Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Is it that simple?

This turned out to be both a bad week and a disappointing week;

- SPX down 1.6%; NDX down 3.1%; RUT down 1.2%; TLT down 2.5%; Treasury rates up 13-19 bps across the 30-2 yr curve; Gold down 3.2%; Silver down 9.8%; Oil down 7.4%; EEM down 2.8%;

Is that news really? No because the King was up – Dollar up 53 bps on the week. Was it the factor that created the huge rally on Thursday & then let it peter out on Friday? Look & decide for yourselves:

The S&P did tend to follow the Dollar, at least as we see it:

Is there anything out there that can lead to a tradable decline in the Dollar? Remember DXY is more than half based on the Euro. And how does the Euro look?

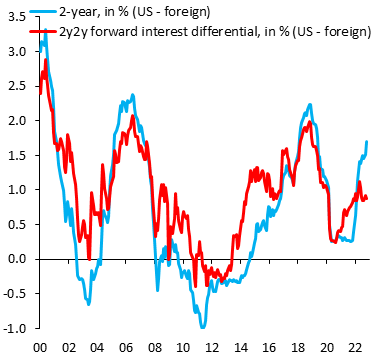

- Robin Brooks@RobinBrooksIIF – – Consensus is that USD has topped out, since 2-year rate differential has risen so much (blue). No! Markets obsess over US recession, while they’re complacent on European recession. As a result, 2-year differential 2 years forward (red) is up far less and can go much higher…

If that doesn’t persuade you, perhaps the fresh out of the oven data below might:

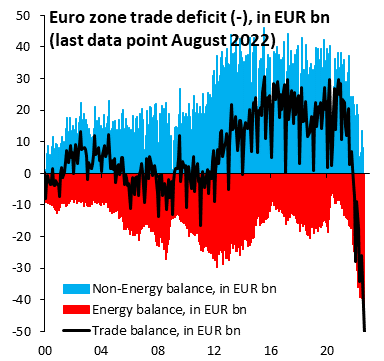

- Robin Brooks@RobinBrooksIIF – – The Euro zone trade deficit for August was published today. It’s a monster. We’ve never before had sustained deficits of this size. When you’re tempted to think the Euro has fallen too much, keep this picture in mind. The shock hitting Europe is massive. Euro will keep falling…

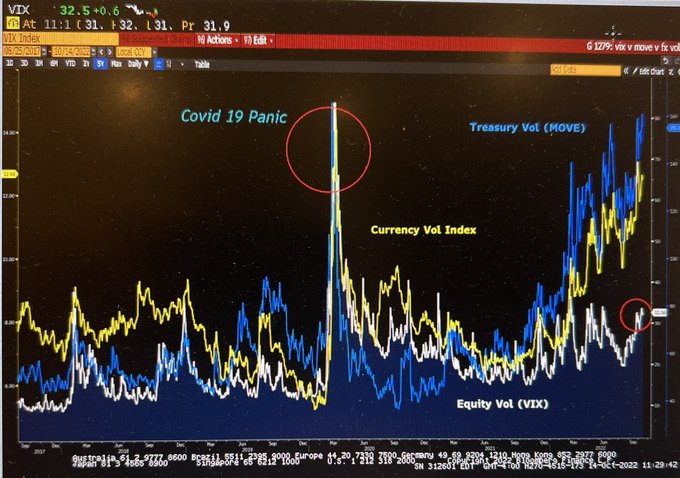

Despite another bad week & despite everything discussed on Fin TV, VIX is simply not high, relatively speaking. This is actually scarier because it says there is something bad brewing percolating deeper in the financial system:

- Lawrence McDonald@Convertbond – – Equity volatility (white) is still cheap to currency (yellow – FX) and rates (blue – bonds). This type of divergence is highly unsustainable. It speaks to colossal stress in different parts of the financial system, still not broadly or entirely expressing itself.

Those who believe that the Dollar is central to the world’s markets right now should read the Bloomberg article about the views of Bob Michele, chief investment officer of J.P. Morgan Asset Management: A couple of excerpts are below:

- “Here’s how it could happen: Foreigners have snapped up dollar-denominated assets for higher yields, safety, and a brighter earnings outlook than most markets. A big chunk of those purchases are hedged back into local currencies such as the euro and the yen through the derivatives market, and it involves shorting the dollar. When the contracts roll, investors have to pay up if the dollar moves higher. That means they may have to sell assets elsewhere to cover the loss.”

- “The market probably saw some of that pressure already. Investment-grade credit spreads spiked close to 20 basis points toward the end of September. That’s coincidental with a lot of currency hedges rolling over at the end of the third quarter, he said — and it may be just “the tip of an iceberg.”

- “The central bank will be so committed to combating inflation that it will keep raising rates and won’t pause or reverse course unless something really bad happens to markets or the economy, or both. If policy makers pause in response to market functionality, there has to be such a shock to the system that it creates potential insolvencies. And a rising dollar might do just that.”

2. Stocks

Go back to last 4 Fridays. The selloffs on these days, especially in the afternoon, have been intense:

- Fri 10/14 = down 404 points; Fri 10/7 = down 630 points; Fri 9/30 = down 495 points; Fri 9/24 = down 486 points

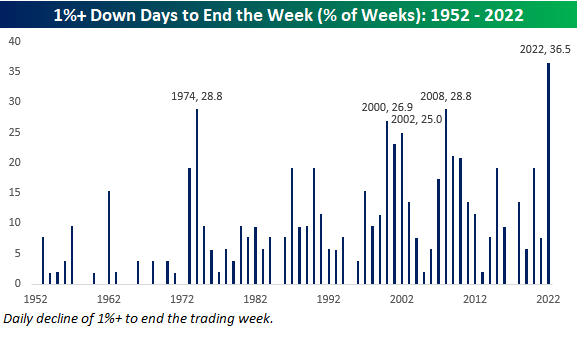

This is highly unusual as Bespoke pointed out on Friday:

- Bespoke@bespokeinvest – – Just an unbelievable stat — if today’s 1% decline holds for $SPY, 36.5% of all days to end the trading week in 2022 will have been 1%+ down days. No other year comes close to this kind of Friday weakness.

On one hand, it might suggest deep fear of what the weekend might bring among investors. On the other hand, if nothing unpleasant happened over the weekend, then the brutal declines of Friday might be repaired somewhat over the first half of next week.

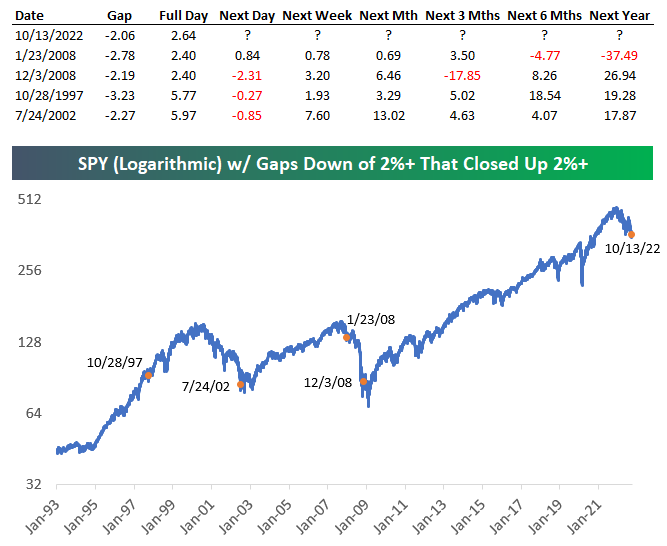

Does that mean investors should NOT lose hope about the explosive rally that took place on Thursday? Perhaps no, per Bespoke:

- Bespoke@bespokeinvest – – Today’s was just the 5th time in $SPY‘s history (since ’93) that it closed higher by at least 2% after opening down at least 2%. SPY fell the next day 3 of 4 times, but it was up over the next week and month all 4 times. bespokepremium.com

That next week & month comment above by Bespoke fits with a bounce call by Dan Niles on CNBC on Thursday:

- ” … in the short term I actually believe October will end up being up; .. when you go into October with the market down 15% in the prior 9 months, odds of October being up are about 83% & your average gain is about 3%.. ”

What about the long term? Niles says S&P 3,000 is his target, 15 PE on $200 eps in 2023. And his tail risk?

- “… the tail risk in my mind is another Lehmann moment; … I firmly believe you are going to get some kind of big financial institution in big trouble … I don’t think it is going to be one of the big banks; but I can see another Archegoes type of situation because so many hedge funds, 60-40 funds, parity funds, have got murdered on their bond positions, got crushed on their stock positions … so I think you could see something like that … that’s the tail risk … ”

This long term stuff, tail risk talk is so tiring! That’s why we love the clips of Larry Williams including the one posted by him on October 12 titled Up, Up & Away! Readers who like to use trades like the ones Williams recommends should watch this 29 minute clip patiently. There are a number of trades of his vintage in the clip below:

4. Overcrowded equity trade?

Hardly a week goes by without someone pointing out that AAPL remains an overcrowded trade & that it has to come down hard. Actually AAPL has gone down hard & now matches the S&P year-to-date.

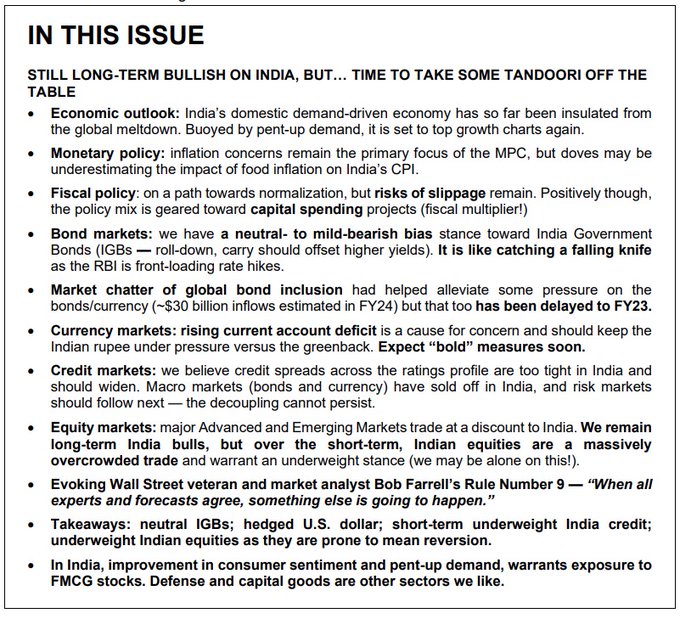

There is another trade internationally, actually in EM, that was described this week as “massively overcrowded” and one that “warrants an underweight stance“.

Note the underlying stocks in the INDA ETF are priced in Rupees, a currency that has fallen by 10%+ against the Dollar this week.

- David Rosenberg@EconguyRosie – – Special Report — With less than a month before the Diwali festivities kick in and the beginning of Samvat New Year 2080, we thought it would be an opportune time to do a Special Report on India. Purchase the Report: bit.ly/3RV9Wsq #RosenbergResearch

There is no doubt Indian stocks have done well in the last few years, especially since PM Modi came to power in 2014. One of his decisions was highlighted in a recent Morgan Stanley clip:

- ” In 2015, for the first time Indian Govt, allowed retirement funds to invest in equities; they come in every month to buy … this is very similar to the story that happened in the US between 1980 & 2000 because in 1980, U.S. allowed 401-K plans to buy equities for the first time & you got a secular run on domestic flows in the U.S.: … I think we are in that secular run in India; we are in 5th or 6th year; .. we have a long way to go before this things ends … ”

INDA is a diversified MSCI based vehicle. We ourselves have always been partial to Indian Banks, IBN & HDB that trade on NYSE. So how did IBN do vs. INDA this year?

So INDA outperformed SPY by 10% and IBN outperformed INDA by 15%. Since arithmetic can be tricky, how about a picture?

Our thinking is simple-minded. So allow us to quote Ridham Desai, MS India Strategist, on Indian financials:

- “financials is clearly the place to be unambiguously … we are about to enter a loan boom which will match pace & scale of the 04-07 era; …. in last 4-5 years, corporate balance sheets have delevered; corporate debt to GDP is 46%; no large economy in the world has such low levels of corporate debt … bank balance sheets look really good; valuations are inexpensive; So I think you are going to get a ferocious bull market in financials … “

As a note, Ridham Desai is almost an opposite of Mike Wilson. His simple view is “equity markets are only for the optimists… if you are a pessimist, go & do something else“. With that caveat, watch the clip below:

Now a suggestion to CNBC USA & of course to both Bloomberg TV & FBN. Look at the following clip in which a CNBC India anchor speaks with three different people representing different areas of JP Morgan India. We think this is an excellent idea. How helpful would it be to see a clip with Marko Kolanovic representing equities, Bob Michele representing fixed income & someone else on JPM currency desk speaking together to one Fin TV anchor?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter