Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Fed & “a negative payroll print“

We have seen this frequently since Lael Brainard essentially declared war on stock & bond rallies on April 5. We saw it again this week after a terrific 8% rally in stocks & a fall in Treasury rates. Bostic came out & took back the dovish statement he had made earlier. Weller promised more rate hikes even after achieving “neutral” rate. And Lael Brainard came out on Thursday & dismissed the notion of a Fed pause in September.

This opinion of ours & many others found emphatic support from Bloomberg Real Yield on Friday June 3:

- Rick Rieder via BTV’s Ferro – “any tightening in spreads, any loosening easing in financial conditions … could be perceived by this Fed as unwarranted easing of financial conditions, one they might have to lean into …”

- Jim Bianco – “if financial conditions ease & get a little bit better, it could undermine their whole modus operandi … “

The Fed’s goal is more aspirational than realistic, said Bob Michele of JPMorgan Fixed Income:

- “It’s very aspirational for central banks to think they can engineer a soft landing; they are dealing with the greatest inflation in 40 years & they are trying to withdraw some of the greatest liquidity ever injected into an economy… that’s a tall order”

So which mistake might the Fed make?

- Bob Michele – Fed can’t make a mistake on inflation again … we think they are going to err on the side of reining it in ….

- Jim Bianco – remember it was this week – lets call it what it was – the President ordered the Federal Reserve Chairman to bring inflation down … if they make a mistake this year, it is not going to be dovish on inflation for second year in a row …

Talk apart, what is the Fed doing?

- Jim Bianco biancoresearch.eth@biancoresearch – – 25/25 So, the Fed is draining money via QT, and their RRP is another way to drain reserves, possibly creating a “double tightening.” This has never happened at this scale before, and we are unsure of its potential impact. Bottom line, reserves are leaving fast via two drains.

And there is little question that the news has deteriorated hard & fast. The speed of the deterioration might be behind a “hurricane” warning from Jamie Dimon & Musk’s admission of his “super bad feeling” about the economy in a memo titled “pause all hiring worldwide“. Musk also said it might be necessary to cut 10% of jobs at Tesla.

That might not isolated to a couple of billionaires. Read what Rick Rieder of BlackRock said on BTV on Friday:

- “…. a long list of companies that are freezing hiring & /or cutting staff; it is persistent across big tech, across tech, across some of the rapid growth areas that you have been seeing – health-care; then the corelated issue to that is you are seeing restaurants – all of a sudden availability of labor is really improving across any sector; … there is no question in my mind you are seeing a turn .. ”

But what about the solid NFP Report? That’s where Rieder began his comments on Bloomberg Open on Friday between 9:00 am & 9:30 am:

- ” .. this is the last solid report you are going to get for a long time; … trend is coming down, trend is decelerating; we have made the turn on employment; .. I think next 3-4 months you are going to see these numbers decline; I could see a negative print over the next 3-4 months … that’s what I am keyed into; that’s what the markets will react to & interpret how deep the Fed is gonna go in bringing employment down & in bringing demand function down; that’s a big deal for markets … “

A “negative print” in jobs added over the next 3-4 months and a Fed that continues to tighten & talk hawkishly into this decelerating trend? Perhaps that is giving Musk a “super bad feeling” about our economy & making Dimon focus on the strength of JPMorgan’s balance sheet!

Some look at this another way & say that Fed is not done until a negative payroll print:

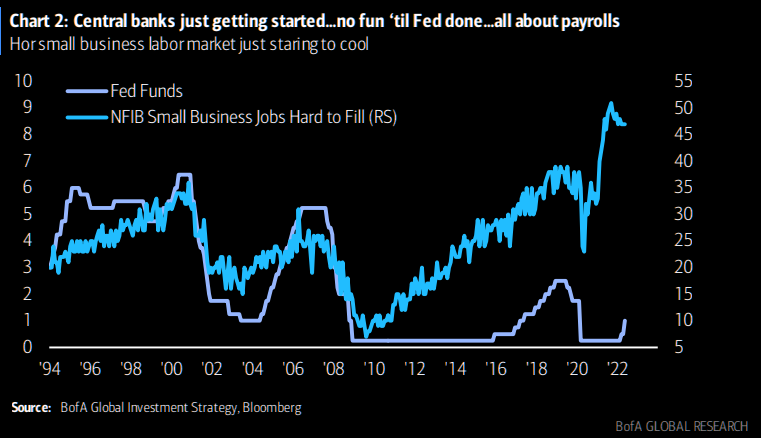

- Via The Market Ear – No fun……til Fed done – That is another piece of Hartnett poetry. He writes: “…Fed begins QT, summer of 50bps hikes, central banks just getting started, terminal rates trending higher across G7 ; 1974, 1981, 1994, 2009, 2018…no fun ‘til Fed done..and in 2022 that requires negative payroll print“.

What Rieder sees as a “turn”, Rosie sees as “arrived”:

- David Rosenberg@EconguyRosie – – Powell’s tunnel vision focused on JOLTS job openings, and as such he is missing a really big story: ADP small biz jobs tanked 278k from February to May. The recession has arrived. #RosenbergResearch #Economy

His colleague of many years mocked this call after the NFP report:

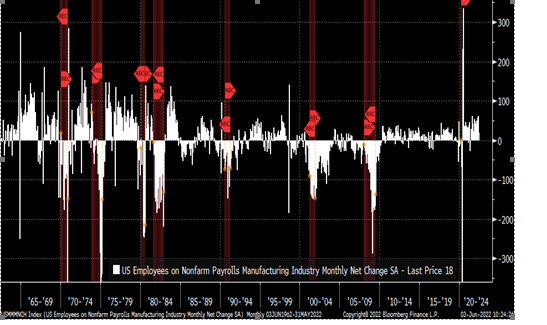

- Richard Bernstein@RBAdvisors – It’s sexy to say “we might already be in a recession” but if that’s the case it’ll be the first #recession during which the #economy actually ADDED #MANUFACTURING JOBS.

2. Ten-year yield peak between 3% & 3.25%?

Remember the long period in which European yields, especially German low yields & then German negative yields, put downward pressure on US Treasury rates. Now the pressure is in the opposite direction. German 2-yr yield rose 31 bps this week followed by German 10-yr yield up 29 bps & German 30-yr yield up 27 bps. And the ECB is expected to raise interest rates by 25 bps or even 50 bps.

Look what the huge move up in German rates & the hawkish talk from Fed officials did this week:

- 30-yr Treasury yield up 12 bps to 3.09%; 20-yr yield up 15 bps to 3.31%; 10-yr up 20 bps to 2.94%; 7-yr up 21 bps 2.98%; 5-yr up 22 bps to 2.94%; 3-yr up 21 bps to 2.86%; 2-yr up 18 bps to 18 bps; 1-yr up 16 bps 2.15%.

With all the hawkish talk & the 10-yr already at 2.94%, the expected targets for the 10-year peak yield must be way high, right? Not really. Three different experts with different views came up with the same 25 bps range:

- Rick Rieder – 10-year target 3%-3.25%; Cash is a good asset

- Bob Michele of JPMorgan– 10-yr settles somewhere around 3%; things are starting to stabilize; there will be more money coming into credit and adding duration to portfolios; … we have already seen a big move in muni markets; … this quarter we should see some of the biggest rebalancing ever & that money should come out of cash & go into bonds & equites …

- Kathy Jones of Schwab – Short end 50 bps next two & then 25 bps topping out at 2.75% area; 10-yr 3-3.25% is upper end you are going to see

Is this why Bond volatility is going down? Because much of the damage is done? In more technical terms, has Fixed Income Duration already been “cleansed out” to a large extent? Notice (go up 6-7 line above) Bob Michele is saying Yes & hence he sees “more money coming into credit and adding duration to portfolios“.

That leads us to Equity Duration Cleansing:

3. Stocks – Duration – 2007 vs. 1994-2011 et al ; Dubravko vs. Wilson

We are actually happy that Microsoft, Apple & other equity duration stalwarts are now facing earnings downshift fears. Those who are bullish on stocks should actually pray for a violently down week & half into the May 15 FOMC meeting.

The above section makes it clear that everyone now sees an economic slowdown coming. No one knows whether it is going to be a moderate slowdown or a “technical recession” a la 1994-2011 kind OR a 2007 type deep recession. This year that will be up to the Fed and what this Fed deems to be its real mandate – to protect the economy or to protect its image. The first deals with the economy & the second is an existential risk for the Fed. We will know more about this in a week & half.

Speaking of now, “the broader backdrop” to Dubravko Lakos & the JPM team, “doesn’t suggest a full-fledged recession; it suggests at most a technical recession“. Then Dubravko clarified by saying

- “to me this is less about recession it is more, what I call, Equity Duration Cleansing. … the S&P 500 index had too much equity long duration bias …. I think we are far along that process [of cleansing the long duration bias] .. so I think the index sensitivity to rates will be diminishing because there has been a pretty substantial adjustment done to the long duration side …”

Putting it less quantitatively, Dubravko said,

- “the market has gone basically from pricing in an early cycle to immediately a late cycle playbook & anything short of a recession, late cycle playbook is just wrong; so I think we need to be open-minded about the fact that we go back to mid-cycle; .. you can see traditional cyclicals & tech bounce“

What might you look at if you are as “open-minded” as Dubravko?

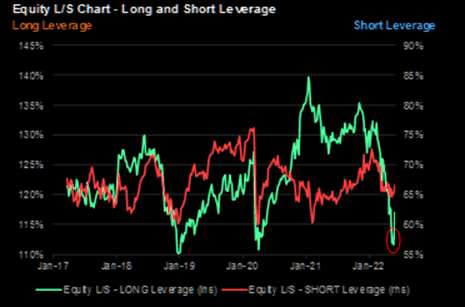

- JPMorgan via The Market Ear – A look-back at the May extremes (I) – What if the third week of May was true capitulation and that we will not see those lows re-tested again? Throughout last month there were many extremes that were broadly suggestive of significant de-risking. JPM states: “Even if the current bounce is just a “bear market rally,” the extremes noted below, along with the fact that it seems few investors are actually positioning for a bounce, could result in a rebound that goes for a bit longer (and perhaps further than many expect)”. First observation: Eq L/S Long lev hit a level in line with 4Q18 and 1Q20 lows.

That is what Mark Newton said to Scott Wapner on CNBC Overtime after Thursday’s rally – that “lows could be in for the year“. He then added in technicalese – “lot of cycles suggest that late June is important“.

Interestingly Mike Wilson is not that far away from Dubravko. Wilson has repeated often that he is NOT calling for a secular bear market. That means he is not looking for a deep recession either. He is probably in sync with KKR’s Henry McVey who said a “transition is underway from inflation concerns to degradation in earnings“.

Wilson argues for a fair value of 3,800 for the S&P to account for the steep downside to earnings he sees. And since markets overshoot on both sides, he is calling for a 3,400 -3,500 level for the S&P in Q3 to give himself room for a bounce back to his fair value of 3,800.

But there is a big difference between Dubravko & Wilson about the level of de-risking in equity positioning in the market. Dubravko & his JPM team focus on institutional or asset trading community. So they see a high level of derisking in their work. Same might be true of technicians like Mark Newton.

To Mike Wilson that is not broad enough. As he said on CNBC Fast Money agreeing to what CNBC’s Tim Seymour’s point:

- “…. active trader community has de-risked quit a bit … but the Asset owner community including retail & individual has not sold yet ; they put in over a trillion dollars in 2021; absolutely we think we will see that group fade; distribute stock, take some profits & hunker down a bit when the numbers come down ; sentiment is bearish but we have not seen flows from the asset owner community … “

Wilson said that at his 3,400-3,500 level he would get aggressive in adding risk. This is similar to David Rosenberg’s target of 3,500 and his personal statement that he would put his money in at 3,500.

So what might one do if one agrees with both Wilson & Dubravko? Follow what Rick Rieder said he is doing at BlackRock – “sell volatility 15% below from here“. Mr. Rieder no doubt deals with highly esoteric forms of volatility trades. What might a simple investor do to at least mimic what Mr. Rieder might be doing? Wait for a really bad day in stocks & Sell January 2023 SPY 350 puts, keeping enough cash in the account to pay for buying SPY at 350. You keep the entire premium you get if SPY trades above 350 in January 2023 expiration. A more aggressive trade might be to Sell October 22 SPY 340 or 350 puts, aggressive in that you are more likely to be forced to buy SPY at 340/350 if Wilson’s target is actually realized in Q3.

Finally we point out that the famed Larry Williams called for a rally in the S&P that could last until August based on proprietary cycle work of his. Jim Cramer featured this on his Mad Money but hid all the relevant & important chart work from the clip CNBC posted for CNBC’s viewer. Guess viewers that make CNBC money from commercials are prohibited from getting even a cursory look at this important call unless they are paying up for Cramer’s for-money-only Club. Ethically rotten in our opinion.

4. Oil & Oil Embargo by EU

Recall Dubrakvo’s statement about their earlier recommendation to investors to move to short duration stocks. He specified in the clip we highlighted above that Energy was their favorite short duration equity trade & added:

- “ … energy we as a house estimate that by 2030 you need $1.2, $1.3 trillion in oil & gas capex for oil & gas for demand & supply to balance out …. on the supply side nothing is being done …. valuation wise the sector has not gone up; the entire move up in energy has been in lock step with earnings …. I would be buying energy complex on pullbacks. … “

What about natural gas, you ask? Read & hear the man who we think embodies “simplicity” of thinking, a trait we hugely admire. Mark Fisher is a legend, we hear, in commodities. If you could bottle the wisdom you hear in the clip below & drink it before every trade you put on, you probably would improve your trading:

- “…. from now until October, until the winter starts, the perception or fear of what will happen this winter, which is what is driving all of this – fear or perception of reality, every dip has to be bought in natural gas; once winter starts then it becomes more tricky; … nat gas is definitely going to trade in double digits, right? ; … the index funds, everyone has to buy the winter before the winter starts; my question is who is going to sell the winter at $8.63; … I like to trade timeframes …. I am probably dead wrong but as long as you can handle the volatility, it seems to me it should be a pretty smooth ride between here & October that nat gas is going to keep going up ; … “

Mr. Fisher also gave what he thinks would be a sure trade. Buy the dip that will occur when Russia-Ukraine war gets a ceasefire or peace…. We guess the thinking is that almost every trader will sell nat gas on that news, sell & sell hard creating a price drop that does not take into account the fundamental demand – supply imbalance… That’s only our guess, We wish Scott Wapner had asked Mr. Fisher to elaborate.

Now from one brilliant commodities mind to another across the world. Back in 1999, Mukesh Ambani’s Reliance commissioned a refinery in Jamnagar in his native Gujarat, India. With its current installed capacity of 1.24 million barrels per day, it is currently the largest refinery in the world. Juxtapose this with the statement this week of Chevron CEO that there may never be another refinery built in America.

Now read what AlJazeera wrote in their article In ‘golden age’ of margins, Indian private refiners profit:

- While many Western buyers are avoiding Russian crude in response to its invasion of Ukraine, Indian private refiners such as Reliance and Nayara have been among the biggest buyers this year of discounted Russian supplies. They are reaping major profits by reducing domestic sales and aggressively boosting fuel exports, including to buyers in Europe, which is now boycotting imports of Russian energy.

- Reliance, operator of the world’s biggest refining complex at Jamnagar in western India, recently deferred its refinery maintenance plan, bought “arbitrage” barrels on the international crude oil market, and boosted fuel exports, it said last month.

- “RIL remains well placed to benefit from the ongoing surge in refining margins given its high complexity, high diesel yield, and high export ratio,” Citi said in a recent report.

- “We are making refining margins of more than $30 per barrel by processing Russian oil and earning huge profits through exports of refined fuel,” said an official at one of the private refiners.

Now ask yourselves, how asinine is EU’s public embargo on importing Russian oil while forcing Russia to sell to private refiners around the world like Reliance & then buying refined products like Diesel at much higher prices from Reliance et al?

But Indian citizens have no reason to be happy because they buy gasoline from stations owned by State-owned companies like Indian Oil that are forced to buy from existing suppliers. It is only private refiners who can buy discounted Russian oil on the open market & then export refined products to EU.

Are you surprised Reliance is up 20% this year?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter