Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Treasuries & TLT

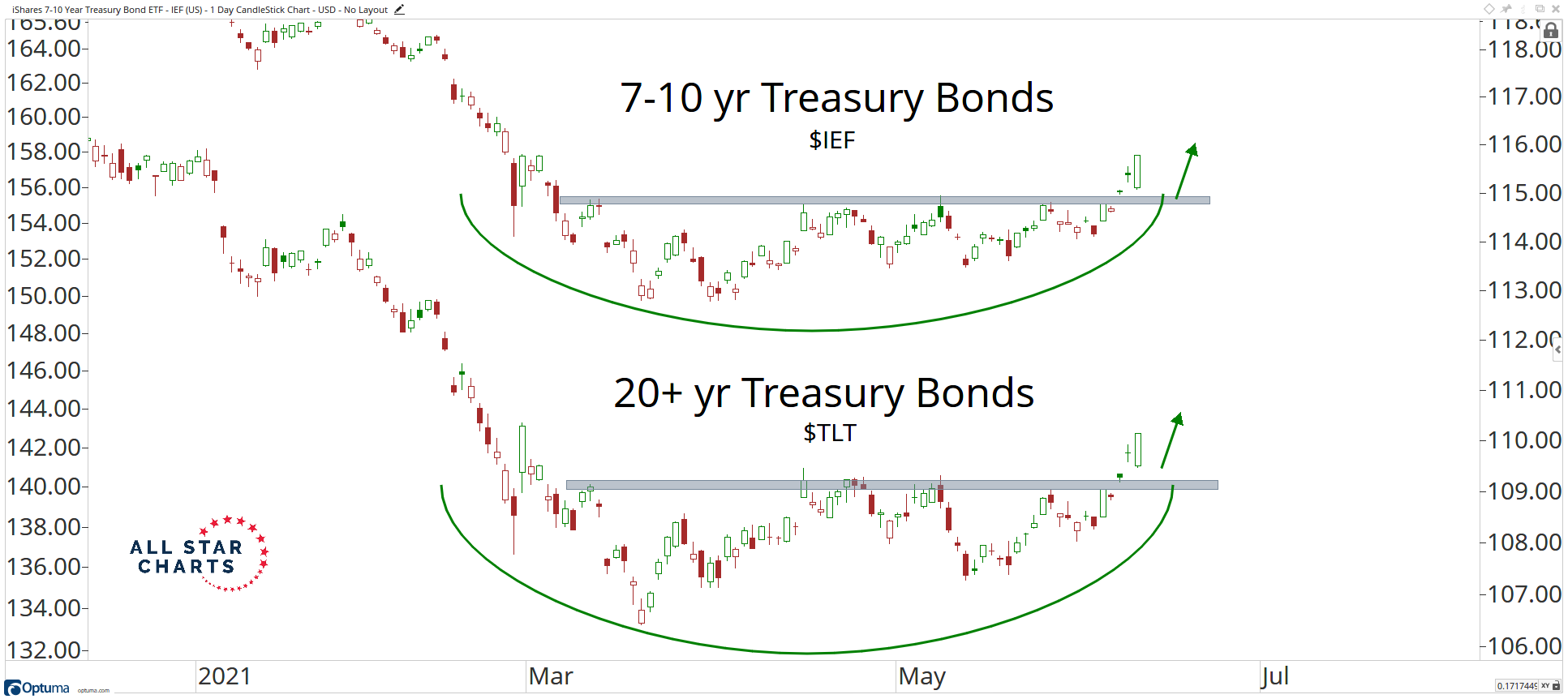

Friday June 4, or NFP Friday, was a “a wonderful day for the $QQQ + $TLT portfolio” as Bloomberg’s Brian Chappatta tweeted that day. That continued for this entire past week with TLT up 1.7% (EDV up 2.2%) & QQQ up 1.6% last week . So we should look at TLT first, in fairness as well as in relative macro importance.

The U.S. 10-yield broke hard through the 1.50% level to close at 1.454%, down 10 bps on the week. The 30-year yield fell 9 bps to close at 2.143% despite a ho-hum auction. The simplest & hence the best comment came from Carter Worth (resident technician of CNBC Options Action) who said “this is so unexpected for consensus that it’s got more to go“. How much more? To 1.25% said he in the clip below:

Another chart comes from J.C. Parets in his article Divergence City + Bonds Break Out!

And the Fed is doing their own thing and MOVE, the bond-VIX (for short) is responding as the VIX does:

- The Market Ear – Fed, the master of risk, prints another new BS high…and MOVE moves violently lower Thursday is Fed BS update day, and here we are again, Fed’s BS printing another new all time high. The mid Feb bond vol panic is now all gone as MOVE moved lower by 8.7% today, adding to the implosion trajectory since March highs.

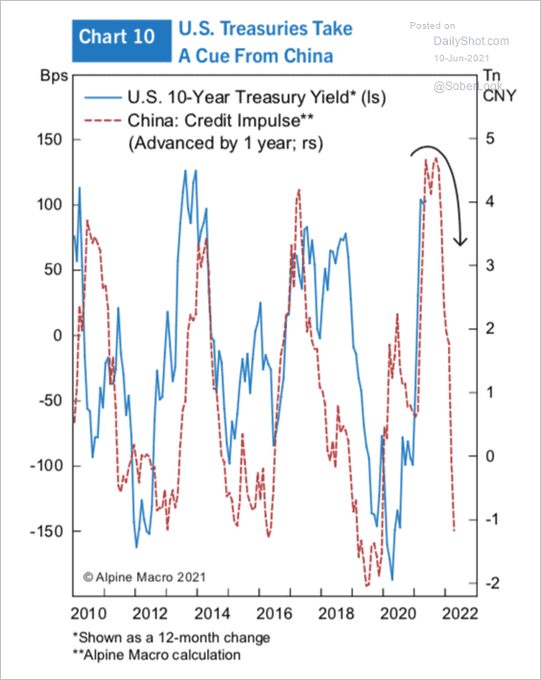

- (((The Daily Shot)))@SoberLook – Jun 10 – The decline in China’s credit impulse points to lower Treasury yields ahead. Source: @RealAlpineMacro

Now if China rolls over, then US ISM could peak & roll over as Raoul Pal said this week on RealVision. He also said that the DeMark monthly chart hit a 9 this week and added that “the monthly 9-signal has a 100% track record for calling a top in yields” and so tech stocks that “look like zero-coupon bonds to infinity (duration)” will do well and “if growth is not as high as we thought, they are going to explode“.

That brings us to FAAMG & QQQ, the first part of Chappatta’s “QQQ+TLT portfolio”.

2. QQQ

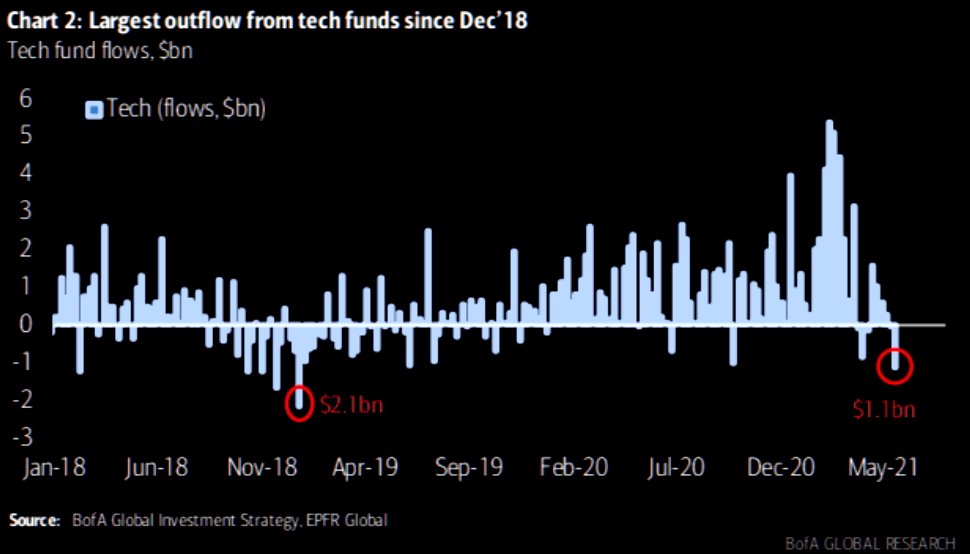

Tom Lee upgraded FANG from Underweight to Overweight for a simple reason. How simple? He pointed out that FANG took it the hardest from the rising rates move and now with that interest rate headwind gone & their secular growth story, it should be great for FANG. He added:

- “… investors are positioned for higher rates; they have trimmed their holdings because of the idea rates are higher, … the rate trajectory is lower, the market will be surprised by lower rates; that’s a tail wind for FANG”

Hmm; is “trimmed” the right phrase for what investors have done with tech stocks, per BofA via The Market Ear?

OK, so what is a target for the NDX?

- TradingView Ideas@TradingViewBot – $NQ1! – Nasdaq100 rally mode started May 13th – TradingView –

- “It’s been a good 4 weeks to own tech and some of the high momentum stocks from the recent past. … But the bigger question is … how far can the $NDX run with this rally. My crystal ball is often cloudy, but always clearer when viewed from the rearview mirror, says … Nasdaq 100 can easily reach 14250 by end of June and might challenge 14,650 by late Summer. And the related question is … where will AMZN , MSFT , GOOG and ADBE be trading if NDX continues it recent rally.”

Hmm; 14250 from 13998 is 4.65%. Apply that to S&P close of 4247 & you get 4,444 – almost exactly Tom Lee’s target of 4400 by end of June!

High Kudos to Jim Cramer & Larry Williams for the call to buy AMZN on Monday, June 7. Cramer relayed this Williams call to viewers of his Mad Money show in his Off the Charts segment. Needless to say CNBC is so ashamed of this call & these types of segments that we can’t find any trace of this clip on CNBC.com. But the stock & its investors listened clearly as the 5-day chart shows:

Finally slowing of or in China is not as much of a negative for FANG as it is for the broader S&P, or the industrial sector.

3. Economy & Fed

But is the steep fall in interest rates bullish for the S&P? Look at the early Thursday morning reaction in the S&P to the stunningly hot inflation report.

The 10-year yield had closed at 1.489% on Wednesday. After the stunningly hot CPI number came out on Thursday morning, the 10-year yield jumped about 3 bps to 1.52% plus and stocks jumped up as well. But as the 10-year rate began falling, the S&P fell as well as the above chart shows. And the S&P meandered till the last 15 minutes or so on Friday when it made small vertical move.

We wonder whether the steep fall in rates is making the market a bit nervous. And it is not as if the system is short of cash liquidity. Far from it:

- Brian Chappatta@BChappatta – Jun 10 – Big lurch higher in reverse repo usage to $535 billion.

Look at the above picture and look at the one below:

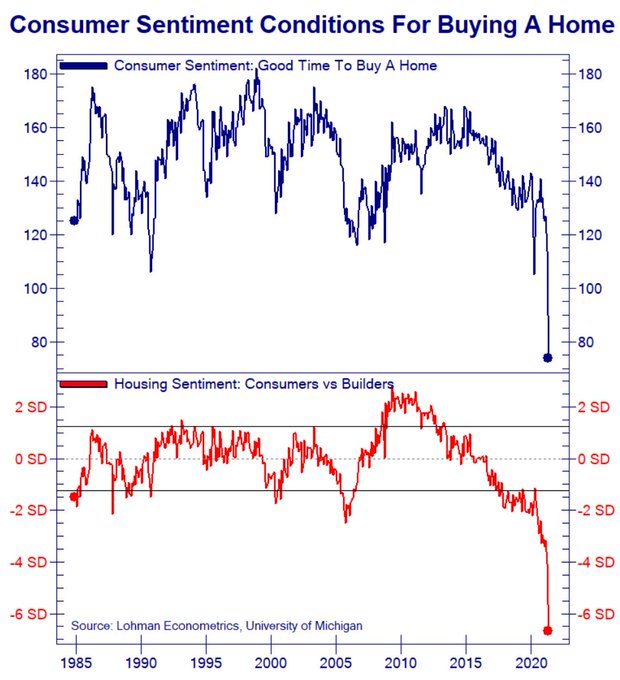

- Not Jim Cramer@Not_Jim_Cramer – Consumer Sentiment towards buying a home goes into freefall

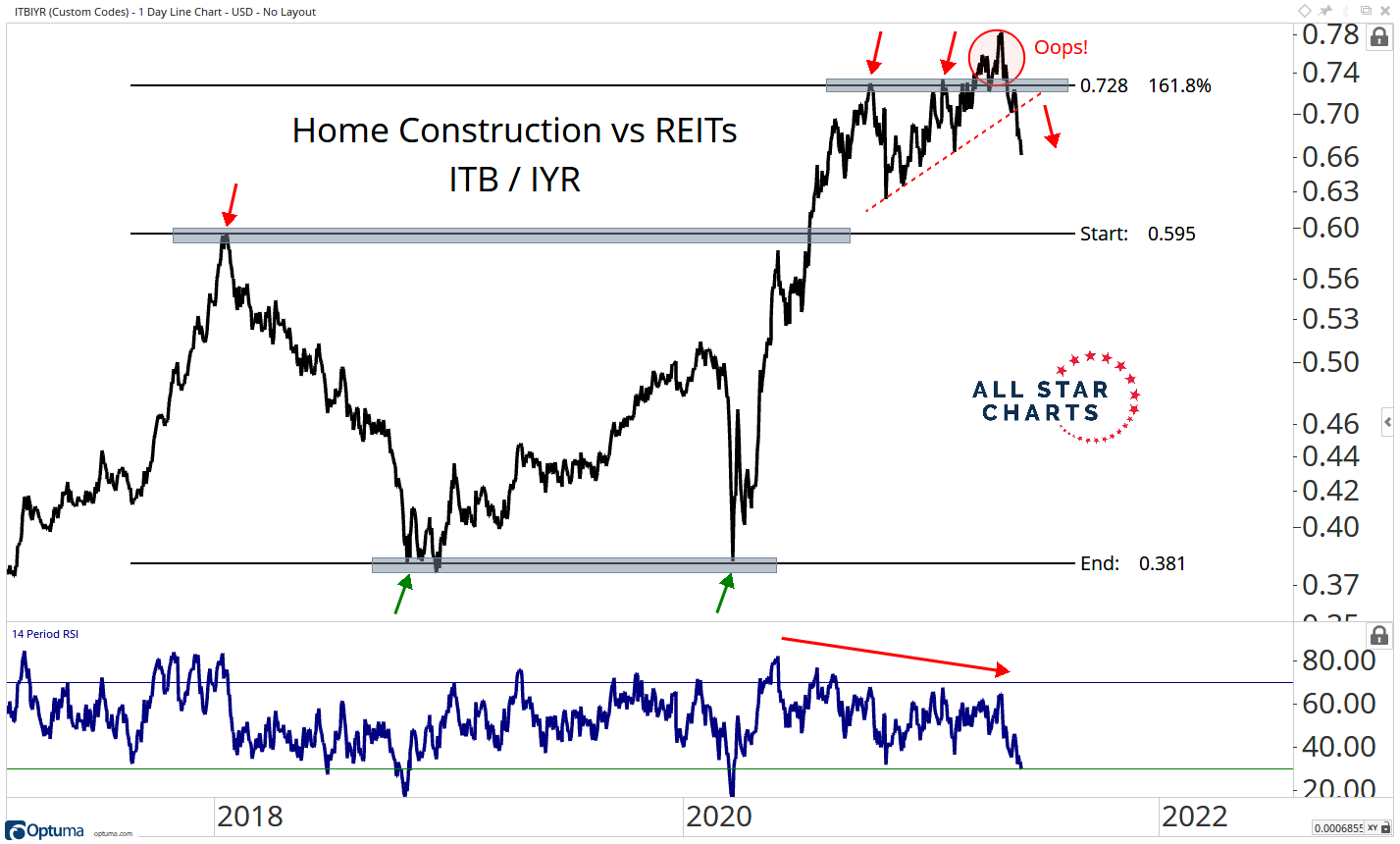

And look what we see despite the determined buying of houses all across America by Blackstone, BlackRock & cohort (courtesy of J.C. Parets):

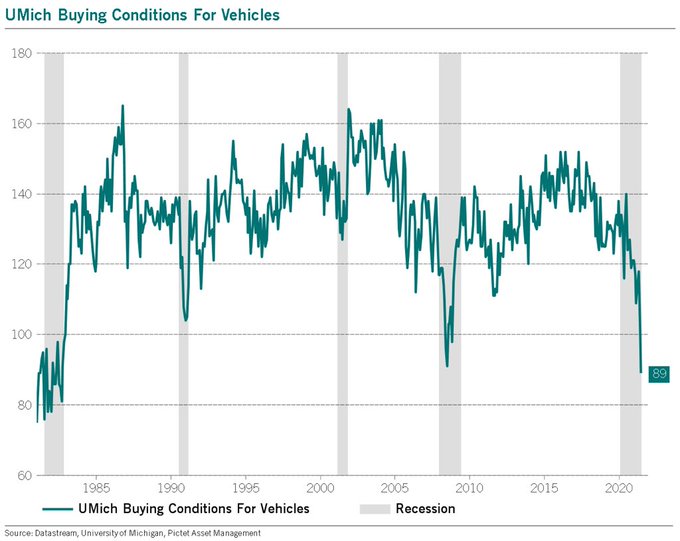

But that is just housing. Cars look great given the action in GM & Ford, right?

- Julien Bittel, CFA@BittelJulien – UMich buying conditions for vehicles just hit a 39 year low…

Is this a case of high inflation in a highly leveraged economy becoming deflationary or is the above a sign that income support from the government has already peaked? Or is the economy saying the Biden team is nowhere close to getting a real stimulus deal that will put incomes in the pockets of middle class Americans?

All of this creates echoes of 2008 (recall that the bond rally of 2007-2008 began in June 2007) and that may a reason for nervousness. But Powell Fed of 2021 is NOT the 2007 Bernanke Fed. And so the taper is all but history for now, we think. Far more importantly, Biden 2021-2022 is NOT Bush 2008. We fully expect the Biden Team to pull out all stops in pushing money into the U.S. economy even if they have to act more GOP-like to get their way. Of course, everything changes if the 10-year yield break below its 200-day which is at 1.16%.

So, all of a sudden, next week’s FOMC statement & the Powell presser became more interesting.

4. S&P 500

What did a veteran observer write about the S&P?

- Lawrence McMillan of Optionstrategist – “Stocks are trying to break out to the upside, but there has not been a very convincing attempt yet. For nearly a month, $SPX has been probing the area of the all time highs (4238) but has been unable to break through. Then yesterday, June 10th, the Index finally sliced on through in strong fashion, quickly rising to almost 4250 in early trading. However, selling appeared almost immediately and drove stocks back down below 4238. $SPX closed at 4239, hardly a convincing upside breakout. If the breakout does not take place, then the possibilities increase that $SPX will retreat to 4060, the bottom end of the trading range.”

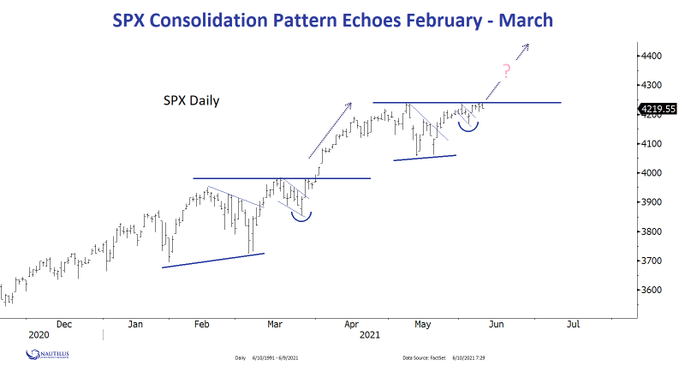

One sees a consolidation resulting upwards:

- Nautilus Research@NautilusCap – Jun 10 – S&P Consolidation pattern “echoes” February – March..

We all have realized that the bond market was ready for a hot CPI number. The question now is whether the stock market is prepared for a correction.

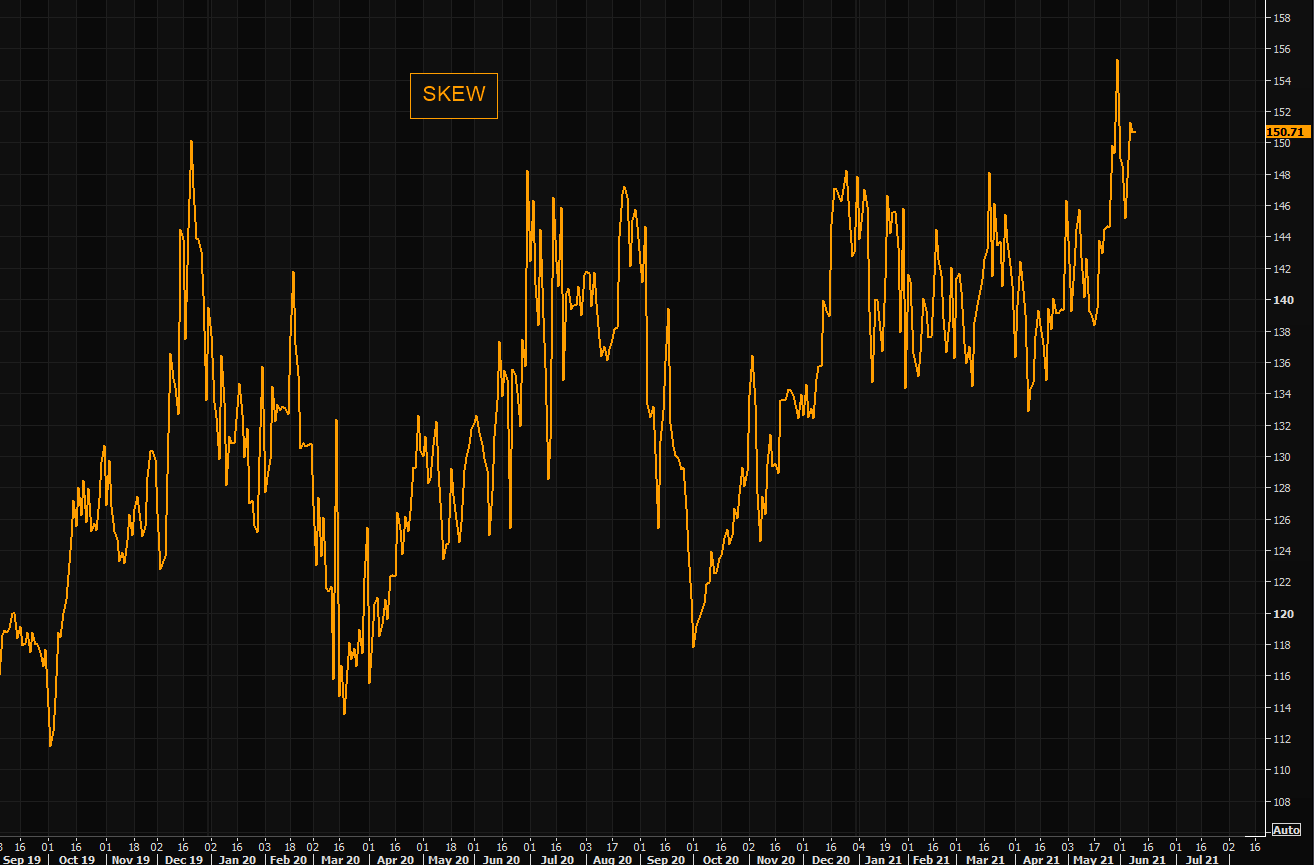

- The Market Ear – People are prepared for the correction. As we showed earlier today, here, index hedging has surged lately as people have been buying puts actively. SKEW index has remained close to recent highs, elevated to put it mildly. This of course has nothing to do with “real fear”, but shows the relative richness of downside protection. Add to the mix that loans on SPY ticked higher, post the latest big move up, and it looks many are looking and hedging the correction possibility as we approach the end of H1 2021. Imagine a break out to the upside and the pain it would lead to…

What about the VIX? Lawrence McMillan writes:

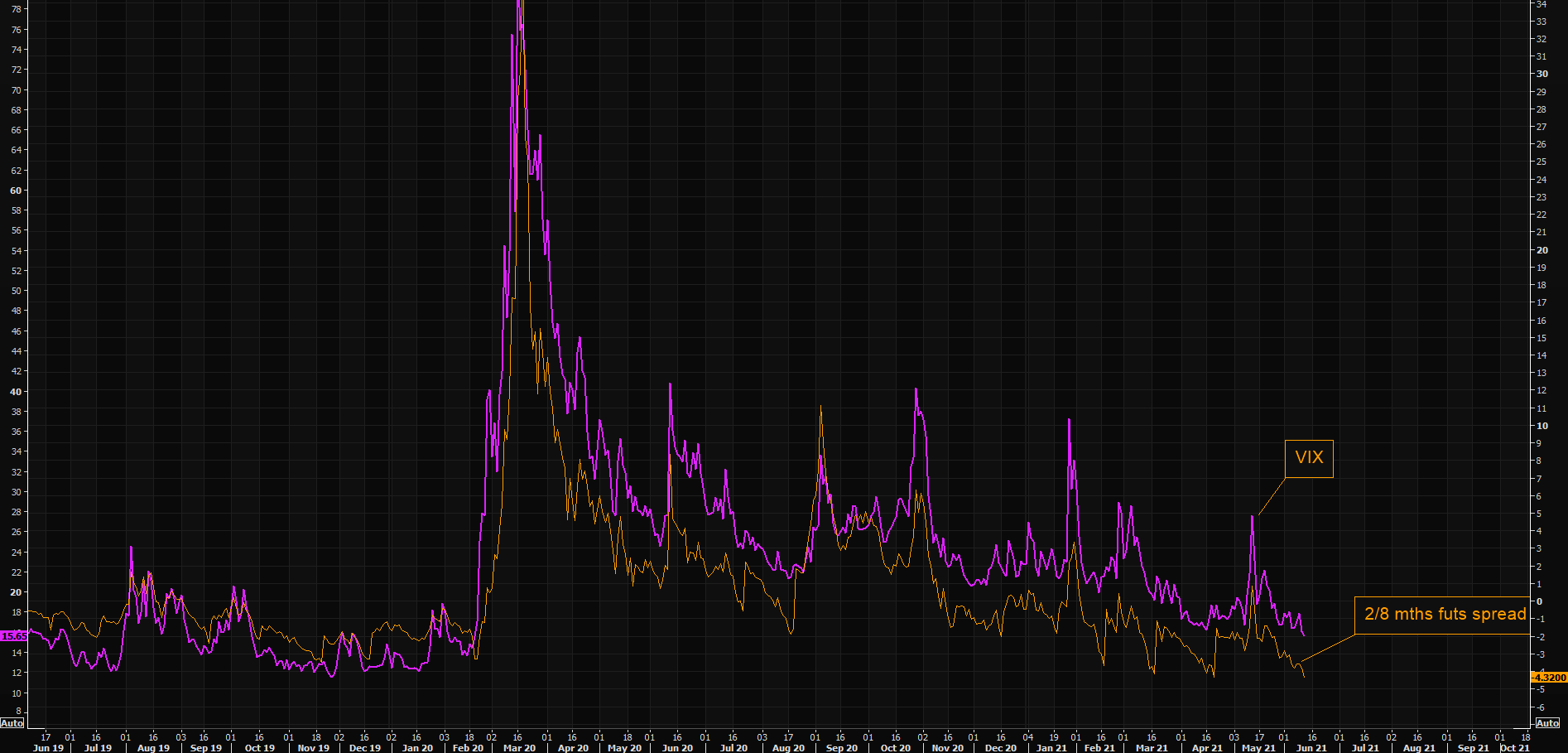

- “The entire volatility complex is generally issuing bullish signals for stocks. The $VIX “spike peak” buy signal of May 21st remains in effect, and the trend of $VIX is lower.”

On the other hand,

- The Market Ear – Everything VIX at post corona lows. VIX index closing at post corona lows, but even more importantly, the VIX 2/8 month futs spread closing at post corona lows as well. This is basically telling you there is “no” fear… Let’s see if today was the day to get into VIX longs…as every aspect of protection was puked.

What is DeMark saying, you ask? We have no access to him but Jim Cramer does. Cramer reported on Friday that S&P is at Demark 11 count and needs 2 more up days to get the 13 peak signal. But it also has to reach DeMark’s upside target of 4335-4344. On the other hand, if it sells off too soon or if it doesn’t hit his price target, then this whole set up goes out of the window.

After all this, the real question is what does the Fed signal on Wednesday June 16? Do they fell cornered by the fall in Treasury yields? Or does it strengthen the hands of those who want evidence & not predictions before they talk about talking about taper? We will find out on Wednesday.

5. Indian Stock Market

Both Jim Cramer & Josh Brown noticed this week that the Indian stock market is on fire. Below is a sensible answer by Josh Brown to a question by a viewer about buying ICICI Bank.

Your questions answered in #AskHalftime pic.twitter.com/dpD9itGfPC

— CNBC Halftime Report (@HalftimeReport) June 10, 2021

Raoul Pal gave a similar answer to a question about when to buy into the Indian Stock market. That answer, that clip and a more detailed discussion about the Indian market rally is in our adjacent article – Financializing 1.3 Billion People; Corona Virus 2nd Wave & Indian Stock Market.

Now sadly back to a discussion we are fed up of.

6. Bloomberg vs CNBC

We have been critical of both networks & view both as having a hand in anti-India regime-change efforts of the US Media. While we feel Bloomberg.com has more dedicated anti-India opinionators on its payroll, the broad Bloomberg.com network does cover India in a factual manner.

Look at our adjacent article about Indian stock market that features not just one but two factual & useful Bloomberg articles about Indian Central Bank. Also we covered in detail an excellent interview on Bloomberg TV on May 6 by Anu-bhuti Sahay, a Standard Chartered Bank economist in Mumbai. That interview was crucial to our view of how the 2nd wave was affecting the Indian economy. We urge all to watch it:

Now compare the above to the pathetic, in fact appallingly stupid, video published on CNBC.com this Thursday, June 10, a video that is the work of one Timothyna Duncan, Multimedia Journalist at CNBC.

Timothyna Duncan, a proud Ghanian ” journalist” & hence a specialist on India, asks in the beginning “ … thousands of people were losing their lives every day, but a second nationwide lockdown was nowhere to be seen?“.

Yes this was being published & distributed on June 10, this past Thursday, the same week when the entire world is talking about India’s stunning recovery. This “journalist” also uses CNBC’s India coverage anchor in Singapore to support her unbelievable stupid video clip.

Timothyna Duncan Tanvir Gill

Now you see why we never ever watch CNBC Asia but usually watch Bloomberg Asia TV in our late evenings. We find CNBC’s coverage appallingly bad.

How did we find this Duncan-Gill video? It was featured at the heart of a Friday, June 11 CNBC.com article about daily deaths in India. The article was centered on a photo dated April 26, 2021 about a patient wheeled into a hospital for Covid-treatment! And the article begins with:

- “India’s daily reported death toll from the coronavirus crisis reached a record high on Thursday, with more than 6,000 people succumbing to the disease. That surpassed a record number of daily fatalities reported by the United States this year.”

That wasn’t it. CNBC’s Tyler Mathisen featured a solitary center doubling its daily death total from an earlier count. Apparently, per Tyler Mathisen, that center had omitted to report 4,000 deaths on one specific day. Mr. Mathisen then expressed concern that previous figures from India may not have been accurate.

Understand Mr. Mathisen is no newbie. He is probably the most veteran & seasoned anchor at CNBC today. And, he used to be the Managing Editor of all of CNBC. So we cannot ignore his slants as we might of a lower level un-informed media journalist like Timothyna Duncan. Why does his expressed “concern” bother us?

- “Mathisen used a 4,000 miscount figure in a 1.3 billion people country to cast doubts on the entire Indian counting system. Not only did he have any other figures, he didn’t show a basis of even casting such a doubt.”

- “Hundreds of thousands of Indian professionals have been involved in treating & burying Covid patients. Without knowing a single one of them, Mathisen essentially threw them all under his counting bus. Is that racism or is that a sheer contempt of all Indians?”

- “Speaking about his expressed “concern”, Tyler Mathisen did not point out even one help CNBC is giving to Indians who might have died in the recent COVID 2nd wave. Has Mathisen even donated $100 to any local drives to help families of those who died in the Covid crisis in India? Not that he mentioned. So how deep is his concern about Indian deaths? Only up to using the deaths to slander the Indian Government?”.

Note that neither the CNBC.com article nor Tyler Mathisen pointed out that even by doubling the entire number of Indian deaths, the figure would remain short of the corresponding per-capita deaths reported in America. And do you think either the CNBC article or Mathisen or Duncan even mentioned the raging discussion about deaths in America miscounted in states like Michigan or New York? Of course not.

So what was the point of the “concern” expressed by Tyler Mathisen or of the article on CNBC.com? It certainly does not seem motivated by humanitarian issues. No indeed. To us, both seem to have one purpose – cast mud on Indian Government.

We do have a slight soft corner for Tyler Mathisen because he was the main trigger for our Blog. Back in 2008, we had a couple of conversations with him which told us that talking to him was useless. So we began this Blog. We don’t think he is a bad guy. Actually he is quite a decent guy based on our interaction with him. But he is set in his mind about Indians as a race and he is unwilling to accept that he knows nothing about Indians or India to use a famous CNBC phrase of Cramer. That’s fine too. But then why let him opine on India on CNBC TV?

The big question is did Mark Hoffman, CNBC President, approve of the comments by Tyler Mathisen, his most veteran anchor or did Mathisen shoot this arrow on his own? Also did Mark Hoffman know of or approve of the childishly stupid clip by Timotheya Duncan? If he did not, who at CNBC.com approved that clip?

Finally, CNBC allowed its Chinese correspondent Yunice Yoon to call the current outbreak in Guangzhou as due to “India virus”. But, to our knowledge, no CNBC correspondent has been allowed to label the Corona Virus as China virus or Wuhan virus. Could it be because CNBC China is a huge network inside China while CNBC is almost not in India?

But wait a minute – CNBC is a large nationwide network inside India with the CNBC brand while CNBC, to our knowledge, doesn’t run a network in China. Yet, CNBC disparages India and allows its Chinese correspondent to use India virus strain terms while banning China Virus or Wuhan Virus terms on CNBC!!!

If this is not utter contempt of Indians, what is?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter