Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”This is 2021“

Thus Spake Pisani on Friday January 20 at about 9:48 am. And Friday proved him right by being the best day for QQQ in 2023 by rising 323 points, even better than Friday January 6 when it rose by 299 points. The rally on Friday January 6 was quite probably driven by the dovish NFP number. That thesis of bad economy being good for stocks was painfully torched (possibly for a mere 1-2 days) this past Wednesday when the Dow fell by 614 points.

The rally in QQQ on Friday January 20 was quite probably driven by the soothing earnings release by Netflix. It was a micro trigger unlike the January 6 macro up trigger & January 18 macro down trigger. And stocks respond to earnings & not as much to economic numbers as Mike Wilson has told us so often.

Not only was Friday January 20 the best day for QQQ in 2023 but it was the consecutive 3rd strong Friday. It was also a day when Google announced large layoffs. And that has been theme for non-Netflix MAAAM names:

- Lawrence McDonald@Convertbond – Jan 21 – Off the lows GOOGL +17% MSFT +12% AMZN +17% META +16% CRM +14% *Big tech progressives cashing in on layoffs, how convenient – won´t see this story in NY Times Monday I suspect.

If you look on a weekly basis, Dow was down 392 on Tuesday, down 614 on Wednesday, down 252 on Thursday and up 331 on Friday or net down 927 on the week. SPX was down 8 on Tuesday, down 62 on Wednesday, down 115 on Wednesday & up 74 on Friday or net down 26 on the week.

In contrast, NDX was up 16 on Tuesday, down 147 on Wednesday, down 115 on Thursday and up 323 on Friday or up 77 on the week. Is this due to the savage selling of these stocks in the tax-loss monetization frenzy or due to their fashionable “untouchable” status? What it does show, however, is that positioning is absolutely a critical factor in the short term.

Whether the strength of Netflix stock is shared at least some what by these MAAAM stocks will be clear in the next two weeks.

2. “pause that refreshes” or a warning?

Last week, the S&P had closed at 3,999+. And bullish signs were everywhere, including in our writing. Noticing that, we had written last week:

- “Frankly, it would help if stocks took a breather or even went down some for a pause that leads to what the gurus above call breakaway momentum or FOMO.”

Was the three-day selloff enough of a pause? Actually it was getting worse until the magical voice of Art Cashin seemed to cool Thursday’s sell-off. He said it is important to hold 3,900. Low & behold, the S&P did close just above 3,900 on Thursday. Then came the Friday liftoff. That led some to draw a chart & ask:

- Via the ZH-Market Ear – SPX – getting very tight – Time for breaking out of this “eternal” range market? SPX is moving tighter and tighter inside the dynamic formation. Support at 3900, resistance at 4k.

Will the S&P escape this cage next week or will it take FOMC-Jay to push it in one direction or the other? Or will it escape the cage next week & then be reversed by FOMC-Jay the following week leading to a false break? We hope its not the latter because false breaks are intense at least most of the times.

This collision between bullish & bearish forces was highlighted by Tom McClellan on Friday after the close. His bullish factors are:

- “3rd year of Presidential term which is nearly always bullish (except Hitler invasion of Poland in 1939)“;

- “gobs of breadth which is always bullish – his friend Deemer’s breakaway momentum has been triggered; McClellan Summation is high enough to suggest escape velocity for the up trend“

His bearish factors are:

- “grand economic experiment the Fed is trying“;

- “ratio of M2 money supply to GDP is shrinking faster than it has in the history of monetary aggregates“

- “taxes are higher than 18% of GDP which has resulted in a recession every time“.

His own conclusion:

- “bearish forces are going to gang up & they are going to outnumber bullish factors and you are not going to have a pleasant year in 2023“

If you look carefully, you would notice that McClellan’s “bullish” factors are short term in nature while his “bearish” factors are likely to take time to gang up. So nothing in his comments precludes the possibility of this rally continuing (assuming FOMC-Powell don’t kill it) until positioning gets full or overflows. In some other years, strong rallies in January have continued, albeit with a slowing momentum, into April. And that, as we enter Q2, might be the time for earnings & the economy to really slow down.

As we recall & remind readers that Larry Williams, per Cramer, said last week that the current rally might run into March.

One other clue might be the statement of Fed bigshot Waller on Friday early afternoon:

- Lawrence McDonald@Convertbond – Jan 20 – FED’S WALLER: IF WE ARE WRONG THIS YEAR, IT WILL BE MUCH EASIER TO CUT RATES. 🙂 Gold – Bloomberg

Now look what QQQ did with this statement from about 1:20 pm:

3. Positioning full or already overflowing?

One asset class is beginning to show these symptoms:

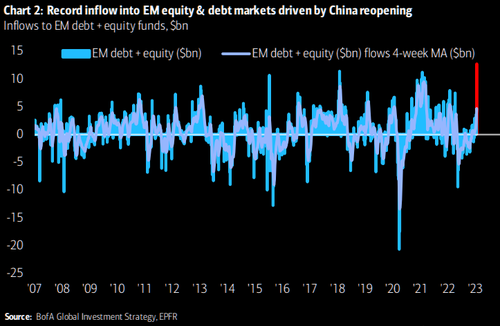

- Via ZH-Market Ear – From “uninvestable” to must have – Hartnett shows the impressive record inflow into EM equity and debt, driven by the Chinese reopening narrative. “1.4bn people ending 2-years of lockdown…SPX +44% during lockdown, +34% during partial reopening, +11% after full reopen.”

Some smart folks we track are already sounding caution:

- Macro Charts@MacroCharts – Jan 21 – EEM traders are chasing one of the biggest FOMO spikes in history. “Sell USD / Buy EM” are among the top consensus trades for 2023 – no one sees downside risks. Many other years began with similar euphoria. Things didn’t go well. Beware consensus trades.

4. Most Dangerous statement of the week (or year)

While the above-quoted statement of Fed honcho Waller might lead to a stock rally next week, we consider it to be a dangerous sign of the over-confidence that seems to pervade this Fed. Let us re-state the statement that was quoted by @ConvertBond:

- “IF WE ARE WRONG THIS YEAR, IT WILL BE MUCH EASIER TO CUT RATES”

This matches the arrogance displayed by Fed Chair Bernanke in 2007 as they stayed tight. When their policy backfired, Bernanke kept cutting rates with abandon to no real effect. A steep recession was the result of Bernanke’s over-confidence in 2007.

It seems from Waller’s statement that this Fed is just as over-confident as Bernanke was when today’s Fed should be much more wary knowing what happened in 2007-2008 & understanding today’s recession might more much more global than the one in 2007-2008.

As Tom McClellan writes in his article Eurodollar COT Model Calls for July 2023 Top For Short Term Rates:

- “The recent rise, though, has matched the message of this model. And there should still be more room for short term rates to keep climbing, as the Fed officials live up to their recent promises and keep hiking rates even though they should stop. This model says that the peak is ideally due in July 2023, but I would take that information as being extremely approximate. More meaningful is the message that by autumn 2023, short term rates should be coming down with some urgency, presumably resulting from the Fed officials realizing by then that they really did take things too far.”

5. Isn’t Class a 5-letter word?

Absolutely. And not just any word, but your pick of “Jalen” or “Hurts” or both. Every college football rasik remembers how Tua Tagovailoa was inserted to rescue the Alabama-Georgia national championship game. Jalen Hurts supported that move by saying “Tua” is the IT-quarterback. Jalen accepted his back up role the following year and stepped in to defeat Georgia in the Alabama-Georgia game by his running. Then he transferred to Oklahoma where he became a better QB under Lincoln Riley. To our knowledge, he never expressed hurt feelings or a negative word, accepting whatever was deemed good for the team. A true & absolute class act.

While Tua, Herbert were top draft picks, Jalen was not drafted until the 5th round. He kept working hard, never bemoaning his luck or fortunes of others. What a Class Act. Now everyone realizes that and understands how patient, dedicated high level of work & learning pays off. He played sensationally against our NY Giants and is, in our opinion, the MVP of Philadelphia Eagles. We could not be happier for him.

A true 5-letter embodiment of Class!

Send your feedback to [email protected] Or @MacroViewpoints on Twitter