Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.In Yellen We Trust

As we had said last week,

- “Why would the Fed even consider raising rates in such an economy and with the election drawing even closer? The short end of the Treasury curve agrees. The 5-year yield fell 2.5 bps this week with the 3-year & 2-year yields falling by 2 bps & 1.6 bps resp.”

Chair Yellen clearly agreed and sent an unambiguously clear signal on Wednesday via the FOMC statement and in her presser, or “sermon” as David Rosenberg termed it. You can always trust her to do the right thing especially if the right thing is to be dovish. Besides not raising the federal funds rate, she downgraded the long term growth rate of the economy from 2% to 1.8%.

Of course, her task was made easier by what BoJ Governor Kuroda did on Wednesday morning our time. He maintained his QE and committed the BoJ to maintain a 0% yield in the 10-year JGB. This brave, almost Quixotic, action had already soothed the “nerve-center” of the global markets – 30-year Treasury yield. Yellen completed the treatment on Wednesday afternoon. Just look at the results – The German 30-year yield fell by 15 bps on the week, the Japanese 30-year yield fell by 10 bps and the 30-year Treasury yield fell by 8.7 bps. Naturally, volatility fell across all 3 large asset classes – bonds, stocks & gold.

This collapse in volatility and fall in long yields was also due to the obvious but unstated fact that the concept of central bank divergence was put to rest by Yellen-Kuroda. Just as the sovereign bond markets had proved since August that they were all different tributaries of the same river, Yellen-Kuroda demonstrated that they were both members of the same central banking team. And we all saw that all the major asset classes, sovereign bonds, stocks and precious metals were all different tributaries of the same river, the river of liquidity that is flowing courtesy of Yellen, Kuroda & Draghi.

It was as if all three were singing on 21st of September:

Love was changing the minds of pretenders

While chasing the clouds away

Our hearts were ringing

In the key that our souls were singing.

As we danced in the night,

Remember how the stars stole the night away.

Of course, the big question is whether the markets remember this 21st night of September come performance fee time in December.

2. Come December

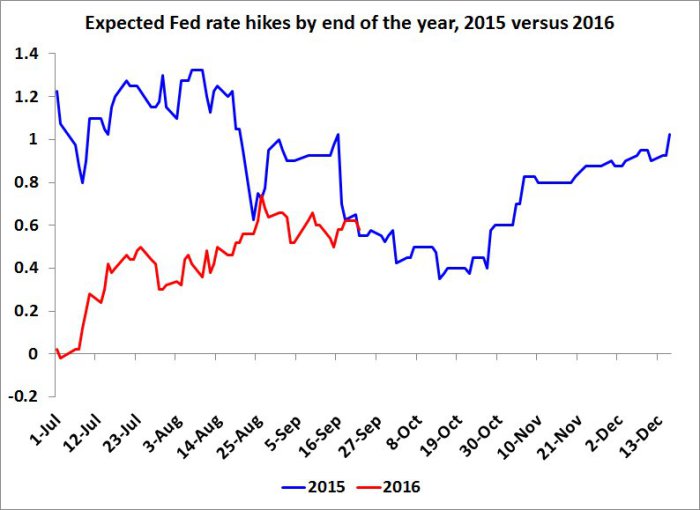

Naturally Chair Yellen talked tough about their intentions for December. But as all of us should know, they are “markets-dependent” which embodies data dependency. What about parallels to 2015?

- Matthew B @boes_ – So begins the long march to December. We are right where we were immediately after the Sept. 2015 FOMC meeting

Just like 2015, we believe we would know more about December in early November. We will have certainty about the election and more information about the direction of the US economy with two more NFP numbers. Until then, what the Fed does in December is a “huge who knows” as Jeffrey Gundlach put it on Wednesday afternoon on CNBC FM.

3. Economy & Long Duration Sovereigns

First an “all of a sudden” un-rosy description of the US economy from David “Rosie” Rosenberg on Friday:

- Home sales sag again – All of a sudden, the housing indicators have taken a turn for the worse, calling into question the veracity of the NAHB housing market index which had looked so promising early in the week

- Listless leaders – For the second time in the past four months, the LEI slipped 0.2 in August and if it were not for the positive impact from the financial markets – the yield curve and equity market – the decline would have been closer to 0.3

- Chicago Bears – Not only is the Conference Board’s Leading Economic Indicator flashing a warning signal, but so is the Chicago National Activity Index

- Employment– The bottom line is that when assessing the labor market and looking at the employment-to-population ratio for the overall economy and for prime-age male adults, the “real” unemployment rate is closer to 8% than 4.9%.

The day before we heard Larry Fink sound a decidedly downbeat note in his conversation with BTV’s Erik Schatzker:

- “We are in more dangerous waters in Europe than we have been in years; … I hear from talking to CEOs in the UK – they are not incrementally hiring, they are not incrementally planning to invest in the UK until there is more certainty; the CEOs in USA aren’t either; 4th quarter is going to be slower than the 3rd quarter; GDP will be weakening in the 4th quarter“.

What about developing countries? Read what a recent Unctad report said per FT:

- “Unctad expects growth in global trade this year to be about the same or less than the 1.5 per cent it recorded last year, down from about 3 per cent in 2012 and 2013 and about 2.4 per cent in 2014.

- It expects growth in world economic output to be about 2.3 per cent, its slowest since 2013, with developed economies growing 1.6 per cent and developing ones about 3.8 per cent — the slowest rate of growth in the developing world since 2009 (see table).

- “One reason that global growth is slowing is that growth in developing countries is slowing dramatically,”

This should be positive for global sovereign bonds and for duration, right? Right said Bill Gross post-Fed:

- Gross on Wednesday said he was extending duration by buying longer-term debt amid persistent signs of slow economic growth globally and subdued inflation. Longer maturities have a higher duration, meaning they gain more in price when interest rates decline.

- “The timing of a bond bear market has certainly been delayed,” Gross said in an interview on Bloomberg Television. The BOJ’s plan “provides what I call a soft cap on Treasuries and on gilts and on bunds,” and signals limited downside in terms of price. “You can’t fight central banks.”

Mark Newton seems to concur from his technical perspective:

- Mark Newton @MarkNewtonCMT – Bund yields, similar to US 10yr Yields, attempted to breakout, but was proven False, Now face a complete Roundtrip

We know what “false breakouts’ often mean – fast move in the opposite direction. So all this is consistent, right?

Wrong, say Jeffrey Gundlach & others. Gundlach believes that the central banks have now “fully capitulated”. They know that their policies are not working & so they want to steepen the curve. His main point is that the bond markets have begun to sniff out higher probability of fiscal stimulus and that is a negative for long duration bonds. He, like others including Pimco, argue for an increase in inflation and so Gundlach now suggests buying what he has ridiculed in the past – 5-year or longer TIPS,

We wonder whether bond markets have been sniffing something themselves or their sniffing is due to the false trails of dissenting members of central banks. There is no doubt that long JGBs created the recent bout of indigestion. Will renewed fears of a global slowdown cure that? A consensus is building about a need for a fiscal stimulus. But how far away is a real stimulus program? Is any real progress on a stimulus possible until the end of Q1 2017?

There is no doubt we are, as Larry Fink said, at a “pivot point, a binary pivot point”. But when do we see a decisive move from fiscal policy makers? Not until Q1 2017 in our opinion. So what will Yellen-Kuroda-Draghi do until then? Squander away the stability they have worked so hard to create or do everything they can to stay the course until the politicians get ready? Our bet is the latter as long as weak data allows markets to give them that latitude.

4. Treasuries & Credit

All the three major sovereign bond curves bull-flattened this week. The interesting divergence came from the 7 bps rise in 30-year Treasury-Bund spread. And leveraged credit CEFs like DPG & UTG massively outperformed the unleveraged ETFs like HYG & JNK. Jim Caron, a smart MS portfolio manager, argued on BTV for over-weighting spread product instead of duration.

5. Equities

First a sound comment from Lawrence McMillan of Option Strategist:

- “In summary, the Fed’s announcement was less a catalyst than it was a concern that didn’t materialize. Prices are rallying and the indicators are turning bullish. It is still going to be necessary to see $SPX confirm this bullishness by moving to a new all-time high. In the unlikely event this all falls apart, and $SPX closes below 2120, that would be very bearish”

To flush this out some more:

- Ryan Detrick, CMT

@RyanDetrick – New all-time highs in these A/D lines today: Dow Mid Cap NDX NYSE NYSE common stock only OEX Small Cap SPX This isn’t bearish. - J.C. Parets

@allstarcharts – 52-week high for the Russell2000 Index. Probably not bearish$RUT$IWM - J.C. Parets

@allstarcharts – highest closing prices for the Semiconductor index since the year 2000?$SOX – probably not bearish….

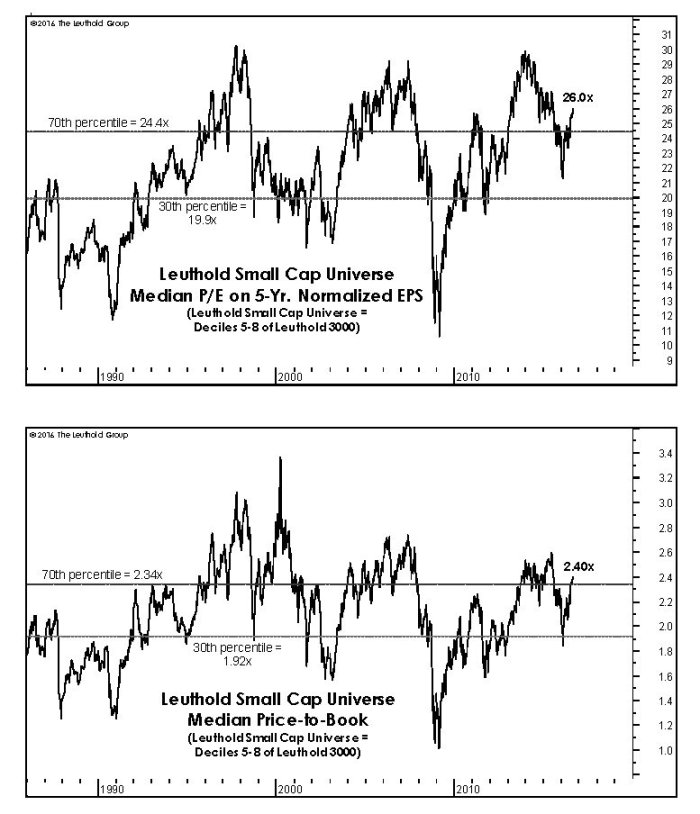

The Russell 2000 ETF outperformed all broad indices this week. Because it has more “room”, perhaps?

- The Leuthold Group @LeutholdGroup – If #Stocks fated to “melt up,” #SmallCaps have room. #PEratio high but below other peaks; P/Book barely >70th% #EPS

But all time highs in some sectors could also mean a top, couldn’t it?

- David Larew

@ThinkTankCharts – NAMO – Generally when the NAMO goes outside the Bollinger Bands, you have a reversal – today was a possible top – reoccurring theme

The reverse of a top is a bottom, right?

- J.C. Parets

@allstarcharts – do they get nicer than this? look at these damn railroads and tell me you don’t want to own them

6. Gold

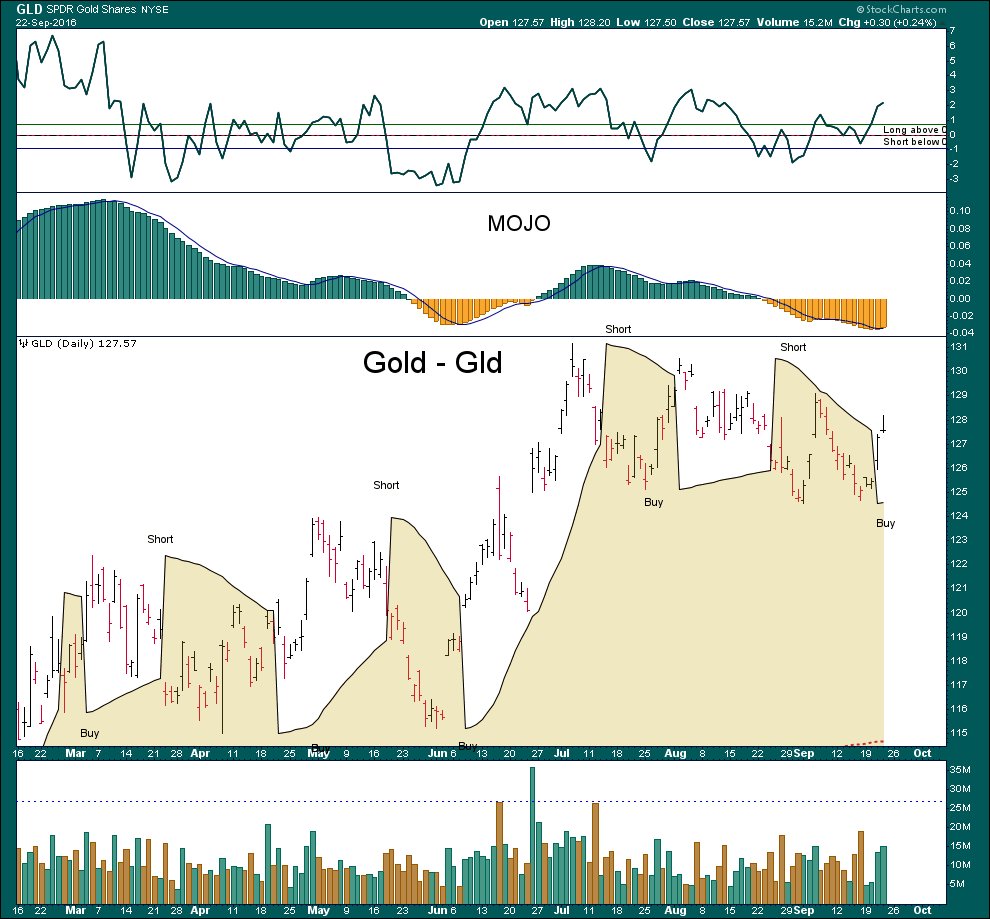

Gold miners exploded post-Fed and despite a hard reversal on Friday, they were the best performers of the week. Was that because they were deeply oversold entering the week or because central banks acting in tandem is just sweet music for gold & miners?

- John Kicklighter @JohnKicklighter – Gold volatility ($GVZ) has dropped to its lowest level in 14 months as the metal works into a breakout pattern…

And short term?

- David Larew

@ThinkTankCharts – Gold Parabolic SARS – GLD went to a Buy signal today – with the SARS you go long and put a trailing stop at the SARS tail, raising it daily

7. Song of the week

Will what Yellen-Kuroda did on this September 21 lead to a year-end rally? If so we will all be singing in December:

Ba de ya – say do you remember

Ba de ya – dancing in September

Ba de ya – never was a cloudy day

For those who don’t know, the lyrics in this article are from a classic, one that we, for some weird or mystical reason, began singing around noon on Wednesday, September 21. Then came Yellen at 2:00 pm. How prophetically weird was that?

[embedyt] http://www.youtube.com/watch?v=Gs069dndIYk[/embedyt]

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter