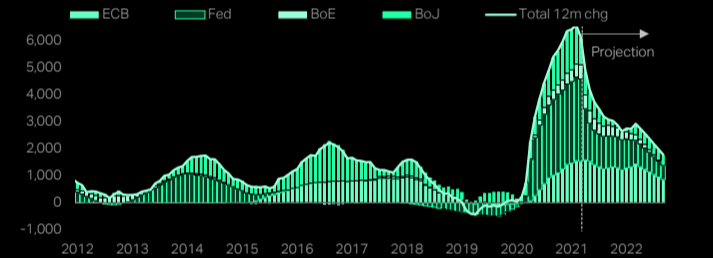

Look at the above chart & then look at below. The divergence might explain how derivatives can spoil the mood:

- TS Lombard via The Market Ear – Rate of change of the most important bid in the world – Rate of change of central bank purchases to slow, not turn negative. Chart shows central bank asset purchases, 12m pace ($bn)

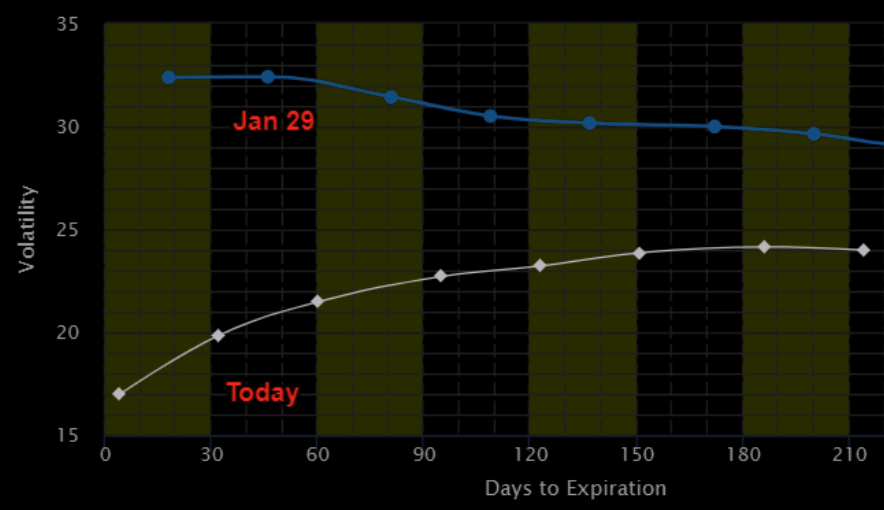

Remember Tom Lee talking about VIX going towards 15 as a reason for his to feel bullish? And recall that VIX “spike peak” of Lawrence McMillan was something we pointed out during the small S&P down moves this year.

Well, VIX 16 is nearly here with VIX closing at 16.25 on Friday. And now, according to the below, some “smart quants” are suggesting shorting it:

- vixcentral via The Market Ear – The looks of a vol collapse – VIX term structure now compared to late January levels – It is rather obvious what has happened, the entire curve has collapsed, but the puking of the short end of the curve is getting rather extreme. Time for some term structure trades. Several smart quant sales have been explaining why you should collect theta selling the short end of the curve, usually an early sign of doing the inverse, i.e betting the steepness will reverse from here. The Monday straddle is pricing approx 0.5% move only… that is how hated short term vol has become.

Isn’t that hate another side of the “perfect panic”?

- The Market Ear – SPX – 577 handles above 200 day moving average – Impressive how perfect the upside panic remains. Overbought, staying overbought…with RSI frustrating many. … Spuz is +8.5% from the low print on March 25. That is all but boring if you played some of those upside call spreads

Going back to Tom DeMark, recall from last week that he said, via Cramer, that QQQ should move higher even if S&P and Dow reach their trend exhaustion. And this week QQQ did get to a new all-time high. So is there time to worry about the QQQ “uptrend faltering“? That is what Tom McClellan said this week in his article NDX Stocks Above 100MA:

- “The Nasdaq 100 Index (NDX) is finally back to making new all-time highs, something that the SP500 has been doing more regularly in 2021. … Now those stocks are back in favor once again.”

- “The current reading of 80 is still below the highs seen in January 2021, but that is not really relevant. The February dip serves to reset the clock, and so now we need to watch for a divergence developing on the new structure, which has not happened yet.”

- “It is a positive sign to see increasing participation in the advance, in the form of more of the NDX component stocks climbing up above their 100MAs. At the point when we see continued higher highs in the NDX with a smaller number of component stocks above their 100MAs, it will be time to worry about the renewed uptrend faltering.”

But didn’t DeMark say that the up move of QQQ while S&P and Dow stall was dependent on Treasury yields falling? That brings us to:

2. Treasury Yields

Look what happened this week. While everyone was focused on S&P, Dow & QQQ reaching all-time highs, Treasury zero-coupon bonds outperformed all of them and even TLT matched the return of the Dow. Now if the S&P is about to falter & Treasury yields maintain their downward trajectory, then clearly the bonds will outperform. But for a short while, right? Not so argue some:

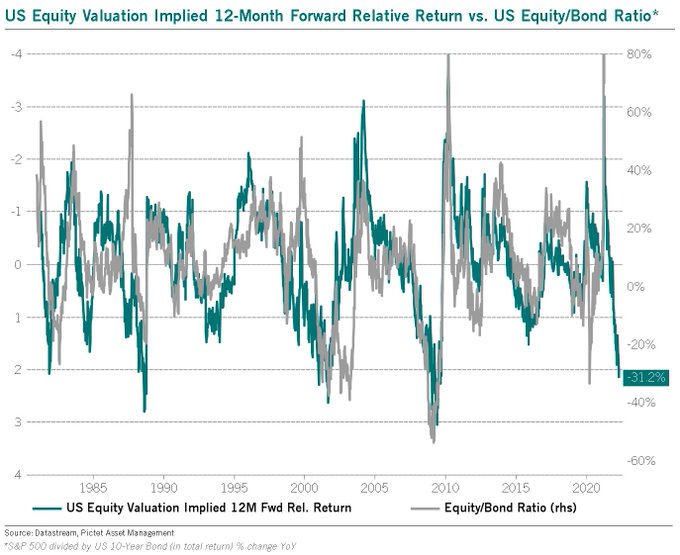

- Julien Bittel, CFA@BittelJulien – Apr 15 – Bonds > equities over next 12M.

Do not forget that the 30-yr bond return in Q1 2021 was one of the worst in 2 decades. So the upside returns from bonds could surprise many.

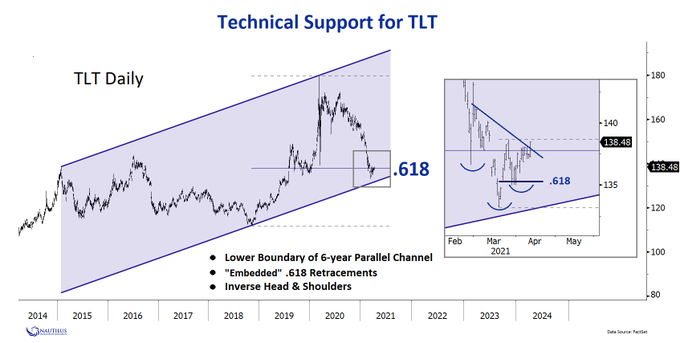

- Nautilus Research@NautilusCap – Apr 15 – $TLT — Embedded .618s, Lower Boundary of Parallel Channel & Inverse H&S…

Yields fell hard across the curve with 30-yr & 20-yr yields down 6 bps and the 10-yr yield down 7.5 bps to close at 1.59%. TLT closed at 139+ already achieving the midpoint of the channel that Carter Worth had predicted last week. But is that it? Not so tweeted Carter Worth on Thursday, April 15:

- Carter Braxton Worth@CarterBWorth – Apr 15 – Do 10-Year Treasury Bond Yields have to go to the bottom of the channel? Of course not. Is it still our contention that they will? Yes. As of now, yields are back down to the midpoint of the channel (and actually a bit below than the midpoint).

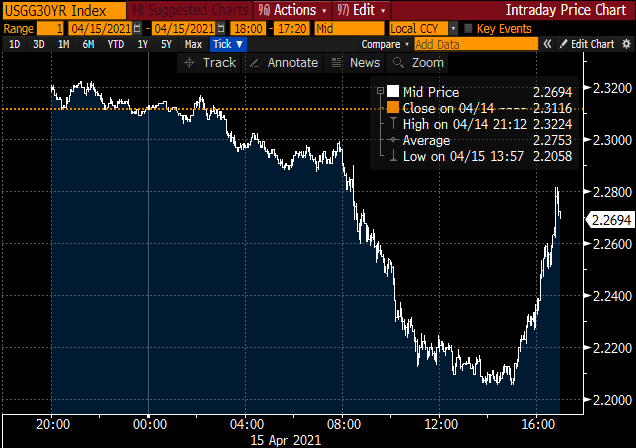

But that day, April 15, was really a big deal. The Retail Sales numbers were stunning and so was the fall in Jobless Claims. Then, instead of shooting up, Treasury rates began falling & almost collapsed. Then they rallied back in the afternoon to recover some of the fall.

- Brian Chappatta@BChappatta – Thu – The long bond had a long day.

The 10-yr yield fell as low as 1.51% on Thursday & then rallied to close at 1.55%. And it rallied further on Friday to close the week at 1.59%. Will this reversal continue next week? Meaning is the 2.5 week fall in Treasury rates over for now? Ira Jersey of Bloomberg said essentially yes on Thursday and Priya Misra of TD said on BTV on Friday that she sold the 5-year Treasury position she had bought at recent high yields on Thursday afternoon.

So next week could prove important for near-term direction of Treasury yields. But what was the reason Treasury yields fell so hard on Thursday after such terrific data? Obviously short covering of massive Treasury short positions was a big factor. But so was the reverse of what Tony Dwyer said in the above clip, that no will be surprised at the strength of the economy in the next 6 months. In other words, was all that strength & more already priced in the carnage in Treasury bonds in Q1?

There might have been something fundamental as well – the increasing belief that the US economic recovery will be hot but short. Or as Lewis Alexander of Nomura said on BTV on Thursday that the peak of economic strength is likely to be Q2.

- I want to point out on the big $1.5 trillion jobs plan that was passed, CBO’s estimate is they are going to spend $1.2 trillion of that before September; that’s extremely front-loaded …. peak in growth of the cycle for us is the 2nd quarter, the quarter we are in now …

Then you have the Fed’s Beige Book released the day before on Wednesday:

- David Rosenberg@EconguyRosie – Apr 14 – Beige Book theme: Inflation seen as temporary and more a margin squeeze problem for stocks than a true price-pressure problem for bonds. Here we are in an alleged inflationary boom, and the term “moderate” was used 105 times versus 73 six weeks ago.

3. Gold

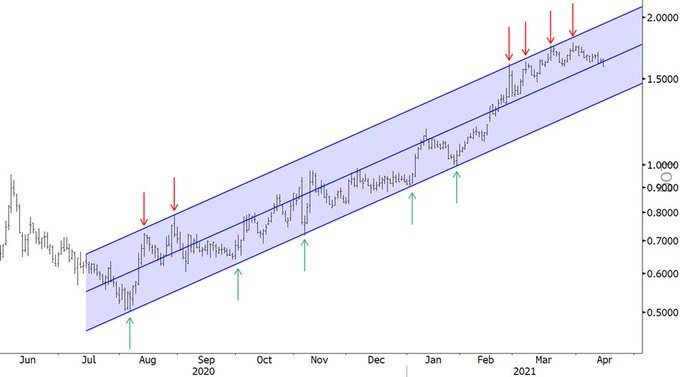

Last week, we featured positive comments by @MacroCharts & Carter Worth about Gold. Good calls by both as Gold rallied by nearly 2% and miners like Newmont rallied by 6.5% on the week. Kudos especially to @MacroCharts who have been right on QQQ and Treasuries for three straight weeks. What did they say this week?

- Macro Charts@MacroCharts – Apr 14 – Been less active here recently, just managing the book. Tech rally was critical to get right. Lately focused on Energy/Metals for another move. Price action remains textbook: responding w precision & no hesitation. Could go longer than many folks believe. Will be back w more soon

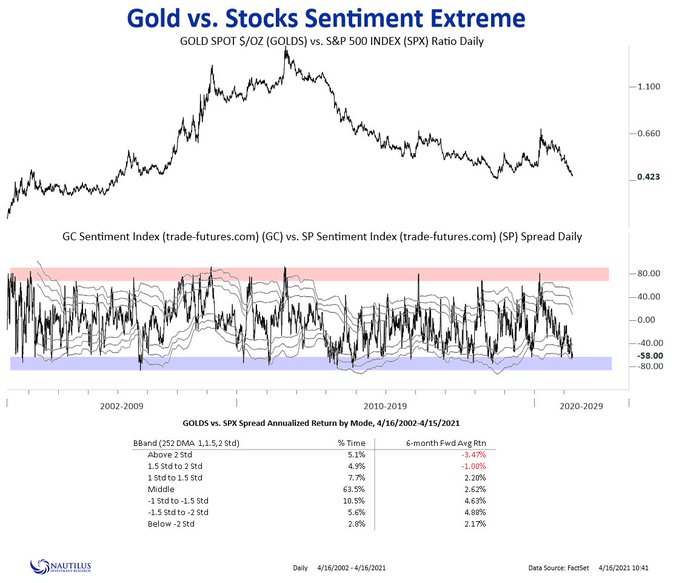

This week another smart entity joined the Gold call:

- Nautilus Research@NautilusCap – #Gold Gold Sentiment DSI vs. S&P Sentiment — Spread on sentiment well “bound” and showing possible extreme.

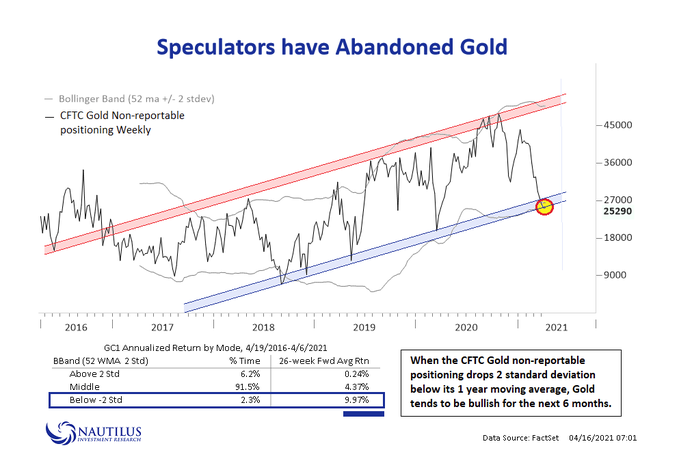

And specifically about Gold Miners:

- Nautilus Research@NautilusCap – #gold #gdx Possible sign that the abandonment of Gold is overdone.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter