Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Back to the election?

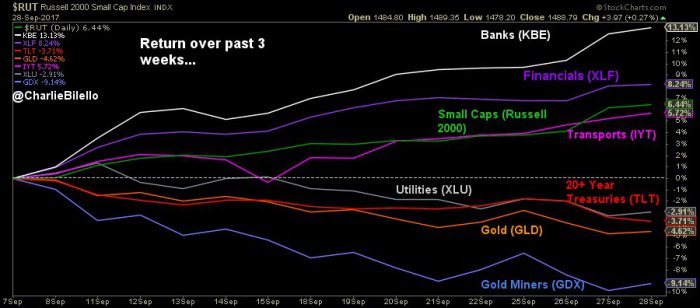

- Charlie BilelloVerified account @charliebilello Over the past 3 weeks, we’ve seen a mini-repeat of the post-election moves. Strength: Banks/Small Caps/Transports Weakness: Treasuries/Gold

Clearly the markets want to believe. We saw that this week when the outline of the tax reform proposal came out. That day in itself was a repeat of the post-election action. Add to that the stimulus coming from rebuilding post Harvey, post-Irma, & now post-Maria.

Market & political pandits kept warning that the proposed tax reform has no chance of passing. But markets did not care. Perhaps they are right. The congressional Republicans have their backs against the wall. They get the message of the victory of Roy Moore in Alabama and the support President Trump has gained by attacking the NFL for disrespecting the National Anthem & the Flag. That has aroused the base just in time for President Trump to begin selling the tax plan.

So some form of a tax cut will pass, we think. The markets are signaling so with rates going up, Dollar rising some & US small caps breaking out. That brings us to the posture that has proved successful all year, the posture expressed weekly by Lawrence McMillan of Option Strategist:

- “In summary, all of our intermediate-term indicators are bullish and thus so is our outlook. We will remain bullish as long as the indicators do, preferring to follow the trend. Having said that, we also view the potential for a sharp, but short-lived correction as being significant right now, and even a slight increase in volatility could trigger it.”

2. Good Overbought or Bad?

First the who cares wing!

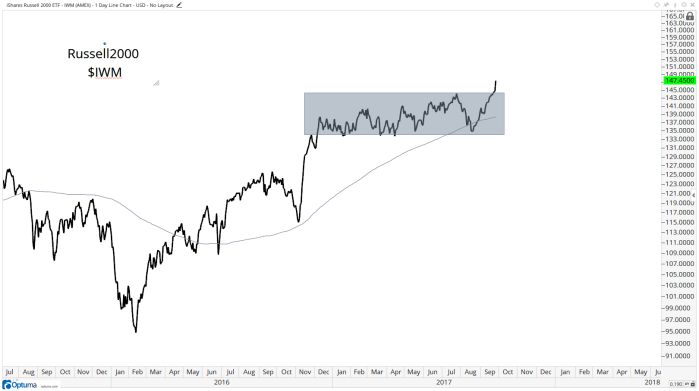

- J.C. Parets @allstarcharts ICYMI here’s why this breakout in Small-caps is so significant and likely just the beginning http://allstarcharts.com/small-caps-break-time-highs/ …

- “Finally the Russell Micro-cap Index. Same story: Major base and fresh breakout after not doing anything this year”.

And the conclusion:

- “I don’t see the point in getting cute and buying garbage like Bonds and Precious Metals. They’re losers. Other than maybe a quick mean reversion trade for a few days, if you’re into that sort of thing, there is no reason to buy those other assets. We need to be buying stocks. Period”.

Now the watch out side:

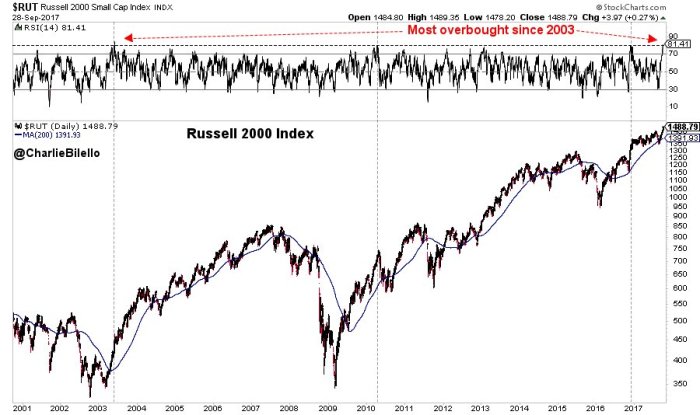

- Charlie BilelloVerified account @charliebilello – Russell 2000 Small Cap Index closes at its most overbought level since 2003 (based on 14-period RSI).

$RUT

And,

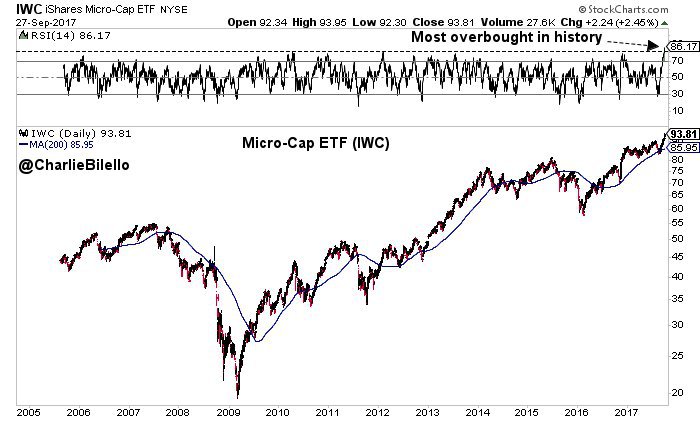

- Charlie BilelloVerified account @charliebilello The Micro-Cap ETF dates back to 2005. Today it reached its most overbought level ever (using 14-period RSI).

$IWC

Harking back to our old friend Dr. Pangloss, wouldn’t it be great to have a swift, sharp correction to resolve the overbought condition and then run again?

Harking back to our old friend Dr. Pangloss, wouldn’t it be great to have a swift, sharp correction to resolve the overbought condition and then run again?

3. Interest Rates

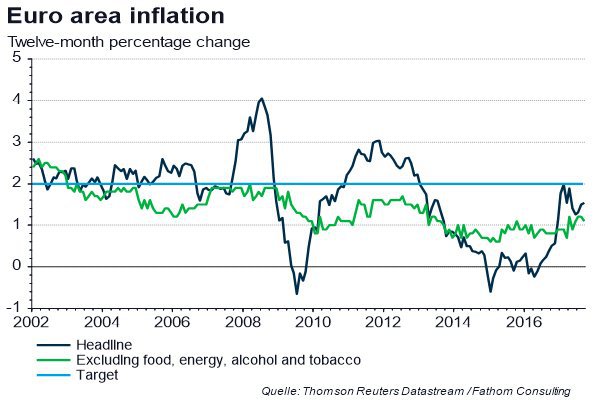

The curve steepened some this week with the 30-10 year part going up more than the short end. The German 10-yr knocked again on the 50 bps door this week but didn’t break it down. The momentum is clearly to the upside & Draghi is next to speak. But the momentum of inflation in Europe is still going the wrong way:

- Holger Zschaepitz @Schuldensuehner In case you missed it: Core

#Eurozone inflation fell to 1.1% in Sept. Subdued Euro Area inflation reflects sizeable econ slack, Fathom says.

But we have seen these fast rises in yields before as Carter Worth pointed out again on Friday. His case is simply that this rise will be of similar amplitude & duration of the previous jumps in Treasury yields. Next week will be a big tell.

4. Gold

J.C.Parets termed gold as garbage. Many seem to agree because:

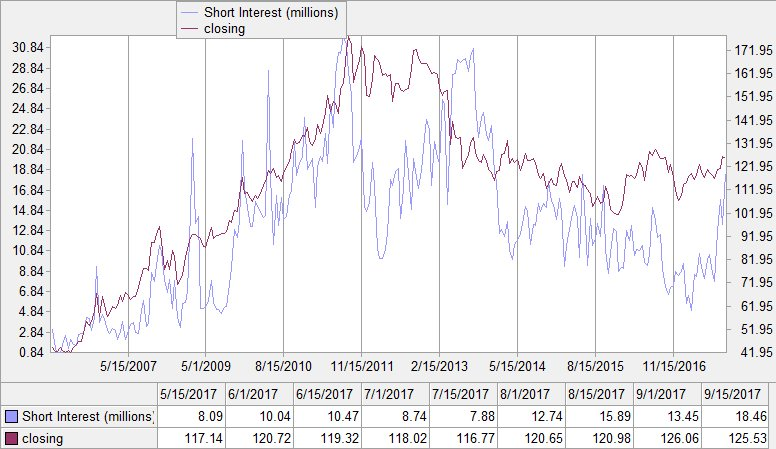

- Chris Prybal @ChrisPrybal In the past six months Short Interest on the $GLD #Gold has increased 273%! In fact, GLD hasn’t been shorted this much since 1/1/2014!

And what did Gold do after 1/1/2014?

By the way, what did TLT do after 1/1/2014?

By the way, what did TLT do after 1/1/2014?

January 1, 2014 came after the huge rise in yields & fall in Gold thanks to Bernanke’s taper tantrum of 2013. The central banks have expressed their semi-hawkish stance most of this year and especially in the past couple of months. The question is whether rate markets & gold markets have priced in more than what the central banks are actually going do.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter