Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Forget about it!

We of course mean any chances of a rate hike in September. Our old claim of “0 before 50 bps” now seems valid. We made that claim because we trusted Chair Yellen to do the sensible thing and not get ahead of where she needs to be. She knows that the economy is not accelerating and she sees no reason to slow it down further.

The US economy seems stuck in the 2% mud. Given the trend of the past 3 quarters, we might even call it 1% mud. Because to get to 2% GDP growth this year, the economy needs to grow by 4% in the second half of 2016.

Remember what Daisuke Karakama, chief market economist in Tokyo for Mizuho Bank Ltd., had said (via Bloomberg.com) last week:

- “Helicopter money, which has been debated in public without anybody clarifying the definition, was used merely as an excuse to unwind speculative yen buying,”

Guess he was right because Kuroda of BoJ disappointed those who were waiting to see the helicopter fly overhead on Friday morning. No wonder the Yen rallied by 4% this week.

Remember the chart from J.C.Parets we featured last week showing how the U.S.Dollar was butting against resistance. Thanks to a more dovish than expected FOMC statement on Wednesday and an agonizingly weak 1.2% print for Q2 GDP on Friday, the U.S.Dollar fell by 2% on the week.

Are width & slopes of trendlines in the eyes of the beholder?

- Becky Hiu

@beckyhiu –$UUP | Oops. False breakout?

Words like “false breakout” are heavy with possibilities. So hopefully this reversal in the Dollar is not a false breakout. Thankfully, being stuck in 1% mud is better than sliding down to 0% or lower:

- Holger Zschaepitz

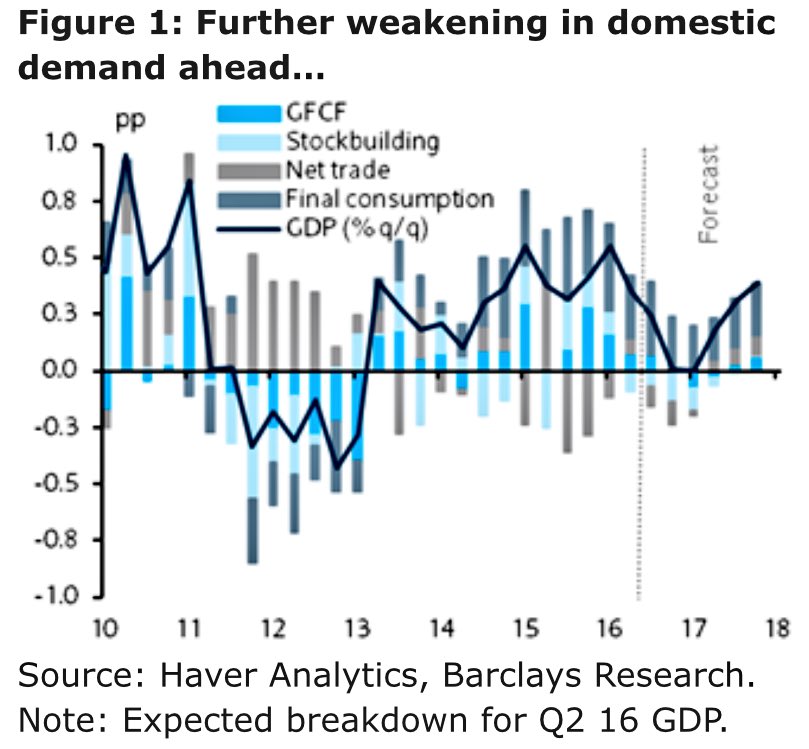

@Schuldensuehner –#Eurozone GDP growth halved to 0.3% in 2016 Q2 on disappointing 0% growth in#France & generally weaker dom[estic] demand.

So how can the Dollar fall much farther against the Euro? Unless, like Japan, Draghi is going to surprise by not delivering more stimulus. No wonder 30-year Bund yield fell by 15 bps this week leading to:

- David Rosenberg – the question now is whether the [treasury] yield curve is speaking a different language than it has in the past – perhaps a German dialect?

