Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1 Yo-Yo or Fool in the Shower?

What is going on with Central Bankers? Let us begin with Chair Yellen. After a long period of warning about their determination to raise rates in 2016, a determination emphasized this week by NY Fed President Dudley, Chair Yellen seemed to suggest a complete reversal in her thinking on Friday. Instead of raising rates, she seemed to suggest letting the US economy run hot for some time. Meaning forget about raising rates, forget about data-dependency, keep the rates low until the economy actually grows.

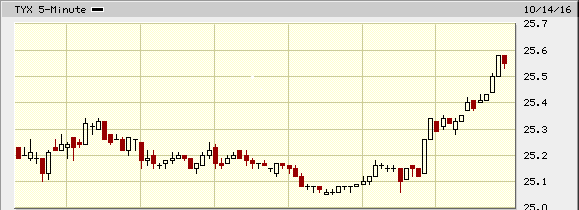

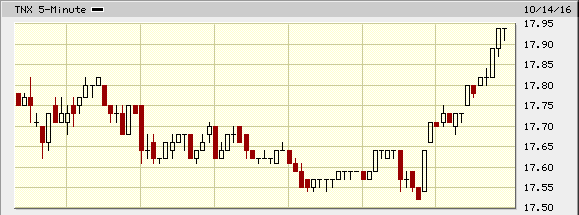

Is Chair Yellen playing a game of yo-yo with investors or is she reenacting the “fool in the shower” caricature of a Fed chair who turns the tap to hot and then corrects by turning it all the way to cold & vice versa? Or she is utterly clueless about the signals she is sending? If she is, she should look at the intra-day charts below of 30-yr yield & 10-year yield via bigcharts.com.

(10-year yield) (30-year yield)

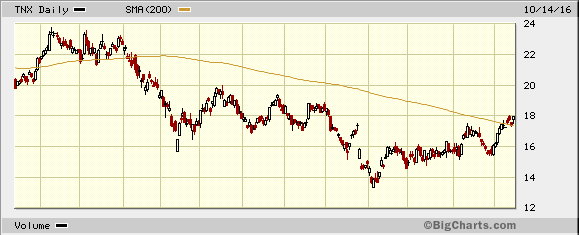

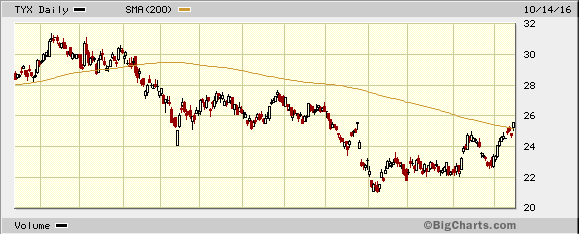

This is what they call carnage. About 80% of this week’s curve steepening took place on Friday afternoon after her speech. And look where the yields closed on the week – above their 200-day moving averages. That is as awful a signal as Treasury markets can send, a signal that yields are about to explode towards a peak in the next couple of months.

(10-year yield) (30-year yield)

We would not be surprised if Vice Chair Fisher takes the completely opposite posture in his speech next week – one of raising rates in December 2016, something that is now virtually priced into the markets. We might also see CNBC’s Steve Liesman come in and explain that Yellen was merely talking about long term theory and that the speech on Friday should not be construed as Yellen turning dovish.

Frankly, this FOMC has left their credibility so far behind that we couldn’t even locate it with a telescope.

2. Huge Macro Trend Change?

This is a really big deal. Because a Fed tightening usually ends up being bullish for Treasury prices or leads to long maturity yields going down. That is what many have been expecting in December. Read what David Rosenberg wrote on Friday:

- “Will the Fed tighten as downside risks prevail? – I have no doubt that as we saw in the aftermath of the December 2015 rate hike, the long end of the Treasury curve rallies with the Fed tightening“

But what if the Fed refuses to raise rates in December despite decent data in their “new” tactic of letting the economy run hot? If that accompanies decent payroll data in November & December, where can the long maturity yields go?

Before Yellen spoke on Friday afternoon, BoE Governor Carney hinted the same and look what happened to UK gilt yields on Friday:

- Holger Zschaepitz

@Schuldensuehner – UK’s 10y yields spike as BoJ’s Carney mimics Keynesian: Says he’ll tolerate UK inflation overshoot as he sees another 500k people unemployed

This is not just Anglo Saxon talk.

- Lawrence McDonald

@Convertbond – Government Bond Sell Off of 2016 Yield Surge from Brexit Panic Lows UK: +0.70% US: +0.50% Germany: +0.32% Japan: +0.23% Bloomberg

Frankly, Brexit has nothing much to do with this. The big change was initiated in Japan by BoJ promising to keep the 10-year JGB anchored at 0% & thus allowing Prime Minister Abe to drench Japan with fiscal stimulus. Draghi is kinda signalling the same by saying ECB is at the end of its monetary policy rope and now its up to the politicians. Now Yellen seems to be signalling her acquiescence to this by saying US economy should run hot meaning she will not raise rates to control the inflation she doesn’t see.

This is a huge change in posture and no wonder FX markets are reacting with strident emotion. What Kuroda, Carney & Draghi are suggesting will lead investors to sell the Yen, Pound & Euro. But what Chair Yellen suggested on Friday did NOT cause the Dollar to fall. Instead, the Dollar rose on Friday as it does when market uncertainty rises.

Back in February 2016, we called these central bankers as modern Pavlovs and asked what would happen if these Pavlovs Go Nuts? Back then, these Pavlovs went nuts & launched negative interest rates and now these mad Pavlovs are going nuts the other way. Not only have negative interest rates run hard towards zero but some, like German rates, have now turned positive.

And remember the old case of Treasury yields falling forever because of negative interest rates overseas? Now you have the reverse, US Treasuries rising inexorably because rates overseas are going in the other direction. That was when the Fed was expected to tighten in December. What if now the Fed signals their interest in letting US economy run hot? Where do long Treasury yields go? And how high does the US Dollar go?

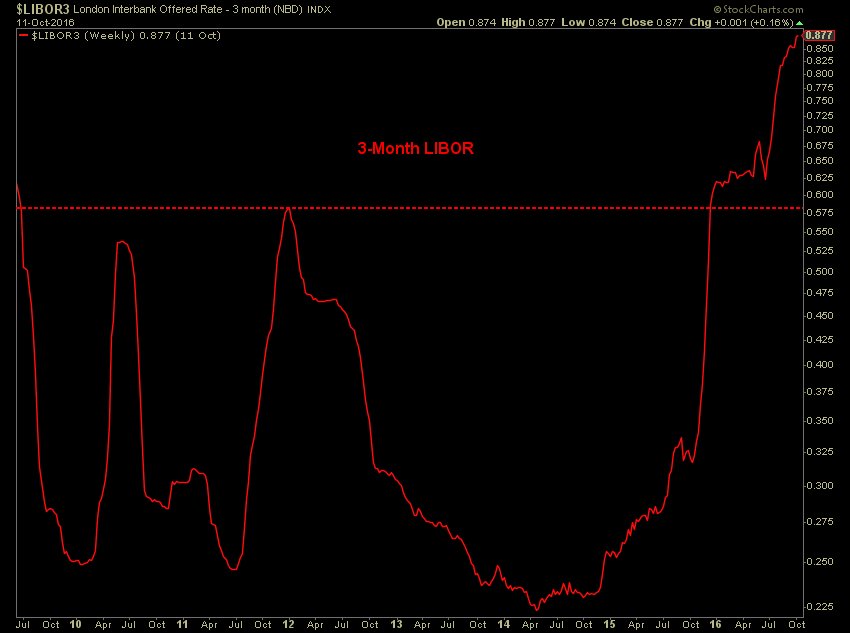

If all this wasn’t enough, look what is going on with 3-month Libor:

- Charlie Bilello, CMT

@MktOutperform 3-month Libor hits another 7+ year high: 88 bps.

3. Credit

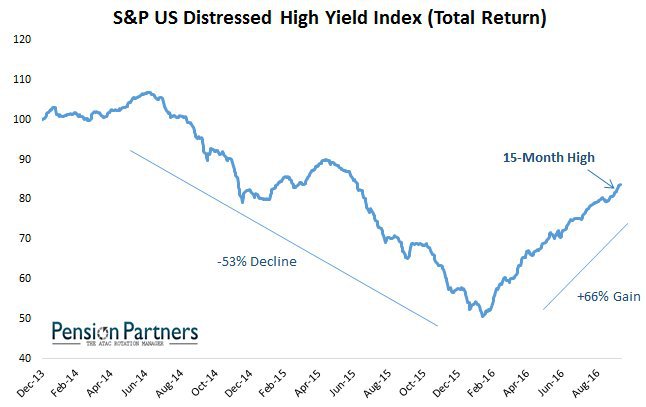

Look how hot the credit markets have been running & that too before the new signal from Chair Yellen about letting the US economy run hot:

- Charlie Bilello, CMT

@MktOutperform US High Yield Spreads… Feb 11: 887 bps Today: 475 bps Tightest levels in 15 months.$HYG$JNK

- Charlie Bilello, CMT

@MktOutperform Distressed high yield bonds hit a 15-month high, up 66% from their Feb lows.

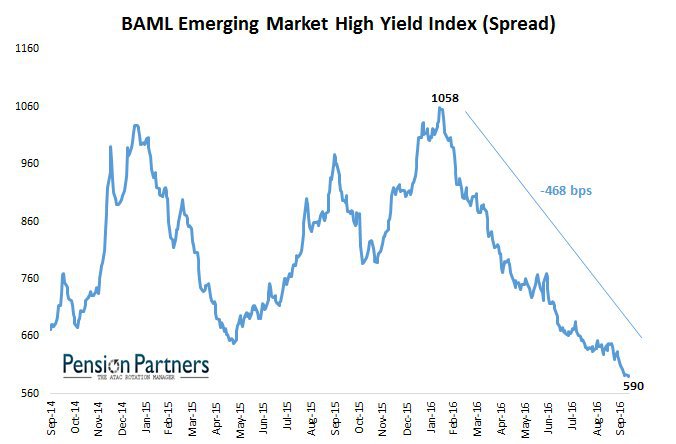

- Charlie Bilello, CMT

@MktOutperform Emerging Market High Yield credit spreads hit a 2-year low: 590 bps.$EMHY

What might happen to these white hot credit markets when Treasury yields explode upwards thanks to “let her run hot” Yellen? What happened to a hot US economy & white hot credit markets when treasury yields spiked in Q2 2007? The US economy remains levered & it may not be able to handle huge spikes in interest rates. And if it doesn’t then we might get the recession in second half of 2007 that BAML sees. And once again it will be a recession caused by a central banker, in this case by Janet Pavlova.

4. Stocks, Gold et al

We are not even going to bother with risk assets this week. If we can’t even figure out what the FOMC is “thinking” about doing, if we cannot even understand what Yellen is trying to tell us, why bother? This week, neither stocks nor gold/silver did much. Naturally, this week’s action was all in currencies & in long sovereign rates.

Send your feedback to macroviewpoints.com Or @MacroViewpoints on Twitter