Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Miracle in NY?

By Thursday, the chances of a Santa Claus rally looked almost zero. The absolute kabash was David Tepper telling CNBC Squawk Box that he was “leaning short” on the stock market. His reasons were sound and his track record is phenomenal. Listen to him yourselves:

Then Art Cashin came on & warned that:

- “.. If S&P goes below 3,800, we may have to put Santa’s face on a milk carton… “

True to form, stocks fell harder and the Dow fell by almost 800 points by mid-day. But all was not lost because of what Art Cashin had added:

- “… some folks think you get a little bit of a late rally on Festivus Eve; today is Festivus Eve; So we will have to do some magic to pull things out … ”

Guess some magic was pulled and that too by an entirely unlikely bunch, according to what Mike Santoli pointed out at the end of the day:

- “TSLA stopped going down & within an hour the market stopped going down“

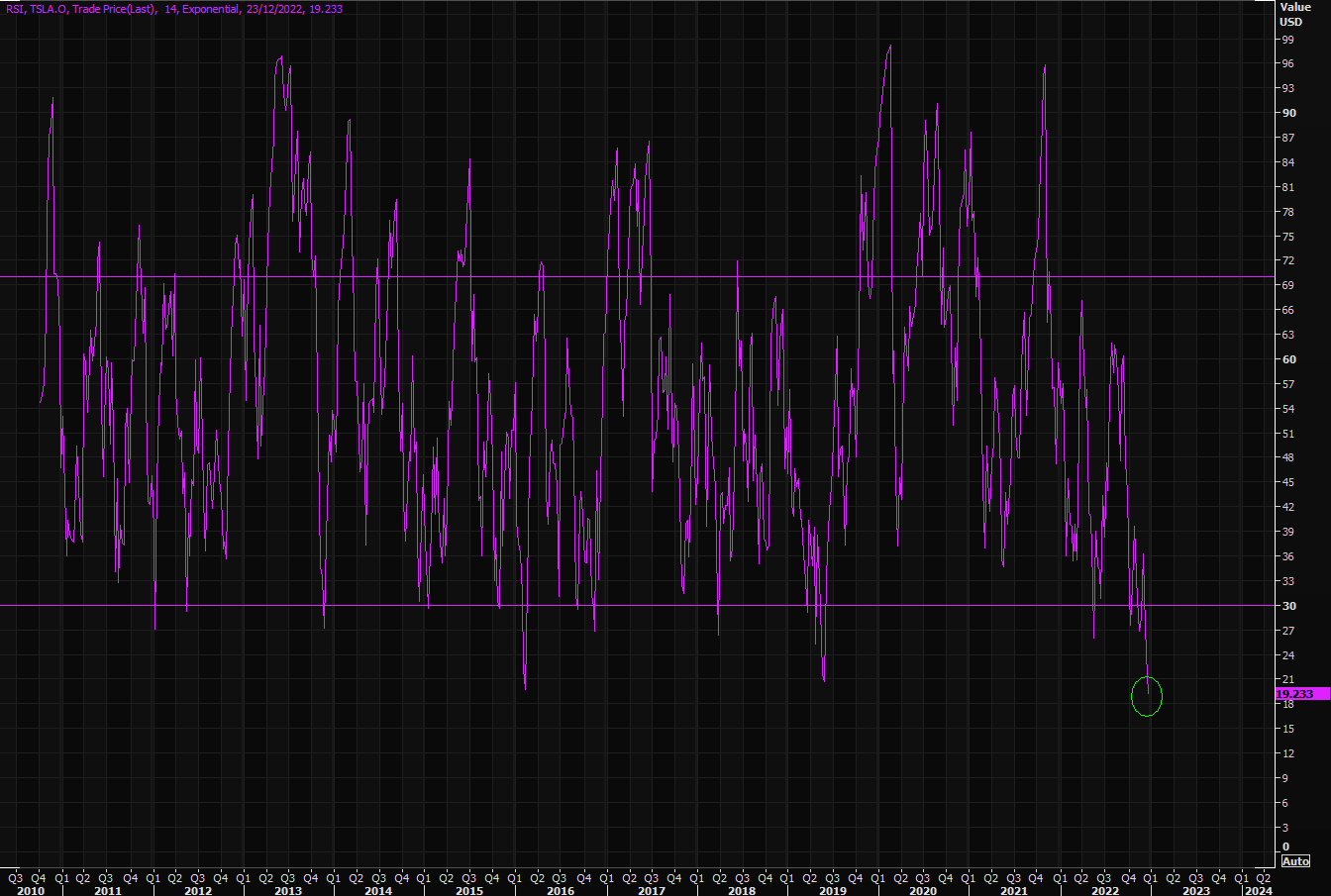

Look how frantically intense was the selling in Tesla:

- Via The Market Ear on Friday – Tesla – king of oversold – RSI daily at extreme levels. RSI weekly at not seen levels.

We don’t know if Santoli’s observation is correct. But it makes sense. If the most horrifically sold Tesla could stabilize, then perhaps the Dow & the S&P could. Look at the Dow stabilize on Thursday post-lunch and achieve a weekly close on Friday 12/23 above the Thursday 12/22 open.

Was it Cashin’s Festivus or was it the amazing call by Larry Williams via Jim Cramer on Monday 12/19:

- ” … If you purchase S&P e-mini futures on December 22 or December 23 using the $1,800 stop loss & held for 5 days before selling into the 1st profitable opening, you would have 21 workable trades & all of them profitable, ever single one … “

Do watch the “voodoo” that WC do yourselves:

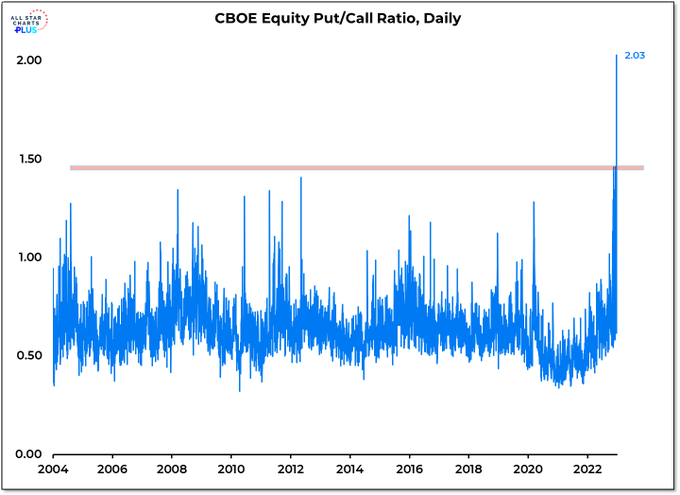

If you watch the clip, you will hear Cramer talking about Larry Williams saying that the level of selling is actually a positive. The CBOE-Put-call ratio did agree wholeheartedly (courtesy of a J.C. Parets retweet):

- Willie Delwiche, CMT, CFA@WillieDelwiche – Dec 22 – 7:57 am – CBOE equity put/call ratio had never before been above 1.5. Yesterday it was above 2.0.

OK, but what about positioning?

- Via The Market Ear – Wednesday 12/21 – Positioning: very different from one year ago – Morgan Stanley’s futures desk note that at FYE21, the buy-side held a net LONG position amounting to $167 billion notional across the major US equity index futures (equal to 18% of total open interest – well above the average since 2010 of 10% of open interest). Yet as of FYE22, the buy-side holds a net SHORT position amounting to $5 billion notional across the major US equity index futures – well off the >15-year extreme net short position of $60 billion notional (9% of open interest) that they held in July 2022, but still considerably (1.5 z-scores) shorter than on average since 2010 (MS)

It is the extreme intensity of selling (for tax loss or otherwise) that might make a rally last into January 2023. Even a luminary who sees a bear market in risk assets in 2023 seems to think so. Look what Jeffrey Gundlach said in his 58-minute DoubleLine conversation with Felix Zulauf (at minute 29:03):

- “I don’t know what you think about this Felix, we are probably going to see a bounce in markets between now & may be a month from now as money has been rotated … then I think you will see a renewed bear market at least in risk assets ... ”

2.Bonds

The real story in the markets this week was about global government bonds. The carnage was led by Germany courtesy of Christine Lagarde:

- German 30-yr yield up 29 bps on the week; Ger 10-yr up 26 bps; Ger 2-yr up 23 bps.

The U.S. Treasury market was not left behind:

- 30-yr Treasury yield up 28 bps on the week; 20-yr up 27 bps; 10-yr up 26 bps; 7-yr up 25 bps; 5-yr up 24 bps; 3-yr up 18 bps; 2-yr up 14 bps; 1-yr up 5 bps;

Naturally the Treasury ETFs were shot:

- TLT down 4.4%; EDV down 4.2% & ZROZ down 7.3%

Economic data in the US didn’t matter much this week as the dominant factor (as even Tepper acknowledged) was initially Christine & then the Bank of Japan. When was the last time the BoJ did something like this & what was the result?

- David Rosenberg@EconguyRosie – – Well, the bond vigilantes barked, and the BoJ blinked. The BoJ last pulled a surprise like this on Christmas Day 1989, we had a level shift in global bond yields, and next thing you know, bond yields sank under the weight of recession for the next four years. #RosenbergResearch

Is that “level shift in global bond yields” playing now?

- Via The Market Ear – Friday – US 10 year – playing out perfectly – The summer set up we mentioned earlier this week continues playing out perfectly. We are now above the short term negative trend line and “well” above the 100 day moving average. Higher for some longer it seems...

That is sort of what Felix Zulauf said in his detailed discussion with Jeffrey Gundlach when he predicted “bond yields to bounce up in the next few weeks“. But then what? Zulauf said:

- “from there you can easily see 200 bps down in the 10-yr Treasury & that gives you a fantastic return … ”

When asked about his favorite trade for 2023, Zulauf answered – 30-year Treasury, fantastic for next year. Gundlach also said 30-yr Treasury & 10-yr Treasury. He pointed out that their funds now have the longest duration in Bonds since he founded DoubleLine over 13 years ago. He also said that odds are greater than 75% that we see a Fed rate cut in 2023.

What about what the Fed, ECB & BoJ are saying now? Both Gundlach & Zulauf said that just as central banks were shocked this year to see how bad inflation was, they will be just as surprised to see the outcome of their rate hikes.

Gundlach also said the biggest opportunity in stocks is EM equities. Zulauf said growth stock will have one hell of a rally but just one; then they will go into hibernation for several years ; then commodities related stocks will work.

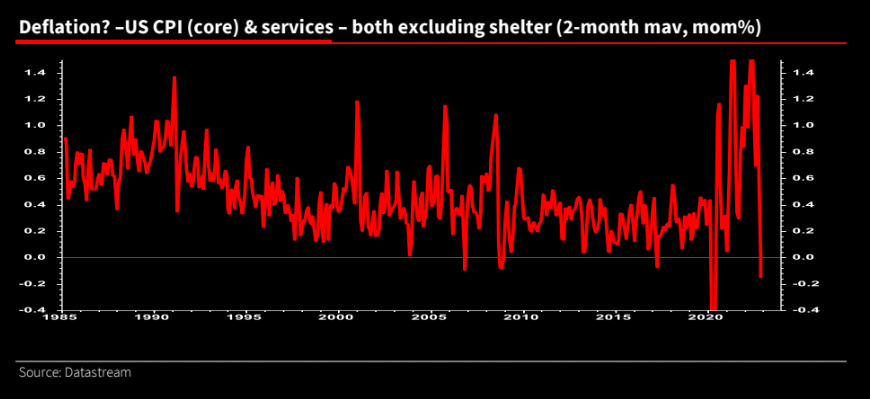

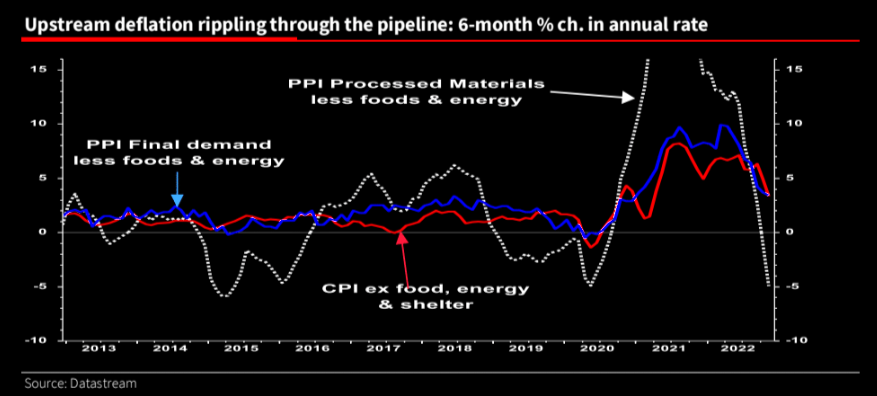

Does all this suggest the “d” word? Even if you thought so, you are late because that call has been made:

- Via The Market Ear – Remember deflation? – Maybe not Ice Age, but Albert Edwards on the big surprise in 2023:”The $64,000 question is how the bond market reacts–especially as investors are fully invested in a rally. Again,the 1970s might be a template. A big rally could be in the offing; however, a higher low means that the 0.5% 2020 low is unlikely to be bettered, but a fall to around 1% is plausible.

The Gundlach-Zulauf clip is long but really worth watching, in our opinion:

3. Energy Stocks & Other winners-losers of the week

It might not be a bad idea to look at Section 3 – Trifecta in Energy of our last week’s article. Mark Fisher, Garner-Cramer & Paul Sankey came in one after another to recommend energy stocks. Did the stocks listen?

- Oil up 7% this week; Brent up 6%; USO up 6.6%; BNO up 6.2%; OIH up 6.3%; XLE up 3.2% & PBR (Petrobras) up 18% on the week.

The real story of the week may be told by two stocks – CLF (materials) up 11% & LRCX (semiconductors) down 7%. If you merely look at weekly results, you might think it was a “dull market” when it wasn’t, except Friday.

Why do we bring up the “dull” term? Because Steve Grasso repeated the dictum “Never Short a Dull Market” on CNBC Fast Money on Friday. Speaking of that show, would Tim Seymour help us simple folks understand what is going on in Brazil, both economically & politically? All we know is that EWZ was up 10% this week.

We may not understand Brazil but we do have a better sense of another BRICS member, the largest & most important of them all – China. Read what Felix Zulauf said in his discussions with Mauldin Economics:

- “I think we are facing a very serious recession outside the US. We are facing a very serious

recession in the Eurozone and in the UK. And probably the most severe recession we are

already facing and in is in China. China is in a deeper crisis than in 2008, and most people think this is due to the lockdowns. I think that the lockdowns are sort of a camouflage to not show the world how structurally weak China has become. ‘ - “Because the Chinese economy has hit the same point as Japan in the early 1990s. It was exhausted after one of the biggest investment and credit booms of mankind, so to speak. And the credit system of China cannot finance high growth. Therefore, they cannot push and stimulate for high growth as they did in previous years.

- “But I think the true factors are very different in nature. And let’s say the Chinese would go for a big stimulus program. If they did, and they could, they could just throw on the printing press… if they did that, they would create a currency crisis. The renminbi would collapse, and they would then trigger something very similar to the Asian Crisis in 1997. And if they did so, they would jeopardize their long-term goals in trade and politics in Asia and the rest of the world.

- “So, I think they are trapped, and they cannot move. They cannot really do what all the analysts

are telling on the daily TV shows, that the Chinese are going to stimulate and turn the

machinery on, et cetera. It’s not going to happen that way. What we will see is, they will

support the system, they will prevent it from breaking down hard, which means it will take

longer.” - So, my guess is at least 10 years to get over this restructuring of the economy. It took Japan 20

years, and the excess is real small. So, I think, China you can forget as a locomotive for the

world economy. And it has been the locomotive for the world economy in the last 15 years.

Frankly, we think Zulauf is missing the biggest danger China faces & the biggest danger China represents to its neighborhood and the world. See our adjacent article Two Macro Events Leading to a Turbulent World?

Send your feedback to [email protected] Or @MacroViewpoints on Twitter