Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”checking … boxes“

The title is a part of the line “… we are checking a lot of boxes for things we like to see develop at or near technical lows … ” used by Chris Verone on CNBC Fast Money on Thursday. That is what we were doing since Monday morning, looking for behavior that might suggest up move triggers. That’s when we thought of asking Jon Najarian (via CNBC & Twitter of course) if he saw any unusual Options activity betting on an up move in stocks. Guess what he delivered on Monday at Half Time – people buying VXX February 19 puts when VXX was trading at 25 on Monday morning when VIX was trading at 39:

Then came 1 pm on Monday and we saw a terrific 2-year Treasury auction with strong foreign demand. Hmm, didn’t they know Powell was going to speak on Wednesday in the post-FOMC presser?

Fast forward to Tuesday at 1 pm for the 5-year Treasury auction. Surely that would be lukewarm, right? That’s why they play the game, as the saying goes. The indirect (foreign demand) came in at 66%, a figure Rick Santelli had not seen in 21 years. Listen to him yourselves:

What has been the real fear in the stock market? That Powell would raise interest rates fast & furious and do QT that would drive rates higher! So when the two Treasury auctions saw such big demand, that fear was somewhat alleviated and the VIX stayed passive. Look at how QQQ behaved after Monday & Tuesday auctions ( 1pm):

The 1 pm auction trigger on Tuesday is clear above. On Monday, the rally had already begun because of the VIX coming down from 39 but you can still see the QQQ rally extend after the 1 pm auction on Monday.

Then came Microsoft earnings on Tuesday after the close. The stock that was down after the numbers rallied hard after the conference call. That was a big positive sign. That carried over to Wednesday afternoon and the Dow was at 34573 at 1:45 pm on Wednesday, 200 points higher than 34265 close on Friday, January 21.

We all know what happened when the FOMC statement was released at 2 pm. By 2:30 pm, the NDX was up 3% on the day & joy reigned in the markets. Then Hyde Powell began speaking & apres that, came the deluge. Treasury rates exploded up & Stocks fell off the cliff. The 2-year yield jumped 11.5 bps in the last 90 minutes on Wednesday. But more on the Powell presser & the deluge in the next section.

After that explosive rise in Treasury yields on Wednesday afternoon, Thursday’s 7-year Treasury auction should have been a disaster right? Actually investor demand was so strong that Dealers only took 14% of the Auction, the smallest number since January 2018. In fact, those who bought the off the run 7-year early morning got a better price than those who bought at the auction. Because rates alone the entire Treasury curve fell hard on Thursday morning.

* Most anchors sadly ignore Treasury auctions & Santelli’s comments about them. So our sincere thanks to CNBC’s Kelly Evans for posting these Santelli clips on the CNBC site.

Fast forward to Thursday’s close. What was that strange sight on your terminal? Stocks were down (S&P down 23 & NDX down 170) BUT VIX was also down 4.5% on the day. Remember how Mark Sebastian, Cramer’s techni-pal, teaches that when S&P and VIX rise together, its a bearish signal. So when S&P & VIX fall together, it should be a bullish signal, right? At least that was our view on Thursday.

Then came Apple earnings after the close on Thursday and doubts were dispelled. Look at the bullish triggers from Monday to Thursday:

- Three large Treasury auctions had met strong investor demand;

- Earnings from market’s generals had been powerful and,

- VIX had steadily fallen for four days & closed down on Thursday, the fourth day.

Are you still surprised that stocks rallied hard to end the week that had begun badly? Especially when Tom McClellan had written the following on Thursday evening in his article Another Oversold 10% Trend of Daily A-D:

- When the 10% Trend of daily A-D gets down to below -600, it shows an oversold condition for the overall stock market. It is possible to get a lower reading than this, but that usually takes a Covid Crash or a Fed and crude oil induced selloff like what we saw in December 2018. The rest of the time, a reading like this is usually enough to mark at least a temporary end to a big selloff.

Let no one forget VIX, the Numero Uno indicator. Remember it touched 39 on Monday morning and it closed Friday at 27.66, down 4% from the 28.88 close on Friday, January 21. Guess how Lawrence McMillan of Option Strategist described it:

- $VIX has increased as this market decline has taken place, but really not all that much. $VIX spiked up to 39 on January 24th, but has fallen back quite a bit from there. That day also marked the low on $SPX so far. Thus, a $VIX “spike peak” buy signal is in effect.

Did this week mark the end of Sebastian-Cramer’s VIX Swell of last week and the beginning of a VIX Spike signal? We will find out next week.

The above is about the short term. The intermediate term is not so clear. Tom McClellan did warn that the above “oversold reading on the 10% Trend is really only useful as a short term indication“.

- “The RASI can also help us know when enough of a selloff has happened on a longer time frame, when it gets down to its own version of a nice juicy oversold level. It is working on doing that now, but better and more permanent bottoms for stock prices tend to occur at much lower RASI levels than the -403 reading we are seeing as of Jan. 26, 2022. So while we may have a nice juicy short term oversold condition according to the 10% Trend of daily A-D, the RASI is saying that a better and more lasting bottom would be better found if we can see the RASI get to a much lower level than this.”

The discussion above about VIX, Treasury auctions et al is from a simple perspective of a simple mind. Proven technicians look at different signals & speak differently as Chris Verone did on CNBC Fast Money on Thursday:

2. Powell’s Presser or Puke?

Remember when we began using the Jekyll-Hyde terminology for Chairman Powell? He was re-nominated by President Biden on Monday, November 22. The White House announcement placed fighting inflation as the first priority for the Fed. Two days later came Powell’s new hawkish stance against inflation in the Fed “minutes” released on Wednesday, November 24. On December 4, 2021, we wrote our article “Jekyll vs. Hyde or a Faustian Bargain?“.

Fast forward to December 15 & recall how superb Chairman Powell was in that presser. It was pure Jekyll Powell. But wasn’t that the norm for him? He had been noted for smoothing the rough edges of the FOMC statement & comforting financial media & investors. That Jekyll Powell was nowhere to be found on this past Wednesday. What all of us saw was Hyde Powell with a quiet intense rage.

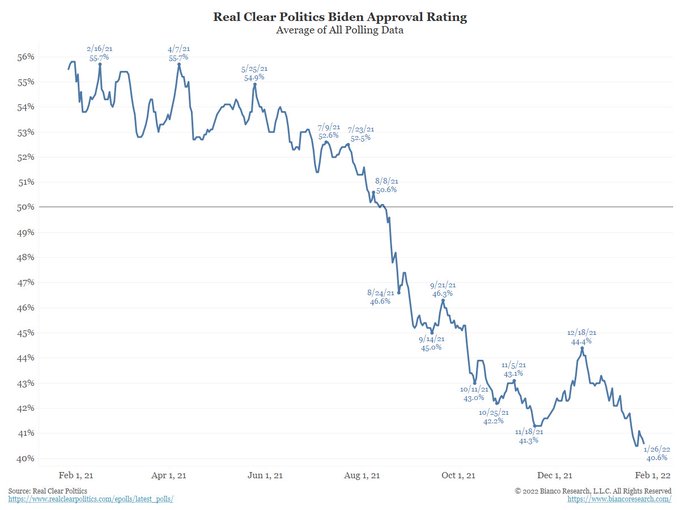

What was Powell’s mandate? To get a turn in the chart below (courtesy of Jim Bianco):

How, you ask? As Jim Bianco put it ” the Fed is under enormous political pressure to at least appear to to be doing something“. About inflation that is. The pressure from financial cognoscenti was even more intense. Witness the tweet by Richard Bernstein before the FOMC statement:

- Richard Bernstein@RBAdvisors – – #Commodities have just hit a 7-year high. Will the #Fed grow vertebrae in today’s #announcement or stay on #schedule to hike….in 7 weeks?

So how did the actual statement read? It was so well worded that Morgan Stanley’s Jim Caron described it as “clear lack of clarity & that’s by design“. In stark contrast, Richard Bernstein was disgusted:

- Richard Bernstein@RBAdvisors – – The #Fed has NEVER been this far behind the #economy and they just said they’ll raise #rates in…7 weeks?!?!?! This Fed has no #inflation fighting creds. Take the over on inflation.

Hyde Powell could have ignored these sentiments BUT he could not ignore the stock market’s sheer unadulterated joy. The NDX rallied to being up 3%+ on the day.

Our guess is that Powell was incensed. Here he had been able to convince the FOMC to do the right thing & not damage markets and, in response, the markets were making him look supine & stupid. Didn’t they know that he needed a sell off to show to his political bosses that he was doing what they wanted? How could he show his face when the markets had shown him up as a monetary dove to those who had re-nominated him?

So we think he came into the presser determined to display his inner inflation-fighting strength & intensity. There wasn’t even a trace of the December 15 Powell who smoothed feathers. It was extreme Hyde Powell who answered every question in the most hawkish way he could. He essentially tore up the FOMC statement verbally in a take-this series of body blows to market psychology. It was as if he was puking out all his anger & frustration about the pressure piling up on him to do the impossible.

All this pushed the stock market into a 900-point down reversal & catapulted the 2-year rate up 11.5 bps, a 2-standard deviation move in the 2-year just with words. But the next day the Treasury market seemed to sense that Powell was puking out his inner frustration. Why do we feel so? Because the very next day, the Treasury market gave back a large portion of the rate propulsion seen during his presser:

- 30-yr yield went up 5.2 bps on Wednesday & fell 7.8 bps on Thursday = net down 2.6 bps

- 20-yr up 5.6 bps on Wednesday & down 6.4 bps on Thursday = net down 0.8 bps

- 10-yr up 8.1 bps on Wednesday & down 3.9 bps on Thursday = net up 4.2 bps

- 7-yr up 9.3 bps on Wednesday & down 2.2 bps on Thursday = net up 7.1 bps

- 5-yr up 10 bps on Wednesday & up 1.8 bps on Thursday = net up 8.2 bps

- 3-yr up 11.6 bps on Wednesday & up 8.1 bps on Thursday = net up 3.5 bps

- 2-yr up 11.5 bps on Wednesday & up 9.9 bps on Thursday = net up 1.6 bps

That’s It??? That’s the impact of Powell’s hawkish tantrum? And by Friday’s close even that meagre impact was gone. So Rich Bernstein can’t be happy despite what Hyde Powell tried to do for him & his cohort. Rich was already enraged at Powell for causing inflation.

Now, to add insult to injury, Rich’s old colleague became enraged at Hyde Powell for the opposite reason – for causing recession:

And unlike Rich, Rosie went after the political masters of Hyde Powell:

- David Rosenberg@EconguyRosie – We had an irresponsible untargeted Biden budget buster (mass stimulus checks and work disincentives) in March that was underwritten by the Fed and now it’s payback time. At least the coming recession will flip the House and Senate in Nov and end this era of fiscal recklessness.

And we thought David Rosenberg was pro-Democrat. By the way isn’t Jim Grant nuts to advocate abolishing the Fed? Where else could we find such opportunities to practice amateur behavioral analysis?

3.Regime Change?

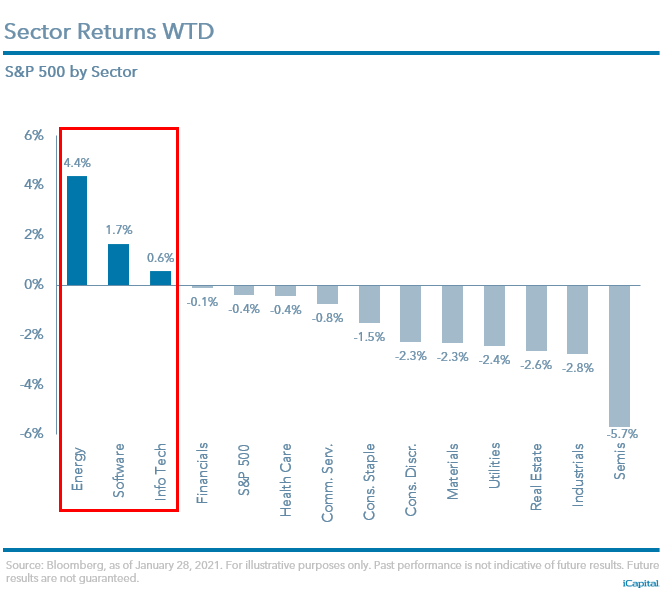

Chris Verone spoke of a regime change in the stock market in the clip above, arguing as many do that cyclicals will be the new leader & old Nasdaq tech will be a laggard. Then you look at the week and notice that Copper was down 4.1%, CLF was down 2.4%, FCX down 13.3% on the week while MA was up with Microsoft up 4.3% and Apple up 4.9%. In fact, Energy was the only commodity sector up this week.

Who noticed this?

Forgetting the Fed, what if the Treasury market remains calm & the economy keeps exhibiting the trend towards softer data, wouldn’t Nasdaq outperform? CNBC’s Sara Eisen asked this question on air on Friday.

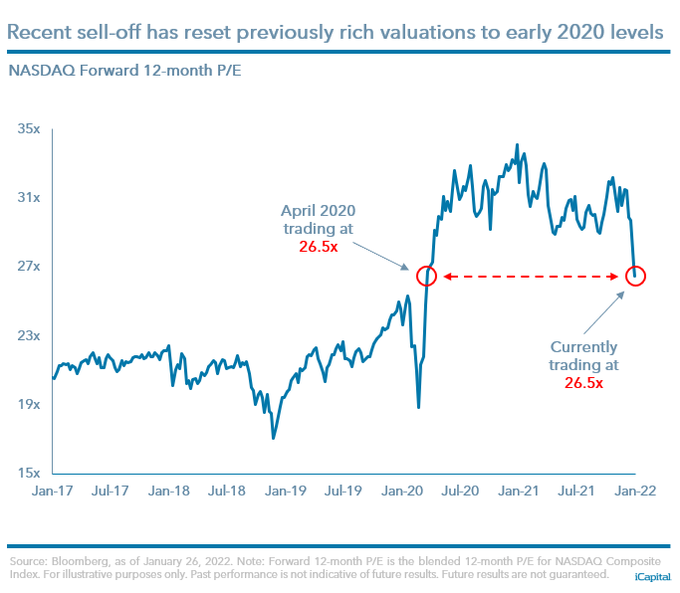

But what about the expensive valuation of the Nasdaq, you ask? Below is more ammunition courtesy of AAmo (otherwise written as Anastasia Amoroso by those with greater typing stamina):

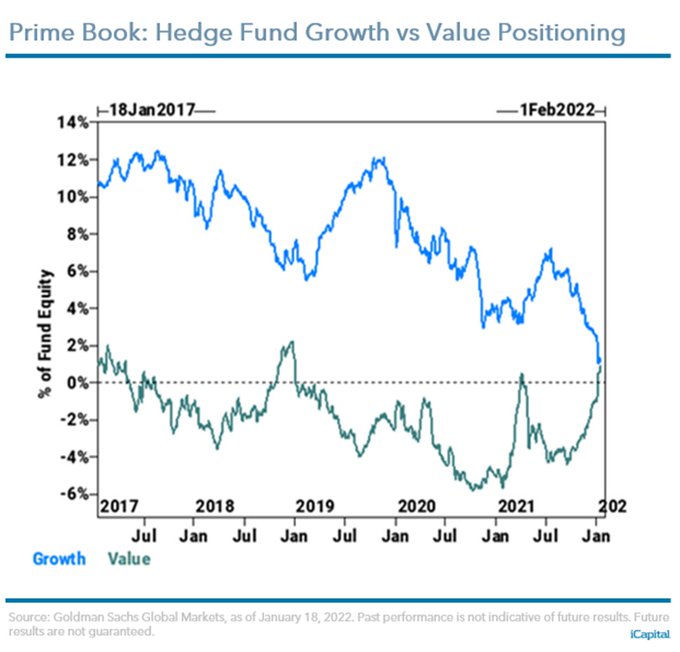

Ok, the earnings & stock performance was better and the valuations are back to old normal. But what about the biggest factor in near-term performance – positioning? From last week’s chart by AAmo:

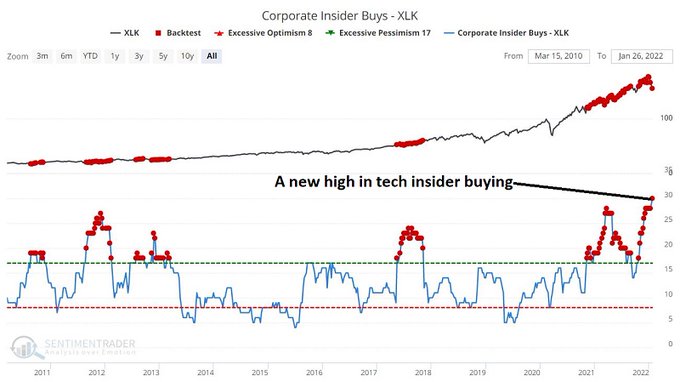

That leaves the most important question of all – what are insiders doing?

- Jay Kaeppel@jaykaeppel – – Still trying to wrap my head around all of the tech insider buying going on. Are they just flat out wrong/crazy? Or are the rest of us missing something? #sentiment

But what about the Semis? They are supposed to lead the QQQ, right? And last week, they were the worst performer (see the first AAmo chart above). Isn’t there a semi-religious dictum that says the last shall be the first? Presumably Carter Worth, resident CNBC Fast Money technician, knows this dictum because he bravely said Buy Semis on Friday evening:

Even Chris Verone should be happy about Semis because they are the most cyclical segment of QQQ. And J.C. Parets has termed Semis as the new Transports in today’s markets. So if Semis turn up, his nouveau Dow theory should drive the Dow higher, right? We will find out soon.

Moving to the broader market,

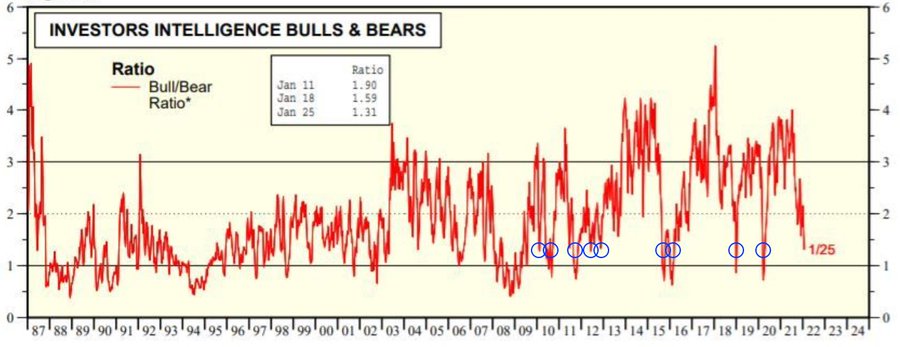

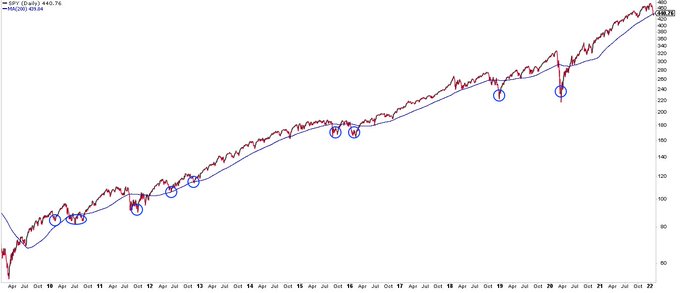

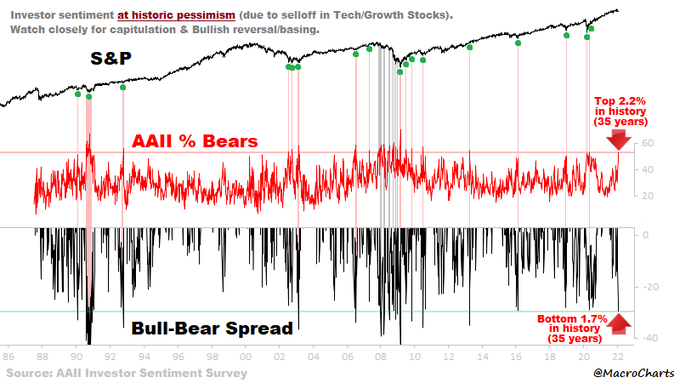

- Urban Carmel@ukarlewitz – For completeness, here’s Investor Intelligence bull/bear ratio, which dropped to 1.3x this week (LHS). Post-GFC, sometimes it stops here, sometimes in falls <1x; regardless, this is the low end of the range where $SPX has been near a bottom (RHS). Consistent with other data

Nothing “sometimes this, sometimes that” in the tweet below:

4. End of an era!

All we are left with a sense of regret that Coach BA called a crazy all-out blitz against Stafford in final seconds instead of playing deep cover to prevent a long reception. That Stafford-Kupp play won the game for Rams with a last second field goal and ended the Tom Brady era as we found out today.

We have been fans of Brady since his junior year at Michigan. We still recall the putdown on TV by the legendary Keith Jackson. Brady was running to the sidelines after a busted play when Jackson drawled “Brady has deceptive speed! He is even slower than he looks“.

His greatest game in college was the Orange Bowl against Alabama, a superior team. But Brady simply would not let Michigan lose, bringing them back after two separate 14-point deficits to win in overtime. We simply could not imagine why the expert coaches & GMs did not draft him. Below are the highlights of that Orange Bowl

We wish him the very best in his future endeavors.

Send your feedback to [email protected] Or @Macroviewpoints on Twitter