Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”face-ripper rally“!

We wondered last week whether the correction in the Russell 2000 was nearly over.

- “Frankly, this week’s chart for the Russell 2000 is a beaut. And this week’s low for the Russell 2000 marks a 10% correction from the all-time high reached a couple of weeks ago. Remember what Mike Wilson of MS said when he downgraded small caps – that this cycle is marked by speed. So is it possible that the correction in Russell 2000 is nearly over?”

We don’t know if the correction in Russell 2000 is actually over but it is up 7.3% from the low of Wednesday, March 24, to its close on Thursday, April 1. This is even better than the 5.6% rally of the Nasdaq 100 from its low on Wednesday March 24 to its close on Thursday, April 1.

- “Won’t it be interesting if Mike Wilson comes in next week to re-upgrade the small cap sector? For one, it would show that simpleton thinking may actually have a bit of value. On the other hand, Russell 2000 did closed down 3% on the week, the only broad index to do so.”

Boy, did we show we have no clue how Mr. Wilson thinks? Mike Wilson did come on BTV Surveillance on Thursday April 1 morning to actually reinforce his non-positive view of Russell 2000. His message was to upgrade portfolio to higher quality because “Q2 is the actual re-opening quarter” & while “dream is always bullish“, the “execution risk goes up“. Therefore he suggested investors “move to a mid-cycle playbook” and he said that he had upgraded consumer staples over consumer discretionary.

Then came Tom Lee on CNBC Closing Bell after the close on Thursday, April 1 and commented about what the Russell 2000 contains:

- “The Russell 2000 is a super-important index in 2021; in other years it may not have mattered as much but because it is chock full of epicenter stocks, it is something we are paying a lot of attention to”

What specifically was Tom Lee paying attention to?

- “… there were some really critical levels in Russell 2000 or IWM that we were watching this week; one was close above 220.93 because, if that does take place which it looks like it happened today & yesterday, it would be a continuation of what we think is a face-ripper rally – a rally that could take a lot of investors by surprise … “

Tom Lee also said that “institutional investors remain pretty cautious and there are a lot of things that keep them worried at night ..“. They must be a lot more worried about the Russell 2000 because,

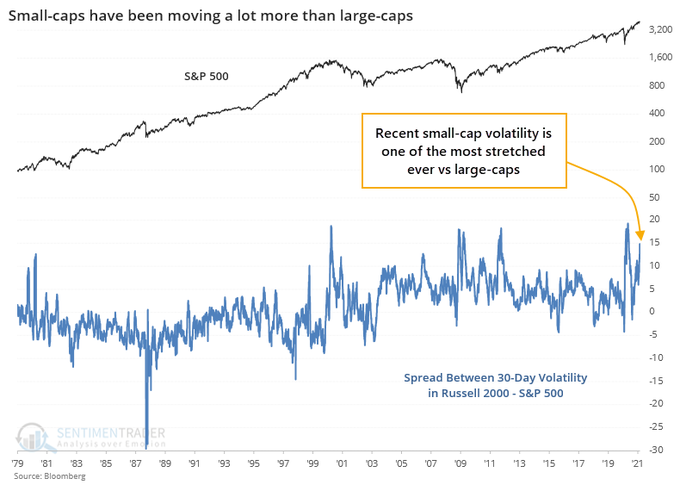

- SentimenTrader@sentimentrader – Small-cap volatility is nearing a record relative to large-caps.

In a chicken & egg type question, what moves first – price of the Russell 2000 index or its Vol? Also would the 916,000 Non-Farm payroll number be positive for small-caps? We are not smart enough to know but we have observed that the direction of Russell 2000 prices & its volatility tend to move inversely.

During the ups & downs this year, it has paid to watch the action in the VIX as a sign, especially the action after a spike in the VIX. As Lawrence McMillan of Option Strategist reminded readers on Friday, March 26, that the “ $VIX “spike peak” buy signal of March 4th remains in effect, and the trend of $VIX remains downward.“

Again, a picture is worth lots of words:

2. NDX family

Both Mike Wilson & Tom Lee seem unenthusiastic about Nasdaq 100 stocks. Mike Wilson said simply tech is “neutral for us”. Tom Lee said – “to me the FAANG trade can still track the market; So I am less concerned about someone who wants Microsoft, Apple, Amazon, Netflix ” .

But NDX was the best broad index this past week, up 2.7% and the FAANG stocks beat the NDX handily – FB up 5.6%; AMZN up 3.5%; NFLX up 6.7% & Google up 6.2%.

- Macro Charts@MacroCharts – Mar 31 – Absolutely textbook strength, coming from all the right *individual* Stocks. Setups responding with precision & no hesitation – a major “tell”. Just a bit more strength and this *could* be gone… perhaps through the summer. Important to emphasize: no one is ready for it.

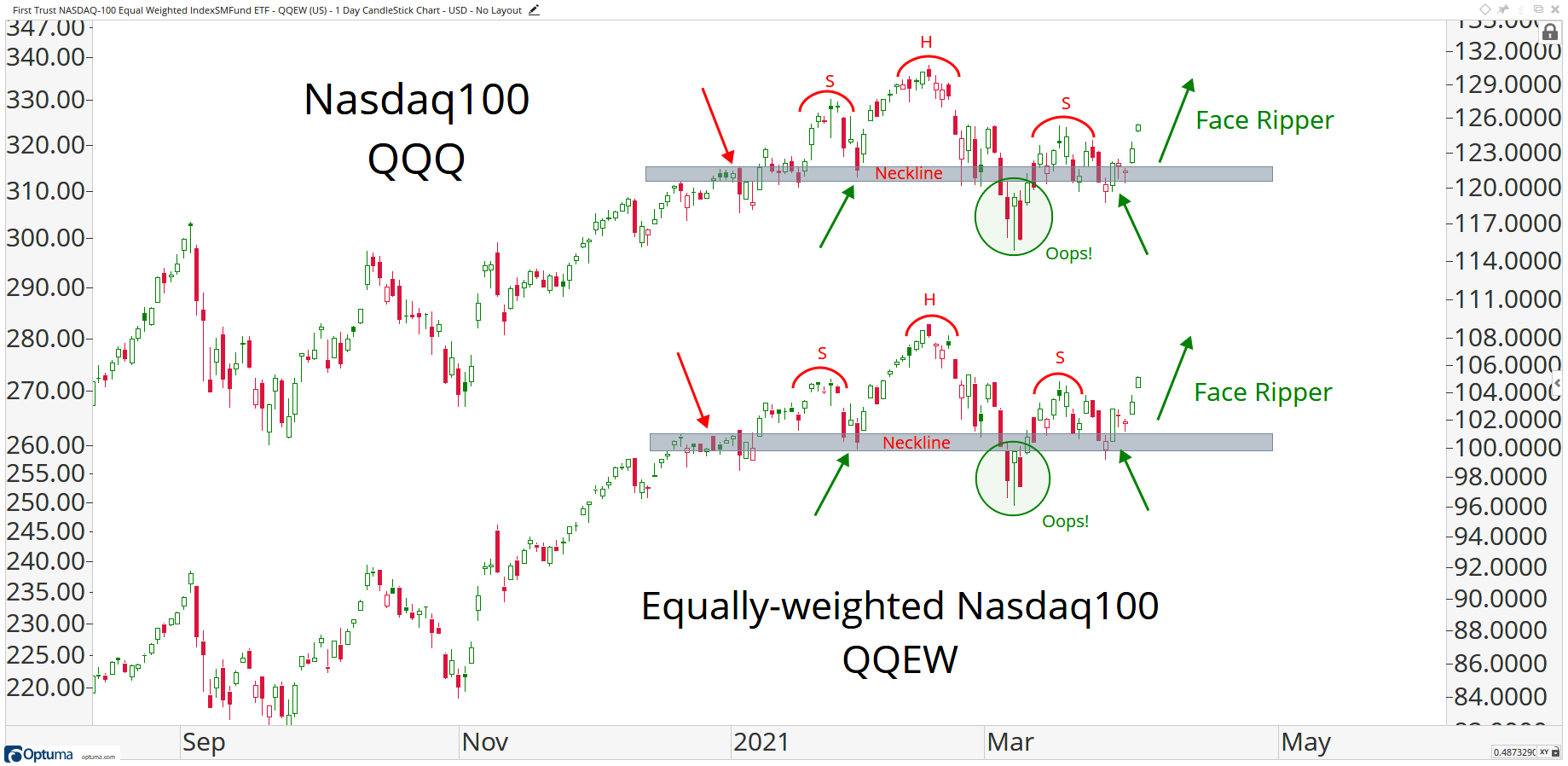

J.C.Parets wrote this weekend:

- “One chart that could suggest Growth can start to rally along with Value is this one below. There’s nothing more bullish than a “Head & Shoulders Top” that actually isn’t that at all.“

- “If the Nasdaq100, and its Equally-weighted version, are above their respective necklines, the path of least resistance is higher, not lower:”

What do historicals suggest?

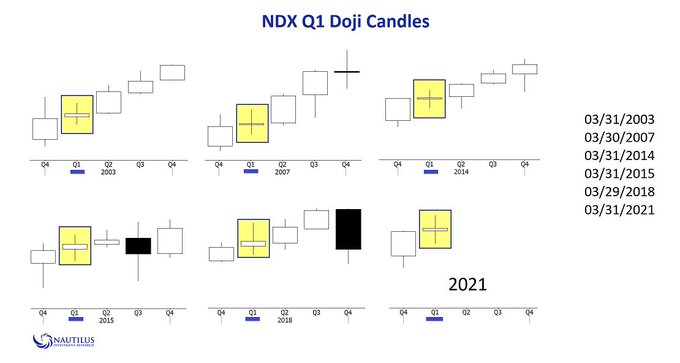

- Nautilus Research@NautilusCap – $NDX Q1 Doji Candles ….

Regardless of what happens in Q3 & later, the above seems to say Q2 is fine for NDX. And isn’t a broad index usually driven by a sector with a history of leading on the upside?

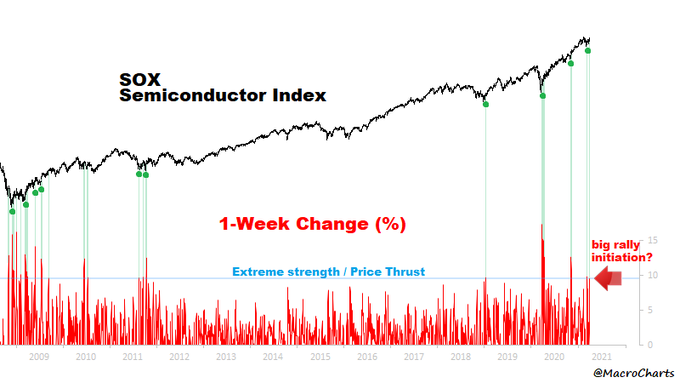

- Macro Charts@MacroCharts – SOX just gained +9.5% in one week, one of the biggest moves ever (Top 3%). Price Thrusts usually trigger the start of *massive* rallies – especially in Bull markets. Critically: this is the SECOND thrust triggered in just 3 weeks. Follow the trend – this could be a big one.

Taiwan Semiconductor (TSM) announced its plans to invest $100 Billion in the next three years to expand its manufacturing capacity and its R&D. Jim Cramer asked Micro CEO, Sanjay Mehrotra, whether this is a return to the old expand & bust practice? Mehrotra said No. Cramer must have believed Mehrotra’s explanation because Cramer said afterwards – “I think this is the golden moment for semi-conductors“

Of course, the biggest risk for NDX stocks is what Treasury rates do, especially after the 916K NFP number on Friday. More on Treasury rates later but we tend to concur with what Jon Najarian said this week that if the long Treasury rates move only within a narrow band of where they closed on Thursday, then the NDX can have a nice rally.

3. S&P

Before we get to Ed Hyman’s adjectives about what is going on, below is a tweet about “something special happening”:

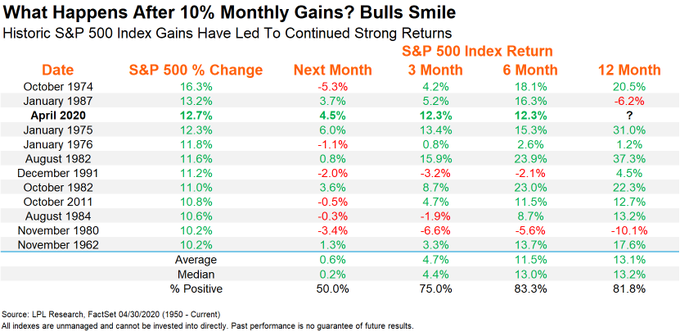

- Ryan Detrick, CMT@RyanDetrick – Random? Or bread crumbs that something special is happening? ’20 was the first year since “82 that saw the S&P 500 gain >10% in 2 seperate months. ’21 first year since ’83 to see ISM manufacturing >64.

He also showed us how much stocks love April:

- Ryan Detrick, CMT@RyanDetrick – Mar 31 – New Post: Stocks Love April

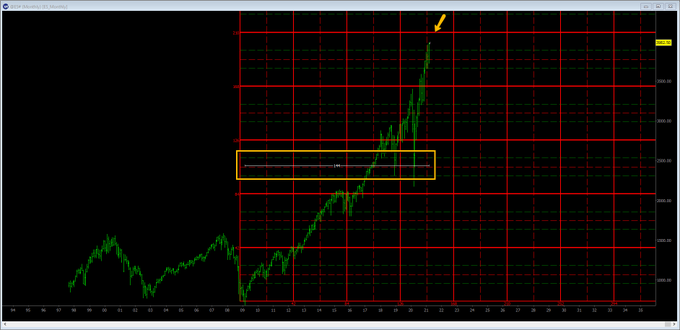

But is it really over-doing it to imagine the S&P going straight to 4300-4400? Some say so & point to a lower short-term ceiling:

- Benn Maldonado@BennMaldonado – $ES monthly printed a new bar & shows that we are heading towards geometric support/resistance in the $ES 4113 area. Pay attention to time here. We are late in this move – 144 months from the March 2009 lows, so we are in the window for a turn (doesn’t mean we have to crash).

Actually the “turn” mentioned by Benn Maldonado may be much more than a mere “turn”; it might actually be a top for the stock market if the models of Tom McClellan prove correct. In his article this Friday titled “Clarifying Oil’s 10-Year Message For Stocks“, Tom McClellan writes:

- in past posts I have noted that the leading indication message from crude has called for a stock market top due in April 2021. So what does it mean that a “top” is due in April 2021? The evidence suggests that it means a price top for the overall stock market sometime around April 2021, plus or minus about 6 months. That is a screwy way to do market timing, but it is the best that this model has to offer.

So he moves to discuss the message of his M2/GDP shifted 1-year forward model:

- “But M2/GDP reached its peak in June 2020, which would mean a peak for the stock market in June 2021, assuming that the 1-year lag time works exactly perfectly. And that is an important assumption to bring to light, because the lag in this model is not always exactly 12.0000 months. This is a good enough model, however, to suggest that a top sometime this summer is reasonable to expect, and that would not be too far off from crude oil’s message for a top ideally due in April.”

Remember that Tom Lee’s call for a rally to 4400 is for the first half of 2021 & not an year-end target. Also look again at the Nautilus tweet in Section 2 (NDX) above to see that the NDX rally tends to peter out in July.

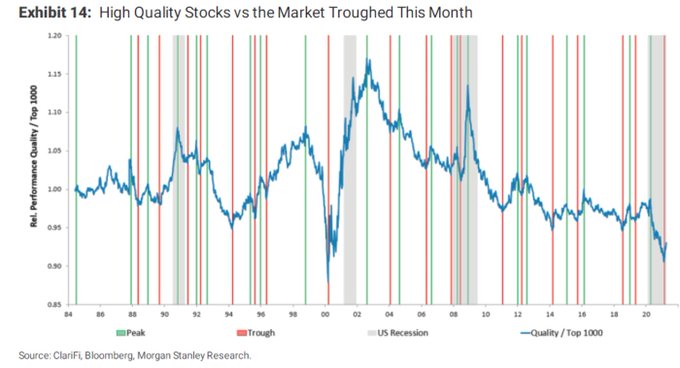

Going back to Mike Wilson’s call to move up in quality in stock portfolios, is it possible that it could be the new “value” trade?

- Jesse Felder@jessefelder – Mar 30 – ‘High-quality stocks now look extremely cheap compared to low-quality stocks. Going back to 1984, the virtues of a strong and stable company have never been less in demand.’ bloomberg.com/opinion/articl by @johnauthers

However, XLP, consumer staples ETF was down 76 bps this week, a 180 bps underperformance to the S&P this week.

4. “have to be very humble”

Who said that? Only the guy who has been voted often as the #1 Economist by Institutional Investors. And what is he being humble about? Read & listen to what Ed Hyman said on BTV Surveillance on Thursday morning:

- ” … whole picture is without precedent; totally original, totally unique, totally fluid. So you have to be very humble about what you think is going on, what you think is going to happen – because it has been nothing like this in terms of the pandemic, the rebound & now the stimulus … it’s totally unique …”

First his comments about the economy:

- “Economy has taken off about 3 weeks; when the checks came out, retail exploded; airlines have; so economy has lifted off; “booming” is a little strong; it s comin on; its gonna come on big-time rest of this year …”

Second his comments about the stock market:

- “earnings this quarter are going to be explosive; they will be up 35% in the 1st quarter; a world where you have on one side, rising interest rates & inflation which are negative for the stock market; on the other side, you have earnings which are explosive; problem is you get rates every single minute; you get earnings once a quarter starting in about week & half now; … by the end of 2022 they will be $230 which multiplied by 20 gives you pretty big S&P; “

That’s interesting, right! Unless our calculator is malfunctioning, 230 times 20 is 4,600 on the S&P and the S&P is already at 4,000 as of Thursday. So at best, the S&P will rise 15% from new till end of 2022. And is Tom Lee et al are correct & the S&P goes to 4,400 in June, then the S&P will only advance 4.5% over the next 18 months. Doesn’t this suggest that the call for a top this summer makes some sense?

Finally, Hyman’s comments about inflation:

- “inflation is gonna go up; its gonna go up more than people expect; its gonna peak later than people expect; and then its gonna come down; at the peak the Fed would be the most nervous they are about inflation; rates will be up, wages would be up & commodity prices would be up; by 2023 you will be down to 2%, 2.5% but inflation could go up to 3% before you get that …”

And all this was before the 916K jobs number on Friday. Brian Chappata changed his tune about the economy and wrote the following in his Bloomberg article Jobs Report Shows Gain of 1 Million and Heralds New Economic Era:

- “If the February U.S. jobs report signaled that America is truly rounding the final corner on the Covid-19 pandemic, then after a month of ramped up vaccinations and warmer weather, the latest data suggest that the world’s largest economy is now in an all-out sprint to herd immunity and a full reopening. … “For payrolls, we are about to scream ‘seven-figure months only!’” he [Dutta] wrote in an article for Business Insider. In a similar vein, Atlanta Fed President Raphael Bostic said this week that “a million jobs a month could become the standard through the summer.”

5.Treasury Rates

The most important chart of the week could prove to be the one below about how the 5-year Treasury yield reacted to the 916K NFP number on Friday morning:

- Brian Chappatta@BChappatta – Straight line up for 5s, highest yield since Feb. 2020.

The 5-year yield was up 6.7 bps on Friday and closed at 97.4 bps, perilously close to the 1% level. But the 30-year yield was only up 2.5 bps on Friday. It was the smallest rise except for the 1-year yield which was up 0.5 bps. Even the 2-year yield was up 2.8 bps on Friday, more than the 30-year yield. What gives?

The 5-year yield was also the strongest on the week , up 11 bps on the week. The 7-year was the next, up 9 bps. The 3-year was the 3rd up 8 bps. In contrast, the 30-year yield closed down 0.6 bps; the 20-year yield closed flat & the 10-year yield was up 5 bps & closed at 1.72% below the 1.75% reached intra-day on Thursday. Again what gives?

In fact, the action in rates was weird on Thursday, the day the manufacturing ISM printed a stunning number:

- Rick Rieder@RickRieder – Today’s @ism manufacturing reading of 64.7 is the highest since 1983: Evidence continues to mount that we could be in the midst of the strongest #economic expansion in many decades.

The 10-year rate did jump to 1.75% in the morning. Then look what happened:

- Brian Chappatta@BChappatta – It’s a risk-on kind of day. 10-year yields now down 7 bps.

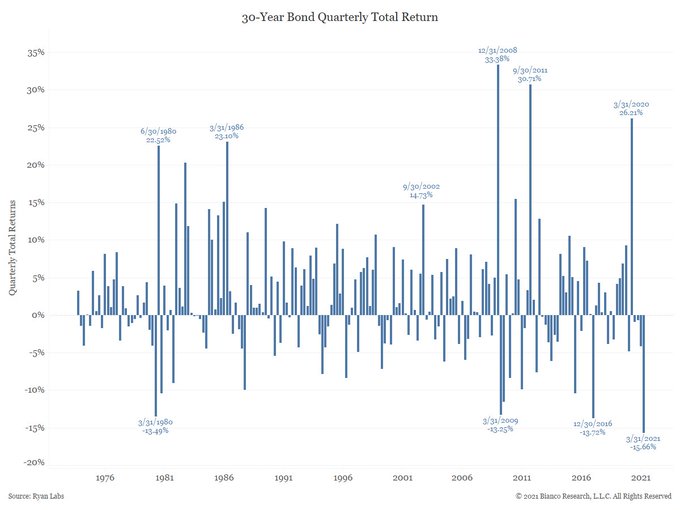

Frankly, we don’t understand what happened to Treasury rates on Thursday, April 1. Was the Treasury market playing April Fool with investors? Or was it the final stage of the Treasury buying as a part of Q1 rebalancing? After all, the rebalance had to be huge given the worst loss in the 30-year Treasury since 1976:

- Jim Bianco@biancoresearch – The total return of the 30-year Treasury bond was a 15.66% LOSS in the first quarter. With data going back to 1976, this marks the worst quarter on record for the long bond. (1/3)

Discretion being the better part of valor, we prefer to wait to see how the long end of the Treasury market reacts next week to Friday’s big NFP number.

6. Dollar

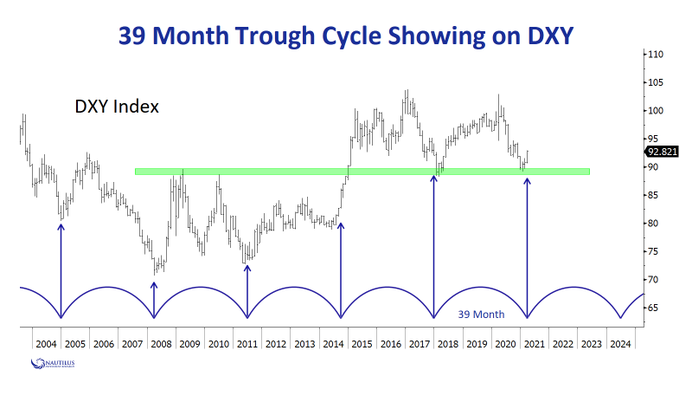

How the Dollar reacts to the 916K NFP number will be interesting as well. After all the Dollar is still heavily shorted & now the fundamentals of the US economy should provide support to the Dollar. And the 39-month Trough cycle has already bounced:

- Nautilus Research@NautilusCap – Mar 29 – $DXY $dollarindex — Corrected .. 39-month trough cycle.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter