Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.“nimble” vs. rigid?

We love horses & have always loved them. They are such magnificent animals & they react so well to signals. That’s why we used their analogy in our last week’s article – “stocks reacted as horses do when the gate is opened at Kentucky Derby“. What signal catapulted them?

- “ .. when Maestro Powell began speaking & especially when his “nimble” posture became visible, stocks took off & didn’t stop till the close on Friday.”

Clearly that was NOT the consummation Chairman Powell had wished for, devoutly or otherwise. In fact, in our humble opinion, he desired the reverse. He has been trying to walk a thin line, we think, between being as hawkish as the financial elite want and his more rational & modest hawkishness. So to maintain his own hawkish credentials among the financial & political elite, he probably wanted a muted reaction from the stock market. Had stocks gone down modestly in response to his presser, he would have been content in our opinion.

Instead he got an explosive breadth thrust from stocks. Not just an ordinary thrust but the “Strongest 4-Day Breadth Thrust in history“ according to @MacroCharts. That means all the political & financial elites in America would call him names, including the normally mild-mannered Rich Bernstein:

- Richard Bernstein@RBAdvisors – – #Fed couldn’t be more lily-livered. #Inflation at 40-yr high, record corporate pricing intentions, #labor market historically tight yet Fed timidly raises rates 25bp & will start reducing their balance sheet at a “coming meeting”. Continue to take the over on secular-inflation.

No wonder Chairman Powell came in on Monday, March 21, determined to punish these wild unruly markets. And he delivered his spanking. He virtually promised to raise rates by 50 bps in the next meeting & keep raising them. What was the reaction of the Treasury market?

- 1-year Treasury yield rose by 41 bps; 2-yr up by 34 bps; 3-yr up by 37 bps; 5-yr yield, the most sensitive in the belly, up 41 bps; 7-yr up by 39 bps; 10-yr up by 34 bps; 20-yr up by 22 bps & 30-yr, the most sensitive to inflation, up by only 19 bps. But the 30-20 yr curve remained Inverted; 10-7 yr curve remained Inverted; 10-5 yr remain Inverted & even the 10-3 yr remained Inverted.

But how did the stock market horses behave? Did they respond to the tongue lashing by Chairman Powell or the tightening of reins by the Treasury market? No; they kept going as if they were now running in the Preakness Stakes right after finishing the Kentucky Derby:

- S&P up 1.8%; Nasdaq up 2% & NDX up 2.3% for the week. And the biggest stocks ran hard with Apple up 6.3%, Amazon up 2%, Alphabet up 4% & FB up 2.5%. Double And the leaders kept their lead – CLF up 20%, FCX up 8%, MOS up 14.5%, OIH up 9%. Brazil (EWZ) was up 9.3% with Petrobras (PBR) up 11.4%. All this with the Dollar up 60 bps on the week.

CNBC’s Sant-O, otherwise known as Mike Santoli, summed it up perfectly – “All the Bulls had to do was to preserve last week’s rally; they actually increased it“. The normally un-mild Jim Cramer was also mild & emphatic in his Friday evening show saying that Larry Williams says the Bear Market has ended.

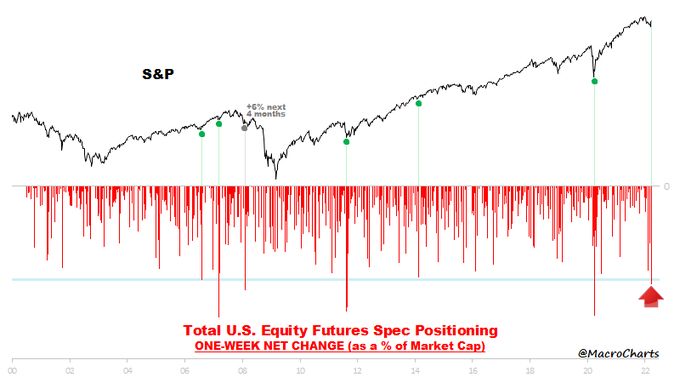

But is the fuel spent? Have the speculators covered most of their shorts?

So should Chairman Powell be unhappy? No because he may be in the pole position for claiming the “Maestro” title that we have already bestowed on him. Remember when Chairman Greenspan began being recognized as a “maestro” type? It was after he successfully “whipped” inflation in 1994 by hurting the Treasury market like an Ava-Taar of Mongol Generals of Genghis Khan. The second quarter of 1994 was a rout personified for the Treasury market.

Why remember that now? Because of a hawkish for awhile economist, one who still expects the terminal Federal Funds rate for this cycle with a 3-handle, even possibly a 4-handle. Look what Ian Shepherdson, Pantheon Macroeconomics Chief Economist, said on Bloomberg Surveillance on Friday, March 25:

- ” …. this is kind of 1994 all over again in terms of the speed & scale of the hikes and that ended up very messy for the bond market; the economy didn’t go into recession but it was certainly under a lot of stress. And so I am nervous that this is really asking a lot of the economy when there are frailties we don’t even know about coming out of the pandemic. So I would be quite surprised if the Fed is able to push at that sort of speed without taking even a pause or breath….”

- ” … I think the glide path of inflation may be down as soon as second quarter, quite steeply to the downside …. if it surprises markets, media & the Fed to the downside in the summer, then pressure to keep going by 50 bps points & 50 bps is much diminished … “

Is that what the stock markets, especially the cap-weighted S&P & the NDX, are smelling right now? Remember the 1994 bear market in Treasuries & tech stocks like Cisco ended at the end of Q2 1994.

No one knows how Q2 2022 will turn out. But if Shepherdson proves correct in his analogy to 1994, then the bear market in Treasury market might end soon & the NDX might rally on. And, in that case, the maestro title will certainly fit Chairman Powell.

2.Ukraine

It certainly has gone off the radar of financial markets and of Fin TV. And it looks as if President Zalensky’s address to the joint session of Congress was his peak in America. Read what (retd.) General Keane said on TV this past Wednesday:

- “I know for a fact through sources, reliable ones that is, that for over a week now, White House has been putting pressure on Zalensky to take a deal; & that indicates that we are not on the same page because the deal constructed likely at this time would be unfavorable to him;”

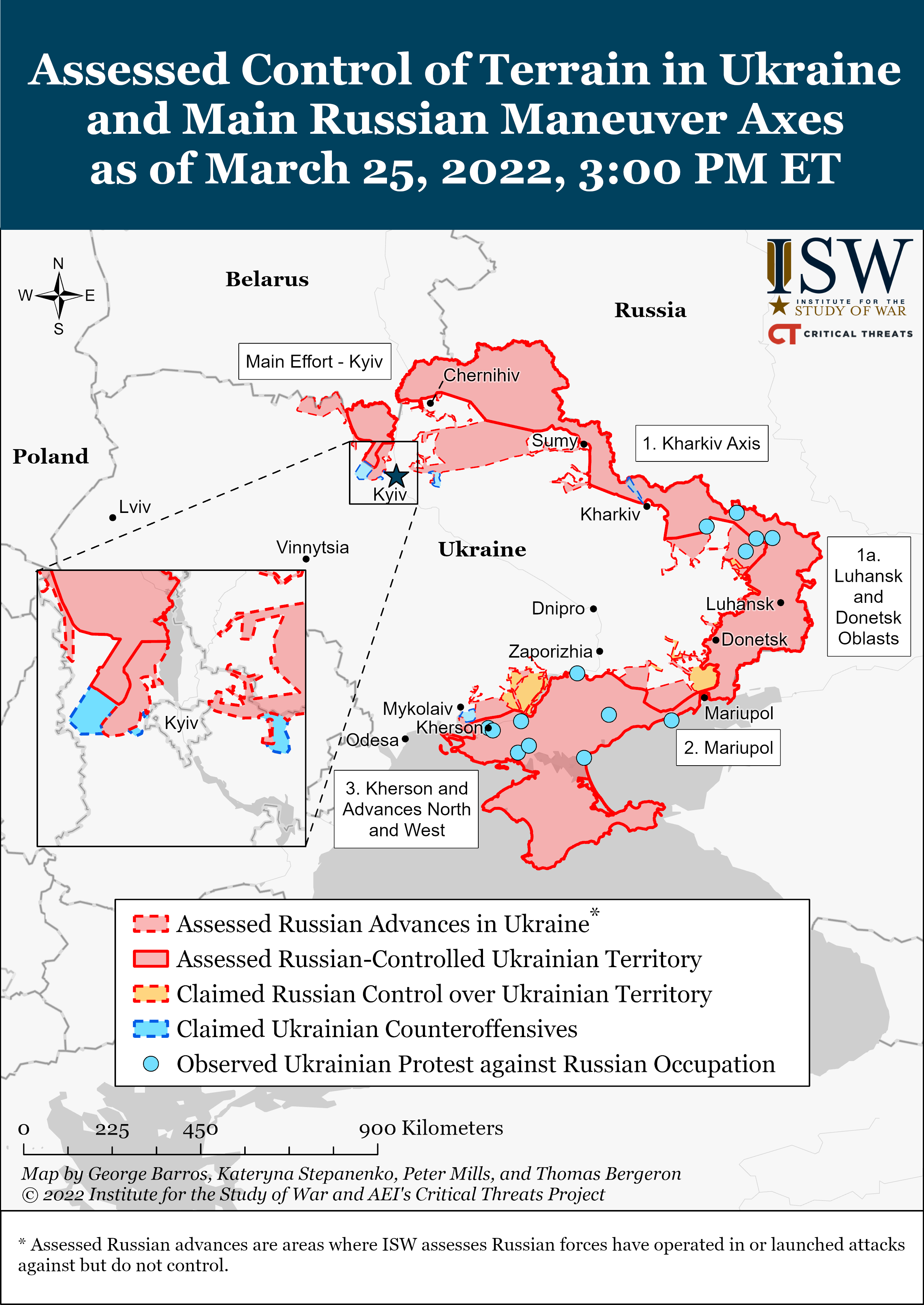

Over last week, we heard from two different sources about how the position of Ukrainian forces might end up being “precarious”. A recent CNAS (Center for a New American Security) podcast spoke about a pincer movement that is being slowly undertaken by Russia via one set of forces moving south from Kharkiv & another moving north from South Ukraine. This pincer movement could trap a sizable number of Ukrainian military in the Donbas region. And that the CNAS podcast labeled as being “precarious” for the Ukrainian military.

We also saw a retired military expert voice the same concern on a Fox show this weekend but can’t recall either the expert’s name or the show. This expert said that 40,000 Ukrainian soldiers might get caught in this squeeze. This concern might also suggest why the White House has been putting pressure on President Zalensky to make a deal now & why President Putin might not be willing to rush into a deal.

However it does look as if a deal could be reached in not too distant a future. And if it does, it will again demonstrate that markets tend to know what might happen better & faster than media.

*PS – After our references to magnificent horses & the first two legs of the Triple Crown, how could we not feature the GOAT Triple Crown performance by the GOAT of horses?

Send your feedback to [email protected] or @MacroViewpoints on Twitter