Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Maestro!

That’s the only word we can use to describe the performance of Chairman Powell in his presser on Wednesday, November 3. The mark of the truly smart is how they well & how quickly they learn. By that standard, Powell is smartest Fed Chair we have seen. Greenspan was called Maestro but Powell has left him behind and in a much more positive way. Greenspan prided himself in making sure people don’t understand him. Powell’s virtuoso performance was masterful because he was clear & he made himself clear to all the markets.

He was so clear that even simple folks like us got it. Look at what we tweeted to the masters of the Fin TV universe (BTV, CNBC, Fox Business) on the morning of the day after Powell’s presser (Thursday November 4):

- Editor Viewpoint@MacroViewpoints – – Seriously folks! Just look – Stocks Up, Treasuries Up (Rates down hard), Yield-curve bull-steepening, Gold, Silver, Copper, Oil up; Bright Lights everywhere .. What a quintessentially Great Deepavali (Diwali) for investors? Call him Jay or Call him MVP. Just thank him

So many expressed surprise late this week about the fall in Treasury yields. They should have remembered what Priya Misra of TD Securities said (on BTV) on Wednesday, October 20:

- … I think the bond market here is so nervous about inflation & thinks the Fed will be forced in; all the bond markets in the front end are calling the Central Banks’ bluff; Now I think the ball is is back in the Central Banks court; they have to push back ….

That is precisely what Chairman Powell did in his Press Conference on Wednesday November 3. He pushed back with strength couched in gentle, even delicate prose & tone. He satisfied those who were clamoring for action by giving them some like a taper beginning this month. But he took it back by saying they might increase the taper or reduce it as conditions warrant.

What about raising rates? Look what he said:

- “We don’t think it’s time to raise rates now. If we do conclude that it’s necessary to do so, then we’ll be patient, but we won’t hesitate.”

Some like Brian Chappatta of BTV said “what does that mean lol“? They didn’t get it but the Treasury market clearly did.

Every major battle in history depends on the pre-battle positioning of the two warring sides. What was the positioning of the hawkish forces prior to FOMC day, Wednesday Nov 3?

- During week ending October 15 – 30-yr down 11.5 bps & 3-yr yield up 11 bps = intense flattening

- During week ending Oct 22 – 30-yr yield up 2.8 bps, 3-yr & 5-yr yields up 8.6 bps – flattening again

- During week ending October 29 – 30-yr down 13.6 bps & 5-yr down 1.2 bps, 3-yr down 2.3 bps, 2-yr up 3.4 bps – intense flattening

This is what Priya Misra meant (we think) by saying “all the bond markets in the front end are calling the Fed’s bluff“”. Others were saying similar but in less combative language like Frances Donald of Manulife on Tuesday, November 2 saying “central banks are too hawkish“. And then you saw Ian Lyngen of BMO saying softly but directly on BTV on FOMC morning (per our recollection & sparse notes):

- “… very strong tendency in futures market for over [tightening] right now, more than 2 Fed rate hikes priced in 2022…“

And then Ian Lyngen actually committed what amounts blasphemy among the big money guys:

- “… pain trade is towards lower yields … rates grind down for end of the year towards 1.25% – 1.35% ; consistent with trading environment this year”…

Now think back to Friday, October 22 and the stunning call by Gundlach about the 30-year Treasury bond above 2% making sense. In the last two weeks since his call, 30-year yield is down 19.2 bps; TLT is up 3.3% and EDV, zero-coupon ETF, is up 4.4%.

And yet, the CNBC show (Half Time Report) and its host (Scott Wapner) have not even mentioned the great call by Gundlach in the last two weeks. Amazing isn’t it? A network like CNBC which still depends on viewership has not been marketing this great Gundlach call to tell its viewers how they may benefit by watching CNBC.

Is this because of some great insightful strategy in the executive management of CNBC or is this being “dumb as a door knob” as it seems to simple viewers like us? Actually it might be because of intense quasi-religious intolerance of Treasuries & low yields at CNBC, especially at CNBC Half Time Report! It appears that host Scott Wapner has so gone over to the big billionaire crowd that suggesting Treasury yields could go lower seems like blasphemy to him. Speaking personally, we would like to say Thank you Mr. Wapner because his quasi-religious orthodoxy was a signal to us to believe in the opposite.

And this stone wall of rigid orthodoxy made Chairman Powell’s words so much more powerful.How powerful? He actually bull-steepened the Treasury curve reversing the trend of the past 3 weeks. The 30-year yield fell 5.9 bps from 1.94%% at 1:50 pm pre-FOMC to 1.885% at Friday’s close while the 5-year yield fell by 13.4 bps from 1.186% at 1:50 pm pre-FOMC to 1.052% at Friday’s close.

What is the ultimate accolade for a successful FOMC & presser? A significant reduction of fear & uncertainty. The above shows how successful Chairman Powell was with Treasury rates and the below shows how successful he was with the S&P fear & uncertainty – a fall from 16.19 at 1:50 pm pre-FOMC to 14.75ish on Thursday morning.:

So how do we really feel about what Chairman Powell did in his statement & presser? Look what we tweeted to the big money Fin TV universe on Thursday morning:

- Editor Viewpoint@MacroViewpoints – – @BloombergTV @CNBC@FoxBusiness –

Celebrate Brightness with Fireworks, leave darkness behind. Maestro Powell wishes all investors a Happy, Prosperous & Mangal Diwali. Thanks Jay, America’s MVP

2. NFP

Friday 8:30 am delivered a strong, impressive Non Farm Payroll report according to most observers. Actually it might have been much stronger than even most observers said. It took the manager of the monstrous asset pool, Rick Rieder of BlackRock (on Bloomberg Open), to explain the true size of job gains:

- “pretty impressive number; .. actually non-seasonally adjusted number was 1.558 million jobs [added]; …”

So every one expected rates go up as the stock market rallied hard in the pre-market. To their delight, Treasuries acted as they would have expected by rising 2-4 bps across the Treasury curve.

And then the other shoe fell. We ourselves were surprised enough to point it out to the Fin TV elites:

- Editor Viewpoint@MacroViewpoints – –@BloombergTV@CNBC @FoxBusiness – Notice folks! 30-year yld is now DOWN after payroll number …. What does it say?

We think of the 30-year Treasury Bond as the “bondo the tutti bondi” (in a pathetic rephrase of capo the tutti capi title). Pathetic or otherwise, the entire Treasury curve followed the 30-year and went negative. Not just small negative but decidedly negative on the day with

- 30-year yield down 7.8 bps; 20-yr down 7.6 bps; 10-yr down 7.4 bps; 7-yr down 6.5 bps; 5-yr down 5.2 bps; 3-yr down 2.4 bps & 2-yr down 1.8 bps

This shocked our CNBC Anchor friends who kept wondering & asking their guests (equity managers all) why did rates fall? One obvious reason is as Rick Rieder explained on Bloomberg Open (minute 8:50 to 11:50) on Friday morning:

- “rates market & stock market are both right; .. they are pricing in immense liquidity in the system; demand for long-range interest rates is immense; .. the front-end and belly demand from banks is tremendous; … listen I think growth is durable, consumer is durable in terns of strength of demand; .. I think it promotes the equity market higher; by the way there is a natural demand for yield, for these income-producing assets is extraordinary .. the 10-yr note is priced wrong in near term; we are at low end of the range but I don’t think rates are going much higher in this paradigm because organic demand, liquidity, demographics; the pension fund system is now fully funded; its gonna keep rates contained; monies will keep coming into equities. …”

But this seems unsatisfactory to some, in particular to the normally astute Lisa Abramwicz who tweeted on Friday:

- Lisa Abramowicz@lisaabramowicz1 – Good luck trying to come up with a fundamental narrative for bond yields right now. The October jobs report was better than expected, with the labor market showing real signs of momentum. And yields fell. US 2-year yields are 10bps lower than they were just days ago.

Hmm! We don’t suppose Ms. Abramowicz is a fan of Steven Segal movies. Louis Pasteur may be more her type. So allow us to Google-quote the following:

- “During an 1854 lecture at the University of Lille, French microbiologist and chemist Louis Pasteur said, ““In the fields of observation chance favors only the prepared mind.””

So how does one prepare the mind in the field of observation of interest rates? One quick, easy way is to check writings of Rosie, he of the ultimate inverse pseudonym:

- Weekly Snack of Rosie – Incomes Sag – The big news on Friday was how personal incomes in nominal terms declined a sharp 1.0% versus the consensus of down-0.3%. The problem was a $296 billion (annualized) plunge in fiscal handouts (jobless benefits) that swamped an $80 billion wage and salary pick-up. The fiscal drag is overwhelming. In real terms, personal disposable incomes plunged 1.6% after dipping 0.2% in August and they have now retreated in five of the past six months — and are down 0.5% at an annual rate year-to-date. What an economy!

We prefer eloquent pictures with words. Sadly we like many of our viewers don’t have access to Mr. Rosenberg’s charts (unlike Ms. Abramowicz we presume). But not to worry because we have the magnanimous Mr. Twitter & Mr. Bittel:

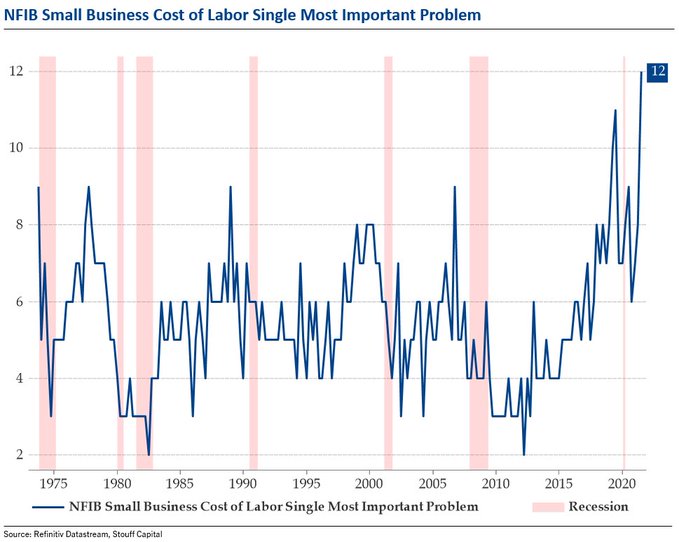

- Julien Bittel, CFA@BittelJulien – – Margin pressures are building… Since NFIB started publishing this survey in October ‘73, it’s been a good late-cycle barometer. At extremes of 8 or above, the US economy entered recession 19 months later on average… The index just hit a 48 year high. Facts > narratives.

Is there an implication here?

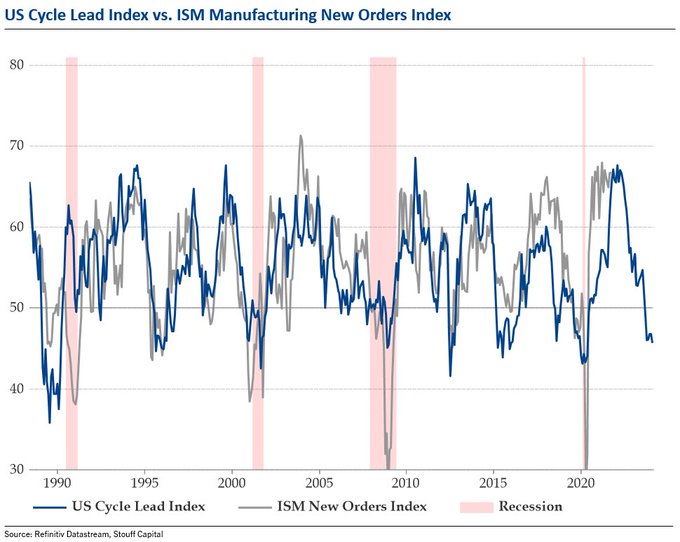

- Julien Bittel, CFA@BittelJulien – – Economic momentum is peaking. At the highs of 68 in March, ISM Mfg New Orders were in the 95th %ile of their historical distribution since 1948… Very stretched. My leads suggest we top out early next year & then work lower. Huge asset allocation implications. Stay tuned.

We wonder whether the above qualifies for a “fundamental narrative for bond yields” for Ms. Abramowicz. Will she tell us?

3. Hall of Fame?

After a great October, the first week of November was terrific as well:

- Dow up 1.4%; S&P up 2%; NDX up 3.2%; RUT up 6.1%; IWC (micro-caps) up 5.9%; DJT (transports) up 5.9%; SMH (semis) up 8.2%;

Is there anything that we would have preferred to complement the above? Look again at VIX chart of last week:

VIX bottomed for the week on Thursday late morning around 14.75; it again fell on Friday morning only to bounce hard above 16 on Friday afternoon. On two successive days (Thu & Fri), VIX rallied 2.25% & 6.74% resp despite strong rallies in S&P. We recall that Cramer & his techni-pals have told us that it is bearish when both S&P and VIX go up simultaneously.

This pattern has been seen on a weekly basis for two successive weeks. This week the S&P was up 2% & VIX was up 1.4%. The week before the S&P was up 1.3% & VIX was up 5.4%. Is this a bearish sign? Would Cramer & his techni-pals enlighten us?

Assuming it is bearish, many (Mark Newton, Ryan Detrick to name two) tell us that a 3-5% selloff that lasts a week or two is all that we might see and that would be a buying opportunity.And our VIX guru seems to agree:

- Lawrence McMillan of Option Strategist – $VIX indicators have remained bullish for stocks, but $VIX itself is reluctant to give up too much ground. It is holding at 15, roughly. In a typical bull market like this, $VIX would be in the 12- 14 range or even lower. But big-money $SPX option traders are still a bit leery of what lies ahead and so are buying enough puts to keep $VIX somewhat elevated. I am becoming more and more convinced that we are going to have to see $VIX below 12 before this current bullish phase terminates. These $VIX bulls are going to have to give up their game.

What should people trim if there is a short correction or even without it? Anastasia Amoroso said the following on Bloomberg Open on Friday:

- “I do like what I see but some of the moves have been parabolic … we are already up 8.5% (vs avg 4.5%) – its been very impressive but gives me some pause … Semis, real-estate, energy I like but are susceptible … If December FOMC is more hawkish, then could see a near-term hiccup … “

On the other hand, how much further can the stock market go, on an average?

What about EM you ask? Chinese ETFs were down on the week, even FXI was down 2.6%. Despite the huge move in U.S. semis, EWY (South Korea) was down 6 bps on the week. Brazil was up 1.4% & Indian ETFs were strong despite the 2-day Diwali holiday on Thursday & Friday – INDY up 2.3%, INDA up 2.4% and small-caps SMIN up 3.7% on the week.

4. Commodities

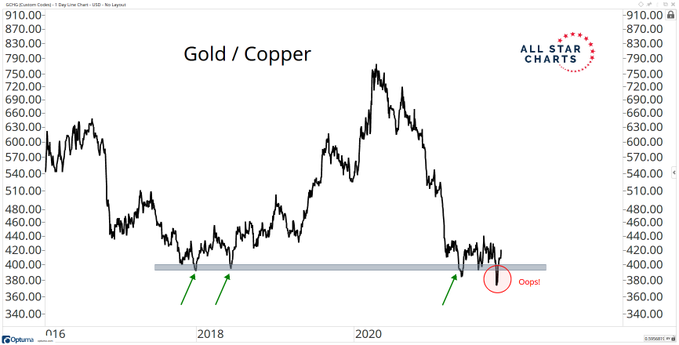

Oil was down 2% but OIH & XLE were up 2.9% & 1.3% resp. Copper was down 71 bps with FCX down 2.5% & CLF down 7.4%. In contrast, Gold was up 2% with GDX & GDXJ up 3% on the week. And Gold, & Gold miners was the final buy trade for Carter Worth, resident technician of CNBC Options Action.

Even a recent skeptic asked the question:

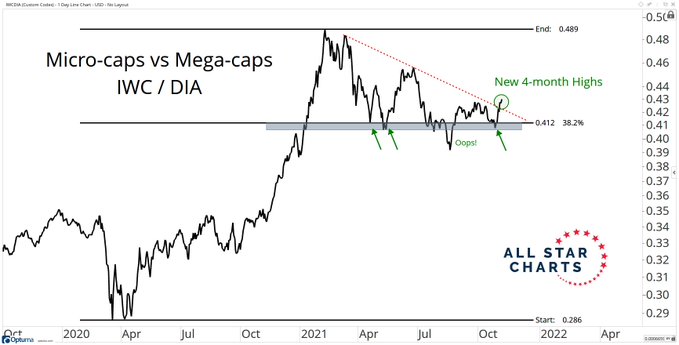

- J.C. Parets@allstarcharts – Nov 6 – something? or nothing?

4. Diwali

We can’t remember a time when our thoughts about Diwali were so focused on what happened this week in America. For details refer to our adjacent article A Great Week of Diwali & A Perfect Start for the New Year. But however focused we might be on USA & NYC, we have to show the scale of Diwali celebrations in the ancient city of Ayodhya that might have begun Diwali. Reportedly 900,000+ lights were lit along the banks of the legendary Sarayu River.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter