Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Numero Uno once again!

What has worked again & again this year? VIX ! None of the big or profound issues we discussed last week are anywhere near a solution or even an understanding. Yet, it did not matter. What mattered? The state of the VIX as we had quoted last week in Section 4 of our article:

- The Market Ear – VIX term structure – extreme edition – … stress in the short end of the curve is now extreme. …. big panic being priced in

- Anastasia Amoroso – the “fear factor” …. difference between put and call volatility. It is (almost) back to March 2020 levels

- The Market Ear – … very stressed. VIX 2/8 futs month spread is trading at levels we last saw during the “crash” in late January. The entire term structure is very extreme here

So guess what happened this week? VIX fell 39% to 18.69. Naturally what happened to stocks?

- Dow up 4%, S&P up 3.8%, RSP (Equal-Weighted S&P) up 3.2%, NDX up 3.9%, Russell up 2.5%, IWC (Micro Caps) up 2.5%, Transports up 2.7%, EEM up 2.5%, Chinese ETFs up 4%, Brazil up 2.6%, South Korea up 2.6%, Indian ETFs up 1.7%, Oil up 8.9%, Oil Services ETF up 10.2% .

What happened to the scary Hyde-Fed that is going to taper & tighten? What happened to the fear that big tech stocks or MANAA as we call them were going to crater & crater the stock market? Praise the VIX, we say and point out:

- Microsoft up 6.2% on the week, Apple up 11.2%, Netflix up 1.7%, Alphabet (GOOGL) up 4.2% and Amazon up 1.8%. Even FB, the stock technicians dislike, was up 7.7%.

This is an anti-tightening action, the action that says stable earnings may be the key going forward. No wonder XLP, Consumer Staples ETF, was up 3.5%, almost as much as the MANAA-weighted S&P 500.

Is this week just a vicious bounce back from last week or is it a virtuous uplift?

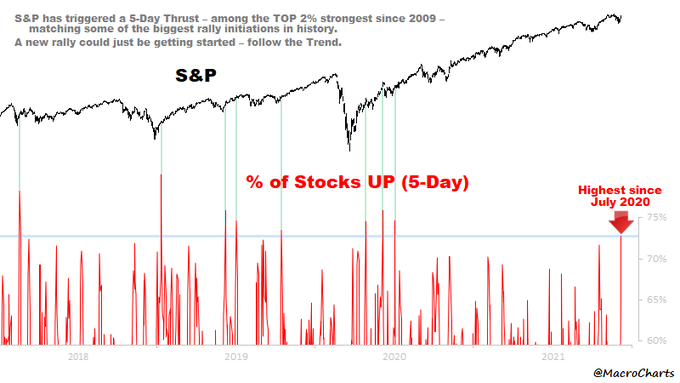

- Macro Charts@MacroCharts – Massive strength in Stocks: S&P has triggered a 5-Day Thrust – among the Top 2% strongest since 2009 – matching some of the biggest rally initiations in history. Don’t underestimate how far Stocks could still go. A new rally could just be getting started – follow the Trend.

Look at the tweet two days prior to the above:

Getting back to Thursday, December 9:

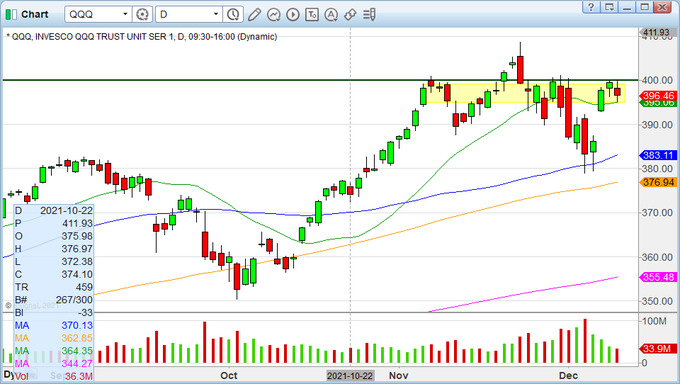

- HCPG@HCPG – – Best bull case is to stay in this narrow highlighted zone above 20sma, create a base, and breakout of 400 $QQQ Bear case, get below that yellow zone

But none of the above tweets mention our Numero Uno factor, the VIX. Fortunately, Jim Cramer relayed the bullish message of the VIX via his techni-pal, Mark Sebastian. Simply put, Mr. Sebastian says the Santa Claus rally is on and it could get to 5,000.

Nice talk, but just talk. Is there any Cramer pal who actually walked this walk on Friday?

- Bob Lang@aztecs99 – Dec 10 – looking for a year end push, adding some index plays with the chat room — spy and qqq for 12/29

And what did he opine about Friday’s strong close?

All this might also have been courtesy of a strange yet now common behavior in markets? The CPI number on Friday morning was as bad as expectations, the highest in decades. Naturally Treasury rates rose 2-3 basis points on that news. But then they began falling & the 30-year led the fall into negative territory. Not even a strong Sentiment number could reverse the fall in the entire Treasury curve.

We will leave the whys & wherefores to later sections and focus on the result or THE RESULT, as we should say:

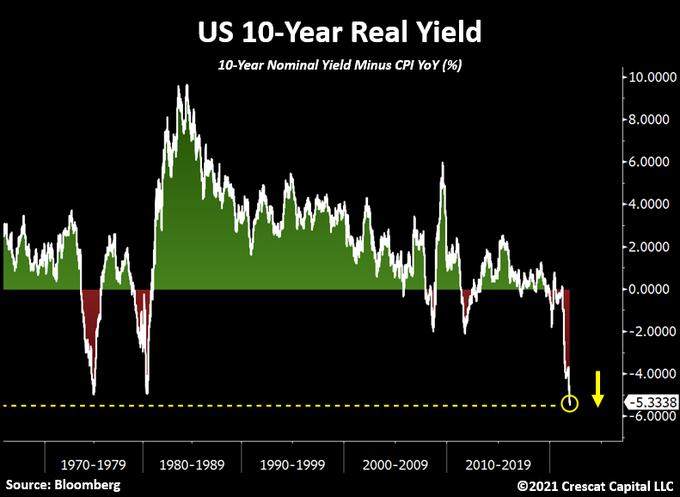

What might Al Capone have said to this single point negative real yield? “You got nothing, nothing; … you don’t got a thing … “!

David Bailin, Global Head of Citi Private Bank, doesn’t speak that way but his message via BTV’s Lisa Abramowicz, was essentially the same. First he dismissed current inflationary stuff as “transitory” and then made the BIG point that we are going to have negative real interest rates for the next decade. So investing in most asset classes for the next ten years is likely to give investors negative returns vs. inflation for the next decade. At the same time, he pointed to the

- “extraordinary amount of cash on the sidelines; Citi global wealth ultra high networth clients have cash levels of 20%-30% in their portfolios right now; they are concerned about valuation; they are going to be surprised & not benefited from this condition of lower rates for longer …. ”

Jonathan Golub of Credit Suisse also dismissed the inflation panic in his conversation with Jena Ferra on Bloomberg Open on Friday morning:

- “Fed backed away from the word “transitory” but they still believe & Wall Street still believes that this inflation problem we have is going to resolve itself over the next year, 18 months, two years or some reasonably short period of time“

That means,

- “you have 150 bps on 10-year & headline inflation of 6-8% …. corporate profits & CPI are like on top of each other; inflation means more sales … looking at really good earnings next year; ”

He then pointed out the “key issue” for next year:

- ” … stock valuations don’t care about inflation; they care about the discount rate & the discount rate is really low; and if the Fed tries to slow things down more by speeding up their taper process, they are likely to put even further downward pressure on the yield curve; that I think is going to be the key issue; … ”

If he is right, then we are back to the Bailin expectation of negative real rates for quite some time. Then Golub pointed out how & when the Fed damages the stock market:

- “ … the other thing we have to remember is that the Fed doesn’t damage the market by raising interest rates; they damage it when they invert the yield curve & right now no one expects the Fed to invert the yield curve for a couple of years … “

So?

- ” … so you know they are going to move more gradually; they are not doing anything to disrupt the liquidity in the market; and all of this points to multiples being up incrementally … but that on top of good earnings is a great stock market year … “

2. Curve inversion; Fed’s Transformation

Steve Major mocked the Fed saying “getting hawkish just when inflation is about to crash around their ears is a way of tightening policy“. Then he pointed to the Treasury curve inversion that has already happened:

"The U.S. government has effectively borrowed from the children to pay their parents." HSBC's Steven Major explains why money created through QE may not be truly stimulative & how to approach next week's Fed meeting https://t.co/GFqbpu8U7j pic.twitter.com/8oG9enast1

— BSurveillance (@bsurveillance) December 8, 2021

- ” …2-year Treasury, 1-year forward, trading at 1.20% at the end of last week; so the forward has got a lot of cover for the Fed hikes; and in fact, in the forwards, there is inversion already; you go out 1-year on 10-30 and you see an inversion; if you look at a chart of last 30-40 years, you see inversions only happen 2 or 3 times; ….. So I think fading the inversion is important; we have to look at the forwards; the 2-year rate is already pretty high in the forwards … once bitten, twice shy … “

Remember we termed Powell’s transformation in the Fed minutes & his congressional testimony as one from Jekyll to Hyde. That is hardly what Ellen Zentner of Morgan Stanley could say. So, in her conversation with BTV’s Alix Steel, Zentner said:

- “ a perceived change in the Fed’s reaction function & we think that’s what we have seen; it culminated in Powell’s remarks in his testimony where they clearly put price stability first while before it was maximum employment … ”

So a working class American whose family has already been ravaged by big price hikes in everything they buy in the interests of maximum employment will NOW be told his/her continued employment is not that important. Even more simply put, as they scramble their meagre resources to pay for winter’s heating bills they now have to worry about possible unemployment. Aren’t they likely to see this Powell transformation as from a Jekyll to a Hyde?

And the Fed is doing it now, when even a wrong-until-now hawk like Mohammed El Erian warned CNBC’s Becky Quick that the Fed could end up inverting the yield curve? And now, when Ellen Zentner, in addition to David Bailin, Jonathan Golub, Stephen Major, said she still expects “inflation to come off its highs as we move through the first quarter of next year“?

Assuming they do so, how will the markets react? An old dictum says the market doesn’t fall twice on the same news. So if Powell comes across as hawkish as he was in the Congressional testimony, will the markets react as harshly as they did last week? Or will the bond market will actually let Treasury rates fall on this widely expected faster taper + rate-hikes-later communication because it is likely to be more dovish than their worst fears? And if so, will the stock market rally?

On the other hand, what if Powell comes across as more circumspect and a less of a “Heil White House” type of a subordinate? Will both stock & Treasury markets rally on reduced fears with VIX breaking 16 again?

We will all find out together.

3. The Big Risk

Summer of 42 was a cute, soft movie. But Summer of 2007 was a very different story. Wasn’t that the last summer when Fin TV was so full of hot inflation coverage? We can still hear echoes of CNBC Fast Money lectures of that summer. We are now seeing more references to 2007 than we saw in the post financial crisis period. One example is,

- Liz Ann Sonders – LizAnnSonders – November @AtlantaFed median wage tracker reversed higher at +4.3% y/y, highest since June 2007

The Treasury market seems to be sending an even starker signal far more loudly than it did in the summer of 2007. Very strong economic data is leading to Treasury rates going down instead of shooting up. The Treasury market screamed in pain last week when Hyde-Powell showed his new & dark side. Yes, the Treasury market screamed when they faced the visage of 1% Federal Funds Rate!! Go figure!

Gone are the Greenspan 2003 days when 1% rate was deemed as ridiculous low. Gone are the 2008 days when 0% rate was deemed as ridiculously low. Today 0% rate is viewed as the upper bound of interest rates. And why not when the real 10-year rate is now negative? America has joined the developed world, it seems.

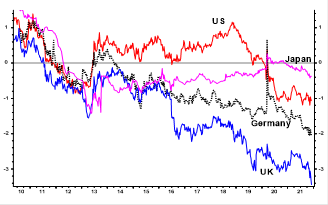

- Albert Edwards@albertedwards99 – – All is not well. Real 10y yields are plunging in Germany (now -2.1%) and especially UK (-3.5%). Incredible! We’re getting a misleading impression of real yield stability in recent weeks watching the US market. And who would have thought Japan would end up the high yield market

In this world, a tightening campaign to even 1% Federal Funds rate could be destructive. Because of the enormity of debt in the world. As Bear Traps Report reminded us this week,

- there is $30T more debt on earth today sub 2% in yield – than there was in the last two hiking cycles. The below 2% part is important because it speaks to colossal convexity in today´s bond market. Everyone knows – with interest rates UP, bond prices go DOWN. The problem is – with trillion more debt on earth BELOW 2% – a 25bps rate hike carries the destructive forces of 4 hikes 15 years ago!!!

Let us repeat what we said in summer of 2007. This may be the time to get more dovish instead of getting hawkish. Someone needs to remind Fed Spokesman Liesman & Billionaire-spokesman Wapner that it is the rate of change that matters.

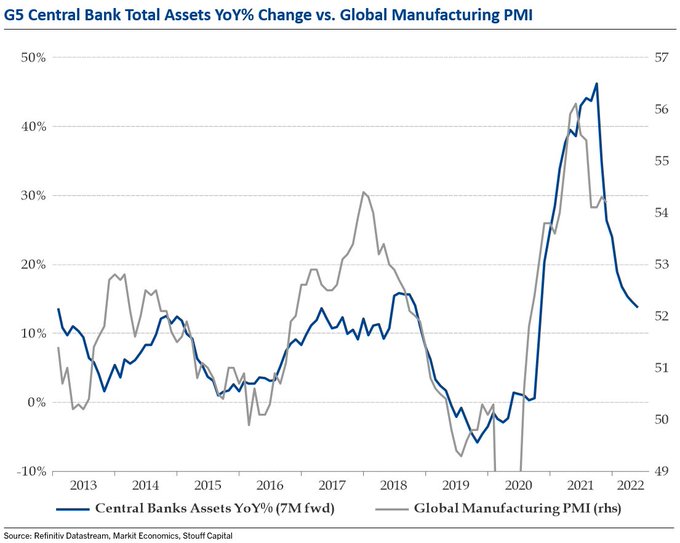

- Julien Bittel, CFA@BittelJulien – – While absolute levels of global central bank balance sheets are important, it’s the pace of growth that drives economic momentum. G5 CB balance sheet growth YoY peaked in Q1 & works with a lead. The Global Mfg PMI slowed to 54.2 in Nov. & this trend should continue into H1 ‘22.

What might it mean for credit?

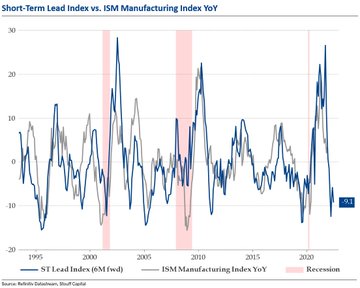

- Julien Bittel, CFA@BittelJulien – Very little risk being priced into high yield spreads these days… Some of my leads suggest the ISM should fall ~9pts by end of Q2 ‘22. This would target an ISM of 51.5. If correct, this would mean that spreads could double next year. Definitely a risk worth monitoring.

Q2, 2022? Isn’t that Summer of 2022, a la Summer of 2007 or worse Summer of 2008? Just remember the number – $30 trillion of Bonds yielding less than 2%. You know where the term “horse sense” originated? Because horses scream in fear & refuse to move forward when they sense quicksand ahead. And smart riders listen to their horses and turn around.

Will the Fed get some of this horse sense?

4. A turn for the better?

Did you notice that the U.S. Dollar fell some on Friday despite the hot hot CPI & sentiment data? One quick solution for the Fed is to somehow weaken the U.S. Dollar. That raises the question:

- J.C. Parets@allstarcharts – If Emerging Market Currencies were EVER going to stop going down, wouldn’t this be where that would happen? @WisdomTreeETFs @JeremyDSchwartz

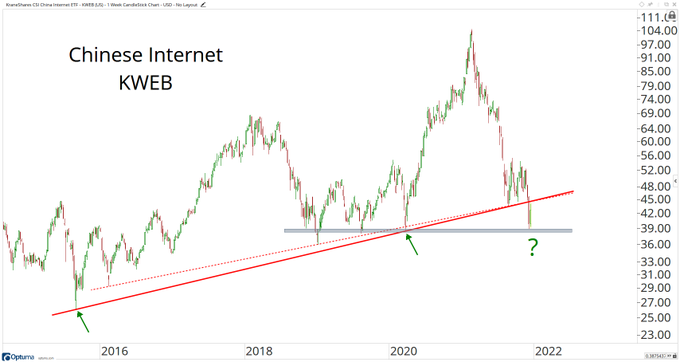

What then about the utterly discarded KWEB?

- J.C. Parets@allstarcharts – Are Chinese Internet Stocks ever going to stop going down? $KWEB working on a 60% decline this year all the way back to the depths of the COVID lows. It’s hard to find anything out there worse than this group. So bad it’s good? Or about to get worse?

Remember the good old days when Chinese low prices helped cool down goods inflation in America. Are those good days about to get here again?

That seems to be more talk, a la Ruchir Sharma. Is there any one getting ready to walk?

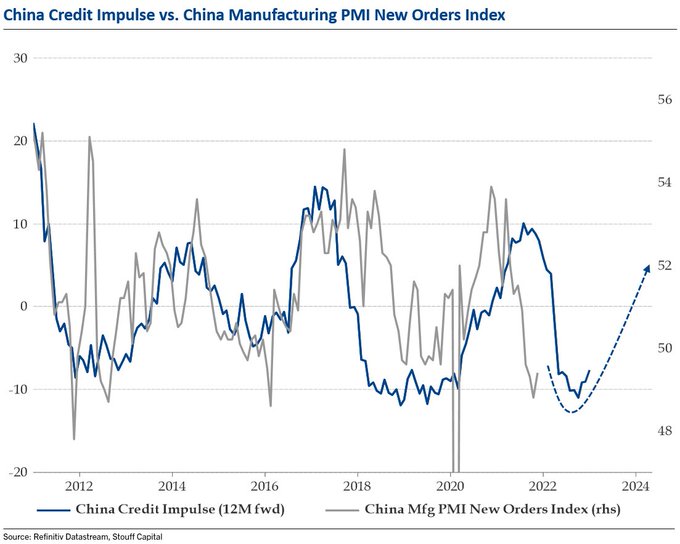

- Julien Bittel, CFA@BittelJulien – – We’re writing a very long piece on China at the moment discussing why we like Chinese equities vs. US as a relative long idea for 2022. A few points to share: 1) Trades at a 40% discount to US 2) Short China top 5 most crowded trades (BofA FMS) 3) China credit impulse up

Hmm. But is there anyone who is already walking on this path? Watch the video below of Goldman’s Tim Moe upgrading China to Buy. The case is similar to the one above. But Moe also highlights the increasing percentage of high tech in Chinese market cap (KWEB anyone?).

Moe is also upgrading MSCI ASEAN area that has underperformed for 10 years, a la Ruchir Sharma logic. Moe’s 3 reasons are 1) economic & earnings momentum 2) banks (35% of index) doing better & 3) signs of digital economy coming into the listed market area (like in China 10 years ago & now happening in India).

Well, we cannot send a taste of Indo-Chinese cuisine (Chinese cuisine adorned with Indian spices) via this post. So we insert below an evergreen clip from 1958 when Bengal was the melting pot of Chinese immigrants into India. Four years later, China attacked India and this genre disappeared:

The basic couplet goes like this:

- My youth is from Singapore & my style is Shanghai; My name Chin Chin Chu; You & me alone in this moonlit night, Hello Mister how do you do?

5. To the Future from the Tech of Back

Unlike KWEB, this has already done great this year. But it might not even be the first inning as a major CEO said this week. And it is a perfect fit for the “negative real rates for the next decade call” of Citi’s David Bailin in Section 1 above.

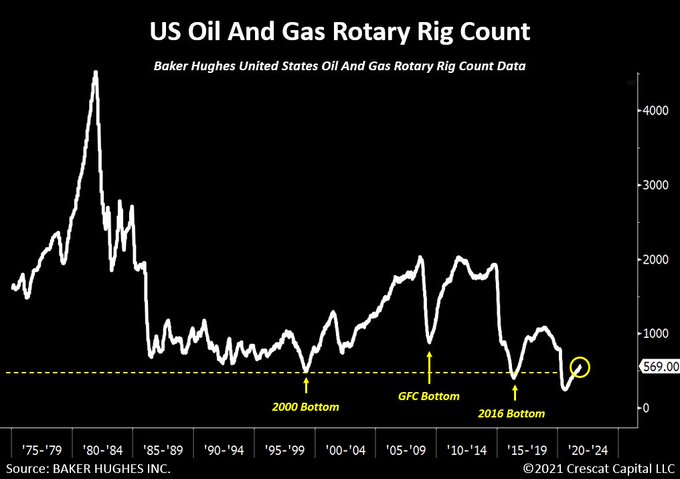

- Lisa Abramowicz@lisaabramowicz1 – Oil is headed for its biggest weekly gain in more than three months, back to September levels. WTI is up 50% on the year.

It is hard to imagine now that drilling of oil wells was at its inception a major technological achievement that changed the world’s prosperity trajectory. Why is that relevant today?

- Richard Bernstein@RBAdvisors – Energy the next growth story? Last time the #Energy sector’s FCF Yield was this attractive was around the #TechBubble and Energy then outperformed for a decade.

Some call it one of the early innings:

Now to the CEO who said “it is not even the first inning“, a CEO whose stock is up 158% this year:

(minute 4:35 to 8:40)

Charif Souki, CEO of Tellurian Energy, said a new plant can pay for itself in 2 yrs with natural gas in USA at $4 and globally at $25. An excellent short clip.

The big change for investors is what Scott Sheffield of Pioneer Natural Resources said this week:

- Squawk Box@SquawkCNBC – “I never received a call from the administration about adding more rigs,” says $PXD CEO Scott Sheffield to @SullyCNBC . “I don’t think we have an obligation to grow production…we added too much oil several different times over the last 10 years and we had a price collapse.”

This commitment to investor returns is really important to get more mainstream stock investors into energy stocks. Kudos to Mr. Sheffield.

On another note, the above shows we forgive even though we don’t forget. There is a norm to college football fans. Except for blood feuds like Michigan-OSU, when a fan gets a good luck wish for his/her team, norm suggests the receiving fan also send a good luck wish to the first fan’s team. Either because of his Anchoritis or because of a rare moment of arrogance about Hokies, Mr. Sullivan did not follow the norm & wish us good luck for Michigan. No big deal. To each his own.

But today it gives us a chance to follow the norm & thank Guy Adami of CNBC Fast Money for his positive mention about Michigan going into the Playoffs. And we take this opportunity to wish Georgetown Hoyas best of luck for this College Basketball season.

So in this happy positive fan moment & this oil section, allow us to insert a happy, spoofy Bollywood clip filmed in Dubai about a beautiful woman sent (by their sister & her boyfriend) to soften up two mafia-type brothers by flirting with both of them. This un-serious spoof was a huge hit in the Emirates & the Middle East, thus providing a tenuous excuse to insert it in this section:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter