Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”diplomacy has come to an end!“

We thought Bullard comments on Thursday 12:30 ish were stunning. Then on Friday afternoon we heard something even more stunning. Frankly, we had never ever heard that type of warning from the US National Security head before. Warning that the President of the other nuclear superpower in the world was going to invade his neighbor in the next couple of days coupled with explicit warning to all Americans to leave in 24-48 hours that about-to-be-invaded country.

Why on Friday? We wondered until we heard (retd.) General Keene explain on Fox that Thursday’s marathon 9-hour long negotiation between Russians & Ukrainians held in Normandy in the presence of France & Germany had ended without any progress. A simple YouTube search found the clip below from Russia’s Envoy at Normandy, Dmitry Kozak who said:

- “Unfortunately almost 9 hours of talks ended with no significant results that could be put into papers. We tried to agree on the talks final statement based on the last meeting in Paris on January, 26th. … We agreed that the Normandy format talks, by all means, should overcome all the differences we have on interpreting the Minsk agreements, because the Normandy format is a control mechanism for the Minsk negotiation process in the contact group. But we failed to overcome those differences.”

Watch the clip yourselves:

General Keene said on Fox that, after the above failure to reach any accord, President Putin had essentially ended any discussions & no foreign leader would be received in Moscow by President Putin. So, Gen Keene said “diplomacy has come to an end“.

Gen. Keene added that the man heading the Russian military is General (Valery) Gerasimov who, according to Wikipedia, “is the strategist alleged to have conceived the “Gerasimov doctrine” – combining military, technological, information, diplomatic, economic, cultural and other tactics for the purpose of achieving strategic goals” [emphasis ours]. Gen. Keene told Sandra Smith of Fox that he knew Gen. Gerasimov personally & praised his abilities in fulsome terms.

If Gen. Keene sitting in America knows this much about Gen. Gerasimov, surely the Ukrainian political & military leadership know at least that much about Gen. Gerasimov. And, most probably, they also know that “France is OK with Finlandization of Ukraine” as Ian Bremmer told Sara Eisen of CNBC on Friday after the close.

We are simple folks with simple mind, as we have readily admitted. And our simple mind can’t help wondering where & how do the Ukrainian negotiators get the courage to refuse to come to a deal with Russia? Neither Germany nor France can lift a finger to militarily help Ukraine. Even the White House is warning the world that the “invasion” of Ukraine by Putin could be violent & awful.

So what is driving these Ukrainian negotiators & their political bosses in Kyiv to essentially tell Russians to invade & be damned? Do they & their political bosses have suitcases packed with currency to escape to the west in private planes as the Afghan President did with his “buddies”?

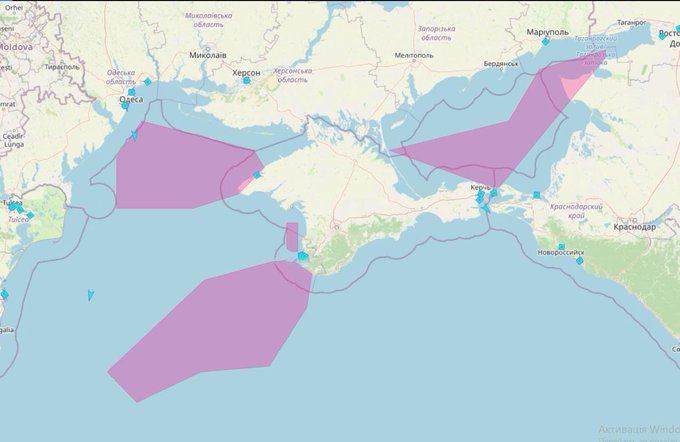

By the way while the Ukrainian negotiators were talking fruitlessly for almost 9 hours, Russian naval ships were entering the Black Sea, not for a joy ride but, “for blockade of Ukraine’s ports“. This is from the tweet below, from BBC correspondent in Kyiv, that was retweeted by Ian Bremmer with the caption “Russian navy drills in the black sea largely blocking access to Ukrainian ports“.

- James Waterhouse@JamWaterhouse · Feb 10 – UA Foreign Minister Dmytro Kuleba on growing border concerns: – Says there’s evidence Russian troop numbers increasing on border – Claims Russia’s planned Navy missile drills on 13 Feb are in fact a blockade of Ukraine’s ports. (Pic from Ukrainian Navy)

So once again we wonder what is it that is providing Ukrainian leadership such confidence to tell Russians to go drink Vodka? On the other hand, the Ukrainians may not even know that the Russian “invasion” is imminent. In fact, Steve Harrigan of Fox, said to Sandra Smith on Friday afternoon that no one is worried in Kyiv

- “Sandra, I gotta tell you, for me and for many people here, journalists, this is absolutely stunning news“

So what is the problem? That Ukraine does not have a Television network that can report the alarming warning from USA to the Ukrainian people Or that the entire media establishment of Ukraine dismisses that warning?

In stark contrast, Ian Bremmer, founder of Eurasia Group & an exquisitely connected luminary, certainly believed the warning from the White House. His main point was the difference between “steps of military escalation” and a real invasion. The first, he said, would not result in big sanctions because “France is OK with Finlandization of Ukraine. Listen to him yourselves:

We sincerely hope that there is NO “invasion” by Russia by armored divisions & tanks. We see a greater possibility of “steps of military escalation” to use words of Signor Bremmer including a landing on Ukrainian ports on the Black Sea, like Odessa. We can see such a naval landing “justified” in the name of Odessan Nationalism from Ukrainian rule. To a lesser degree, we can see outbreaks of “freedom”

movements in Russian enclaves within Ukraine. All of the above fit in the French expression of “Finlandization” of some parts of Ukraine. But we really don’t see a massive armored invasion of Ukraine with a physical occupation of Kyiv.

If our “vision” proves correct, then we may actually have been given a real correction, a correction that actually hit the MANAA stocks harder than the average stock. But before we go there, we need to look at an even more stupid act on Thursday.

2. Semi-Treason, A Selfishly Disruptive guy Or Need for Investor Protection?

On Thursday the company Affirm put out a tweet during market hours about its earnings that were supposed to be released after the close of the stock market. The AFRM stock was halted for trading until all details were published.

A few hours before that & about 30-minutes before the auction of the 30-year Treasury bond, St. Louis Fed President Bullard shocked the bond market by his extreme views about what the FOMC should do, views that were NEW MATERIAL INFORMATION for Treasury investors who had already put in their orders to buy the 30-year auction.

To us simple folks, this is no different than a key member of senior management of a company putting out his views about the company’s future decisions 30 minutes before the pricing of a secondary by that company. And such release of his views causing a sharp decline in the stock that was being offered to investors in the secondary. We do think such an action of that senior management might result in cancellation of his company’s secondary & even reissuance of the offering prospectus.

So why wasn’t Thursday’s 30-year auction halted or postponed by a day? Bullard is a member of the FOMC, the committee that sets interest rate policy for the country. The decisions of the FOMC & therefore the opinions of each member of the FOMC are of extreme importance to investors in US Treasuries. So the utter irresponsibility of Bullard is a matter of grave concern for all Americans & even for all investors in Treasuries.

We get that the Federal Reserve, despite their paramount role in how Treasuries perform, does not manage the issuance of Treasury bonds. That is a function of the Department of Treasury. So it is indeed possible that Bullard was not even aware that the 30-year Treasury auction was scheduled to be priced within 30 minutes of his interview.

In fact, we desperately hope that Bullard was indeed unaware of the 30-year auction scheduled to be priced within 30 minutes of his interview on Bloomberg TV. Because if he were aware of the auction and still went ahead of new material information of his views, then it should amount to tampering of the auction process. And in that case, the auction must be cancelled & repriced in the next few days.

Regardless of whether Bullard was aware of the 30-yr auction and regardless of his motives for his reckless expression, we think it is absolutely important for the Fed to implement strict policies for FOMC members. Specifically, & at the very least, their public expressions of their views, except in congressional testimony, must take place before or after market hours.

In some countries, the Central Reserve Bank is also responsible for issuance of that country’s government bonds. In those countries, what Bullard did would possibly deemed a serious violation, one that results in higher cost for the Country issuing the bonds & for the people of the country. And a violation that results in damage to the country, its treasury & its economy could perhaps be deemed at semi-treason.

Frankly, we are disturbed that no one on Fin TV bothered to discuss the broader ramifications of what Bullard did to Treasury investors on Thursday around 12:30 pm. It goes to show the cavalier nature of the Fed’s compliance practices. And it shows how much of a supplicant of the Fed Fin TV has become!

3. R-word

An intensely strong CPI plus Bullard caused the 2-year yield to explode up by 28 bps on Thursday. The 1-yr yield was up 27 bps & the 3-yr yield was up 24 bps. In contrast, the 30-year yield was only up 10 bps despite a D-rated 30-yr auction. This led to the obvious set of comments:

- AndreasStenoLarsen@AndreasSteno – Feb 10 – Another positive inflation surprise, another flattening of the yield curve. The 5s30s spread will invert within 2 months from now, if we extrapolate the trends from New Years until now

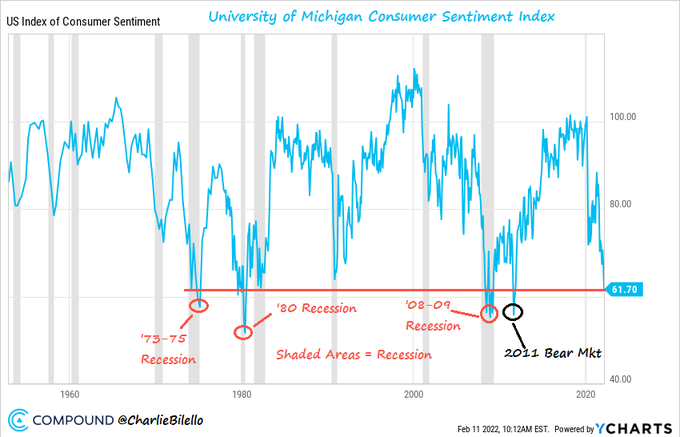

Thursday was Bullard day. Friday it was anti-Bullard day at least at the University of Michigan:

- Charlie Bilello@charliebilello – Feb 11 – US consumer sentiment index from the University of Michigan goes back to 1952. The only time it was this low (61.7) without the US being in a recession was a brief period during the 2011 bear market (Aug-Oct ’11). Charting via @ycharts

Lakshman Achuthan of ECRI also used the R-word on Friday:

- Lakshman Achuthan@businesscycle – Feb 11- 1/ “The policy mistake odds are pretty high … If you look back at recessions, they tend to happen in the vicinity of the Fed goofing up and oil prices being high. All these things are on our radar screen.”

David Rosenberg wrote in his weekly Linked In column:

- “I retain the view that we don’t come out of this current episode without a recession. The Fed feels compelled to tighten policy into an unprecedented withdrawal of fiscal stimulus — as it moves to crush the 40-year high 7% inflation into a flattish yield curve. And three-quarters of the time, recessions follow Fed rate hikes — this time, not just in the face of a flat yield curve but also into a massively leveraged economy and financial system.”

- “The yield on the 10-year T-note is now at the 2% mark in the aftermath of the January data, which saw consumer prices jump 0.6% MoM (consensus was +0.4%) and the core also up 0.6% (consensus was +0.5%). And the year-over-year inflation rate is now at 7.5%, up from 7.0% in December, and the highest since February 1982. In the past sixty years, not once did the economy manage to skirt a recession at this level of inflation.”

Well, there is another way to look at 2022, a look that avoids a recession:

- SentimenTrader@sentimentrader – Feb 11 – The only times in the past 40 years when both the Bloomberg US Aggregate Bond Total Return Index and the S&P 500 Total Return Index both showed 5% drawdowns from their 12-month highs: • June 1994 • Today

How did 1994 look pictorially, you ask?

- SentimenTrader@sentimentrader – Feb 11 – As you sort through the predictions, guesses, and hysteria about the Fed and its probable route forward, keep in 1994 in mind. The economy was recovering, stocks were soaring, and inflation was becoming a concern. Stocks bottomed AFTER the Fed surprised investors with a hike.

One difference between 1994 & 2022 – Oil was not a big factor for inflation in 1994. In contrast, Oil was a big factor in both 1990 & 2008. And Oil is a humongous factor today.

4. Stocks

Those who remember 1994 might also remember that Cisco bottomed at $19 in June 1994. It never looked back until 2000. So if 2022 is like 1994, then might this be a time to get back into tech?

- Anastasia Amoroso@AAmoroso_1 – – Hot inflation>more rate hikes>slower growth in cyclical parts of the economy. Thank you @bsurveillance for the discussion on why it might be time to take profits in cyclicals. But still like energy & high quality dividend-payers, to pair with tech.

She said “be granular in tech – digital transformation; tied to cloud ecosystem ; semiconductors – sweet spot in secular growth from 5G; be pretty granular in tech …. not social media“. Listen to her yourselves:

Another summer of 1994 type conviction below:

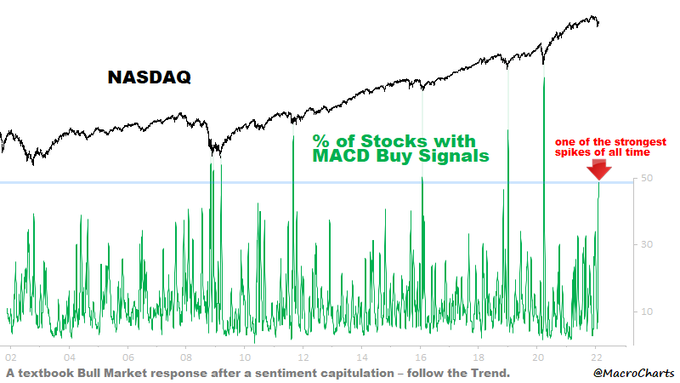

- Macro Charts@MacroCharts – Feb 10 – Important strength in Growth Stocks: HALF of Nasdaq Stocks have triggered Buy signals – one of the strongest spikes of all time. Spikes of this magnitude led to historic rallies in Stocks. A textbook Bull Market response after a sentiment capitulation – follow the Trend.

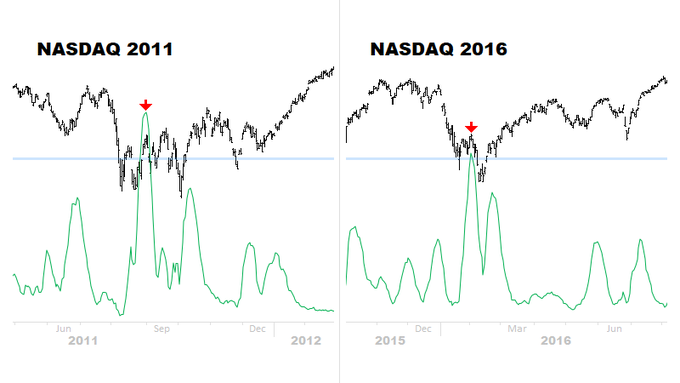

But the reference is not to 1994 but to 2011 & 2016:

- Macro Charts@MacroCharts·15h – May be similar to 2011/2016: •Spike triggered near bounce peak •Market retested lows •Sentiment plunged, but key Stocks remained in Buy position •Capitulation created the best Buy opportunity of the year •Building focused exposure to the right Stocks was critical to success

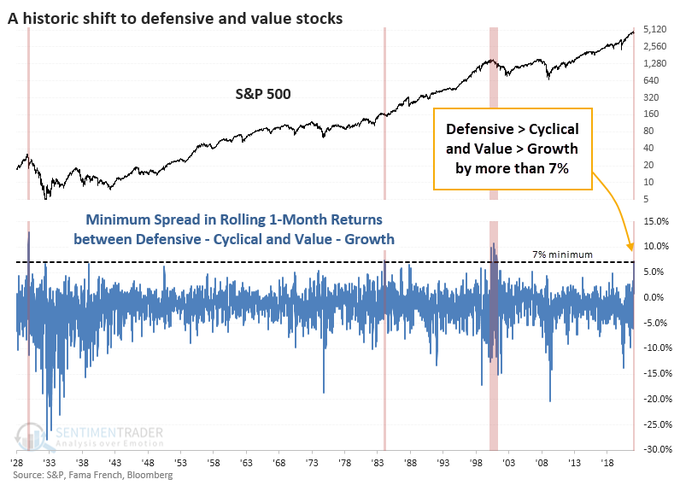

But Value-aficionados need not lose heart. They might get a 7% return in one month:

- SentimenTrader@sentimentrader – Feb 10 – This is the 4th time in ~100 years that investors favored: • Value over Growth • Defensive over Cyclical – Both by more than 7% over a 1-month period.982288

5. Volatility

Remember the unusual options play brought to our collective attention by Jon Najarian on Monday Jan 24? It was a buy of Feb VXX 19 puts when VXX was at 25 on that Monday.

Just look at the above 1-month chart of VXX to see how terrific that call was. Actually shorting VXX was probably much better. Any way the point is VXX broke below 19 on this past Wednesday & Thursday morning when Bullard struck.

The VIX gave a Spike Buy signal at that time as well. And it looked great until Bullard spoke as this week’s VIX chart shows:

That Spike Buy signal was cancelled out by Bullard as Lawrence McMillan of OptionStrategist wrote this Friday:

- $VIX jumped sharply higher on February 10th (almost 4 points), and that was enough to return $VIX to a “spiking” mode and to stop out the previous “spike peak” buy signal. This sets up a new suy signal down the road, when $VIX completes its next “spike peak.”

And now the classic bullish signal from the always-wrong crowd:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter