Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.NFP

Man, what a disappointment!! A market that was primed to see a 1 million number in new jobs got only 266K new jobs! The Bond market reacted instantly with yields collapsing by 10 bps. The immediate view was:

- Justin Wolfers@JustinWolfers – U.S. payrolls grew by +266k, which would be fabulous in normal times, but is utterly disappointing at a moment in which forecasters expected +1 million jobs, and we’re still missing millions of pre-pandemic jobs. This is a big miss that changes how we think about the recovery.

No wonder the 10-year yield fell precipitously to 1.462%. But this fall was reversed very quickly with a different realization.

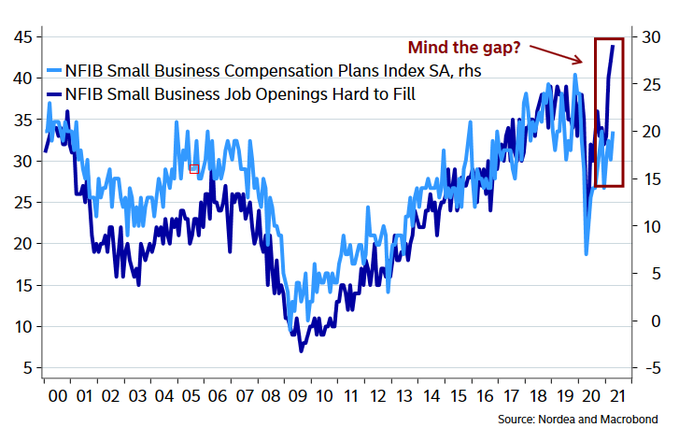

- AndreasStenoLarsen@AndreasSteno – May 7 – Job openings are RECORD hard to fill Hiring not impressive (NFP a clear disappointment) Bottom-line: Get ready for bigger sign-on bonuses and higher wages!

Jim Bianco put on his old CMT hat and said Friday morning’s reversal in 10-yield could prove to be a turning point in yields. Carter Worth of CNBC Options Action said “the opportunity to buy bonds, TLT, for a bounce has come and gone“. Better hear from him directly with his charts:

But Carter Worth was not outright bearish saying “our hunch is over time rates continue to work within the channel“. Earlier on Friday afternoon, Jim Caron of Morgan Stanley also said on BTV that rates “can sit in this range of an extended length of time“.

The rise in rates might have been muted but the rise in commodities was not. The Dollar fell by 75 bps on Friday and Copper flew up by almost 3% with Gold following with a 1% up move.

2. Stocks

How right was TomMcClellan last week when he predicted an upturn in stocks this week? Kudos to him. But the real message for us came on Tuesday afternoon via our most favored short term indicator:

Look at the near 20% rocket in the VIX after Yellen’s comments on Tuesday around 11:00 am. As we have seen recently, it has been profitable to consider such VIX spikes as buying opportunities. That proved true this week as well.

Who do we thank for the rally? Look what @Sentimentrader posted in their Stat Box:

- “Nearly 60% of technology stocks fell to a 1-month low on Tuesday, despite major tech indexes being above their rising 200-day moving averages. According to our Backtest Engine over the past 20 years, this has happened 44 times, leading to a positive return a month later after 34 of them, as most didn’t turn into larger declines.”

The selling was not restricted to technology stocks:

- The Market Ear – Thu – “Hedge funds selling – Tuesday was the 2nd largest day of net selling YTD and it did continue yesterday, even though at a smaller intensity. Net Leverage has now dropped to the 77th %-tile over the last 12 months, which is the least aggressive positioning we have seen in a while. It is still however in the 98th %-tile since 2010. On a sector basis, it is worth noting that Info Tech stocks have been net sold for six straight days”

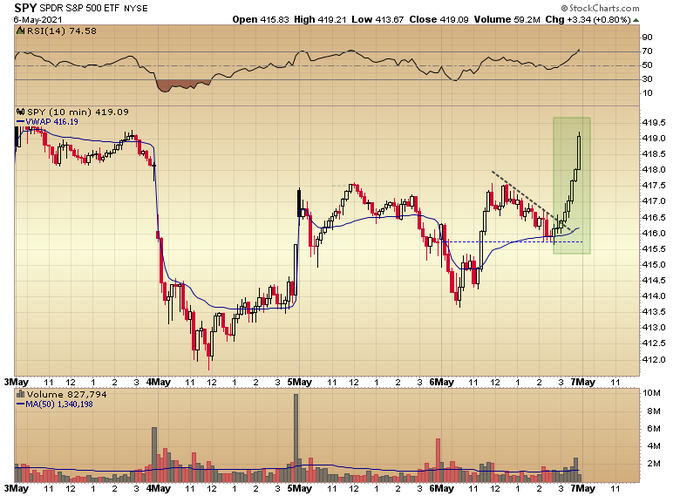

With this type of selling & fall in net leverage, shouldn’t you expect what happened on Thursday afternoon? From about 2:30 pm on Thursday to be precise:

- Rob Moreno@rightviewrob – May 6 – $SPY (10 min chart) around 2:30, as the index was retesting its opening level and the VWAP, buying entered the market. It was large and continued into the close. More on this chart on the website tomorrow morning.

This S&P rally continued on Friday after the NFP number with a gain of 32 handles following a 34 handle up move on Thursday. So this week’s 1.2% gain was realized from Thursday 2:30 pm to Friday’s close. What was the old adage, old meaning about 2008? That it is the “hedging” that blows up funds, not necessarily their original positioning sins. And they call “Hedgies” the smart money.

Once again, the S&P closed above 4,200 thus meeting Tom Lee’s first target. This week he came on CNBC Fast Money to reiterate his 4,400 target for mid-year. Once again, we point out that 4400 is only 4% away from Friday’s close. This is not to minimize Tom Lee’s views. Look what he said about energy stocks, specifically OIH (Oil Service Stocks) on Tuesday’s Fast Money:

- “… entire energy complex is a buy; Oil companies are seeing the best supply-demand alignment they have seen in more than 10 years; .. if it [oil] breaks through $68, reaching $80 by the summer would be pretty reasonable … a group like Oil-field services, which is like $190 today, OIH – its never been below $450 of Oil is at $70 & its never been below $600 if oil is at $80; this group, OIH, could triple … if Oil is in Goldman’s target of $80.. so energy is one of the best risk-rewards right now ..

Look what OIH did in the 3-days after the above comments:

Read what Tom Lee said at about minute 4:38 of the clip above:

- “… we also know that investors are cautiously positioned …. & once the tail risks come off, right now people are focused on the risks from India and if India starts to see an improvement in the catastrophe, both in the health care & economic perspectives diminish, then I think it is back to risk on and that’s how we propel to 4400; …”

For a more detailed discussion about the crisis in India, we refer readers to “Indian Economy” & “What’s next” sections of our adjacent article titled (for our general readership) Guess What? Indian Stock Market Was a Buy Two Weeks Ago! What’s Next? If nothing else, we recommend listening to the BTV clip of the views of Anu-bhuti Sahay (Standard Chartered Economist in Mumbai) about Indian economy featured in that article.

So if we are correct about risks in India diminishing & if Tom Lee is correct about that making it “back to risk on”, then what should people do? Buy S&P calls for June-end or July expiration? That would be a question for Tom Lee & not for simple minds like ours.

On that note, what did Lawrence McMillan of Option Strategist write on Friday?

- “$SPX has three major support levels, all noted with horizontal red lines on the chart in Figure 1: 4120 (which is the daily lows of several days during April), 4000 (which was the March high), and 3850-3870 (which is the area from which the current leg of this bull market rally emanated on March 26th.”

- “In summary, we remain bullish. Maintain a “core” bullish position. There are no confirmed sell signals at this time. The main things to watch are the trends of $SPX (upward) and $VIX (downward). As long as those are intact (i.e., as long as $SPX is trading above support), then the bulls have the upper hand.”

But we remind readers that the same bullish Tom Lee is warning about a near 10% correction from 4400 and that “the real bludgeoning is going to take place in the mega-caps, stay-at-home, FANG, digital world complex of stocks … ” and the “real opportunity” is in what he terms as epicenter stocks.

On Friday, J.C. Parets pointed to that rotation taking place right now :

- “Large-cap Growth was down relative to Large-cap value every day this week. That makes it 3 down weeks in a row as the ratio continues to press down near 52-week lows.”

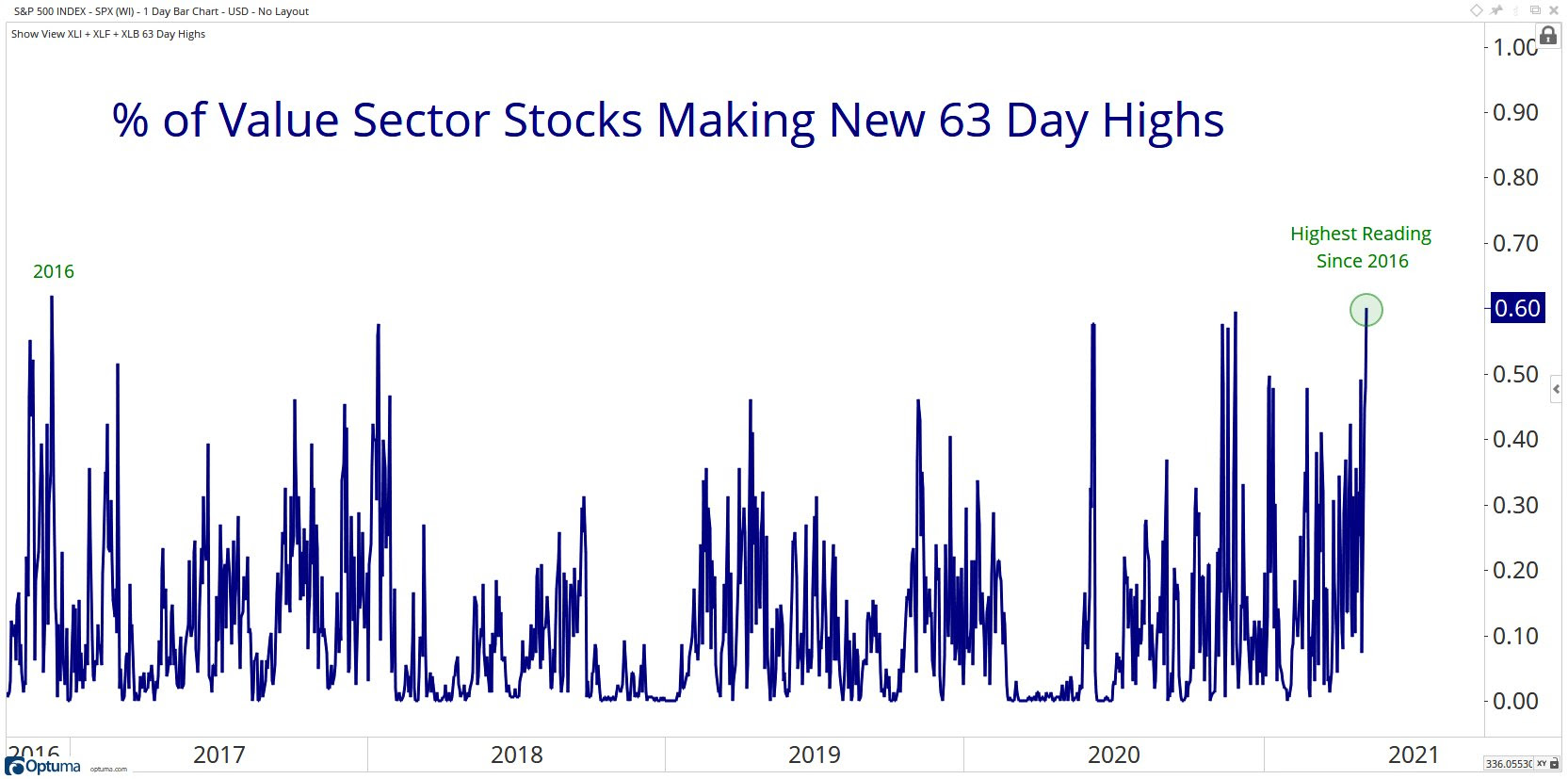

- “The strength has been in Value, which just put in a monster bullish breadth thrust. Remember these are things we tend to see near the beginning of bull market cycles, not near the end of them:”

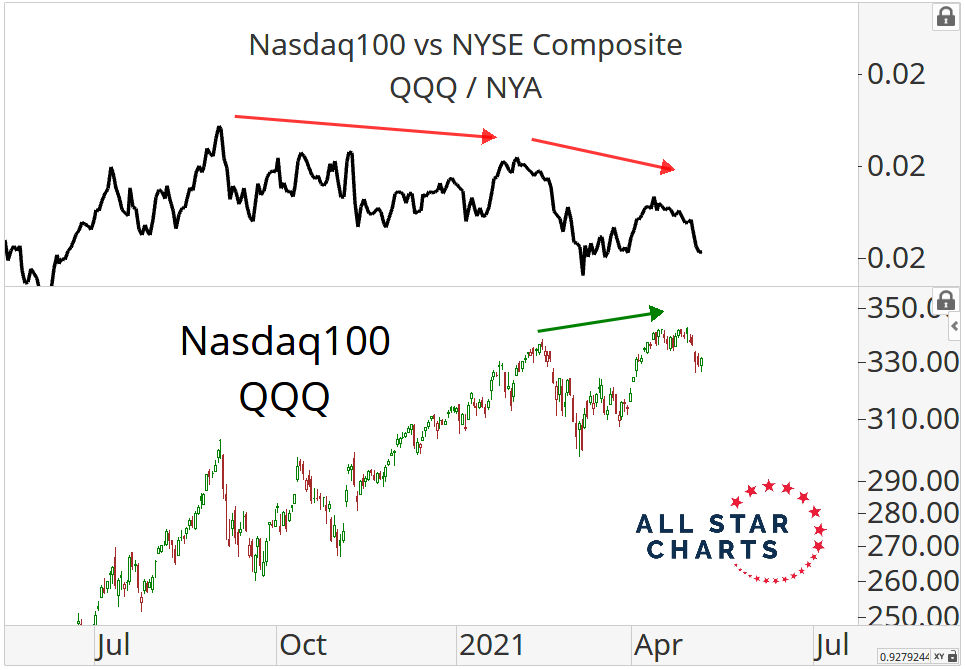

Parets also made another important point via another chart:

Parets wrote:

- “Remember, over half the top 100 components in the NYSE Composite are NOT even American companies. They’re foreign ADRs. You’re going to get a lot more value outside of the United States, which is obviously really Growth heavy.”

3. Commodities

While EM stocks were up in general & Indian stocks were up 3-4%, the real star was another that is also caught up in a terrible CoronaVirus crisis. EWZ, the Brazil ETF, was up 7% this past week.

So if oil is going up and Brazil is rising then how might Petrobras behave? PBR closed 2020 at around $12 and closed this week at $9. Yet, we don’t hear smart guys on FinTV talking about it? We recall the celebrated Mark Fisher talking about Petraobras during an earlier panic sell off in Oil. What does he think now? Enquiring minds would no doubt like to know.

Speaking of Oil, below is a victory lap for an analyst who has been spectacularly right on oil stocks since the Dow got rid of Exxon:

While Oil is the rage, Gold actually did much better this week. Gold was up 3.7% and the Gold miners, GDX & GDXJ, were up 8.8% & 8.5% resp. So what is the mission now? It is “to ride the new uptrend“, wrote Tom McClellan this week in his article Gold’s 13-1/2 Month Cycle In Up Phase:

He added:

- “Now gold is in the ascending phase of the new cycle, which is when the best gains for gold prices are usually seen. Sometime this autumn, we will need to start worrying about the next mid-cycle low appearing, and thus to get a left-hand top before that mid-cycle low. And much later on, we will get to make a determination about whether this new cycle will see right or left translation. For now, the mission is to ride the new uptrend.”

Send your feedback to [email protected] Or @MacroViewpoints on Twitter