Editor’s Note: In this series of articles, we include important or interesting videoclips with our comments. This is an article that expresses our personal opinions about comments made on Television and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Janet Yellen delivered

Frankly, we have no idea what Dr. Yellen delivered. We did not hear anything materially different in her statement, prepared comments or in her answers. She did come across as confident and in control, both intellectually and in presence. The confidence & poise she delivered may have been a slight unpleasant surprise for markets which have been groupies of the soft, dovish Yellen portrait. May be that is why they all got so spooked on Wednesday afternoon.

Usually, the days after the FOMC meeting show a directional bias. Not this time. Stocks fell on Wednesday afternoon, rallied on Thursday to reverse Wednesday’s loss, rallied hard Friday morning and sold off badly on Friday afternoon. Basically, stock indices closed down from pre-Fed levels, long duration treasuries rallied and gold was basically flat. No big deal, broadly speaking.

But action in a couple of areas was intense. Money center banks rallied hard, Brazil & Mexico rallied and the belly of the Treasury curve exploded. In fact, Brazil’s Bovespa rallied all 5 days this week, and was up 5.5% on the week until the sell-off on Friday afternoon. The 5-year & 3-year yields rocketed higher to close up 13 bps fro their Friday levels. Surely, the vicious sell-off in interest rates should have been negative for emerging markets as weak as Brazil & Mexico.

Perhaps the answer is simple. The Yellen composure made large institutions lose their composure and they took their positions down. Large institutions that had taken refuge in the belly of the Treasury curve were definitely spooked by the threat of earlier than expected interest rate normalization. That explains the vertical lift-off of 16 bps on Wednesday afternoon. But what about the rally in Brazil, Mexico? As Elliott Wave pointed out mid-week, these two markets were at the bottom of a long channel and poised to rally. So all the heavy action could have been nothing but position unwinding.

2. U.S. Treasuries

In the classic the dog didn’t bark manner, the 30-year Treasury yield actually fell by 5 bps from its pre-Fed level while the 5-year yield exploded up. The Santellian manner of describing this was:

- “let me get this right — they are doing a taper which means they are not buying as many long maturities and on the short end they are promising not to raise rates – what happened yesterday? the part that they are not buying any more rallied and parts that they say, scout’s honor we are not going to change, that sold off”

It would be interesting to see how the 3-7 year yields hold up in the couple of weeks ahead. What about the long end? Santelli explained

- “the long end, the 10s & 30s that I feel pretty confident they will always have one eye on the weakness of stocks because if we ever have a time there is ever a time when not as many want stocks, they are going to love the long end”

A similar explanation is offered by Abigail Doolittle in her article 10-year yield is the Tell:

- “Either way, if the 10-year yield isn’t going to spike back above 3.00% on the combination of a $30 billion tapered monthly bond-buying program and some sort of time frame for when the Fed may formally start to raise interest rates, this suggests rates are less in the grip of policy and more in the grasp of a preference for safety.”

- “In turn, this suggests there are some smart and market-moving investors who think the Fed’s attempt to pullback on its accommodation is likely to cause market gyrations that warrant stepping back from the edge of the risk curve.”

- “That the 10-year yield is still down more than 25 bps on the year tells us those investors have not changed their mind and are continuing to favor safe haven assets including the yen and gold too.”

An emphatic if simpler statement was the tweet from Keith McCullough of HedgEye on Friday afternoon:

- Keith McCullough @KeithMcCullough – Long Bonds? $TLT +1%, yep – Janet ain’t letting rates rise, bros

What about the flattening of the yield curve?

- Tom Graff @tdgraff – Curve flattening means Fed is ahead of the inflation curve. Too far ahead.

That may be the key to the outperformance of the 30-year Treasury – the finest indicator of inflation. Guy Adami of CNBC FM has said that the action in Treasury yields seems to be suggesting deflation ahead. This week GaveKal Capital voiced the same concerns in their article Deflation Storm Clouds. The charts in that article are interesting and lead GaveKal to remark:

- “This may explain why the shorter-term correlation between stocks and bonds has shot back up recently, indicating a growing fear of a deflationary shock.”

- “This may also explain why counter-cyclical stocks have retaken market leadership so far this year. This tends to be consistent with bonds outperforming stocks.”

Of course, all these concerns can be wiped out by a strong payroll number on April 4 as Paul Richards of UBS said on CNBC FM-1/2 on Friday:

- “they (bond markets) are waiting on the data; it means that the April 4 employment number is huge; this is going to be the first month without weather impact and who knows, if we are going to run up 3% its going to need like a 250K number; can it sustain & go through 3% number? – I think it does, because there is confidence in the economy;”

The payroll number is still two weeks away. The bond market will weigh each piece of data till then and get positioned for that huge

number.

3. U.S. Equities

The best call of last week was by Paul Richards of UBS who exhorted CNBC FM viewers to get long risk last weekend. What did he say this Friday?

- “the Fed is confident; what I saw from Yellen is confidence; there is

confidence in the economy; I think stocks can go up and yields can go

up; the apex I think is 3.5% on the 10-year; if that goes, that’s a

different investment opportunity for moms & pops & everybody at

home… but in the meantime stocks, if stocks go up 10% instead of 25%

this year, I don’t have a problem. especially with 10-yr at 3.25%, its

goldilocks”

Ed Yardeni on CNBC FM – 1/2 on Thursday, March 20

- “still

a bull market; I think we are going higher; I have this gimmicky

target of 2014 by the end of 2014; point is we can be up 8-10% this

year; its not a foregone conclusion that rates are going up.. I think

inflation is going to remain extremely low, I think the new target is

5.5% but they were not explicit about it”.

Lawrence McMillan of Option Strategist on Friday:

- “The market action in the last 10 days has been a complete whipsaw. Volatility indices ($VIX, $VXO, and $VXST) spiked sharply higher last week. But when they spiked back down, they generated buy signals, which are now in effect.”

- “In summary, the indicators are mixed now, but the $VIX buy signal should be significant. We may not really know which way the market is going to move until it breaks out of the $SPX 1840-1880 range, though.”

Ralph Acampora was cautious with Maria Bartiromo on FBN on Monday, March 17:

- “low inflation & that’s what makes me so bullish long term … we go higher; but got to see new highs on the Dow & in DAX”

- “price of gold – on a technical basis is approaching a very important level; the August 2013 high which is 1434.. if we break above that, then I think most technicians will agree that we have a major reversal to the upside”

- “if we get a major reversal to the upside in Gold, I think that spells contra-cyclical movement for the stock market; I don’t want to see gold go up, I want to see Dow go up”

- “Emerging markets – they look terrible; we talk about China, China peaked in 2011; I am a long term bull but my nose is wiggling a little bit”

Jim Cramer on CNBC Mad Money on Thursday, March 20

- “many people are worried about 2 things in this market, heightened valuations and froth. It is absolutely true that when you have multiple stocks valued on sales as we have in the cloud area not on earnings, you are in a tread carefully universe – the price-earnings ratio of the S&P 500 is almost 17.5 which is the most expensive this market has been since the bull run got started and that is not good;”

- “However, the key here is that neither tech nor financials that are leading the market are expensive by any measure; in fact they are historically much closer to the rock bottom valuations than the sky high ones… makes them terrific leaders because they have so much room to run before they do get expensive – I don’t want to overlook the bubblish portion of the market, for example, the froth indicators are I follow are still flashing red but not as intensely as we have seen previously ;we are seeing steep declines in the frothiest stocks”

Cramer’s concern about froth and the overall concern about investors being “all-in” is best described by the charts from Elliottwave International article titled 13 Eye-Opening Finance and Economics Charts You Will Not See in the News:

Getting to interesting tweets, the first is binary:

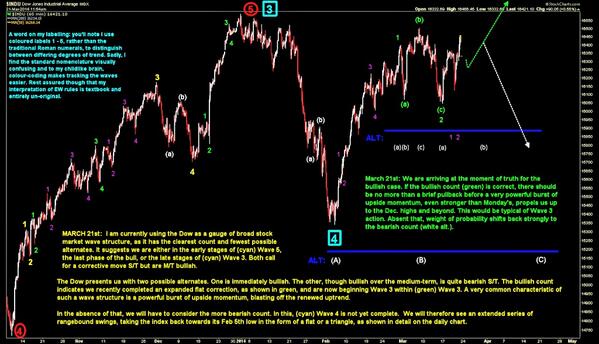

- James Goode @OntheMoneyUK – Momentum of truth arrives for S/T bulls ~> breakout now, or fakeout pic.twitter.com/qF62WPZko2

Last week, Jeff Cooper wondered whether that action marked a top. He tweeted a similar thought on Friday:

- Jeff Cooper @JeffCooperLive – ye old hate email indicator lives as a twitter stream indicator in calling the top in ’07 and may have done so yet again in 2014

Cooper also wrote about a turning point in March in a free article on Minyanville.com:

- “Since March 7, the S&P has carved out four outside down distribution days in nine sessions. March has seen important turns in the markets since 2000. These two square-outs from March 7 and then Tuesday’s square-outs at 1878 and 1872 respectively, have rejected the market with authority, underpinning the notion of a significant turning point occurring this March.”

4. Gold

This turned out to be the worst week for Gold in 2014. GLD fell by 4% this week while miner ETFs GDX & GDXJ fell by 9%. So kudos to three tweeters who advised getting out on Friday, March 14 – @Convertbond, @JeffCooperLive & @Vconomics.

Mark Dow of Behavioral Macro on CNBC Futures Now on Thursday, March 20:

- “… I think gold goes higher before it goes lower; buts its just hard to have a clear view; what you really have to key off of rather than price levels is sentiment; Gold is the ultimate psychological trade; the ultimate sentiment driven asset; it is not about fundamentals; there are no fundamentals”

Carter Worth, resident technician of CNBC Options Action, didn’t have to play Hamlet on Friday:

- “this rally is a major break above the down-trend line … a bearish to bull

ish reversal..50% of the original decline from 1900 to 1100 is 1500 and we think that’s where gold is headed; closed this week at 1350 or near there.. GLD we play it on the long side”

No one beats Tom McClellan in discussing seemingly irrelevant but empirically interesting correlations. Read his latest title Gold Bugs Cheer The Rain. His chart doesn’t tell the story as poetically as he does:

- “why rainfall in the Pacific Northwest would have anything at all to do with the movements of gold prices. But this week’s chart shows that there is clearly a relationship”.

- “Gold prices peaked back in 2011, along with rainfall totals for Tacoma, WA. And gold’s decline to the Dec. 2013 price low coincided with a period of diminishing rain for Tacoma in specific, and for the northwest in general”.

- “For now, the rain is continuing to fall in the Pacific Northwest, the Pacific tree frogs are happy, the rainfall totals are rising, and so are gold prices. So if you are a gold bull, or a banana slug, pray for more rain in the Pacific Northwest. But history says Washingtonians should get ready for a dry period, and for a gold bear market leading to bottom in 2016. When that decline toward 2016 will start is a much harder question”.

5. Crimea & Bahrain

Last week, we discussed a far out scenario that might appear tempting to Putin if US-EU sanctions end up damaging Russian economy. That scenario was:

- “Russia needs a high oil price to keep its economy solvent and would need a much higher price of oil if western sanctions really hit hard. What could Putin do to move oil prices up to a higher base? What is the soft spot for America, a spot which can cause serious problems and an oil spike? Our immediate answer, though highly improbable at this time, is Bahrain. This is so symmetric to Crimea – a majority Shiite population that doesn’t want to be ruled by a Sunni minority; a tyrant-like Sunni “royal family” that has oppressed the majority far worse than Yanukovych did in Ukraine and home of the US Fifth Fleet that guards the Persian gulf. This would be our choice of a likely spot to create a spike in oil prices and cause maximum damage to US position in the Persian gulf. Of course, this way out scenario assumes a resumption of the cold war.”

This week we found that this far out scenario was considered as remote but likely by GaveKal. Below are quick excerpts from an article by Louis Vincent Gave via the e-letter of John Mauldin:

- “Indeed, in the Sunni-Shia fight that we see today in Syria, Lebanon, Iraq and elsewhere, the Sunnis control the purse strings (thanks mostly to the Saudi and Kuwaiti oil fields) while the Shias control the population. And this is where things get potentially interesting for Russia. Indeed, a quick look at a map of the Middle East shows that a) the Saudi oil fields are sitting primarily in areas populated by the minority Shias, who have seen very little, if any, of the benefits of the exploitation of oil and b) the same can be said of Bahrain, where the population is majority Shia.”

- “Indeed, a greater clash between Iran and Saudi Arabia would probably see oil rise to US$200/barrel. Europe, as well as China and Japan, would become even more dependent on Russian energy exports. In both financial terms and geo-political terms, this would be a terrific outcome for Russia.”

A direct conflict between Iran & Saudi Arabia is very unlikely. The stakes are so huge that everyone will have to get in. So it is likely that, if it came to that, these two would first fight a proxy war in Bahrain. Look at the current proxy war being waged in Syria by Iran & Saudi Arabia backed by Russia & USA resp. Look how horrible that is in human terms. A proxy war in Bahrain that is 10% as brutal would take Oil to about $125 a barrel. That is far better than the $200 target discussed by GaveKal from any direct clash between Iran and Saudi Arabia.

This is the time for US-EU and Russia, especially the US, to shout & threaten to act in a semi-theatrical manner and then slowly take the volume down. That is assuming President Obama does not give in to the fever gripping both right-wing neocons and left-wing HR interventionists.

Featured Videoclips:

- Marc Faber on BTV Street Smart on Monday, March 17

1. “China Unwind will be a disaster” – Marc Faber on BTV Street Smart with Matt Miller & Trish Regan – Monday, March 17

There is probably no one combines investing and entertainment as Marc Faber, the editor of the Gloom, Boom & Doom report. The detailed summary below is courtesy of Bloomberg TV PR.

MARC FABER:

- Well I think that we had a colossal credit bubble in China and that this credit bubble is now being gradually deflated and will bring about problems in the real estate market and among some major players in the commodity markets as well. So overall, if I look at export figures from China, and they are very closely correlated to overall economic growth, then there is a huge discrepancy between what China reports and what China’s trading partners are reporting.

- So if you look at the figures of China, exports are still growing. If you look at the trade figures China exports to Taiwan, so China records exports of so and so much. The Taiwan report imports from China at a much lower level. So which figures are more reliable? I think the figures of the trading partners of China are more reliable. And they would suggest that growth has slown down considerably.

MATT MILLER: Hang on. So Marc, are you calling for a Chinese report of 4 percent or are you saying it’s more realistic that we’ll see 4 percent and the Chinese will come out with a report or their own numbers that are closer to the 7, 7.5 that’s expected?

FABER:

- Governments will always publish the statistics that they wish to show irrespective whether that is in China or in other countries. Governments control basically the statistical offices, so they can show whatever they want. As Stalin said, it’s not important who votes but who counts the votes. And the government counts the statistics.

REGAN: Yeah, and if you’re China, you’ve got some muscle there to count what you want. But at the end of the day, investors, they have a tendency to see through these things. Marc Faber, do you believe investors are seeing through this? Have they disc

ounted China enough in your view?

FABER:

- Look, the fact is simply that Chinese stocks have been just about the worst performing stocks since 2006. Now analysts will dismiss that and say everything is prefect in China, but the stock market does not seem to believe everything that the government is saying about the economy. And clearly there are strength signs in the Chinese economy. In particular, as I said, we have this huge explosion of debt. Debt as a percent of GDP has increased in the last five years by more than 50 percent. Total debt is now over 215 percent of GDP, and a lot of it is trade finance that is being rolled over.

- In addition to that, there are lots of funny deals. A friend of mine who analyzes China very carefully, Simon Hunt (ph), he pointed out that trade finance between one state-owned enterprise and a private company has amounted to over $5 trillion by continuing to roll over the same collateral several times. There’s lots of funny things that are happening in China. And when the whole thing unwinds it will be a disaster.

MILLER: Well surely they can do that kind of thing within their own borders and kind of keep a lid on it. But as you say, if there are discrepancies with their export numbers and say Taiwan’s import numbers, or if indeed we see all of their export numbers dropping, all of their import numbers dropping more importantly, it could portend disaster for the rest of Asia. Do you see that sort of playing through, those ripples playing through Asia this year?

FABER:

- Yes. I think that investors are not sufficiently aware that the Chinese economy is far more important for other emerging economies than the United States because China is a large importer of resources. In other words, iron ore, copper, zinc (inaudible). And at the same time, they are a huge exporter to commodity producers of their own manufactured goods, as well as Korean exports. The commodity producers are much larger than Korean exports to the US or to the EU .

- So if the Chinese economy slows down, commodity prices – industrial commodity prices are likely to remain under pressure. They already come down a lot. They remain under pressure and the resource producers have less money. In other words, the Brazilian goes into recession. The Middle East does not grow as much as before. Central Asia, Africa and so forth all contract, and then they buy less from China and you have a vicious cycle on the downside.

REGAN: Let’s talk about what’s going on over in eastern Europe right now as we watch Vladimir Putin take over Crimea. How – how big might this get in your view and how should investors be thinking about Europe right now as a result of these moves from Putin?

FABER:

- I think, as an international observer, Mr. Putin did the right thing from his perspective. We have to look – put ourselves into his shoes. He did absolutely the right thing at the right time.

REGAN: I’m sorry. He did the right thing at the right time. What do you mean by that, Marc?

FABER:

- By that I mean that there was interference by foreign powers in Ukrainian politics that were unfavorably from the perspective of Russia.

REGAN: So he – he needed to save his warm water ports? He went in and took over this region, which you see as a logical political move. I guess the big question is is he going to do more.

FABER:

- The Crimea is strategically most important for Russia. It has practically no meaning strategically to the United States or to Europe. But for Russia it’s very important. I don’t think that Russia will move further into Ukraine unless there is serious provocation. But I doubt it will happen. But I think the wider implication is that we have now border lines. In other words, the US would intervene if a foreign power would establish bases in Haiti and in Cuba and so forth and so on, and the Chinese will react if foreign powers threaten Chinese access to resources.

- This is very important because the occupation or say the referendum in Crimea and Crimea moving to Russia gives essentially a signal to China that one day they can also move and seize some territory that they perceive that belongs to them.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter

1 Comment

Comments are closed.