Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Out of the Blue

Out of the blue on this Friday afternoon, we saw:

Federal Reserve@federalreserve–Watch Chair Powell on @60Minutes this Sunday at 7 pm EDT

Federal Reserve@federalreserve–Watch Chair Powell on @60Minutes this Sunday at 7 pm EDT

Before we could even ask why, we saw a response:

- Brian Chappatta@BChappatta – The fact that this is airing ~36 hours before what could be the highest CPI print since 2018 should not be lost on anyone.

And a prediction:

- Jim Bianco@biancoresearch – His will be speaking 36 hrs before Tues CPI report. My guess, he will tell everyone the coming CPI spike is a “base effect.” He will then properly pronounce the word “transitory” several times. Then he will reassure that the printing press will remain at 11 until its too late.

- Scott Pelley: Has the Fed done all it can do?

- Jerome Powell: Well, there is a lot more we can do. We’re not out of ammunition by a long shot. No, there’s, there’s really no limit to what we can do with these lending programs that we have.

Will he essentially say that again arguing there is lot to be done to get to full employment & to get wages up and for that there is no limit to how patient the Fed will be? He is not going on 60 Minutes to mince words or prevaricate. Our bet is he will come across as decisive and determined to assure the American people that he is on their side.

But is he going to be speaking to the American people or to One Man (& his advisors)? That is essentially what Wharton Professor Jeremy Siegel said on CNBC on Thursday:

- ” honestly, Powell is playing the game with Biden because he wants to be renominated in February of next year & I think there is a game here; that’s why he is being so compliant. I think the Fed recognizes the danger but we have to think who is Biden going to reappoint & I think he wants the job; once he gets that job for another 4 years, he can be much tougher on inflation”

Professor Siegel is no simple guy. He has taught a large group of students who now have key positions. He commands an audience in financial circles & has a major following. If he was bold enough to say what he did, we feel that theme is being discussed in his network. And as a professor he can speak freely that others may not be able to.

So is it a coincidence that Chairman Powell announced he will be on 60 Minutes the day after Prof. Siegel said what he did? We have no clue but we can’t dismiss the possibility.

We went back to read what we had written on November 26, 2020:

- “So, as we see it, the Biden team has gone “Trump-er” than even Trump. That is why they selected Janet Yellen to be their Secretary of Treasury, the one who might have greater influence within the Fed than even Chairman Powell. And they have kept Lael Brainard at the Fed as a leash on Chairman Powell to ensure he remains dovish in 2021. … This is a team with true progressive firepower that can intellectually dominate the Fed if necessary. Led by Yellen, you can depend on these progressive thinkers & credible implementers to keep the Powell Fed onto the straight & narrow dovish path.”

We remembered the above “Brainard-Yellen” comments when we saw the following on Friday:

- Brian Chappatta@BChappatta – Let’s talk fixed-income mutual fund reform. It’s the talk of the town in DC. None other than Treasury Secretary Janet Yellen and potential future Fed Chair Lael Brainard are determined to find a way to prevent the kind of bond-market chaos of March 2020.

The title of Mr. Chappatta’s article is Would Punishing Panic Sellers Doom Bond Mutual Funds? The key paragraphs are:

- “Since then, two of the most influential U.S. policy makers have been candid about the fact that bond mutual funds pose a unique and serious problem during times of market stress. First was Fed Governor Lael Brainard during a March 1 speech on preliminary financial stability lessons from a year ago:

- “The COVID shock also highlighted the structural vulnerabilities associated with the funding risk of other investment vehicles that offer daily liquidity while investing in less-liquid assets, such as corporate bonds, bank loans, and municipal debt. Funds that invest primarily in corporate bonds saw record outflows in March 2020. These open-end funds held about one-sixth of all outstanding U.S. corporate bonds prior to the crisis. Bond mutual funds, including those specializing in corporate and municipal bonds, had an unprecedented $250 billion in outflows last March, far larger than their outflows at any time during the 2007–09 financial crisis. The associated forced sales of fund assets contributed to a sharp deterioration in fixed-income market liquidity that necessitated additional emergency interventions by the Federal Reserve.”

Yellen remembers the utter mess Bernanke & she created via their 2013 taper. Brainard-Yellen recall the near disaster Powell created in Q4 2018 and they have seen the rapid sell off in Treasuries just a few weeks ago. If that was bad, they must be sleepless imagining the dreadful havoc a late 2020 or early 2021 taper might unleash.

Note when Brainard made the speech quote above. On March 1, right in the midst of the steep selloff that resulted from what Chairman Powell said. That should tell you how petrified the Fed Brain Trust is with the prospect of a market-forced taper. And they are not just petrified of the bond market’s reaction but the reaction of their political bosses.

And we just don’t mean President Biden & his team but we also mean Congresswoman Maxine Waters & the “progressive” wing. Just imagine how infuriated they would be if a steep bond market sell-off made it hard to fund the a big infrastructure plan.

All the above apart, we hope & almost think what Powell-Brainard-Yellen should be fearing is their “fear itself“. The damage and the sell off in long Treasuries was too steep to be repeated so soon. And then second half of 2021 may have “a different look“:

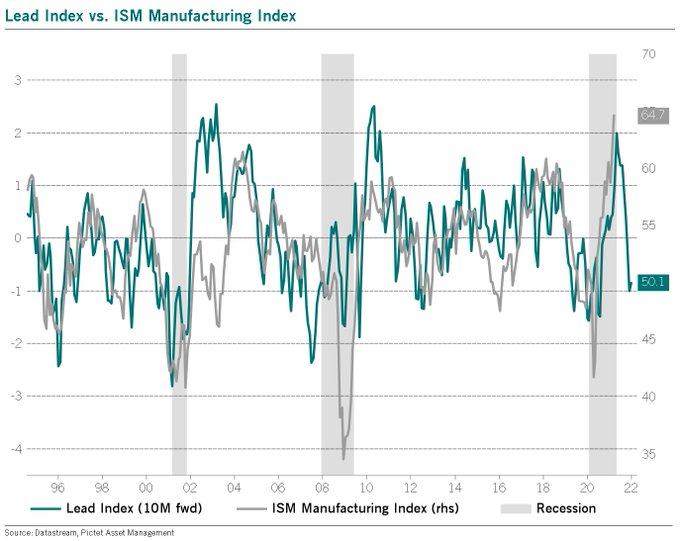

- Julien Bittel, CFA@BittelJulien – This is the chart that makes all of this interesting… Suggests a very different look to H2. I will send more charts on this next week.

2. Does rest of CNBC ignore Jim Cramer?

Yes, they respect Cramer, praise him, listen to him when he appears on their shows but, as this week showed again, they don’t even notice what he says on his own Mad Money show. No one on regular CNBC seemed to even know that Cramer made a big call on Tuesday, a decidedly anti-Cramer call for a top next week in the S&P and the Dow.

Well, Cramer didn’t actually make the call; Tom DeMark did. But Cramer would not have discussed it at length if he didn’t find it credible. Per DeMark as of Tuesday April 6, via Cramer:

- “S&P getting very close; S&P needs 2 more days to fit the pattern; 2 days when the index has both a higher high & a higher close; also S&P needs to hit his price projection around 4139 which should happen in 2 up days ; that would complete a DeMark countdown; if S&P falls, the first support is around 3909; if it breaks below that, DeMark expects some serious carnage… The S&P’s weekly chart shows same kind of uptrend exhaustion …”

- “now the Dow pattern is identical to that with S&P; 2 more higher highs & higher closes and a rally to 33959; …”

- “Nasdaq is a little different; DeMark believes QQQ will climb another 5%; he believes QQQ has more upside potential than Dow and S&P;”

- “Only way (Cramer said) we get Dow and S&P down and Nasdaq up if the bond market changes direction; Treasury yields need to go lower.. for me that’s the lynchpin of this whole thesis .. I think it might be starting today”

- “Bitcoin seeing uptrend exhaustion pattern; 66347 would be a significant top;”

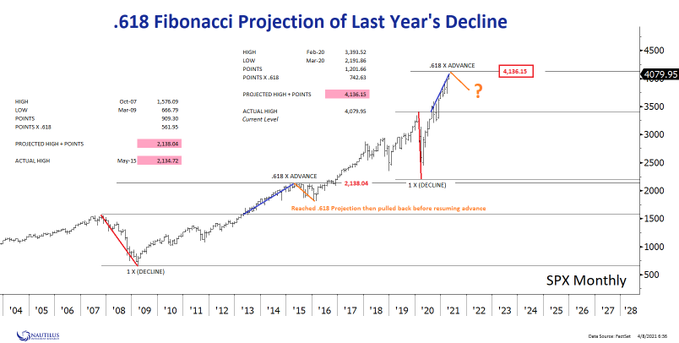

The S&P closed on Friday at 4128.80 less than 11 handles from DeMark’s 4139 target; the Dow closed at 33800.60 a bit farther than DeMark’s 33959 target. Another also pointed to 4136 target:

- Nautilus Research@NautilusCap – $spx #fibonacci — .618 Projection(s)….

What about the idea that QQQ can go up over Dow, S&P AND Treasury rates can fall? Guess who suggested that on Thursday?

- CNBC’s Fast Money@CNBCFastMoney – – Chartmaster @CarterBWorth of @csm_researchdigs into what’s behind the tech rally and if this surge can continue. $XLK $QQQ $NDX

Chartmaster @CarterBWorth of @csm_research digs into what’s behind the tech rally and if this surge can continue. $XLK $QQQ $NDX pic.twitter.com/za1Ndv1BMT

— CNBC's Fast Money (@CNBCFastMoney) April 8, 2021

The VIX closed at 16.69 on Friday and as it happens, “The most recent $VIX “spike peak” buy signal (generated on March 5th, 2021) has “expired” per Lawrence McMillan on Option Strategist.

Interestingly, a big trade was put on Thursday a 200,000 contracts July 25-40 call spread in VIX. And on Friday, Carter Worth of CNBC Options Action noted that VIX had filled a long unfilled gap this week and we are likely to get a pop in the VIX:

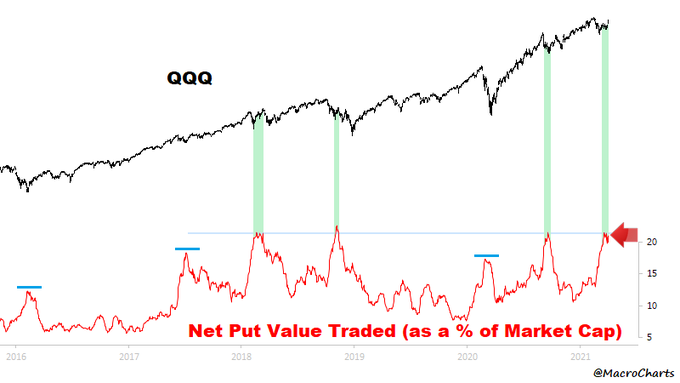

What about QQQ?

- Macro Charts@MacroCharts – Speculative options activity remains extremely pessimistic. $QQQ is up +11.5% in a month, with Put activity still in the stratosphere. It’s a full-tank “Wall of Worry” – still miles away from euphoria. At this pace, buyers will eventually have to chase *much* higher prices.

3. Gold

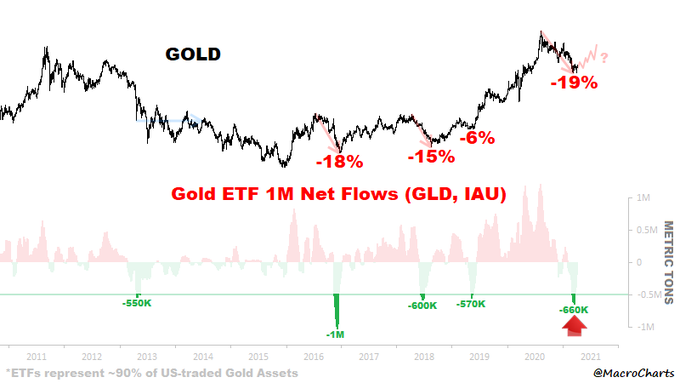

These folks have already been right on both Treasury yields & on QQQ. This week, they addressed Gold.

- Macro Charts@MacroCharts – Gold. • Second largest ETF capitulation in history – priors led to some massive rallies • Weekly Hammers in Gold/Silver last week – moving higher this week • Key Gold Miners leading higher A potential significant contrarian Buy opportunity setting up for Q2 – watch closely.

In a rare three out of three, Carter Worth agrees:

- Options Action@OptionsAction – Looking for a shining opportunity? Chartmaster @CarterBWorth of @csm_research says there is a golden opportunity for one beaten down commodity. $GDX

Looking for a shining opportunity? Chartmaster @CarterBWorth of @csm_research says there is a golden opportunity for one beaten down commodity. $GDX pic.twitter.com/oLARKkfQ3a

— Options Action (@OptionsAction) April 9, 2021

Send your feedback to [email protected] Or @MacroViewpoints on Twitter