But that depends on the answer to the question below:

2. Stagflation really?

Some are sure:

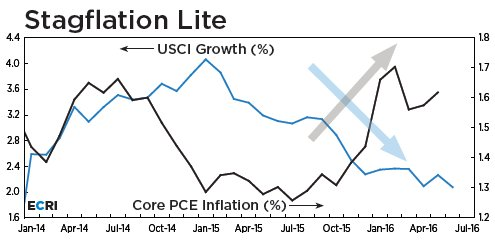

- Lakshman Achuthan @businesscycle – Weak #GDP report no surprise if watching ECRI’s USCI (blue line): stagflation lite is real. https://goo.gl/y7LVBt

David Kotak of Cumberland Advisors wrote on Friday “there seems to be solid evidence that inflation has topped 2%“. On the other hand:

- David Rosenberg – Second Half prognosis – slower growth, lower inflation – I’m

hearing a lot about a reflation trade coming, but somehow I think this is yet another false dawn …

3. Treasuries

The stagflation lite or disinflation debate is key to further decline in US interest rates. Some like Komal Sri Kumar and Scott Minerd argue for 90 bps-1% in the 10-year yield. Jeffrey Gundlach couldn’t care less as he said on Friday:

- “The yield on the 10-year yield may reverse and go lower again but I am not interested. You don’t make any money. The risk-reward is horrific, … There is no upside” in Treasury prices.

Many believe in this sentiment. That may be why Treasury auctions saw dismal participation this week and why TLT had corrected its overbought condition prior to the FOMC statement. Perhaps. like Charlie Brown, they believed Lucy this time:

(courtesy of Dana Lyons)

Carter Worth, resident technician at CNBC Options Action, suggested going with the flow and getting long TLT on Friday. Rates he said are going lower. How much lower, he did not say. But they at least have to break to all-time lows, don’t they? Of course that’s not much farther. The 10-year has to fall by only 15 bps to get to new lows. We could see that next week if the NFP number comes in more like the May number rather than the June number.

4. Stocks – Sell the July High?

“Buy the June Swoon, Sell the July High” was a tweet by Urban Carmel @ukarlewitz in early July that referred to the LPL Research article titled Welcome to the Strongest Month for Equities Since 1928. That article stated “July is consistently positive, while June and August are usually weak” and added ” … August is usually when big drops can happen, as that month is lower by 4.8%, on average, when it is red”.

Jeff Gundlach went much farther on Friday according to:

- Lisa Abramowicz

@lisaabramowicz1 – DoubleLine’s Jeff Gundlach said stock investors have entered a “world of uber complacency”

The Reuters article quotes Gundlach:

- “The artist Christopher Wool has a word painting, ‘Sell the house, sell the car, sell the kids.’ That’s exactly how I feel – sell everything. Nothing here looks good, … The stock markets should be down massively but investors seem to have been hypnotized that nothing can go wrong.”

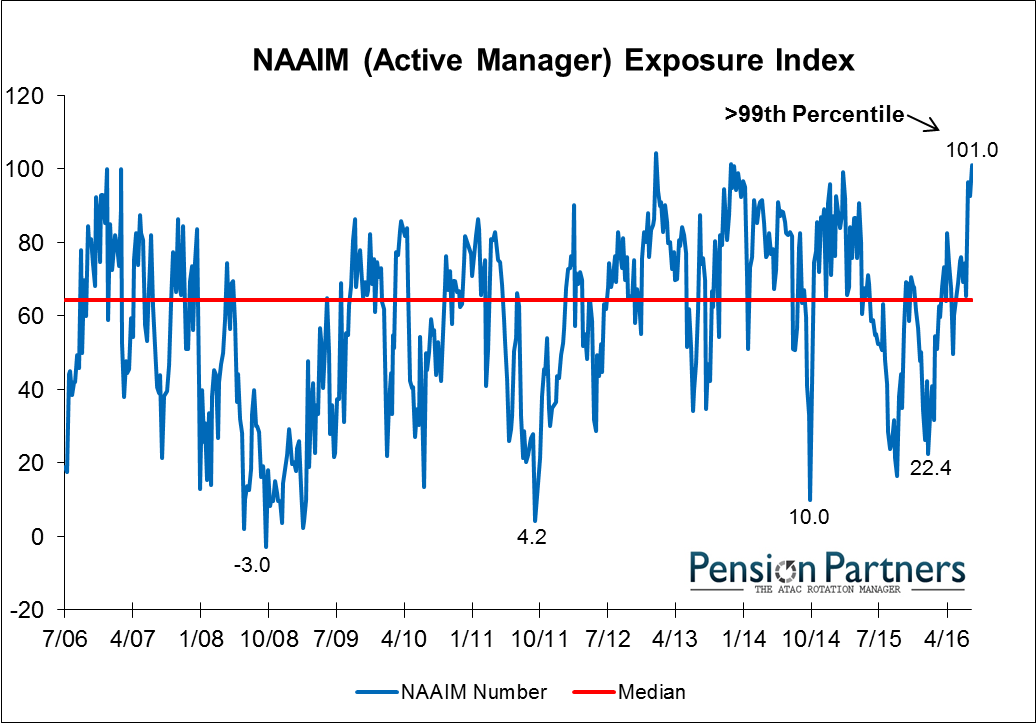

How would “uber complacent” investors be positioned now?

- Charlie Bilello, CMT

@MktOutperform – Jul 28 – Active Manager Exposure to US Equities… At Feb Lows (S&P 1810): 22% Today (S&P 2170): 101%$SPX

Going back to old-fashioned nomenclature:

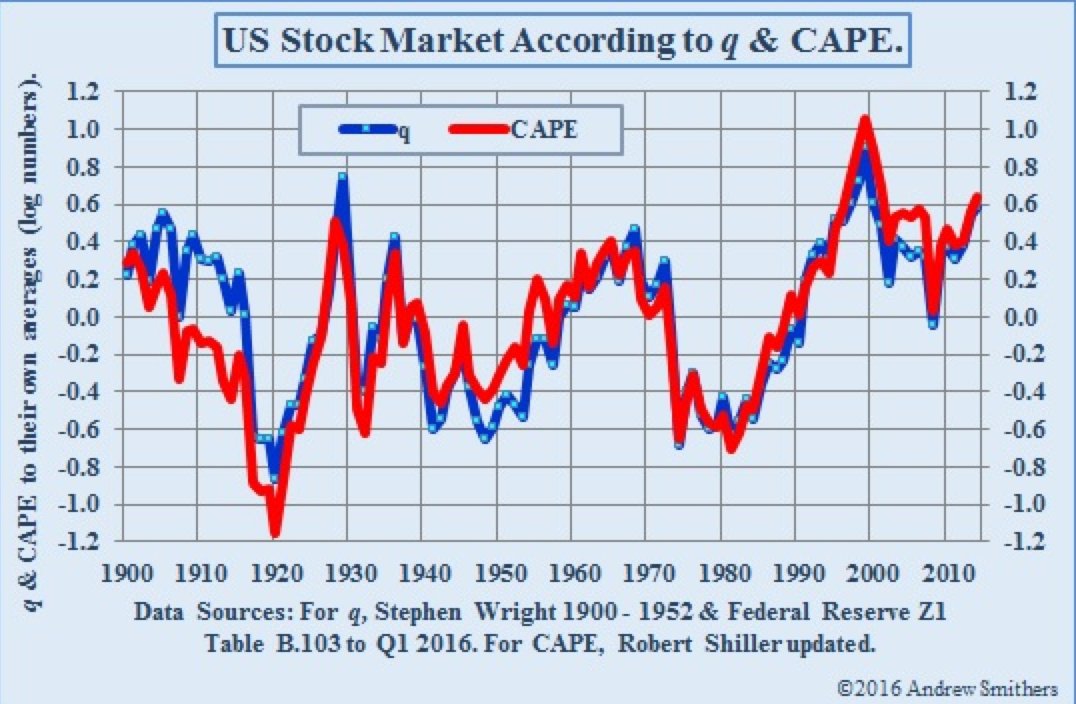

- Jonathan Tepper

@jtepper2 – And Tobin’s Q for US equities. Only higher in 1929 and 1999. I’m sure this time is different.

So what would some do?

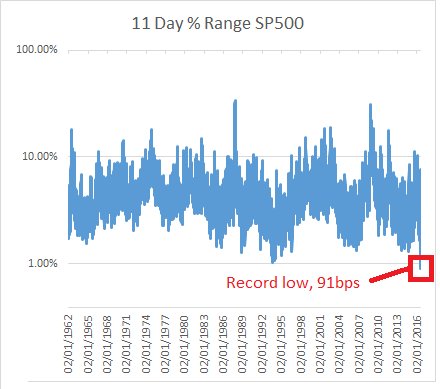

- K1T CAPITAL

@k1tCapital – We’re about to get aggressive with$SPY short – h/t@RyanDetrick for 11 day range

With all this, wouldn’t be lovely if Monday opened with a big bounce? Perhaps because the European stress tests cleared all the big European banks? Isn’t that as good an excuse as any? Because of such risks, some would like to see some real evidence before turning negative:

- Lawrence G. McMillan

@optstrategist – “a true market top will not form until we see some sell signals from our indicators.”http://www.optionstrategist.com/blog/2016/07/weekly-stock-market-commentary-72916 …$SPX

5. Gold, Silver, Miners – Tale of Two Weeks

The July 16 – July 22 week saw a hard fall in Gold & miners. This past week saw a rebound that recaptured all that was lost & gained some more:

- July 16-July 22 – GDXJ down 9%; GDX down 4.5%; Silver down 3%; Gold down 1%.

- July 23-July 25 – GDXJ up 9.3%; GDX up 6.4%; Silver up 3.6%; Gold up 2%

What does this say? Forget technical charts & stuff; The action in Gold & Miners is purely dependent on monetary policy triggers. Yes, the Dollar is also dependent on same monetary policy triggers at least right now.

A Fed on hold for a long time, GDP growth tepid; some nascent talk about additional stimulus eventually. How is all this not positive for Gold & Miners? Gundlach seems to agree based on what he told Reuters:

- Gundlach reiterated that gold and gold miners are the best alternative to Treasuries and predicted gold prices will reach $1,400.

Actually, $1,400 is only 3% away from Gold’s closing price of $1,357.90. That was a weekly close above the important level of $1,350. A bad NFP number might just get Gold close to if not above $1,400 next Friday. Of course, a strong number may send it down.

6. Oil

Who knows how & why Oil does what it does? Just as everyone was talking about $35 oil, look what it did:

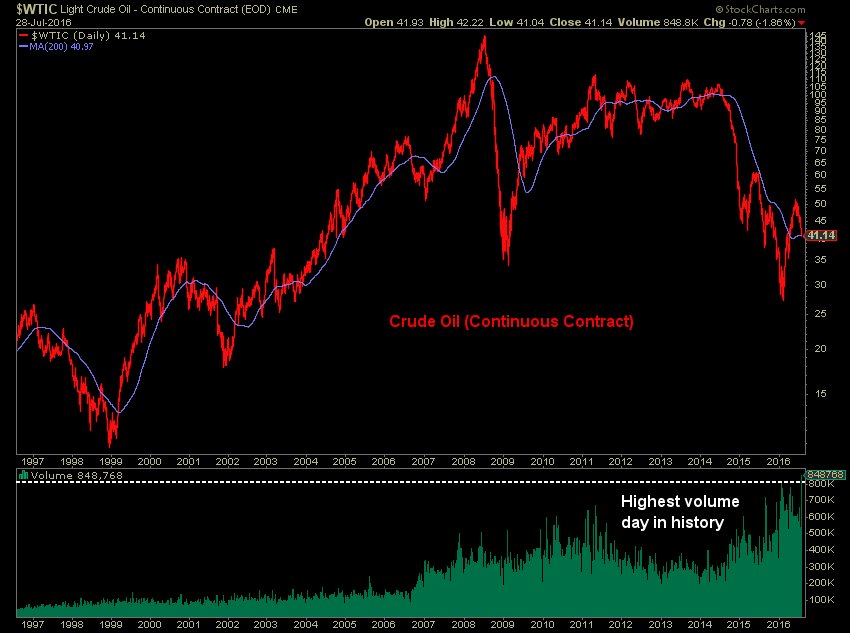

- Charlie Bilello, CMT

@MktOutperform – Jun 28 – Crude Oil closes just above its 200-day moving average in what appears to be the highest volume day in its history.

And Oil extended that reversal with a rally on Friday that some described as an “outside day”. Despite that, Oil had an awful week with both USO & BNO down 6%. So does it rally hard next week or fall down again? We don’t have a clue. That is why we totally concur with the sentiment below:

- M Lebon

@LongTplexTrader – I do not know how you#CL_F traders do it. Every Wed is a#NFP day for you.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter